Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693768

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693768

Asia-Pacific Biopesticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 171 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

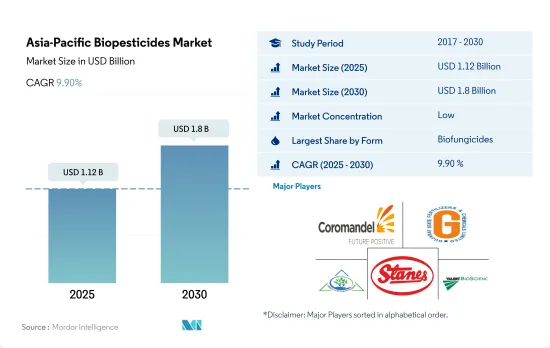

The Asia-Pacific Biopesticides Market size is estimated at 1.12 billion USD in 2025, and is expected to reach 1.8 billion USD by 2030, growing at a CAGR of 9.90% during the forecast period (2025-2030).

- Biopesticides are naturally occurring substances or agents derived from animals, plants, insects, and microorganisms, including bacteria and fungi. They are used to manage agricultural pests and infections. The market for biopesticides in the Asia-Pacific region was valued at USD 854.2 million in 2022.

- Biofungicides are the most popular biopesticides used in the region. They held a market share of 36.8% in 2022. Bacillus, Trichoderma, Streptomyces, and Pseudomonas are the most commercially used species of microorganisms in agriculture. These biofungicides effectively act against pathogens, such as Pythium, Rhizoctonia, Fusarium, Sclerotinia, Thielaviopsis, Botrytis, and powdery mildew.

- Among bioinsecticides, the bacterial insecticide Bacillus thuringiensis is most predominantly used in agriculture due to its immense potential to control pests by producing proteins during the sporulation phase. Bacillus thuringiensis is effective in managing lepidopteran species that affect a wide range of crop types.

- Pseudomonas fluorescens and Xanthomonas campestris are fungi and bacteria, respectively, gaining commercial importance as bioherbicides in the region. The extracellular peptides and a lipopolysaccharide released from these organisms inhibit the growth of weeds. Xanthomonas campestris is known to control horseweed effectively.

- The need for sustainable approaches in managing biotic stresses in agriculture is the potential driver for biopesticide usage in the region.

- The Asia-Pacific region is witnessing a significant shift toward sustainable agriculture practices, with countries like China and India leading the market. China is currently the largest consumer of biopesticides in the region, and it accounted for a 29.1% share in 2022.

- In response to rising concerns over soil contamination, pollution, and chemical residues in food, the Chinese government is taking proactive measures to promote the usage of organic inputs. These initiatives include bearing the cost of organic certification, providing funding for on-farm infrastructure and organic fertilizers, training, marketing assistance, and assisting with land acquisition. Middle and higher-income families are driving this growing demand for organically-grown food.

- However, India has the world's highest number of organic growers, and it is the fifth-largest country in terms of organic agricultural land area. During 2021-2022, India produced over 3.4 million metric tons of certified organic products, including a wide range of food products. This high adoption of organic farming practices is expected to drive the biopesticides market in the region.

- One key driver of the biopesticides market is the development of herbicide-resistant weeds such as L. rigidum, R. raphanustrum, Bromus spp., and Hordeum spp. These weeds have developed resistance against traditional chemical herbicides that kill the weeds by ACCase- and ALS-inhibition, making control difficult. This presents an opportunity for farmers to adopt other alternatives like bioherbicides, thus driving the Asia-Pacific biopesticides market. The market is estimated to record a CAGR of 9.8% between 2023 and 2029.

Asia-Pacific Biopesticides Market Trends

Growing Government support in countries like China, India, Indonesia, and Australia, boosts organic farming in the region

- The organic agricultural area in the Asia-Pacific region was over 3.7 million hectares in 2021, representing 26.4% of the global organic area, as per FiBL statistics. The organic area under cultivation grew by 19.3% between 2017 and 2022. As of 2020, the region recorded around 1.8 million organic producers, with India topping the list with 1.3 million organic producers. China, India, Indonesia, and Australia are the major countries with large organic cultivation areas in the region. Government authorities in countries like China and India are constantly promoting organic agriculture to reduce reliance on chemical inputs for crop cultivation. For instance, India has implemented schemes like Paramparagat Krishi Vikas Yojana and the All India Network Programme on Organic Farming (AI-NPOF).

- In 2021, China accounted for a maximum share of 66.1%, with 2.5 million ha, followed by India, Indonesia, and Australia, with 19.3%, 1.5%, and 1.4%, respectively. The total organic land is divided into three crop types, namely row crops, horticultural crops, and cash crops. Row crops occupy a major share of organic agricultural land in the region, accounting for 67.5% share, i.e., 2.5 million ha in 2021. The major row crops grown in the region include paddy, wheat, pulses, soybeans, and millets.

- Cash crops held the second largest share, with 0.7 million ha in 2021, accounting for an 18.5% share of organic cropland. The demand for organic cash crops like sugar and organic tea is increasing worldwide. China and India are the largest organic green and black tea producers, respectively. The growing international demand is expected to increase the organic acreages in the region.

Per capita spending on organic product predominant in Australia and China's organic food market growing significantly

- The per capita spending on organic products in the region was recorded at USD 85.1 in 2021. Australia witnessed a higher per capita spending on organic products, with USD 58.3 in the same year, attributed to the higher demand due to consumers' perception of organic food as healthy. As per the Global Organic Trade data, Australia's organic packaged food and beverage market was valued at USD 885.2 million in 2021.

- China's organic food market grew by 13.3% in 2021, and the positive growth pattern is expected to continue, with an estimated CAGR of 7.1% between 2023 and 2029. With an increasing emphasis on the importance of organic products among the younger generation and a rise in demand for organic baby food due to the growing number of mothers in the workforce and the increasing adoption of the health and wellness trend, organic products are expected to reach a value of USD 6.4 billion by 2025.

- Organic products in India represent far less than 1.0% of global demand, with a per capita expenditure of just USD 0.08 in 2021. However, India represents a promising market over the coming years, reaching a value of USD 153.3 million by 2025. Currently, the market for organic goods in the region is very fragmented, with just a few supermarkets and specialty stores selling them, as only people from higher-income families are potential customers. Growing consumer knowledge and buying motivations will lead to a better understanding of the sustainability qualities of organic food in the region. Increasing per capita income, along with increased consumer awareness of the importance of organic food intake, has the potential to raise per capita expenditure on organic food items in the Asia-Pacific region.

Asia-Pacific Biopesticides Industry Overview

The Asia-Pacific Biopesticides Market is fragmented, with the top five companies occupying 3.31%. The major players in this market are Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, IPL Biologicals Limited, T.Stanes and Company Limited and Valent Biosciences LLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 500028

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Philippines

- 4.3.7 Thailand

- 4.3.8 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Biofungicides

- 5.1.2 Bioherbicides

- 5.1.3 Bioinsecticides

- 5.1.4 Other Biopesticides

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Philippines

- 5.3.7 Thailand

- 5.3.8 Vietnam

- 5.3.9 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Andermatt Group AG

- 6.4.2 Biobest Group NV

- 6.4.3 Biolchim SPA

- 6.4.4 Coromandel International Ltd

- 6.4.5 Gujarat State Fertilizers & Chemicals Ltd

- 6.4.6 Henan Jiyuan Baiyun Industry Co. Ltd

- 6.4.7 IPL Biologicals Limited

- 6.4.8 Koppert Biological Systems Inc.

- 6.4.9 T.Stanes and Company Limited

- 6.4.10 Valent Biosciences LLC

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.