PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431051

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431051

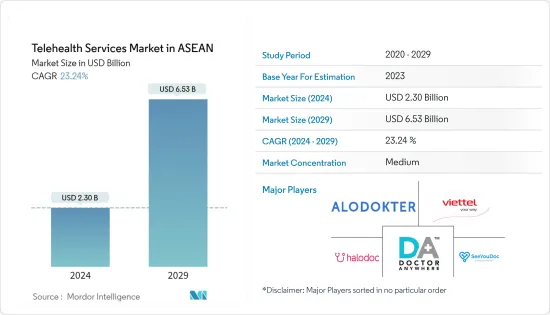

Telehealth Services in ASEAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Telehealth Services Market in ASEAN Industry is expected to grow from USD 2.30 billion in 2024 to USD 6.53 billion by 2029, at a CAGR of 23.24% during the forecast period (2024-2029).

Telehealth is the delivery of healthcare services using technology in the diagnosis, treatment, and prevention of disease or injuries, research, evaluation, and education for healthcare providers and their communities.

In the current ASEAN market, The Telehealth Service Market is anticipated to witness a proliferation in the coming years backed by an increase in the biotechnology industry in the country. The rapid urbanization in the country is leading to an increased demand for best-in-class infrastructure in the residential domain along with a rise in the demand for premium infrastructural Types. The increase in the healthcare costs, a spur in the technological innovations in the healthcare sector, and efforts to find a resolution to address the accessibility issues of the healthcare sector in remote areas which have been a perennial problem in the developing economies across the countries are expected to ramp up double-digit growth prospects for the ASEAN telehealth market in the coming timeframe and offer bountiful opportunities to the potential industrial makers of the product and the to-be-investors to register significant growth in the coming timeframe.

It's common to find a few competing telehealth platforms in one country, as some platforms have started serving in Telehealth Services Market along with their primary business industry. The use of mHealth in ASEAN countries has increased exponentially in the last decade as it is one of the fastest-growing markets for the digital economy. The diversity in telehealth and telemedicine practice across countries calls for uniformity in guidelines and standards. Payers, regulators, and policymakers have been referring to guidelines and legislations, especially if telemedicine were integrated into existing policies and standard care. The telehealth guidelines in ASEAN, as the region shares common social and economic conditions, are having a very progressive impact on the region's Telehealth Service Market. Advances in digital technology have expanded mobile health (mHealth) applicability from providing health care in remote communities.

The COVID-19 pandemic further underscores the need for digital health services in ASEAN. Given the spread of the pandemic and the largescale lockdown measures imposed by governments in response, digital health services helped alleviate the pressure on medical resources and minimize the amount of persontoperson contact that is required for treatment. Initiatives were made by the Indonesian, Malaysian, and Philippine governments to foster the use of telemedicine amid the pandemic. The COVID-19 pandemic has spurred the growth of telemedicine from telephone consultations to a spectrum of ICT applications. The diversity in telemedicine practice across countries calls for uniformity in guidelines and standards

ASEAN Telehealth Service Market Trends

Shortage of Healthcare Personnel is helping telehealth market to grow

The shortage of healthcare personnel is positively influencing the demand for telehealth in the ASEAN countries. The ratio of doctors per person in Thailand and Indonesia is 0.4:1000. Telehealth has improved the patient's access to healthcare, especially in archipelago nations like the Philippines and Indonesia. It has also helped cater to the rural areas where medical infrastructure and services are less available. Moreover, the growing geriatric population and increasing prevalence of chronic diseases in South East Asia are contributing to the growing demand for quality healthcare.

The ASEAN telehealth market accounted for the largest revenue share of 50.4% owing to the rising adoption of telemedicine platforms by healthcare practitioners. Telehealth was adopted by healthcare practitioners in order to reduce the growing burden on healthcare facilities and resources. Increasing demand for reducing hospital admissions and improvements in hospital workflow is propelling the adoption of telehealth technologies among healthcare providers, which will lead to growth in this market.

Vietnam Government Boosting Telehealth Market by Increasing Digi-health Services in Public Hospital

More than 92% of Vietnam Public hospitals have outsourced to local IT companies such as FPT, Link Toan Cau, Dang Quang and OneNet to develop digital solutions for their facilities. Private hoispitals are contributing more to the telehealth services as compared to the poublic hotels and startups are performing at smaller stage currently. Since June 2018, Vietnam has set a clear target that, by 2025, 95% of Vietnamese population will have Electronic Medical Records, currently in 2021, there are 24 provinces implementing EHRs in Vietnam, six of which officially considered the 'piloting EHR provinces' . Healthcare digitalisation continues to facilitate the enhancement of operational efficiency and medical outcomes in public hospitals.

After introducing compulsory insurance, Vietnam now aims to grow the coverage rate of health insurance, setting the goal of reaching 95% in 2025. Nevertheless, out-of-pocket expense ratios in Vietnam are some of the highest in ASEAN, which puts considerable financial pressure on lower income households.

ASEAN Telehealth Service Industry Overview

The Telehealth Services Market in ASEAN is growing and moderately competitive across various countries including Singapore, Indonesia, Malaysia, Vietnam, Thailand, and others offering a huge number of competitive players dominating the market, nowadays grabbing the market more powerfully by the innovations and partnerships with the foreign telehealth services players yielding opportunities to the Market, thus it has made the Telehealth Services Market in ASEAN very competitive and strong. Many of these platforms were originally startups that evolved into mature businesses, while others were created by (or with the support of) key players in the field, such as medical institutions, telecommunication companies, and insurance companies. International chains and their brands are entering the ASEAN market for telehealth services but altogether the ASEAN Telehealth groups such as DoctorAnywhere, Halodoc, Viettel, SeeYouDoc, and many others have been focusing on tieng up with the most popular Hospitals or Diagnostic Centers or Doctors or Retired Surgeons with enhanced technology innovations and offering more platforms for Telehealth services, thus, leading the Telehealth Services Market in ASEAN to the new heights and expected to grow throughout the forecasted period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXCEUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Insights on Various Regulatory Trends Shaping Telehealth Services Market in ASEAN

- 4.5 Insights on impact of technology and innovation in Telehealth Services

- 4.6 Insights on Performance of Telehealth Services in ASEAN

- 4.7 Industry Attractiveness - Porters' Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Remote Patient Monitoring

- 5.1.2 Real time interactions

- 5.1.3 Store and Forward

- 5.1.4 Other Services

- 5.2 By Mode of Delivery

- 5.2.1 Web-Based

- 5.2.2 Cloud-Based

- 5.2.3 On-Premises

- 5.3 By Types

- 5.3.1 e-Consultation

- 5.3.2 Online Appointment Booking

- 5.3.3 Telemedicines

- 5.3.4 Diagnostics and Fitness Monitors

- 5.4 By End User

- 5.4.1 Providers

- 5.4.2 Players

- 5.4.3 Patients

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 Singapore

- 5.5.2 Indonesia

- 5.5.3 Vietnam

- 5.5.4 Thailand

- 5.5.5 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Doctor Anywhere

- 6.2.2 MyDoc

- 6.2.3 Speedoc

- 6.2.4 WhiteCoat

- 6.2.5 Aldokter

- 6.2.6 Halodoc

- 6.2.7 Viettel

- 6.2.8 DoctorRaksa

- 6.2.9 SeeYouDoc

- 6.2.10 Vieve Healthcare

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US