Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1429999

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1429999

South America Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 434 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

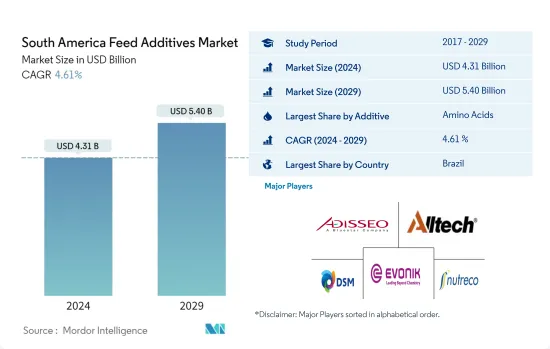

The South America Feed Additives Market size is estimated at USD 4.31 billion in 2024, and is expected to reach USD 5.40 billion by 2029, growing at a CAGR of 4.61% during the forecast period (2024-2029).

- In 2022, amino acids, binders, minerals, probiotics, and prebiotics were the major feed additive types used for livestock feed in South America, which together accounted for 60.8% of the total feed additives market by value.

- In South America, amino acids accounted for a market value of USD 812.1 million in 2022. Lysine is one of the most vital amino acids required for animal nutrition. Thus, in 2022, it accounted for 38.3% of the South American feed amino acids market by value.

- Macrominerals are the most used feed minerals in the region and accounted for an 88.6% share of the feed mineral market by value in 2022. Macrominerals are essential mineral nutrients that animals must consume in significant amounts. Calcium, chlorine, magnesium, phosphorus, potassium, sodium, and sulfur are included in macrominerals. Due to their high requirement in supporting the immune system and reproductive health of cattle and poultry, macrominerals are majorly used in the region.

- In the South American feed acidifiers market, Brazil held the major market share of 58.5% by value in 2022. The high share of Brazil was due to the increase in feed production in the country. For instance, feed production increased from 67.4 million metric tons in 2017 to 76.8 million metric tons in 2022.

- During the forecast period (2023-2029), the dairy cattle sub-segment is expected to be the fastest-growing segment in the South American feed binders market, recording a CAGR of 5.0%. Binders boost animal health by reducing livestock diseases, in addition to improving the stability and consistency of feed. Thus, due to the importance of feed additives in animal nutrition, the market is anticipated to grow during the forecast period.

- South America grew rapidly, recording an 11.9% share of the global feed additives market by value in 2022. Brazil is the leading country, contributing the maximum value to the South American feed additive market in 2022. The fastest-growing segment in Brazil is aquaculture, expected to record a CAGR of 5.2% during the forecast period, followed closely by ruminants, with a CAGR of 4.7%. This growth is largely driven by an 8.5% increase in Brazil's overall livestock population from 2017 to 2022 and the rising exports of meat and meat products.

- Argentina is the second-largest feed additive country-wise market in South America and is expected to record a CAGR of 4.6% during the forecast period. In 2022, the ruminant segment accounted for the maximum share of 49.3% of the Argentine feed additives market as the population of ruminants continues to increase, thereby increasing consumption.

- Chile is the fastest-growing market in South America, which is expected to register a CAGR of 5.2% during the forecast period. Amino acids are the most widely used additives in animal feed in Chile, which accounted for 24.8% of the overall feed additive market by value in 2022. The swine segment is the fastest-growing in the country, and its market share is expected to grow during the forecast period.

- The Rest of South America regional segment accounted for 21.0% of the South American feed additive market in 2022, with the poultry segment holding the largest share of 64.8%, followed by swine with a 14.6% share.

- The South American feed additive market is expected to register a CAGR of 4.6% during the forecast period, driven by the rising use of feed additives to support animals' nutritional requirements and the rapid expansion of meat production.

South America Feed Additives Market Trends

Broilers and layers dominate the poultry production as the poultry farming gained popularity due to high Return on Investment (ROI) and increased demand for poultry products

- Poultry farming is a vital industry in South America, with the regional poultry industry experiencing an impressive growth of 10.1% in 2022 from 2017. This growth can be attributed to the increased consumption of poultry meat and its products, both domestically and internationally. In 2022, the consumption of poultry meat in Brazil alone was around 10.3 million metric tons, a significant increase from 9.6 million metric tons in 2018. This trend is set to continue as the poultry industry continues to grow and industrialize across many parts of South America.

- The production of broilers and layers is a major contributor to the region's poultry segment, accounting for around 97.3% of the total poultry production in 2022. Brazil is the largest producer of poultry products in South America, accounting for about 14.6 million metric tons of chicken meat in 2021. The region is also a significant poultry exporter globally, with Brazil accounting for over 70% of the region's poultry meat exports. In 2021, Brazil exported about one-third of its chicken production to over 150 countries, with China being the largest destination export hub for the region.

- Poultry farming is gaining importance in the region, particularly in Brazil, due to its high yield and quick returns on investment. As a result, the poultry farming industry in South America, particularly in Brazil, is experiencing steady growth due to increasing demand for poultry meat and its products, both domestically and internationally. With an increasing focus on industrialization and its many benefits, the poultry farming industry in the region is poised for continued growth over the coming years.

Freshwater cultivation account for 90% of aqua production and expansion of aquaculture industry is contributing to increasing aqua feed production

- Aquaculture feed production in South America has been rapidly increasing since 2017, recording a 57.5% rise in 2022, producing about 5 million metric tons of compound feed for aquatic species. Brazil and Chile have been the major contributors to the growth in feed production for aquaculture, with both countries accounting for 1.4 and 1.2 million metric tons, respectively, in 2022. This growth is primarily attributed to the rise in freshwater cultivation of aquaculture species in these countries, with freshwater cultivation account for 90% of the aquaculture production in Brazil on average after 2020.

- Fish feed production in South America has been on the rise and accounted for 80.4% of the total aquaculture feed production in 2022. This increase in fish feed production can be attributed to the rising fish farming in countries, like Brazil and Chile, with a 56% increase in regional production compared to 2017. This trend is expected to continue over the next few years as the potential for the expansion of the fisheries and aquaculture industries in the region is enormous.

- Tilapia farming is one of the significant contributors to the expansion of the aquaculture industry in the region, and this has led to increased demand for compound feed. Shrimp feed production witnessed a significant increase of 51.4% in 2022 compared to 2019, driven by the rising demand for the high-profit-margin Whiteleg shrimp species. This trend is expected to continue in the next few years, driven by increasing shrimp production and export demand.

- In conclusion, aquaculture feed production in South America is projected to continue to increase in the next few years, driven by the expansion of the fisheries and aquaculture industries, rising demand for high-quality protein, and growing export demand.

South America Feed Additives Industry Overview

The South America Feed Additives Market is fragmented, with the top five companies occupying 24.57%. The major players in this market are Adisseo, Alltech, Inc., DSM Nutritional Products AG, Evonik Industries AG and SHV (Nutreco NV) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 55740

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Additive

- 5.1.1 Acidifiers

- 5.1.1.1 By Sub Additive

- 5.1.1.1.1 Fumaric Acid

- 5.1.1.1.2 Lactic Acid

- 5.1.1.1.3 Propionic Acid

- 5.1.1.1.4 Other Acidifiers

- 5.1.2 Amino Acids

- 5.1.2.1 By Sub Additive

- 5.1.2.1.1 Lysine

- 5.1.2.1.2 Methionine

- 5.1.2.1.3 Threonine

- 5.1.2.1.4 Tryptophan

- 5.1.2.1.5 Other Amino Acids

- 5.1.3 Antibiotics

- 5.1.3.1 By Sub Additive

- 5.1.3.1.1 Bacitracin

- 5.1.3.1.2 Penicillins

- 5.1.3.1.3 Tetracyclines

- 5.1.3.1.4 Tylosin

- 5.1.3.1.5 Other Antibiotics

- 5.1.4 Antioxidants

- 5.1.4.1 By Sub Additive

- 5.1.4.1.1 Butylated Hydroxyanisole (BHA)

- 5.1.4.1.2 Butylated Hydroxytoluene (BHT)

- 5.1.4.1.3 Citric Acid

- 5.1.4.1.4 Ethoxyquin

- 5.1.4.1.5 Propyl Gallate

- 5.1.4.1.6 Tocopherols

- 5.1.4.1.7 Other Antioxidants

- 5.1.5 Binders

- 5.1.5.1 By Sub Additive

- 5.1.5.1.1 Natural Binders

- 5.1.5.1.2 Synthetic Binders

- 5.1.6 Enzymes

- 5.1.6.1 By Sub Additive

- 5.1.6.1.1 Carbohydrases

- 5.1.6.1.2 Phytases

- 5.1.6.1.3 Other Enzymes

- 5.1.7 Flavors & Sweeteners

- 5.1.7.1 By Sub Additive

- 5.1.7.1.1 Flavors

- 5.1.7.1.2 Sweeteners

- 5.1.8 Minerals

- 5.1.8.1 By Sub Additive

- 5.1.8.1.1 Macrominerals

- 5.1.8.1.2 Microminerals

- 5.1.9 Mycotoxin Detoxifiers

- 5.1.9.1 By Sub Additive

- 5.1.9.1.1 Binders

- 5.1.9.1.2 Biotransformers

- 5.1.10 Phytogenics

- 5.1.10.1 By Sub Additive

- 5.1.10.1.1 Essential Oil

- 5.1.10.1.2 Herbs & Spices

- 5.1.10.1.3 Other Phytogenics

- 5.1.11 Pigments

- 5.1.11.1 By Sub Additive

- 5.1.11.1.1 Carotenoids

- 5.1.11.1.2 Curcumin & Spirulina

- 5.1.12 Prebiotics

- 5.1.12.1 By Sub Additive

- 5.1.12.1.1 Fructo Oligosaccharides

- 5.1.12.1.2 Galacto Oligosaccharides

- 5.1.12.1.3 Inulin

- 5.1.12.1.4 Lactulose

- 5.1.12.1.5 Mannan Oligosaccharides

- 5.1.12.1.6 Xylo Oligosaccharides

- 5.1.12.1.7 Other Prebiotics

- 5.1.13 Probiotics

- 5.1.13.1 By Sub Additive

- 5.1.13.1.1 Bifidobacteria

- 5.1.13.1.2 Enterococcus

- 5.1.13.1.3 Lactobacilli

- 5.1.13.1.4 Pediococcus

- 5.1.13.1.5 Streptococcus

- 5.1.13.1.6 Other Probiotics

- 5.1.14 Vitamins

- 5.1.14.1 By Sub Additive

- 5.1.14.1.1 Vitamin A

- 5.1.14.1.2 Vitamin B

- 5.1.14.1.3 Vitamin C

- 5.1.14.1.4 Vitamin E

- 5.1.14.1.5 Other Vitamins

- 5.1.15 Yeast

- 5.1.15.1 By Sub Additive

- 5.1.15.1.1 Live Yeast

- 5.1.15.1.2 Selenium Yeast

- 5.1.15.1.3 Spent Yeast

- 5.1.15.1.4 Torula Dried Yeast

- 5.1.15.1.5 Whey Yeast

- 5.1.15.1.6 Yeast Derivatives

- 5.1.1 Acidifiers

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 Archer Daniel Midland Co.

- 6.4.4 Cargill Inc.

- 6.4.5 DSM Nutritional Products AG

- 6.4.6 Evonik Industries AG

- 6.4.7 IFF(Danisco Animal Nutrition)

- 6.4.8 Kemin Industries

- 6.4.9 Novus International, Inc.

- 6.4.10 SHV (Nutreco NV)

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.