PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403801

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403801

South America Hemodynamic Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

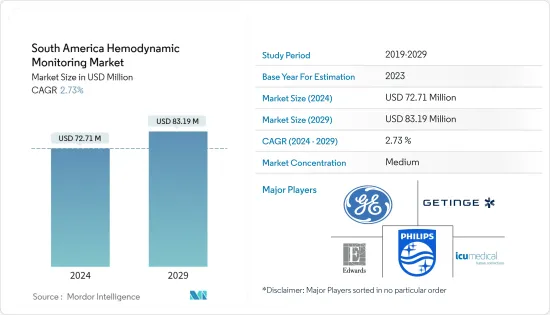

The South America Hemodynamic Monitoring Market size is estimated at USD 72.71 million in 2024, and is expected to reach USD 83.19 million by 2029, growing at a CAGR of 2.73% during the forecast period (2024-2029).

The outbreak of the COVID-19 pandemic has pushed the healthcare industry into action. Initially, the pandemic imposed an adverse effect on the market in South America America. For instance, as per the study published by the National Library of Medicine in April 2022, COVID-19 led to a significant decrease in cardiac diagnostic procedures in South America, mainly due to social distancing. It also stated that the pandemic had disrupted care delivery for cardiovascular diseases in South America. Similarly, as per the study published by the Journal of the American College of Cardiology, in January 2021, globally, cardiac diagnostic procedure volumes decreased by 42.0% from March 2019 to March 2020 and by 64.0% from March 2019 to April 2020 with the greatest decrease in South America. Therefore, such instances indicate that the market witnessed slow growth during the pandemic. However, the sector has been recovering well since restrictions were lifted, leading to increased cardiac procedures, thereby witnessing significant growth.

The key factors propelling the growth of this market are an increase in the number of critically ill geriatric cases, a rise in the prevalence of cardiac disorders and diabetes, increasing demand for home-based and non-invasive monitoring systems, and an increase in the number of people suffering from hypertension. For instance, according to the study published by Clanica e Investigacion en Arteriosclerosis, in August 2021, the prevalence of risk factors for cardiovascular diseases among the South American population was relatively high in 2021. It also reported that the prevalence of high-risk scores for cardiovascular diseases and diabetes mellitus was high and healthy lifestyle habits were low in 2021.

Furthermore, as per the study published by the National Library of Medicine, in February 2021, in South America, hypertension, prediabetes, and type 2 diabetes mellitus prevalence range varies from 30.0% to 50.0%, 6.0% to 14.0%, and 8.0% to 13.0% respectively in the year 2021. It also reported that the proportion of awareness, treatment, and control of hypertension was deficient in Latin America. All these conditions are associated with an increased risk of cardiovascular diseases owing to which such instances are anticipated to propel the cases of cardiovascular diseases. Since hemodynamic monitoring devices are one of the essential requirements for monitoring of cardiac activity, therefore, significant market growth is expected over the forecast period.

However, increasing complications associated with invasive monitoring systems are the major factors restraining the market growth.

South America Hemodynamic Monitoring Market Trends

Non-Invasive Monitoring Systems Segment is Expected to Hold Significant Market Share Over the Forecast Period

Non-invasive monitoring systems include a standard five-lead electrocardiogram, non-invasive BP measurement, pulse oximetry, capnography, and nasopharyngeal and bladder temperature. Factors such as an increasing number of geriatric populations, along with a growing number of heart diseases are anticipated to stimulate the demand for non-invasive monitoring systems. For instance, according to a study published in European Heart Journal in August 2022, the incidence of CVD (per 1000 person-years) varied between countries, with Brazil having the highest incidence (3.86) and Argentina having the lowest (3.07). Mortality rates (per 1000 person-years) varied more between countries, with Argentina having the highest (5.98) and Chile having the lowest (4.07). Men had a higher CVD incidence (4.48 vs. 2.60 per 1000 person-years) and mortality rate (6.33 vs. 3.96 per 1000 person-years) than women. This is likely to increase the demand for non-invasive monitoring devices, thereby boosting the market growth.

