PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406225

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406225

Finland Pharmaceutical - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The Finland pharmaceutical market is anticipated to register a CAGR of 3.9% during the forecast period.

According to the Finnish Medicines Agency, data updated in 2022, the COVID-19 pandemic in Finland did not significantly impacted medication availability. To avoid complications even if the situation persists, Finnish healthcare and pharmaceutical operators collaborated closely to prevent shortages. Companies evaluated the effects of the COVID-19 outbreak on production and the state of supply chains and stocks in collaboration with pharmaceutical producers and importers. The authorities were closely observing the situation with other companies in the industry. For instance, the European medical authorities in Finland exchanged updates on the issues faced within the country regularly. To support the continued availability of medicines in the European Union (EU), the European Medicines Agency (EMA) supports developing and approving safe and effective treatments and vaccines. It also supports the provision of accurate information to patients and healthcare professionals. In March 2021, Finnish academic- Rokote Laboratories Finland Ltd. worked on developing and marketing a nasal spray vaccine targeting COVID-19. The vaccine performed well in in-vivo studies with animal models. Hence, the studied market witnessed significant growth and is expected to grow over the forecast period.

Factors such as the rising incidence of chronic diseases and growing research and development (R&D) investments in the country are expected to boost market growth over the forecast period.

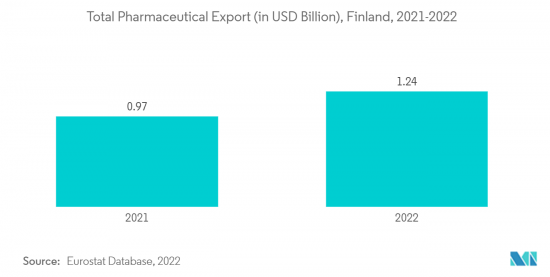

The increasing country's spending on pharmaceutical products indicates the high demand for drugs, which is expected to fuel the market growth. For instance, according to the International Trade Administration, US Department of Commerce, data updated in June 2023, Finland imported USD 2.52 billion in pharmaceutical products. It exported USD 1.24 billion in 2022 compared to USD 2.46 billion and USD 978 million in the previous year. Also, as per the source mentioned above, the Finnish population spent an estimated USD 4 billion on pharmaceutical products in 2020, representing a 1% increase from the preceding year. Additionally, as per the data published by Orion Corporation in its 2022 Financial Statement, the company reported net sales of EUR 321.9 million (USD 354.92 million) pharmaceutical products in Finland in 2022 as compared to EUR 33.4 million (USD 36.83 million) in 2021. Thus, the increasing revenue indicates the high demand for pharmaceutical products. It urges the company to develop innovative drugs for treating various diseases, hence expected to augment the market growth over the forecast period.

Furthermore, the increasing focus of the government and institutions to accelerate drug development initiatives in the country is also expected to fuel market growth. For instance, in March 2022, iCAN, in partnership with the University of Helsinki, HUS Helsinki University Hospital, and other company partners, launched the iCAN Flagship Project. It enables broad genomic and molecular profiling of cancers in Finland for improving treatments. Also, in February 2022, the Minister of Family Affairs and Social Services, Krista Kiuru, signed an agreement on establishing the National Drug Development Centre to promote competitive drug development. Such initiatives are anticipated to fuel the development of novel drugs for treating chronic disease patients, propelling the market growth.

Also, the growing number of grants and project launches by the companies increases drug research and development activities in the country, which is anticipated to propel the growth of the pharmaceutical market over the forecast period. For instance, in March 2023, Orion launched a project to build a unique data and AI-based pharmaceutical research ecosystem in Finland in cooperation with other companies, research institutes, and universities. Business Finland allocated over EUR 10 million (USD 11.03 million) to Orion, and nearly EUR 20 million (USD 22.05 million) is reserved for the research institutions and companies participating in the ecosystem to be created. The project aims to reduce the time required to discover and produce breakthrough medications by utilizing artificial intelligence and enhancing data processing and analysis. Such initiatives are expected to create new competencies by bringing together experts in disease biology, pharmaceutical research, and data science, bolstering market growth.

Therefore, the studied market is expected to grow over the forecast period due to growing demand for pharmaceutical products, increasing company spending in research activities, launches of drug development projects, and funding. However, the highly expensive patented drugs are likely to hinder the growth of the pharmaceutical market in Finland over the forecast period.

Finland Pharmaceutical Market Trends

Prescription Drugs Segment is Expected to Hold Significant Share Over the Forecast Period

The prescription drugs segment is expected to witness significant growth in the pharmaceutical market over the forecast period due to factors such as the rising prevalence of chronic diseases, the increasing geriatric population, the growing demand and adoption of prescription drugs, and increasing product launches in the country. In addition, technical advances, a rise in per capita healthcare expenditure, and disposable income in the country are also expected to boost segment growth over the forecast period.

The rising burden of chronic diseases coupled with the increasing population may lead to hospitalization and long-term medication demand. It is expected to augment the segment growth. For instance, according to 2023 data published by the United Nations Population Fund, about 61% of the population living in Finland is aged between 15-64 years, and about 24% of people aged 64 years and over in 2023. Also, the rising geriatric population is more prone to developing chronic diseases, such as cardiovascular diseases, neurological disorders, and cancer, raising the demand for effective therapeutics, which is expected to boost segment growth.

Additionally, the country's increasing pharmaceutical and prescription drug revenues reflect the substantial demand for prescription medications to treat chronic conditions, which is expected to propel the segment's growth. For instance, according to data published by Orion Corporation in its 2022 Financial Statement, the company reported sales of EUR 3,416 million (USD 3,668.39 million) in pharmaceuticals and EUR 1,950 million (USD 2,094.08 million) in prescription drugs in Finland in 2022 as compared to sales of EUR 3,306 million (USD 3,550.26 million) in pharmaceuticals and EUR 1,880 million (USD 2,018.90 million) prescription drugs in Finland in 2021.

Furthermore, the rising number of drug launches is expected to increase the availability of novel prescription drugs in the market. Hence, it is expected to augment the market growth. For instance, in December 2022, Biofrontera's Scandinavian licensing partner Galenica AB, Malmo, Sweden, started commercialization of Ameluz and BF-RhodoLED in Finland, to treat mild to moderate actinic keratoses, skin growths caused by exposure to sunlight, which can lead to skin cancer, in Finland. Also, in June 2022, the hospital district of Southwest Finland introduced Pfizer's orally administered antiviral Covid-19 medication Paxlovid.

Therefore, the studied segment is expected to grow over the forecast period due to increasing prescription drug revenue generated by the companies and new drug launches.

Cardiovascular System Segment is Expected to Register Significant Growth Over the Forecast Period

The cardiovascular system segment is anticipated to witness significant growth in the pharmaceutical market over the forecast period owing to factors such as the rising prevalence of heart diseases, growing demand for effective drugs to treat cardiovascular diseases, and increasing research activities.

The need for pharmaceutical products such as biologics or other therapeutic medications is rising in Finland owing to the growing burden of cardiovascular diseases among the population. For instance, according to the data published by NCBI, in June 2021, it was observed that the prevalence of heart failure (HF) increased from 3.7% among people aged 50 years or less to 15.3% among those aged 85 years or more. In addition, the number of HF patients is anticipated to rise in the coming years owing to the rising aging population. Thus, the expected increase in the number of people suffering from heart disease raises the demand for effective drugs, which is anticipated to fuel the segment's growth.

Additionally, various research studies were conducted to assess the effectiveness of various prescription drugs for treating patients with heart failure, diabetes, and other diseases. For instance, according to an article published in ClinicoEconomics and Outcomes Research in January 2023, it was observed that empagliflozin, an SGLT2 inhibitor, enhances the outcomes for people with heart failure by lowering the combined risk of cardiovascular mortality or hospitalization for worsening HF. Also, empagliflozin is a cost-effective treatment for patients with HF in the Finnish healthcare setting. It is anticipated to increase its adoption among patients, hence contributing to the market growth.

Therefore, owing to factors such as the high burden of heart diseases, the growing number of research studies by companies, and new drug launches, the studied segment is expected to grow over the forecast period.

Finland Pharmaceutical Industry Overview

The Finland pharmaceutical market is highly competitive and consists of several major players. A few major players are currently dominating the market in terms of market share. Some prominent players are vigorously making acquisitions and joint ventures with other companies to consolidate their market positions in the country. Some key companies currently dominating the market are AbbVie Inc., AstraZeneca plc, Bayer AG, C.H. Boehringer Sohn AG & Ko. KG, and GlaxoSmithKline plc, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.1.1 Healthcare Expenditure

- 4.1.2 Pharmaceutical Imports and Exports

- 4.1.3 Epidemiology Data For key Diseases

- 4.1.4 Regulatory Landscape/Regulatory Bodies

- 4.1.5 Licensing and Market Authorization

- 4.1.6 Pipeline Analysis

- 4.1.6.1 By Phase

- 4.1.6.2 By Sponsor

- 4.1.6.3 By Disease

- 4.1.7 Statistical Overview

- 4.1.7.1 Number of Hospitals

- 4.1.7.2 Employment in the Pharmaceutical Sector

- 4.1.7.3 R&D Expenditure

- 4.1.8 Ease of Doing Business

- 4.2 Market Drivers

- 4.2.1 Significant research and development programs

- 4.2.2 Rising Incidence of Chronic Disease

- 4.3 Market Restraints

- 4.3.1 Highly Expensive Patented Drugs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD )

- 5.1 By ATC/Therapeutic Class

- 5.1.1 Alimentary Tract and Metabolism

- 5.1.2 Blood and Blood Forming Organs

- 5.1.3 Cardiovascular System

- 5.1.4 Dermatologicals

- 5.1.5 Genito Urinary System and Sex Hormones

- 5.1.6 Systemic Hormonal Preparations,

- 5.1.7 Antiinfectives For Systemic Use

- 5.1.8 Antineoplastic and Immunomodulating Agents

- 5.1.9 Musculo-Skeletal System

- 5.1.10 Nervous System

- 5.1.11 Antiparasitic Products, Insecticides and Repellents

- 5.1.12 Respiratory System

- 5.1.13 Sensory Organs

- 5.1.14 Other ATC/Therapeutic Classes

- 5.2 By Prescription Type

- 5.2.1 Prescription Drugs (Rx)

- 5.2.1.1 Branded

- 5.2.1.2 Generic

- 5.2.2 OTC Drugs

- 5.2.1 Prescription Drugs (Rx)

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AbbVie Inc.

- 6.1.2 AstraZeneca plc

- 6.1.3 Bayer AG

- 6.1.4 C.H. Boehringer Sohn AG & Ko. KG

- 6.1.5 GlaxoSmithKline plc

- 6.1.6 F. Hoffmann-La Roche AG

- 6.1.7 Bristol Myers Squibb Company

- 6.1.8 Eli Lilly and Company

- 6.1.9 Merck & Co., Inc.

- 6.1.10 Sanofi S.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS