PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406216

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406216

South Korea Major Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

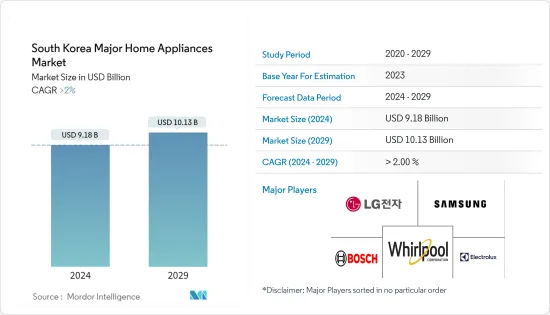

The South Korea Major Home Appliances Market size is estimated at USD 9.18 billion in 2024, and is expected to reach USD 10.13 billion by 2029, growing at a CAGR of greater than 2% during the forecast period (2024-2029).

Major home appliances in South Korea are witnessing growth in the market due to constant innovation by the manufacturers. Samsung and LG are innovating new products such as refrigerators and washing machines with larger capacity for greater food storage. Product innovations and government policies are fostering the growth of IoT in the major appliances segment. The major home appliances market in South Korea is driven by increasing single families, premiumization of products, personalization, and cost reduction by automation in the home appliances market. Fine articulation, on the other hand, has been an issue in the major home appliances market for some of the consumers seeking a healthy lifestyle. Advancements in Technologies and speed of development are supporting the growth of the South Korean major home appliances market. Smart Home appliances have become a vital part of the home appliances market in South Korea.

The COVID-19 pandemic led to a change in South Korea's major home appliance consumption trends; the popularity of electronics helping with household chores increased as most of the population worked from home, and spending more time at home required many appliances that could complete tasks quickly.

South Korea Major Home Appliances Market Trends

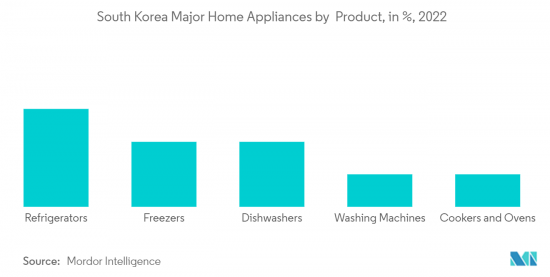

Washing Machines are Highly Demanded Major Appliances in South Korea

Koreans' demand for washing machines is constantly rising, with front-load washing machines gaining more share in the market. Top-load washing machines are losing share to front-load machines due to their more powerful function and use in the commercial sector. On the other hand, automatic dryers are also gaining popularity. South Koreans are also preferring washing machines with IoT and are looking for premium segment washing machines.

Rising Popularity of Dishwashers Among South Koreans

Dishwashers are drawing attention as the household appliance that decreases household labor for South Koreans. There is an upward trend in buying dishwashers in the South Korean large home appliance market. Millennials and working couples in the country are demanding dishwashers to seek convenience.

Dishwashers are emerging as must-haves for households in South Korea's market. The popularity of dishwashers has been rising among different age groups in the market. Different age groups are more and more interested in having dishwashers in the country as they help people in washing dishes by saving time.

South Korea Major Home Appliances Industry Overview

The major home appliances market in South Korea is competitive with the presence of local manufacturers and global manufacturers. There is a rise in competition in the country because of the presence of Japanese and Chinese players. The manufacturer, therefore, is producing products in the overseas market to cater to demand in the premium category. Key companies in the market include LG Electronics Inc., Samsung Electronics, Electrolux AB, Whirlpool Corporation, and Bosch, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Online Sales are Witnessing a Major Share of the Market

- 4.2.2 Increasing Technological Advancements is Driving the Demand for Energy-Efficient Home Appliances

- 4.3 Market Restraints

- 4.3.1 Changing Consumer Preferences

- 4.4 Market Opportunities

- 4.4.1 Growing Demand for Energy-Efficient Appliances

- 4.4.2 Rise in Smart Home Technology Integration

- 4.5 Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Innovations in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Refrigerators

- 5.1.2 Freezers

- 5.1.3 Dishwashers

- 5.1.4 Washing Machines

- 5.1.5 Cookers and Ovens

- 5.1.6 Other Products

- 5.2 By Distribution Channel

- 5.2.1 Hypermarkets/Supermarkets

- 5.2.2 Specialty Stores

- 5.2.3 E-commerce/Online

- 5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 LG Electronics

- 6.2.2 Dong Yang Diecasting Co.

- 6.2.3 Samsung Electronics

- 6.2.4 Bosch

- 6.2.5 Electrolux AB

- 6.2.6 Whirlpool Corporation

- 6.2.7 Panasonic Corporation

- 6.2.8 Haier Electronics Group Co. Ltd

- 6.2.9 Mitsubishi Electric Corporation

- 6.2.10 Gorenje Group*

7 FUTURE OF THE MARKET

8 DISCLAIMER