Furthermore, the increase in the regulatory framework and availability of non-invasive monitoring systems in Brazil is expected to drive segmental growth. For instance, according to an article published by the Journal of Hyman Hypertension in July 2022, Brazil confirms the need for a robust regulatory framework to increase the availability of validated automated blood pressure measuring devices and a comprehensive strategic approach that involves relevant stakeholders, includes a multi-pronged approach and is associated with a national program to prevent and control non communicable diseases.

Thus, all aforementioned factors are expected to boost segment growth over the forecast period.

Brazil is Expected to Dominate the South America Hemodynamic Monitoring Market Over the Forecast Period

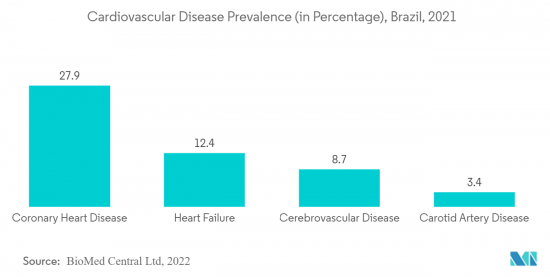

Brazil contributes to the maximum share of the market due to factors such as the rising cases of cardiovascular diseases and associated risk factors such as diabetes, and hypertension. For instance, according to a report in May 2022 published by the Ministry of Health Brazil, the number of adults with a medical diagnosis of hypertension increased by 3.7% in 15 years in Brazil, and the rate went to 26.3% in 2021 from 2016. Thus, with a high prevalence of associated risk factors of CVD such as hypertension, the demand for hemodynamic monitors increases, thereby driving market growth in Brazil.

Furthermore, as per the data published in PLOS Journal in September 2021, cardiovascular diseases represent a significant public health problem, as they are the leading cause of disability affecting adults of full working age, accounting for about 27.7% of deaths in Brazil. Similarly, as per the report published by the World Bank in April 2023, diabetes prevalence among the Brazilian population aged 20 years to 79 years of age was 8.8% in 2021. With the high prevalence of diabetes, the chances of cardiovascular disease increase, thereby increasing the demand for hemodynamic monitoring.

Therefore, due to the abovementioned factors, the market is anticipated to witness considerable growth over the forecast period.

South America Hemodynamic Monitoring Industry Overview

The South American hemodynamic monitoring market is moderately concentrated in nature due to the presence of companies operating globally as well as regionally. The competitive landscape includes analyzing international as well as local companies that hold market shares and are well known, including Getinge Group, Koninklijke Philips NV, Edwards Life Sciences Corporation, and GE Healthcare, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Geriatric Population and Rise in the Prevalence of Cardiac Disorders and Diabetes

- 4.2.2 Increasing Demand for Home-based and Non-invasive Monitoring Systems

- 4.2.3 Increasing Number of People Suffering from Hypertension

- 4.3 Market Restraints

- 4.3.1 Increasing Incidences of Complications Associated with Invasive Monitoring Systems

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By System

- 5.1.1 Minimally Invasive Monitoring Systems

- 5.1.2 Invasive Monitoring Systems

- 5.1.3 Non-invasive Monitoring Systems

- 5.2 By Application

- 5.2.1 Laboratory-based Monitoring Systems

- 5.2.2 Home-based Monitoring Systems

- 5.2.3 Hospital-based Monitoring Systems

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Getinge Group

- 6.1.2 Koninklijke Philips NV

- 6.1.3 Edwards Lifesciences Corporation

- 6.1.4 GE Healthcare

- 6.1.5 ICU Medical Inc

- 6.1.6 Cheetah Medical Inc

- 6.1.7 LiDCO Group PLC

- 6.1.8 Draeger Medical

- 6.1.9 Schwarzer Cardiotek GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS