PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1873968

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1873968

Video Surveillance Market by Offering (Cameras, Monitors, Storage Devices, Accessories), Software (VMS, VAS), Camera (PTZ, Dome, Box & Bullet, Panoramic, Bodyworn, Fisheye), Storage (DVR, NVR, HVR, IP Storage, Direct), System - Global Forecast to 2031

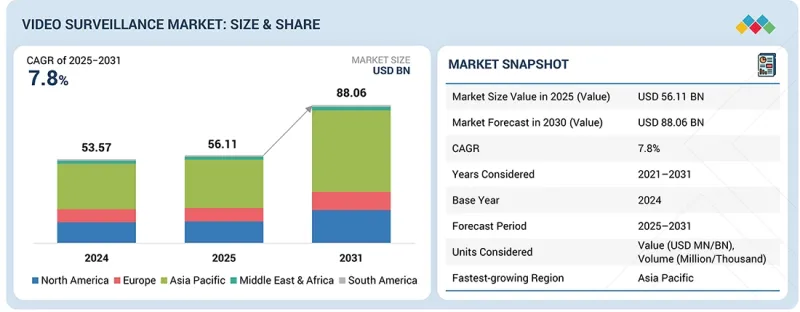

The video surveillance market is valued at USD 56.11 billion in 2025 and is projected to reach USD 88.06 billion by 2031, registering a CAGR of 7.8% during the forecast period. The video surveillance market is experiencing robust growth as demand for intelligent security and monitoring solutions increases across various sectors, including commercial, industrial, residential, and public.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Software, Storage, System and Region |

| Regions covered | North America, Europe, APAC, RoW |

Core components, including cameras, video management software, and storage devices, are being enhanced with AI-driven analytics, IoT integration, and cloud connectivity to improve real-time monitoring and threat detection. Emerging technologies such as facial recognition, motion analysis, and remote surveillance are enabling proactive security management. The market's expansion is further supported by smart city initiatives, growing safety concerns, and advancements in IP-based systems, which drive the widespread adoption of intelligent and connected video surveillance solutions worldwide.

"The IP cameras segment, by camera type, is expected to grow at the highest CAGR during the forecast period."

The IP cameras segment is expected to grow at the highest CAGR during the forecast period, owing to the increasing demand for advanced, network-based surveillance solutions that offer superior image resolution, scalability, and remote accessibility. IP cameras offer enhanced flexibility compared to traditional analog systems by transmitting video data over IP networks, allowing for centralized monitoring and seamless integration with cloud and IoT platforms. These cameras support AI-driven analytics, including facial recognition, motion detection, and behavioral analysis, enabling organizations to enhance security intelligence and automate incident response. The rapid expansion of smart city initiatives, transportation monitoring, and industrial automation is further accelerating their adoption. Additionally, declining costs of IP-based systems and improvements in data compression and network bandwidth efficiency are making them more accessible across commercial, residential, and public infrastructure applications. Collectively, these factors position IP cameras as the preferred choice for modern, intelligent video surveillance deployments worldwide.

"Commercial vertical is expected to hold the largest market share in the video surveillance market."

The commercial vertical is expected to hold the largest market share in the video surveillance market during the forecast period, driven by the growing need for enhanced security, operational efficiency, and regulatory compliance across business establishments. Retail stores, corporate offices, banking institutions, healthcare facilities, and hospitality sectors are increasingly deploying advanced surveillance systems to prevent theft, monitor employee and customer activities, and ensure a safe environment. The integration of AI-powered analytics, facial recognition, and automated alerts enables businesses to proactively manage risks and optimize operations. Additionally, the rising adoption of cloud-based video management systems and remote monitoring capabilities supports real-time access and centralized control of multi-site locations. Increasing investments in smart building infrastructure and digital transformation further contribute to the demand for intelligent video surveillance solutions, positioning the commercial sector as a leading adopter of security technologies for business continuity and asset protection.

"China to dominate video surveillance market in Asia Pacific"

China dominates the video surveillance market in the Asia Pacific region due to large-scale government initiatives, extensive infrastructure development, and the strong presence of leading domestic manufacturers such as Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), and Zhejiang Uniview Technologies Co. (China). The country's rapid urbanization and commitment to public safety have led to widespread deployment of intelligent surveillance systems across smart cities, transportation networks, and critical infrastructure. China's leadership in AI, big data analytics, and 5G connectivity further enhances the capabilities of surveillance solutions, enabling real-time monitoring, facial recognition, and behavioral analysis. Additionally, the local availability of cost-effective hardware, advanced manufacturing capabilities, and continuous investment in R&D strengthen China's dominance in both domestic and export markets. These factors collectively position China as a global hub for innovation and large-scale adoption of next-generation video surveillance technologies, driving its leading role in the regional market.

- By Company Type: Tier 1-25%, Tier 2-40%, and Tier 3-35%

- By Designation: Directors-32%, Managers-30%, and Others-38%

- By Region: North America-20%, Europe-40%, Asia Pacific-35%, and RoW-5%

Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), Hanwha Vision Co., Ltd. (South Korea), Honeywell International Inc. (US), Motorola Solutions, Inc. (US), Axis Communications AB (Sweden), Bosch Security Systems GmbH (Germany), Teledyne FLIR LLC (US), i-PRO (Japan), Zhejiang Uniview Technologies Co. (China), VIVOTEK Inc. (Taiwan), Eagle Eye Networks (US), NEC Corporation (Japan), ADT LLC (US), and MOBOTIX AG (Germany) are some of the key players in the video surveillance market.

The study includes an in-depth competitive analysis of these key video surveillance players, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the video surveillances market by offering [hardware (cameras, monitors, storage devices, accessories), software (video management software, video analytics software), services (video surveillance-as-a-service, installation & maintenance)], by system type (analog, IP, hybrid), by vertical (commercial, infrastructure, military & defense, residential, public facilities, industrial), and by region (North America, Europe, Asia Pacific, and Rest of the World). The report's scope encompasses detailed information on the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the video surveillance market. A thorough analysis of key industry players has provided insights into their business overview, solutions, and products, as well as key strategies, contracts, partnerships, agreements, new product launches, mergers & acquisitions, and other recent developments associated with the video surveillance market. This report provides a competitive analysis of emerging video surveillance market startups.

Reasons to buy this report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall video surveillance market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising adoption of edge AI to enhance data security and privacy, rise of smart city initiatives), restraints (privacy associated with cloud-based systems, high operational cost), opportunities (emergence of AI- and ML-integrated video surveillance systems, rise of smart home technologies), and challenges (cybersecurity risks, data compression issues)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the video surveillance market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the video surveillance market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the video surveillance market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players in the video surveillances market, such as Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), Hanwha Vision Co., Ltd. (South Korea), Honeywell International Inc. (US), Motorola Solutions, Inc. (US), Axis Communications AB (Sweden), Bosch Security Systems GmbH (Germany), Teledyne FLIR LLC (US), i-PRO (Japan), Zhejiang Uniview Technologies Co. (China), VIVOTEK Inc. (Taiwan), Eagle Eye Networks (US), NEC Corporation (Japan), ADT LLC (US), and MOBOTIX AG (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: REGIONAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VIDEO SURVEILLANCE MARKET

- 3.2 VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY AND VERTICAL

- 3.3 VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY VERTICAL

- 3.4 VIDEO SURVEILLANCE MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising adoption of edge AI to enhance data security and privacy

- 4.2.1.2 Increasing crime rate and terrorism

- 4.2.1.3 Growing inclination of business owners toward VSaaS models to ensure security and prompt decision-making

- 4.2.1.4 Rise of smart city initiatives

- 4.2.2 RESTRAINTS

- 4.2.2.1 Privacy concerns associated with cloud-based systems

- 4.2.2.2 High operational costs

- 4.2.2.3 Compatibility issues due to lack of harmonized standards

- 4.2.2.4 Rising storage and management costs

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Emergence of AI- and ML-integrated video surveillance systems

- 4.2.3.2 Rapid urbanization and smart city initiatives

- 4.2.3.3 Rise of smart home technologies

- 4.2.3.4 Rising adoption of drones in aerial video surveillance applications

- 4.2.4 CHALLENGES

- 4.2.4.1 Cybersecurity risks

- 4.2.4.2 Data compression issues

- 4.2.4.3 Bandwidth and storage issues

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN THE VIDEO SURVEILLANCE MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL SEMICONDUCTOR INDUSTRY

- 5.3.4 TRENDS IN GLOBAL COMMERCIAL INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY VERTICAL

- 5.6.2 AVERAGE SELLING PRICE TREND, BY FORM FACTOR

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6.4 INDICATIVE PRICING TREND, BY KEY PLAYER

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 852580)

- 5.7.2 EXPORT SCENARIO (HS CODE 852580)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 GANGNEUNG CITY SURVEILLANCE SELECTS BRIEFCAM CAMERAS TO ENHANCE SAFETY

- 5.11.2 VYSTAR SELECTS HANWHA VISION CAMERAS TO PROTECT ASSETS, MEMBERS, AND EMPLOYEES

- 5.11.3 GREATER DAYTON SCHOOL ENHANCES CAMPUS SAFETY AND EFFICIENCY THROUGH MOTOROLA SOLUTIONS' AVIGILON CAMERAS

- 5.11.4 COMMERCIAL GARDEN COMPLEX M AVENUE IN MARRAKECH RELIES ON ADVANCED UNIVIEW SECURITY SYSTEM TO ALLEVIATE RISKS

- 5.11.5 IPSWICH CITY COUNCIL DEPLOYS GENTECH'S VMS SOLUTION TO REDUCE CRIME RATE

- 5.11.6 CHUKCHANSI GOLD CASINO AND RESORT ENHANCES STAFF AND GUEST SECURITY BY EMPLOYING PELCO'S VIDEO SURVEILLANCE SYSTEM

- 5.11.7 SENTINEL MONITORING IMPLEMENTS SCYLLA'S FALSE ALARM FILTERING SYSTEM TO FOCUS ON REAL SECURITY THREATS

- 5.12 IMPACT OF 2025 US TARIFFS-VIDEO SURVEILLANCE MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRIES/REGIONS

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON VERTICALS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 CLOUD COMPUTING

- 6.1.2 VIDEO ANALYTICS

- 6.1.3 EDGE COMPUTING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ACCESS CONTROL SYSTEMS

- 6.2.2 CYBERSECURITY SOLUTIONS

- 6.2.3 BIG DATA ANALYTICS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 DRONES AND AERIAL SURVEILLANCE

- 6.3.2 BIOMETRIC SYSTEMS

- 6.3.3 BUILDING MANAGEMENT SYSTEMS

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): AI-ENABLED ARCHITECTURE OPTIMIZATION AND CLOUD INTEGRATION

- 6.4.2 MID-TERM (2027-2030): HETEROGENEOUS INTEGRATION & DESIGN ECOSYSTEM EXPANSION

- 6.4.3 LONG-TERM (2030-2035+): UNIVERSAL RECONFIGURABLE COMPUTING AND SYSTEM-LEVEL CONVERGENCE

- 6.5 PATENT ANALYSIS, 2015-2024

- 6.6 IMPACT OF GEN AI ON VIDEO SURVEILLANCE MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN VIDEO SURVEILLANCE MARKET

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN VIDEO SURVEILLANCE MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 6.7 CLIENTS' READINESS TO ADOPT AI IN VIDEO SURVEILLANCE MARKET

- 6.7.1 INTRODUCTION

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7.3 STANDARDS

- 6.7.4 GOVERNMENT REGULATIONS

- 6.7.5 CERTIFICATIONS

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOUR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.4 UNMET NEEDS FROM VARIOUS VERTICALS

8 VIDEO SURVEILLANCE MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 HARDWARE

- 8.2.1 CAMERAS

- 8.2.1.1 Camera components

- 8.2.1.1.1 Image sensors

- 8.2.1.1.1.1 Complementary metal-oxide-semiconductor

- 8.2.1.1.1.2 Charge-coupled device

- 8.2.1.1.2 Lenses

- 8.2.1.1.2.1 Fixed

- 8.2.1.1.2.2 Varifocal

- 8.2.1.1.3 Image processing circuitry

- 8.2.1.1.1 Image sensors

- 8.2.1.2 Cameras market, by type

- 8.2.1.2.1 Analog cameras

- 8.2.1.2.1.1 Simple setup and maintenance with minimal technical expertise required to propel market

- 8.2.1.2.2 IP cameras

- 8.2.1.2.2.1 Reliance on IP cameras to capture high-definition and megapixel images to drive market

- 8.2.1.2.1 Analog cameras

- 8.2.1.3 Cameras market, by connectivity

- 8.2.1.3.1 Wired

- 8.2.1.3.1.1 Stable and reliable video transmission with minimal signal interference risk

- 8.2.1.3.2 Wireless

- 8.2.1.3.2.1 Remote access and monitoring from any location to support market growth

- 8.2.1.3.1 Wired

- 8.2.1.4 Cameras market, by form factor

- 8.2.1.4.1 Dome

- 8.2.1.4.1.1 Discreet design suitable for indoor environments and high-traffic areas to drive market growth

- 8.2.1.4.2 PTZ

- 8.2.1.4.2.1 Wide-area coverage with pan, tilt, and zoom functionality to accelerate segmental growth

- 8.2.1.4.3 Box & Bullet

- 8.2.1.4.3.1 High optical performance and ability to work with fixed or varifocal lenses to foster market growth

- 8.2.1.4.4 Panoramic

- 8.2.1.4.4.1 Capability to detect blind spots and ensure maximum security to fuel segmental growth

- 8.2.1.4.5 Fisheye

- 8.2.1.4.5.1 Ultra-wide-angle lenses capturing hemispherical images to contribute to market growth

- 8.2.1.4.6 Body-worn

- 8.2.1.4.6.1 Real-time video and audio recording for incident documentation

- 8.2.1.4.1 Dome

- 8.2.1.5 Cameras market, by resolution

- 8.2.1.5.1 0.3-1.0 MP

- 8.2.1.5.1.1 Cost-effective solutions for basic monitoring needs to contribute to market growth

- 8.2.1.5.2 1.1-2.9 MP

- 8.2.1.5.2.1 Balanced resolution and storage efficiency to contribute to market growth

- 8.2.1.5.3 3.0-5.0 MP

- 8.2.1.5.3.1 High-detail imaging for accurate identification to contribute to market growth

- 8.2.1.5.4 >5.0 MP

- 8.2.1.5.4.1 Need to enhance security and operational efficiency to accelerate demand for >5.0 MP cameras

- 8.2.1.5.1 0.3-1.0 MP

- 8.2.1.6 Cameras market, by channel partner

- 8.2.1.6.1 Distributors

- 8.2.1.6.1.1 Efficient logistics and timely product delivery are driving market growth

- 8.2.1.6.2 Direct to installers or system integrators

- 8.2.1.6.2.1 High focus on building strong customer relationships to boost segmental growth

- 8.2.1.6.3 Direct to end users

- 8.2.1.6.3.1 Expertise in customized system design and integration to contribute towards market demand

- 8.2.1.6.1 Distributors

- 8.2.1.1 Camera components

- 8.2.2 MONITORS

- 8.2.2.1 Up to 20 inches

- 8.2.2.1.1 Use of cost-effective surveillance monitors in control rooms to fuel market growth

