PUBLISHER: Transport Intelligence Ltd. | PRODUCT CODE: 1315034

PUBLISHER: Transport Intelligence Ltd. | PRODUCT CODE: 1315034

Global Freight Forwarding 2023

The major forces that shaped the world economy in 2022 are set to continue into 2023. As a result, the global forwarding market is expected to contract 3.9% in 2023 . What's the outlook for 2027? Which regions will experience the fasted growth out to 2027? Who are the top 20 freight forwarders by market share and revenues?

Ti's ‘Global Freight Forwarding 2023’ report provides an up to date view of the global forwarding landscape, covering market growth rates for 2022 to 2027, and analysis of Ti's State of Logistics Freight Forwarding survey findings. The report also provides analysis of the digital freight forwarding landscape, comparative provider profiles, and key market trends, developments, challenges and opportunities.

Use the report to keep ahead of market trends, develop your digitisation strategy, and understand the growth trajectory of key markets and potential emerging markets amidst challenging market conditions.

SAMPLE VIEW

This report contains:

- Market sizing and forecasting - 2022 market sizes & growth rates, 2023 projections & forecasts out to 2027 - split by region, air & sea freight.

- Digital road freight landscape analysis, including recent layoffs among digital forwarders and acquisitions made by traditional forwarders.

- Digital freight forwarder profiles.

- Competitive landscape analysis of the largest freight forwarders, including market position, revenue, volumes and sustainability practices.

- Global freight forwarding provider profiles.

- Comparison of the technological capabilities of the top 10 freight forwarders.

- Analysis of Ti's State of Logistics Forwarding survey.

Key Questions:

- How are regional markets performing in 2023?

- Which regions will grow the fastest out to 2027?

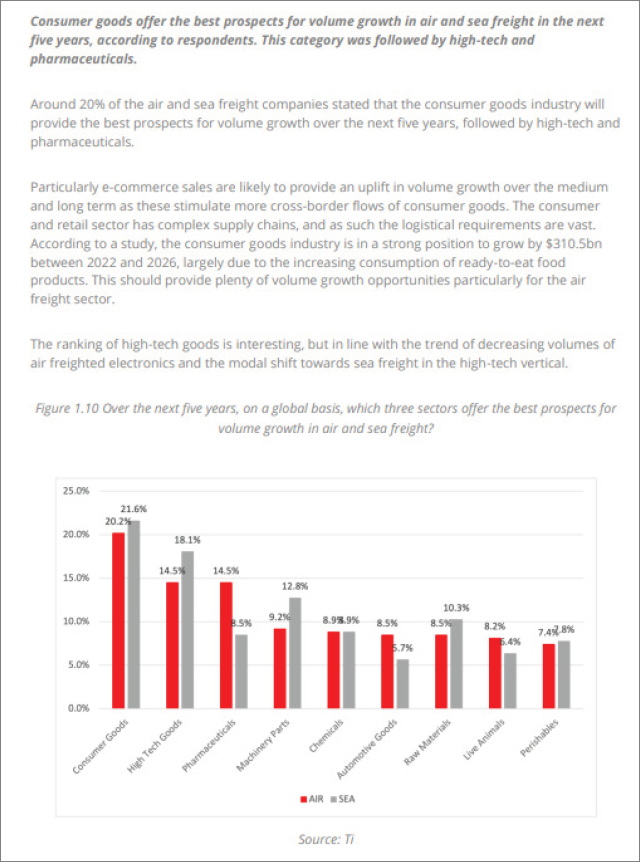

- Which three sectors offer the best prospects for volume growth in air and sea freight?

- Will conventional freight forwarders lose volume share to other parties?

- What are the three most important challenges currently affecting the global freight forwarding industry?

- Who are the leading digital freight forwarders? And what is their core offering?

- How is semiconductor demand impacting air freight growth?

- Will a return to normal market conditions result in the withdrawal of some freighter capacity?

- Who are the top 20 freight forwarders by market share and revenues?

- What are the technological capabilities of the top 10 freight forwarders, and how do they compare?

