Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1272666

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1272666

2-Ethyl Hexanol Market - Growth, Trends, and Forecasts (2023 - 2028)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The market for 2-ethyl hexanol is projected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- Increasing demand for 2-ethyl hexanol acrylate from the paint and coatings, adhesive, and construction industries is expected to drive the market during the forecast period. On the other hand, the market expansion is likely to be hampered by the restricted use of plasticizers in various regions, such as North America and Europe.

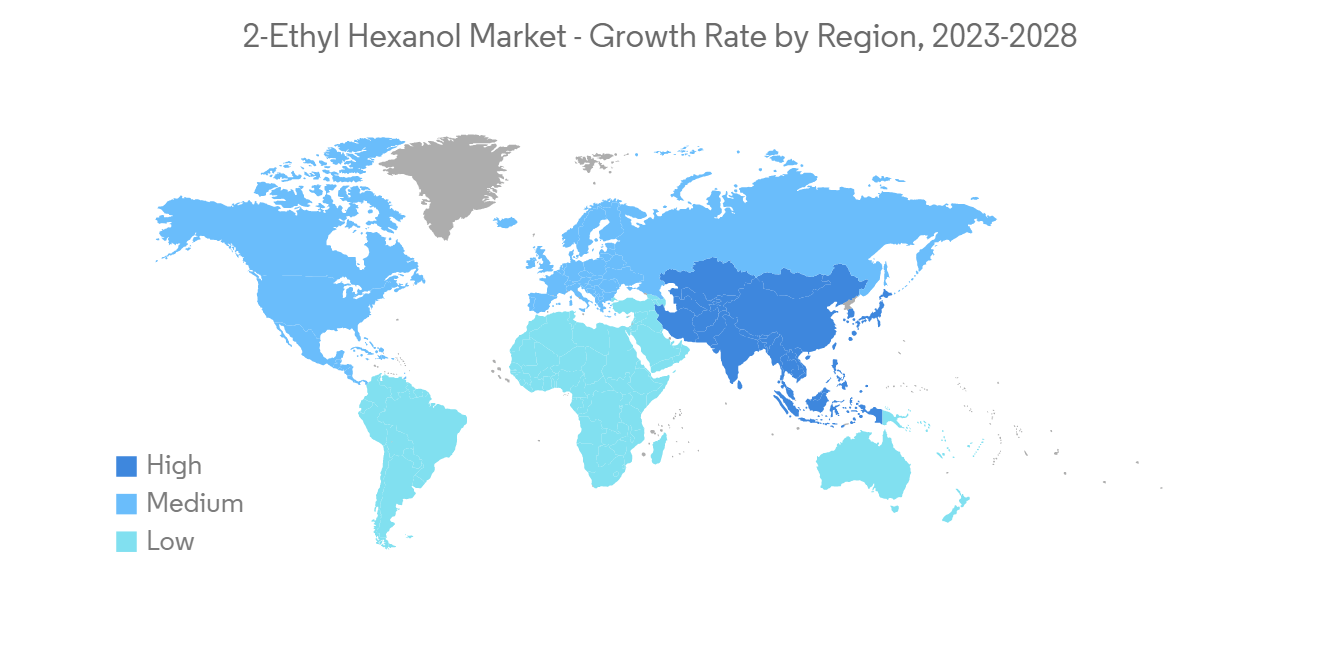

- The rising demand for chemicals across various industries is expected to provide opportunities for the 2-ethyl hexanol market in the coming years. The Asia-Pacific region dominates the market worldwide, with countries like China, India, and Japan being the biggest consumers.

2-Ethyl Hexanol Market Trends

Increasing Demand for 2-EH Acrylate to Propel the Market

- The demand for 2-ethylhexyl acrylate from various end-user industries is predicted to increase the product demand in the market during the forecast period. 2-ethylhexyl acrylate is used to manufacture paint and coatings, and construction and adhesives materials. Further, 2-ethylhexyl acrylate serves as a plasticizing co-monomer in resins for pressure-sensitive adhesives, latex, paints, textile and leather finishes, and coatings for paper.

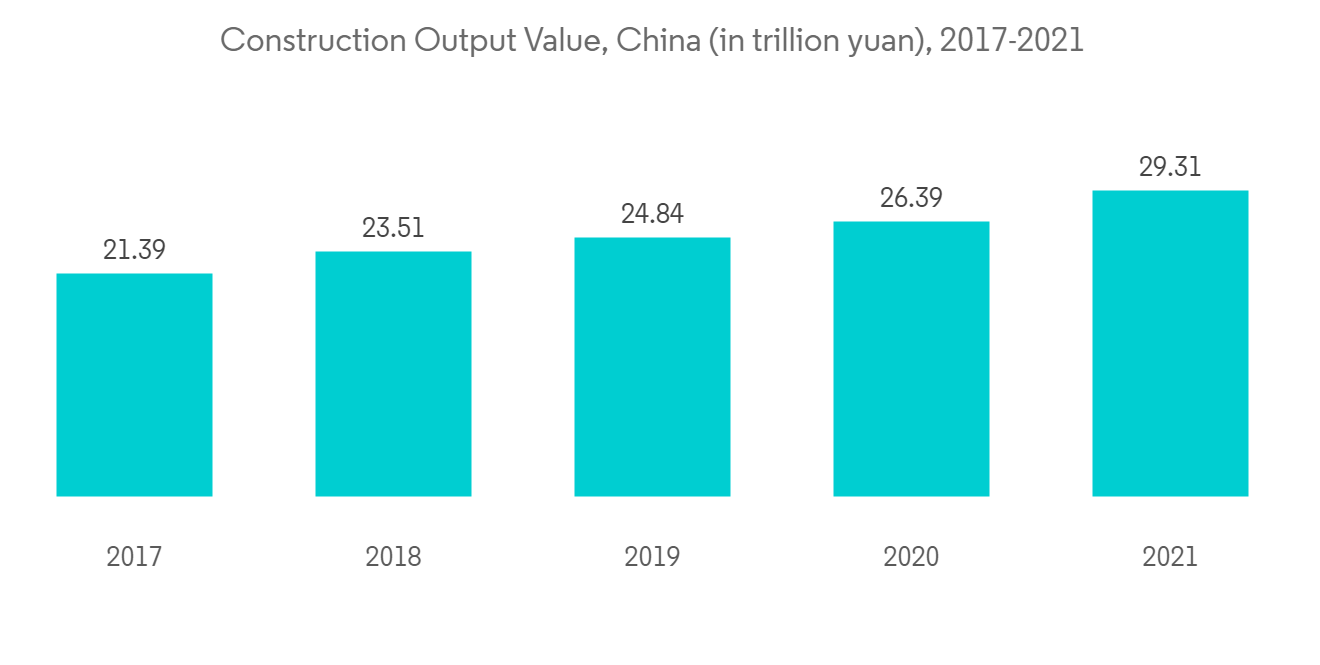

- The global paints and coatings market is expanding owing to growing residential and commercial construction activities, which is expected to drive the demand for 2-ethylhexyl acrylate in construction work. For example, China's growth is fueled mainly by rapid residential and commercial building expansion. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030.

- Also, China's construction output peaked in 2021 at a value of about USD 4.21 trillion. As a result, these factors tend to increase the demand for 2-ethylhexyl acrylate across the globe. All the aforementioned factors are expected to drive the global 2-ethyl hexanol market during the forecast period.

Asia-Pacific to Witness Strong Demand

- Asia-Pacific is expected to have the largest market share in the 2-ethyl hexanol market during the forecast period. With the expanding industries such as paints and coatings, adhesives, etc., the market is expected to bloom across the region.

- China experienced a significant increase in construction activities, resulting in a surge in demand for 2-ethyl hexanol in construction applications. For example, China is one of the leading countries with respect to the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- Furthermore, the packaging segment is the largest consumer of adhesives; thereby growing packaging industry is expected to drive the concerned market. Packaging is witnessing strong demand from end-user industries, such as food and beverages, cosmetics, consumer goods, stationery, etc.

- In India, the packaging category is the highest end-user category, holding about 67% of total adhesive users, supporting the market growth during the forecast period. Thus, the rising demand from various industries is expected to drive the market in the region during the forecast period.

2-Ethyl Hexanol Industry Overview

The 2-ethyl hexanol market is partially consolidated in nature. Some of the major players in the market include Ineos, Mitsubishi Chemical Corporation, SABIC, Eastman Chemical Company, and Dow, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 69091

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for 2-EH Acrylate

- 4.1.2 Increasing Consumption of Plasticizers

- 4.2 Restraints

- 4.2.1 Restricted Use of Plasticizers in Various Regions, such as North America and Europe

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Applications

- 5.1.1 Plasticizers

- 5.1.2 2-EH Acrylate

- 5.1.3 2-EH Nitrate

- 5.1.4 Other Applications

- 5.2 End-User

- 5.2.1 Paint and Coatings

- 5.2.2 Adhesives

- 5.2.3 Industrial Chemicals

- 5.2.4 Other End-Users

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Aregentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dow

- 6.4.2 BASF SE

- 6.4.3 Eastman Chemical Company

- 6.4.4 SABIC

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 LG Chem

- 6.4.7 INEOS

- 6.4.8 NAN YA PLASTICS CORPORATION

- 6.4.9 OQ Chemicals GmbH

- 6.4.10 Elekeiroz

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Rising Demand for Chemicals Across Various Industries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.