- 8.2.2.2 More than 20 inches

- 8.2.2.2.1 Better visibility and high-resolution display to accelerate segmental growth

- 8.2.2.1 Up to 20 inches

- 8.2.3 STORAGE DEVICES

- 8.2.3.1 Digital video recorders (DVRs)

- 8.2.3.1.1 Good image quality, integration with multiple camera systems

- 8.2.3.2 Network video recorders

- 8.2.3.2.1 High-definition recording and playback, remote access, support for easy expansion

- 8.2.3.3 Hybrid video recorders

- 8.2.3.3.1 Combined benefits of DVRs and NVRs to support adoption

- 8.2.3.4 IP storage area networks

- 8.2.3.4.1 Enhanced data management and advanced video analysis

- 8.2.3.5 Direct-attached storage devices

- 8.2.3.5.1 Fast access to stored video and cost-effectiveness

- 8.2.3.6 Network-attached storage devices

- 8.2.3.6.1 Simplified data handling, centralized storage, and better security

- 8.2.3.1 Digital video recorders (DVRs)

- 8.2.4 ACCESSORIES

- 8.2.4.1 Cables

- 8.2.4.1.1 Reliable and high-quality signal transfer, ensuring uninterrupted video feeds to boost demand

- 8.2.4.2 Encoders

- 8.2.4.2.1 Capability to integrate analog systems with digital networks to contribute to segmental growth

- 8.2.4.1 Cables

- 8.2.1 CAMERAS

- 8.3 SOFTWARE

- 8.3.1 SOFTWARE MARKET, BY TYPE

- 8.3.1.1 Video management software

- 8.3.1.1.1 Non-AI-based

- 8.3.1.1.1.1 Cost-effective solution for small-scale or less complex environments to foster market growth

- 8.3.1.1.2 AI-based

- 8.3.1.1.2.1 Growing adoption in smart cities and large infrastructure projects to boost demand

- 8.3.1.1.1 Non-AI-based

- 8.3.1.2 Video analytics software

- 8.3.1.2.1 Video content analysis

- 8.3.1.2.1.1 Real-time alerts for unauthorized access, improving security response, driving growth

- 8.3.1.2.2 AI-driven video analytics

- 8.3.1.2.2.1 Adoption of AI analytics to reduce manual monitoring and enhance accuracy to fuel market growth

- 8.3.1.2.2.2 Analytics at edge

- 8.3.1.2.2.3 Analytics at server

- 8.3.1.2.2.4 AI-driven video analytics use cases

- 8.3.1.2.2.4.1 Industrial safety surveillance

- 8.3.1.2.2.4.2 Industrial temperature monitoring

- 8.3.1.2.2.4.3 Anomaly detection and behavior analysis

- 8.3.1.2.2.4.4 Facial recognition/person search

- 8.3.1.2.2.4.5 Object detection and tracking

- 8.3.1.2.2.4.6 Intrusion detection and perimeter protection

- 8.3.1.2.2.4.7 Smoke and fire detection

- 8.3.1.2.2.4.8 Traffic flow analysis and accident detection

- 8.3.1.2.2.4.9 False alarm filtering

- 8.3.1.2.2.4.10 Wireless video surveillance

- 8.3.1.2.2.4.11 Vehicle identification and number plate recognition

- 8.3.1.2.1 Video content analysis

- 8.3.1.1 Video management software

- 8.3.2 SOFTWARE MARKET, BY DEPLOYMENT MODE

- 8.3.2.1 On-premises

- 8.3.2.1.1 Full control over data security and compliance to propel market

- 8.3.2.2 Cloud-based

- 8.3.2.2.1 Flexible and scalable solutions enabling multi-location surveillance adoption to accelerate market growth

- 8.3.2.1 On-premises

- 8.3.1 SOFTWARE MARKET, BY TYPE

- 8.4 SERVICES

- 8.4.1 VSAAS

- 8.4.1.1 VSaaS market, by technology

- 8.4.1.1.1 AI-enabled VSaaS

- 8.4.1.1.1.1 Rising integration of AI and machine learning in security systems to augment segmental growth

- 8.4.1.1.2 Non-AI video surveillance as a service (VSaaS)

- 8.4.1.1.2.1 Rising demand for cost-effective and scalable cloud-based surveillance solutions to fuel market growth

- 8.4.1.1.1 AI-enabled VSaaS

- 8.4.1.2 VSaaS market, by type

- 8.4.1.2.1 Hosted

- 8.4.1.2.1.1 Availability of low-cost subscription plans to spike demand

- 8.4.1.2.2 Managed

- 8.4.1.2.2.1 Reduced operational costs to create growth opportunities to support market growth

- 8.4.1.2.3 Hybrid

- 8.4.1.2.3.1 Data security, remote access, flexibility, and scalability to boost demand

- 8.4.1.2.1 Hosted

- 8.4.1.1 VSaaS market, by technology

- 8.4.2 INSTALLATION & MAINTENANCE

- 8.4.2.1 Growing demand for professional installation services to ensure system reliability

- 8.4.1 VSAAS

9 VIDEO SURVEILLANCE MARKET, BY SYSTEM TYPE

- 9.1 INTRODUCTION

- 9.2 ANALOG

- 9.2.1 RISING SECURITY CONCERNS IN SMALL ENTERPRISES AND RESIDENTIAL AREAS TO SUPPORT MARKET GROWTH

- 9.3 IP

- 9.3.1 ADOPTION OF AI AND CLOUD-BASED ANALYTICS SOLUTIONS TO DRIVE MARKET DEMAND

- 9.4 HYBRID

- 9.4.1 RISING NEED FOR COST-EFFICIENT MIGRATION FROM ANALOG TO DIGITAL TO DRIVE MARKET DEMAND

10 VIDEO SURVEILLANCE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 COMMERCIAL

- 10.2.1 RETAIL STORES & MALLS

- 10.2.1.1 Need for loss prevention and improved operational efficiency in stores to accelerate segmental growth

- 10.2.2 ENTERPRISES & DATA CENTERS

- 10.2.2.1 Growing adoption of surveillance cameras to safeguard critical assets to support market growth

- 10.2.3 BANKING & FINANCE BUILDINGS

- 10.2.3.1 Rising concerns over ATM fraud and internal theft prevention contribute to segmental growth

- 10.2.4 HOSPITALITY CENTERS

- 10.2.4.1 Rising need to prevent theft, vandalism, and unauthorized area access to accelerate demand

- 10.2.5 WAREHOUSES

- 10.2.5.1 Increasing use of smart cameras for operational efficiency and automation to boost demand

- 10.2.1 RETAIL STORES & MALLS

- 10.3 INFRASTRUCTURE

- 10.3.1 TRANSPORTATION

- 10.3.1.1 Automated toll collection and license plate recognition adoption to contribute to growth

- 10.3.2 SMART CITY

- 10.3.2.1 Traffic management and parking optimization requirements to foster market growth

- 10.3.3 UTILITIES

- 10.3.3.1 Renewable energy facility expansion and distributed asset monitoring to support growth

- 10.3.1 TRANSPORTATION

- 10.4 MILITARY & DEFENSE

- 10.4.1 PRISON & CORRECTION FACILITIES

- 10.4.1.1 Prison overcrowding and increased security risk management to drive market demand

- 10.4.2 BORDER SURVEILLANCE

- 10.4.2.1 National security priorities and illegal immigration concerns to drive market demand

- 10.4.3 COASTAL SURVEILLANCE

- 10.4.3.1 Maritime terrorism and piracy threats to support coastal deployment growth

- 10.4.4 LAW ENFORCEMENT

- 10.4.4.1 Officer safety enhancement during tactical operations to support deployment growth

- 10.4.1 PRISON & CORRECTION FACILITIES

- 10.5 RESIDENTIAL

- 10.5.1 ELEVATING NEED FOR ADVANCED SURVEILLANCE SYSTEMS AND RISE OF SMART HOMES TO SPUR DEMAND

- 10.6 PUBLIC FACILITIES

- 10.6.1 HEALTHCARE BUILDINGS

- 10.6.1.1 Increasing workplace violence against healthcare workers to drive market demand

- 10.6.2 EDUCATIONAL BUILDINGS

- 10.6.2.1 Government grant funding for K-12 security improvements to support deployment growth

- 10.6.3 GOVERNMENT BUILDINGS

- 10.6.3.1 Escalating need to monitor access points and public areas to propel market

- 10.6.4 RELIGIOUS BUILDINGS

- 10.6.4.1 Rising hate crimes and violence against religious minorities to drive demand

- 10.6.1 HEALTHCARE BUILDINGS

- 10.7 INDUSTRIAL

- 10.7.1 MANUFACTURING FACILITIES

- 10.7.1.1 Intellectual property protection and supply chain security to drive market demand

- 10.7.2 CONSTRUCTION SITES

- 10.7.2.1 Liability protection from workplace injuries and accidents to support deployment growth

- 10.7.1 MANUFACTURING FACILITIES

11 VIDEO SURVEILLANCE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- 11.2.3 INFLUENCE OF FEDERAL LAWS AND REGULATIONS

- 11.2.3.1 Key laws and regulations related to video surveillance in US

- 11.2.3.2 Key laws and regulations related to video surveillance in Canada

- 11.2.3.3 Key laws and regulations related to video surveillance in Mexico

- 11.2.4 US

- 11.2.4.1 Growing adoption of AI and facial recognition in surveillance to drive market

- 11.2.5 CANADA

- 11.2.5.1 Government funding for smart city and surveillance infrastructure projects to fuel market growth

- 11.2.6 MEXICO

- 11.2.6.1 Large-scale government initiatives for urban safety and crime reduction to boost demand

- 11.2.6.2 Drivers for video surveillance market

- 11.2.6.3 Opportunities for video surveillance market

- 11.2.6.4 Key companies and their products in video surveillance market

- 11.2.6.5 Recommendations

- 11.2.6.6 Product & vertical trends

- 11.2.6.7 List of suppliers/integrators in video surveillance market

- 11.2.6.8 Impact of state-related laws on companies operating in video surveillance market

- 11.2.6.9 Video analytics penetration

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- 11.3.3 INFLUENCE OF FEDERAL LAWS AND REGULATIONS

- 11.3.3.1 Key laws and regulations related to video surveillance

- 11.3.4 UK

- 11.3.4.1 Growing adoption of AI and machine learning in surveillance systems to support market growth

- 11.3.5 GERMANY

- 11.3.5.1 Rising use of thermal and PTZ cameras for critical monitoring to propel market growth

- 11.3.6 FRANCE

- 11.3.6.1 Rising adoption of intelligent video analytics for security and operations to contribute to market growth

- 11.3.7 ITALY

- 11.3.7.1 Increasing adoption of AI-powered security solutions to enhance crime prevention

- 11.3.8 TURKEY

- 11.3.8.1 Increasing collaboration between local and international technology firms to foster market growth

- 11.3.8.2 Drivers for video surveillance market

- 11.3.8.3 Opportunities for video surveillance market

- 11.3.8.4 Key companies and their products in video surveillance market

- 11.3.8.5 Recommendations

- 11.3.8.6 Trends accelerating market growth

- 11.3.8.7 List of suppliers/integrators in video surveillance market

- 11.3.8.8 Impact of state-related laws on companies operating in video surveillance market

- 11.3.8.9 Key standards and certifications

- 11.3.8.10 Video analytics penetration

- 11.3.9 REST OF EUROPE

- 11.4 RUSSIA

- 11.4.1 GOVERNMENT-LED INVESTMENTS AND INITIATIVES TO DRIVE MARKET GROWTH

- 11.4.2 MACROECONOMIC OUTLOOK FOR RUSSIA

- 11.4.3 DRIVERS FOR VIDEO SURVEILLANCE MARKET

- 11.4.4 OPPORTUNITIES FOR VIDEO SURVEILLANCE MARKET

- 11.4.5 KEY COMPANIES AND THEIR PRODUCTS IN VIDEO SURVEILLANCE MARKET

- 11.4.6 RECOMMENDATIONS

- 11.4.7 TRENDS ACCELERATING MARKET GROWTH

- 11.4.8 LIST OF SUPPLIERS/INTEGRATORS IN VIDEO SURVEILLANCE MARKET

- 11.4.9 IMPACT OF STATE-RELATED LAWS ON COMPANIES OPERATING IN VIDEO SURVEILLANCE MARKET

- 11.4.9.1 Key standards and certifications

- 11.4.9.2 Video analytics penetration

- 11.5 ASIA PACIFIC

- 11.5.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.5.2 TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- 11.5.3 INFLUENCE OF FEDERAL LAWS AND REGULATIONS

- 11.5.3.1 Key laws and regulations related to video surveillance in China

- 11.5.3.2 Key laws and regulations related to video surveillance in South Korea

- 11.5.3.3 Key laws and regulations related to video surveillance in Japan

- 11.5.3.4 Key laws and regulations related to video surveillance in India

- 11.5.3.5 Key laws and regulations related to video surveillance in Australia

- 11.5.3.6 Key laws and regulations related to video surveillance in Singapore

- 11.5.3.7 Key laws and regulations related to video surveillance in Malaysia

- 11.5.3.8 Key laws and regulations related to video surveillance in Thailand

- 11.5.3.9 Key laws and regulations related to video surveillance in Hong Kong

- 11.5.3.10 Key laws and regulations related to video surveillance in Indonesia

- 11.5.4 CHINA

- 11.5.4.1 Integration of artificial intelligence and facial recognition technologies to fuel market growth

- 11.5.5 JAPAN

- 11.5.5.1 Growing adoption of centralized surveillance in logistics and warehousing to accelerate market growth

- 11.5.6 SOUTH KOREA

- 11.5.6.1 Rapid deployment of 5G networks enabling real-time data transmission to support market growth

- 11.5.7 INDIA

- 11.5.7.1 Government initiatives under Smart Cities Mission and Digital India programs to fuel market growth

- 11.5.8 INDONESIA

- 11.5.8.1 Development of cloud-native platforms supporting real-time surveillance analytics to fuel market growth

- 11.5.9 REST OF ASIA PACIFIC

- 11.6 REST OF THE WORLD

- 11.6.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.6.2 TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- 11.6.3 INFLUENCE OF FEDERAL LAWS AND REGULATIONS

- 11.6.3.1 Key laws and regulations related to video surveillance in Middle East

- 11.6.3.2 Key laws and regulations related to video surveillance in Africa

- 11.6.3.3 Key laws and regulations related to video surveillance in South America

- 11.6.4 MIDDLE EAST

- 11.6.4.1 Strategic partnerships and data center expansions to support market growth

- 11.6.4.2 Drivers for video surveillance market

- 11.6.4.3 Opportunities for video surveillance market

- 11.6.4.4 Key companies and their products in video surveillance market

- 11.6.4.5 Recommendations

- 11.6.4.6 Trends accelerating market growth

- 11.6.4.7 List of suppliers/integrators in video surveillance market

- 11.6.4.8 Influence of laws and regulations on industry

- 11.6.4.9 Key standards and certifications

- 11.6.4.10 Video analytics penetration

- 11.6.4.11 GCC countries

- 11.6.4.12 Rest of Middle East

- 11.6.5 AFRICA

- 11.6.5.1 North Africa

- 11.6.5.1.1 Preparations for 2030 FIFA World Cup boosting surveillance technology adoption

- 11.6.5.2 South Africa

- 11.6.5.2.1 Growing presence of global surveillance technology providers to fuel market growth

- 11.6.5.3 Rest of Africa

- 11.6.5.3.1 Rapid urbanization and population growth, driving security requirements

- 11.6.5.1 North Africa

- 11.6.6 SOUTH AMERICA

- 11.6.6.1 Drivers for video surveillance market in South America

- 11.6.6.2 Opportunities for video surveillance market in South America

- 11.6.6.3 Key companies and their products in video surveillance market in South America

- 11.6.6.4 Recommendations

- 11.6.6.5 Trends accelerating market growth

- 11.6.6.6 List of suppliers/integrators in video surveillance market in South America

- 11.6.6.7 South America: Influence of laws and regulations on industry

- 11.6.6.8 Key standards and certifications

- 11.6.6.9 Video analytics penetration

- 11.6.6.10 Brazil

- 11.6.6.10.1 Surging demand for advanced security solutions in retail, infrastructure, and residential sectors to accelerate market growth

- 11.6.6.11 Argentina

- 11.6.6.11.1 Strategic collaborations between international and domestic security providers to support market growth

- 11.6.6.12 Rest of South America

- 11.6.6.12.1 Growing use of intelligent video analytics in retail and commercial sectors to drive market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 System type footprint

- 12.7.5.5 Vertical footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.3.1 Expansions

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 DAHUA TECHNOLOGY CO., LTD

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 HANWHA VISION CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HONEYWELL INTERNATIONAL INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 MOTOROLA SOLUTIONS, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 AXIS COMMUNICATIONS AB.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Other developments

- 13.1.7 BOSCH SECURITY SYSTEMS GMBH

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 TELEDYNE FLIR LLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 I-PRO

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.11 VIVOTEK INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services/Solutions offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.12 EAGLE EYE NETWORKS

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services/Solutions offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.12.3.2 Expansions

- 13.1.13 NEC CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Services/Solutions offered

- 13.1.14 ADT LLC

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Services/Solutions offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.15 MOBOTIX AG

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Services/Solutions offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Deals

- 13.1.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- 13.2 OTHER PLAYERS

- 13.2.1 IRISITY

- 13.2.2 NICE S.P.A.

- 13.2.3 CP PLUS INTERNATIONAL

- 13.2.4 GENETEC INC.

- 13.2.5 CORSIGHT AI

- 13.2.6 HEXAGON AB.

- 13.2.7 TIANDY TECHNOLOGIES CO., LTD.

- 13.2.8 MORPHEAN SA

- 13.2.9 VERKADA INC.

- 13.2.10 CAMCLOUD

- 13.2.11 IVIDEON

- 13.2.12 THE INFINOVA GROUP

- 13.2.13 SPOT AI, INC.

- 13.2.14 INTELEX VISION LTD

- 13.2.15 AMBIENT AI

14 RESEARCH METHODOLOGY

- 14.1 RESEARCH DATA

- 14.1.1 SECONDARY AND PRIMARY RESEARCH

- 14.1.2 SECONDARY DATA

- 14.1.2.1 Major secondary sources

- 14.1.2.2 Key data from secondary sources

- 14.1.3 PRIMARY DATA

- 14.1.3.1 Intended participants in primary interviews

- 14.1.3.2 Key primary interview participants

- 14.1.3.3 Breakdown of primaries

- 14.1.3.4 Key data from primary sources

- 14.1.3.5 Key industry insights

- 14.2 MARKET SIZE ESTIMATION METHODOLOGY

- 14.2.1 BOTTOM-UP APPROACH

- 14.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 14.2.2 TOP-DOWN APPROACH

- 14.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 14.2.1 BOTTOM-UP APPROACH

- 14.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 14.4 RESEARCH ASSUMPTIONS

- 14.5 RESEARCH LIMITATIONS

- 14.6 RISK ANALYSIS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DYNAMICS

- TABLE 2 VIDEO SURVEILLANCE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 4 ROLE OF COMPANIES IN VIDEO SURVEILLANCE ECOSYSTEM

- TABLE 5 INDICATIVE PRICING TREND OF VIDEO SURVEILLANCE CAMERAS OFFERED BY KEY PLAYERS FOR TOP THREE VERTICALS, 2024 (USD)

- TABLE 6 INDICATIVE PRICING TREND OF VIDEO SURVEILLANCE CAMERAS FOR TOP THREE VERTICALS, 2021-2024 (USD)

- TABLE 7 INDICATIVE PRICING TREND OF VIDEO SURVEILLANCE CAMERAS, BY FORM FACTOR, 2024 (USD)

- TABLE 8 INDICATIVE PRICING TREND OF VIDEO SURVEILLANCE CAMERAS, BY REGION, 2021-2024 (USD)

- TABLE 9 INDICATIVE PRICING TREND OF VIDEO SURVEILLANCE CAMERAS, BY KEY PLAYER (USD)

- TABLE 10 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 VIDEO SURVEILLANCE MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 14 EXPECTED CHANGE IN PRICES AND IMPACT ON VERTICALS DUE TO TARIFFS

- TABLE 15 LIST OF PATENTS RELATED TO VIDEO SURVEILLANCE TECHNOLOGY, 2024

- TABLE 16 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 17 VIDEO SURVEILLANCE MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 18 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 VIDEO SURVEILLANCE MARKET: STANDARDS

- TABLE 24 VIDEO SURVEILLANCE MARKET: REGULATIONS

- TABLE 25 VIDEO SURVEILLANCE MARKET: CERTIFICATIONS

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 28 UNMET NEEDS IN THE VIDEO SURVEILLANCE MARKET, BY VERTICAL

- TABLE 29 VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 30 VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 31 VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 32 VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD BILLION)

- TABLE 33 VIDEO SURVEILLANCE HARDWARE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 34 VIDEO SURVEILLANCE HARDWARE MARKET, BY VERTICAL, 2025-2031 (USD BILLION)

- TABLE 35 VIDEO SURVEILLANCE HARDWARE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 36 VIDEO SURVEILLANCE HARDWARE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 37 CAMERAS MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 38 CAMERAS MARKET, BY TYPE, 2025-2031 (USD BILLION)

- TABLE 39 CAMERAS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 40 CAMERAS MARKET, BY TYPE, 2025-2031 (THOUSAND UNITS)

- TABLE 41 IP CAMERAS VS. ANALOG CAMERAS

- TABLE 42 PROS AND CONS OF WIRED SURVEILLANCE CAMERAS

- TABLE 43 PROS AND CONS OF WIRELESS SURVEILLANCE CAMERAS

- TABLE 44 CAMERAS MARKET, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 45 CAMERAS MARKET, BY FORM FACTOR, 2025-2031 (USD MILLION)

- TABLE 46 CAMERAS MARKET, BY RESOLUTION, 2021-2024 (USD BILLION)

- TABLE 47 CAMERAS MARKET, BY RESOLUTION, 2025-2031 (USD BILLION)

- TABLE 48 CAMERAS MARKET, BY CHANNEL PARTNER, 2021-2024 (USD BILLION)

- TABLE 49 CAMERAS MARKET, BY CHANNEL PARTNER, 2025-2031 (USD BILLION)

- TABLE 50 MONITORS MARKET, BY SCREEN SIZE, 2021-2024 (USD BILLION)

- TABLE 51 MONITORS MARKET, BY SCREEN SIZE, 2025-2031 (USD BILLION)

- TABLE 52 VIDEO SURVEILLANCE SOFTWARE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 53 VIDEO SURVEILLANCE SOFTWARE MARKET, BY VERTICAL, 2025-2031 (USD BILLION)

- TABLE 54 VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 55 VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 56 VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 57 VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD BILLION)

- TABLE 58 VIDEO MANAGEMENT SOFTWARE MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 59 VIDEO MANAGEMENT SOFTWARE MARKET, BY TYPE, 2025-2031 (USD BILLION)

- TABLE 60 VIDEO ANALYTICS SOFTWARE MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 61 VIDEO ANALYTICS SOFTWARE MARKET, BY TYPE, 2025-2031 (USD BILLION)

- TABLE 62 AI-DRIVEN VIDEO ANALYTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 AI-DRIVEN VIDEO ANALYTICS MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 64 AI-POWERED INDUSTRIAL SAFETY SURVEILLANCE USE CASE: CPCL SEEKS SECURITY ENHANCEMENTS

- TABLE 65 THERMAL MONITORING SOLUTION USE CASE: ITALCEMENTI IMPROVES KILN EFFICIENCY WITH VISIONTIR'S RKS300 SYSTEM

- TABLE 66 AI-POWERED THREAT DETECTION USE CASE: RAID RISK MANAGEMENT REDUCES FALSE ALARMS WITH SCYLLA TECHNOLOGIES

- TABLE 67 FACIAL RECOGNITION ACCESS CONTROL USE CASE: THAI GOVERNMENT AGENCIES STRENGTHEN SECURITY WITH CYBERLINK'S FACEME SOLUTION

- TABLE 68 AI-ENABLED VIDEO ANALYTICS USE CASE: ORGANIZATIONS ENHANCE CCTV MONITORING EFFICIENCY WITH TELEMUS AI

- TABLE 69 INTEGRATED SECURITY SYSTEM USE CASE: UNIVERSITY OF BALTIMORE STRENGTHENS CAMPUS SAFETY WITH ICS SECURITY SOLUTIONS

- TABLE 70 INTELLIGENT VIDEO FIRE DETECTION USE CASE: INCARPALM ENHANCES FACTORY SAFETY WITH BOSCH'S AVIOTEC SOLUTION

- TABLE 71 AI-BASED TRAFFIC INCIDENT DETECTION USE CASE: DELHI POLICE IMPROVES REAL-TIME MONITORING WITH IVA'S DEEP LEARNING SOLUTION

- TABLE 72 AI-BASED FALSE ALARM FILTERING USE CASE: SENTINEL MONITORING ENHANCES CCTV EFFICIENCY WITH SCYLLA TECHNOLOGIES

- TABLE 73 WIRELESS VIDEO SURVEILLANCE USE CASE: DELTA SHORES REDUCES CRIME WITH SAFE AND SOUND SECURITY'S AVIGILON-BASED SOLUTION

- TABLE 74 ANPR-BASED VEHICLE ACCESS CONTROL USE CASE: IPSWICH STATION ENHANCES PARKING SECURITY WITH TAYLOR TECHNOLOGY SYSTEMS

- TABLE 75 VIDEO SURVEILLANCE SOFTWARE MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD BILLION)

- TABLE 76 VIDEO SURVEILLANCE SOFTWARE MARKET, BY DEPLOYMENT MODE, 2025-2031 (USD BILLION)

- TABLE 77 VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 78 VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD BILLION)

- TABLE 79 VIDEO SURVEILLANCE SERVICES MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 80 VIDEO SURVEILLANCE SERVICES MARKET, BY VERTICAL, 2025-2031 (USD BILLION)

- TABLE 81 VIDEO SURVEILLANCE SERVICES MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 82 VIDEO SURVEILLANCE SERVICES MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 83 VSAAS MARKET, BY TECHNOLOGY, 2021-2024 (USD BILLION)

- TABLE 84 VSAAS MARKET, BY TECHNOLOGY, 2025-2031 (USD BILLION)

- TABLE 85 VSAAS MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 86 VSAAS MARKET, BY TYPE, 2025-2031 (USD BILLION)

- TABLE 87 VIDEO SURVEILLANCE MARKET, BY SYSTEM TYPE, 2021-2024 (USD BILLION)

- TABLE 88 VIDEO SURVEILLANCE MARKET, BY SYSTEM TYPE, 2025-2031 (USD BILLION)

- TABLE 89 VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 90 VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2031 (USD BILLION)

- TABLE 91 COMMERCIAL: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 92 COMMERCIAL: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2031 (USD BILLION)

- TABLE 93 COMMERCIAL: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 94 COMMERCIAL: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 95 COMMERCIAL: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 96 COMMERCIAL: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 97 INFRASTRUCTURE: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 98 INFRASTRUCTURE: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2031 (USD BILLION)

- TABLE 99 INFRASTRUCTURE: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 100 INFRASTRUCTURE: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 101 INFRASTRUCTURE: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 102 INFRASTRUCTURE: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 103 MILITARY & DEFENSE: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 MILITARY & DEFENSE: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 105 MILITARY & DEFENSE: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 106 MILITARY & DEFENSE: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 107 MILITARY & DEFENSE: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 108 MILITARY & DEFENSE: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 109 RESIDENTIAL: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 110 RESIDENTIAL: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 111 RESIDENTIAL: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 112 RESIDENTIAL: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 113 PUBLIC FACILITIES: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 114 PUBLIC FACILITIES: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2031 (USD BILLION)

- TABLE 115 PUBLIC FACILITIES: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 116 PUBLIC FACILITIES: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 117 PUBLIC FACILITIES: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 118 PUBLIC FACILITIES: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 119 INDUSTRIAL: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 120 INDUSTRIAL: VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2031 (USD BILLION)

- TABLE 121 INDUSTRIAL: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 122 INDUSTRIAL: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 123 INDUSTRIAL: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 INDUSTRIAL: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 125 VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 126 VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 127 VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 128 VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (THOUSAND UNITS)

- TABLE 129 NORTH AMERICA: TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- TABLE 130 US: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 131 CANADA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 132 MEXICO: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 133 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 134 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (USD BILLION)

- TABLE 135 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 136 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (THOUSAND UNITS)

- TABLE 137 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 138 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2031 (USD BILLION)

- TABLE 139 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 140 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 141 MEXICO: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 142 MEXICO: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 143 MEXICO: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 MEXICO: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 145 MEXICO: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 146 MEXICO: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 147 MEXICO: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 148 MEXICO: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 149 MEXICO: DRIVERS FOR VIDEO SURVEILLANCE MARKET

- TABLE 150 MEXICO: OPPORTUNITIES FOR VIDEO SURVEILLANCE MARKET

- TABLE 151 MEXICO: KEY COMPANIES AND THEIR PRODUCTS

- TABLE 152 MEXICO: LIST OF SUPPLIERS/INTEGRATORS IN VIDEO SURVEILLANCE MARKET

- TABLE 153 EUROPE: TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- TABLE 154 EUROPE: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 155 EUROPE: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 156 EUROPE: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (USD BILLION)

- TABLE 157 EUROPE: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 158 EUROPE: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (THOUSAND UNITS)

- TABLE 159 EUROPE: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 160 EUROPE: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2031 (USD BILLION)

- TABLE 161 EUROPE: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 162 EUROPE: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 163 TURKEY: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 164 TURKEY: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 165 TURKEY: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 TURKEY: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 167 TURKEY: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 168 TURKEY: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 169 TURKEY: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 170 TURKEY: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 171 TURKEY: DRIVERS FOR VIDEO SURVEILLANCE MARKET

- TABLE 172 TURKEY: OPPORTUNITIES FOR VIDEO SURVEILLANCE MARKET

- TABLE 173 TURKEY: KEY COMPANIES AND THEIR PRODUCTS

- TABLE 174 TURKEY: LIST OF SUPPLIERS/INTEGRATORS IN VIDEO SURVEILLANCE MARKET

- TABLE 175 TURKEY: KEY STANDARDS

- TABLE 176 TURKEY: KEY CERTIFICATIONS

- TABLE 177 RUSSIA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 178 RUSSIA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (USD BILLION)

- TABLE 179 RUSSIA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 180 RUSSIA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (THOUSAND UNITS)

- TABLE 181 RUSSIA: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 182 RUSSIA: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2031 (USD MILLION)

- TABLE 183 RUSSIA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 184 RUSSIA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 185 RUSSIA: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 186 RUSSIA: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 187 RUSSIA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 188 RUSSIA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 189 RUSSIA: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 190 RUSSIA: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 191 RUSSIA: DRIVERS FOR VIDEO SURVEILLANCE MARKET

- TABLE 192 RUSSIA: OPPORTUNITIES FOR VIDEO SURVEILLANCE MARKET

- TABLE 193 RUSSIA: KEY COMPANIES AND THEIR PRODUCTS

- TABLE 194 RUSSIA: LIST OF SUPPLIERS/INTEGRATORS IN VIDEO SURVEILLANCE MARKET

- TABLE 195 RUSSIA: KEY STANDARDS

- TABLE 196 RUSSIA: KEY CERTIFICATIONS

- TABLE 197 ASIA PACIFIC: TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- TABLE 198 CHINA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 199 SOUTH KOREA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 200 JAPAN: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 201 INDIA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 202 AUSTRALIA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 203 SINGAPORE: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 204 MALAYSIA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 205 THAILAND: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 206 HONG KONG: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 207 INDONESIA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 208 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 209 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (USD BILLION)

- TABLE 210 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 211 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (THOUSAND UNITS)

- TABLE 212 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 213 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2031 (USD BILLION)

- TABLE 214 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 215 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 216 INDIA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 217 INDIA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 218 INDIA: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 219 INDIA: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 220 INDIA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 221 INDIA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 222 INDIA: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 223 INDIA: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 224 INDONESIA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 225 INDONESIA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 226 INDONESIA: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 227 INDONESIA: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 228 INDONESIA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 229 INDONESIA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 230 INDONESIA: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 231 INDONESIA: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 232 ROW: TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- TABLE 233 MIDDLE EAST: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 234 AFRICA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 235 SOUTH AMERICA: KEY LAWS AND REGULATIONS RELATED TO VIDEO SURVEILLANCE

- TABLE 236 ROW: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 237 ROW: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 238 ROW: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 239 ROW: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (THOUSAND UNITS)

- TABLE 240 ROW: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 241 ROW: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2031 (USD MILLION)

- TABLE 242 ROW: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 243 ROW: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD BILLION)

- TABLE 244 MIDDLE EAST: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 245 MIDDLE EAST: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD BILLION)

- TABLE 246 MIDDLE EAST: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 247 MIDDLE EAST: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 248 MIDDLE EAST: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 249 MIDDLE EAST: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 250 MIDDLE EAST: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 251 MIDDLE EAST: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 252 MIDDLE EAST: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 253 MIDDLE EAST: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 254 MIDDLE EAST: DRIVERS FOR VIDEO SURVEILLANCE MARKET

- TABLE 255 MIDDLE EAST: OPPORTUNITIES FOR VIDEO SURVEILLANCE MARKET

- TABLE 256 MIDDLE EAST: KEY COMPANIES AND THEIR PRODUCTS

- TABLE 257 MIDDLE EAST: LIST OF SUPPLIERS/INTEGRATORS IN VIDEO SURVEILLANCE MARKET

- TABLE 258 MIDDLE EAST: KEY STANDARDS

- TABLE 259 MIDDLE EAST: KEY CERTIFICATIONS

- TABLE 260 AFRICA: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 261 AFRICA: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 262 AFRICA: VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 263 AFRICA: VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2031 (THOUSAND UNITS)

- TABLE 264 NORTH AFRICA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 265 NORTH AFRICA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 266 NORTH AFRICA: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 267 NORTH AFRICA: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 268 NORTH AFRICA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 269 NORTH AFRICA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 270 NORTH AFRICA: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 271 NORTH AFRICA: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 272 SOUTH AMERICA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 273 SOUTH AMERICA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 274 SOUTH AMERICA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 275 SOUTH AMERICA: VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2031 (THOUSAND UNITS)

- TABLE 276 SOUTH AMERICA: DRIVERS FOR VIDEO SURVEILLANCE MARKET

- TABLE 277 SOUTH AMERICA: OPPORTUNITIES FOR VIDEO SURVEILLANCE MARKET

- TABLE 278 SOUTH AMERICA: KEY COMPANIES AND THEIR PRODUCTS

- TABLE 279 SOUTH AMERICA: LIST OF SUPPLIERS/INTEGRATORS IN VIDEO SURVEILLANCE MARKET

- TABLE 280 SOUTH AMERICA: KEY STANDARDS

- TABLE 281 SOUTH AMERICA: KEY CERTIFICATIONS

- TABLE 282 BRAZIL: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 283 BRAZIL: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 284 BRAZIL: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 285 BRAZIL: VIDEO SURVEILLANCE HARDWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 286 BRAZIL: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 287 BRAZIL: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 288 BRAZIL: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 289 BRAZIL: VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2025-2031 (USD MILLION)

- TABLE 290 VIDEO SURVEILLANCE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 291 VIDEO SURVEILLANCE MARKET SHARE ANALYSIS, 2024

- TABLE 292 VIDEO SURVEILLANCE MARKET: REGION FOOTPRINT

- TABLE 293 VIDEO SURVEILLANCE MARKET: OFFERING FOOTPRINT

- TABLE 294 VIDEO SURVEILLANCE MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 295 VIDEO SURVEILLANCE MARKET: VERTICAL FOOTPRINT

- TABLE 296 VIDEO SURVEILLANCE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 297 VIDEO SURVEILLANCE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 298 VIDEO SURVEILLANCE MARKET: PRODUCT LAUNCHES, JANUARY 2023 TO OCTOBER 2025

- TABLE 299 VIDEO SURVEILLANCE MARKET: DEALS, JANUARY 2023 TO OCTOBER 2025

- TABLE 300 VIDEO SURVEILLANCE MARKET: EXPANSIONS, JANUARY 2023 TO OCTOBER 2025

- TABLE 301 VIDEO SURVEILLANCE MARKET: OTHER DEVELOPMENTS, JANUARY 2023 TO OCTOBER 2025

- TABLE 302 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 303 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 304 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 305 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: DEALS

- TABLE 306 DAHUA TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 307 DAHUA TECHNOLOGY CO., LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 308 DAHUA TECHNOLOGY CO., LTD: PRODUCT LAUNCHES

- TABLE 309 DAHUA TECHNOLOGY CO., LTD: DEALS

- TABLE 310 DAHUA TECHNOLOGY CO., LTD: OTHER DEVELOPMENTS

- TABLE 311 HANWHA VISION CO., LTD.: COMPANY OVERVIEW

- TABLE 312 HANWHA VISION CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 313 HANWHA VISION CO., LTD.: PRODUCT LAUNCHES

- TABLE 314 HANWHA VISION CO., LTD.: DEALS

- TABLE 315 HANWHA VISION CO., LTD.: EXPANSIONS

- TABLE 316 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 317 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 318 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 319 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 320 MOTOROLA SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 321 MOTOROLA SOLUTIONS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 322 MOTOROLA SOLUTIONS, INC.: PRODUCT LAUNCHES

- TABLE 323 MOTOROLA SOLUTIONS, INC.: DEALS

- TABLE 324 AXIS COMMUNICATIONS AB.: COMPANY OVERVIEW

- TABLE 325 AXIS COMMUNICATIONS AB.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 326 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES

- TABLE 327 AXIS COMMUNICATIONS AB.: DEALS

- TABLE 328 AXIS COMMUNICATIONS AB.: OTHER DEVELOPMENTS

- TABLE 329 BOSCH SECURITY SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 330 BOSCH SECURITY SYSTEMS GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 331 BOSCH SECURITY SYSTEMS GMBH: PRODUCT LAUNCHES