Key Findings:

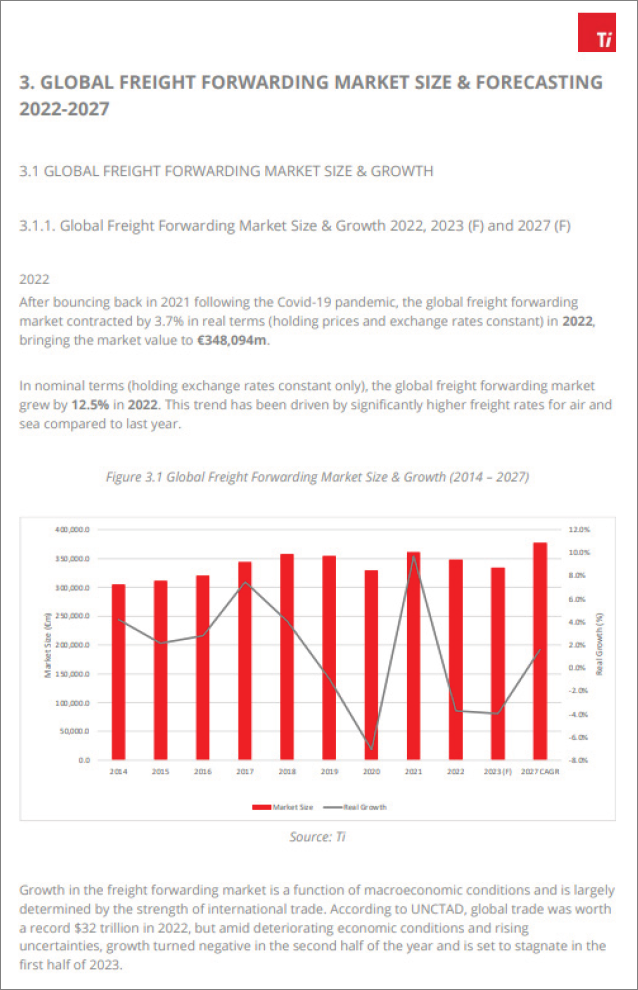

- The global freight forwarding market contracted by 3.7% in 2022, and will shrink even further in 2023, contracting by 3.9%.

- The global freight forwarding market is expected to grow at a 1.6% CAGR over the five years to 2027.

- Air freight forwarding is forecast to expand 1.7% out to 2027. Sea freight forwarding will expand 1.6%.

- The majority of freight forwarders expect to continue seeing air and sea freight volume increases in the next 12 months.

- De-globalisation will have a negative impact on freight forwarding revenues.

- Access to technology is the most important challenge currently affecting the global freight forwarding industry.

- Rising competition and stronger negotiation by clients are the main reasons for the increased pressure on margins.

- Leveraging technology and offering more value-added serves will be the most successful strategies in pulling back eroding margins in the freight forwarding market.

TABLE OF CONTENTS

Table of Figures

1. State of Logistics Survey 2023-Air and Sea Freight Forwarding

- 1.1. Trade Lanes

- 1.2. Margins

- 1.3. Volumes

- 1.4. Vertical opportunities in air and sea freight

- 1.5. Investments

- 1.6. Disintermediation

- 1.7. Deglobalisation

- 1.8. Digital Platform

- 1.9. Technology

- 1.10. Sustainability

- 1.11. Challenges

2. Digitalisation

- 2.1. Layoffs in the digital forwarding sector amid the broader industry downturn and ongoingeconomic uncertainty

- 2.2. Digital Freight Forwarder Profiles

- 2.3. Digital forwarders acquired by traditional forwarders

3. GLOBAL FREIGHT FORWARDING MARKET SIZE & FORECASTING 2022-2027

- 3.1. Global Freight Forwarding Market Size & Growth

- 3.2. Overview of regional performance

- 3.3. High-level market development

- 3.4. Freight Forwarding Market Size & Growth by Region

4. Competitive Landscape - Comparison of Global Freight Forwarders

- 4.1. Top 20. Global Freight Forwarders by Revenue and Market Shares 2022

- 4.2. Top 20. Global Air Freight Forwarders by Revenue 2022

- 4.3. Top 20. Global Air Freight Forwarders by Tonnes

- 4.4. Top 20. Global Sea Freight Forwarders by Revenue and Market Shares

- 4.5. Top 20. Global Sea Freight Forwarders by TEUs

- 4.6. Profit and margins Comparison

- 4.7 Comparison of technological capabilities of the Top 10 Freight Forwarders

- 4.8. Freight Forwarding Sustainability Comparison

5. GLOBAL FREIGHT FORWARDING PROVIDERS

- 5.1. DB Schenker

- 5.2. DHL GLOBAL FORWARDING, FREIGHT

- 5.3. DSV A/S

- 5.4. EXPEDITORS

- 5.5. GEODIS

- 5.6. KERRY LOGISTICS

- 5.7. Kintetsu World Express

- 5.8. KUEHNE + NAGEL

- 5.9. NIPPON EXPRESS

- 5.10. Sinotrans

ABOUT TI

LICENCE AND COPYRIGHT