- TABLE 332 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 333 TELEDYNE FLIR LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 334 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 335 TELEDYNE FLIR LLC.: DEALS

- TABLE 336 I-PRO: COMPANY OVERVIEW

- TABLE 337 I-PRO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 338 I-PRO: PRODUCT LAUNCHES

- TABLE 339 I-PRO: DEALS

- TABLE 340 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 341 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 342 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 343 VIVOTEK INC.: COMPANY OVERVIEW

- TABLE 344 VIVOTEK INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 345 VIVOTEK INC.: PRODUCT LAUNCHES

- TABLE 346 EAGLE EYE NETWORKS: COMPANY OVERVIEW

- TABLE 347 EAGLE EYE NETWORKS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 348 EAGLE EYE NETWORKS: PRODUCT LAUNCHES

- TABLE 349 EAGLE EYE NETWORKS: EXPANSIONS

- TABLE 350 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 351 NEC CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 352 ADT LLC: COMPANY OVERVIEW

- TABLE 353 ADT LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 354 ADT LLC: PRODUCT LAUNCHES

- TABLE 355 MOBOTIX AG: COMPANY OVERVIEW

- TABLE 356 MOBOTIX AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 357 MOBOTIX AG: PRODUCT LAUNCHES

- TABLE 358 MOBOTIX AG: DEALS

- TABLE 359 IRISITY: COMPANY OVERVIEW

- TABLE 360 NICE S.P.A.: COMPANY OVERVIEW

- TABLE 361 CP PLUS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 362 GENETEC INC.: COMPANY OVERVIEW

- TABLE 363 CORSIGHT AI: COMPANY OVERVIEW

- TABLE 364 HEXAGON AB.: COMPANY OVERVIEW

- TABLE 365 TIANDY TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 366 MORPHEAN SA: COMPANY OVERVIEW

- TABLE 367 VERKADA INC.: COMPANY OVERVIEW

- TABLE 368 CAMCLOUD: COMPANY OVERVIEW

- TABLE 369 IVIDEON: COMPANY OVERVIEW

- TABLE 370 THE INFINOVA GROUP: COMPANY OVERVIEW

- TABLE 371 SPOT AI, INC.: COMPANY OVERVIEW

- TABLE 372 INTELEX VISION LTD: COMPANY OVERVIEW

- TABLE 373 AMBIENT AI: COMPANY OVERVIEW

- TABLE 374 VIDEO SURVEILLANCE MARKET: RESEARCH ASSUMPTIONS

- TABLE 375 VIDEO SURVEILLANCE MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 VIDEO SURVEILLANCE: MARKETS COVERED AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL VIDEO SURVEILLANCE MARKET, 2025-2031

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN VIDEO SURVEILLANCE MARKET (2023-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING MARKET GROWTH

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN VIDEO SURVEILLANCE MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 GROWING INTEGRATION OF ARTIFICIAL INTELLIGENCE (AI) AND VIDEO ANALYTICS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 9 COMMERCIAL VERTICAL SEGMENT AND CHINA TO DOMINATE ASIA PACIFIC IN 2025

- FIGURE 10 COMMERCIAL VERTICAL TO ACCOUNT FOR LARGEST SHARE OF VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC THROUGHOUT FORECAST PERIOD

- FIGURE 11 CHINA TO EXHIBIT HIGHEST CAGR IN VIDEO SURVEILLANCE MARKET

- FIGURE 12 VIDEO SURVEILLANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 VIDEO SURVEILLANCE MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 14 VIDEO SURVEILLANCE MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 15 VIDEO SURVEILLANCE MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 16 VIDEO SURVEILLANCE MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 17 VIDEO SURVEILLANCE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 VIDEO SURVEILLANCE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 VIDEO SURVEILLANCE ECOSYSTEM ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE TREND OF VIDEO SURVEILLANCE CAMERAS OFFERED BY KEY PLAYERS FOR TOP THREE VERTICALS, 2024 (USD)

- FIGURE 21 AVERAGE SELLING PRICE TREND OF VIDEO SURVEILLANCE CAMERAS, BY FORM FACTOR, 2024 (USD)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF VIDEO SURVEILLANCE CAMERAS, BY REGION, 2021-2024 (USD)

- FIGURE 23 IMPORT SCENARIO FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 24 EXPORT SCENARIO FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 FUNDS RAISED BY COMPANIES TO DEVELOP VIDEO SURVEILLANCE PRODUCTS

- FIGURE 27 PATENTS GRANTED AND APPLIED IN VIDEO SURVEILLANCE MARKET, 2015-2024

- FIGURE 28 VIDEO SURVEILLANCE MARKET DECISION-MAKING FACTORS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 31 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 32 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR FROM 2025 TO 2031

- FIGURE 33 BLOCK DIAGRAM OF STATIONARY SURVEILLANCE CAMERAS

- FIGURE 34 KEY COMPONENTS OF ANALOG CAMERAS

- FIGURE 35 KEY COMPONENTS OF DIGITAL/IP CAMERAS

- FIGURE 36 BLOCK DIAGRAM OF ADVANCED IP SURVEILLANCE CAMERAS

- FIGURE 37 CAMERAS, BY FORM FACTOR

- FIGURE 38 VIDEO SURVEILLANCE SOFTWARE, BY TYPE

- FIGURE 39 IP CAMERAS TO WITNESS HIGHER CAGR FROM 2024 TO 2030

- FIGURE 40 BLOCK DIAGRAM OF ANALOG VIDEO SURVEILLANCE SYSTEMS

- FIGURE 41 BLOCK DIAGRAM OF IP VIDEO SURVEILLANCE SYSTEMS

- FIGURE 42 INFRASTRUCTURE SEGMENT TO RECORD HIGHEST CAGR FROM 2024 TO 2030

- FIGURE 43 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN VIDEO SURVEILLANCE MARKET FROM 2025 TO 2031

- FIGURE 44 NORTH AMERICA: VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 45 EUROPE: VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS OF TOP PLAYERS IN VIDEO SURVEILLANCE MARKET, 2020-2024

- FIGURE 48 VIDEO SURVEILLANCE MARKET: SHARES OF KEY PLAYERS, 2024

- FIGURE 49 VIDEO SURVEILLANCE MARKET: COMPANY VALUATION

- FIGURE 50 VIDEO SURVEILLANCE MARKET: FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 51 VIDEO SURVEILLANCE MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 52 VIDEO SURVEILLANCE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 VIDEO SURVEILLANCE MARKET: COMPANY FOOTPRINT

- FIGURE 54 VIDEO SURVEILLANCE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 56 DAHUA TECHNOLOGY CO., LTD: COMPANY SNAPSHOT

- FIGURE 57 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 58 MOTOROLA SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 59 AXIS COMMUNICATIONS AB.: COMPANY SNAPSHOT

- FIGURE 60 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 61 VIVOTEK INC.: COMPANY SNAPSHOT

- FIGURE 62 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 ADT LLC: COMPANY SNAPSHOT

- FIGURE 64 MOBOTIX AG: COMPANY SNAPSHOT

- FIGURE 65 VIDEO SURVEILLANCE MARKET: RESEARCH DESIGN

- FIGURE 66 VIDEO SURVEILLANCE MARKET: RESEARCH APPROACH

- FIGURE 67 VIDEO SURVEILLANCE MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 68 VIDEO SURVEILLANCE MARKET: BOTTOM-UP APPROACH

- FIGURE 69 VIDEO SURVEILLANCE MARKET: TOP-DOWN APPROACH

- FIGURE 70 VIDEO SURVEILLANCE MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 71 VIDEO SURVEILLANCE MARKET: DATA TRIANGULATION

- FIGURE 72 VIDEO SURVEILLANCE MARKET: RESEARCH LIMITATIONS