Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431693

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431693

UK Dog Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 264 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

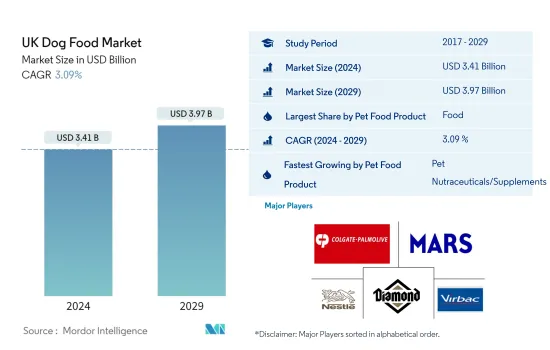

The UK Dog Food Market size is estimated at USD 3.41 billion in 2024, and is expected to reach USD 3.97 billion by 2029, growing at a CAGR of 3.09% during the forecast period (2024-2029).

The food segment dominated the product types as they are the primary sources of nutrition regardless of dog breed size and age

- The UK dog food market has been experiencing steady growth, increasing by about 13.5% between 2017 and 2021. This increasing trend in the market is mainly due to the growing pet dog population in the country, which reached 12.9 million as of 2022. Growing pet humanization has contributed to market growth.

- The food segment dominated the market and accounted for 68.4% in 2022, as food is a staple purchase for most pet owners in the country, regardless of their dog breed size or age. The dog food market in the country is estimated to register a CAGR of 2.7% during the forecast period.

- Dog treats hold the second-largest market share in the United Kingdom, accounting for 15.0% of the market in 2022. Dogs show a preference for treats over other pets. These treats serve multiple purposes, including training, maintaining dental health, and providing rewards. The dog treats market is projected to register a CAGR of 2.0% during the forecast period.

- Dog veterinary diets accounted for 12.8% of the market in 2022. These diets are specially formulated to address specific health conditions in pets, such as urinary tract diseases, renal failure, and digestive sensitivity. Dog veterinary diets are estimated to exhibit a CAGR of 3.7% during the forecast period.

- Dog nutraceuticals or supplements accounted for 3.8% of the market value in 2022. These pet supplements are often given to pets to support overall health and well-being. The market for dog supplements is projected to register a CAGR of 9.3% during the forecast period.

- The increasing trend in the pet population and the various benefits offered by the wide range of commercial pet products are anticipated to drive the market during the forecast period.

UK Dog Food Market Trends

Adoption from animal shelters and rescue organizations and providing companionship are increasing the dog population

- Dogs are one of the most important pets adopted by pet parents in the United Kingdom, accounting for 33.8% in 2022. The higher share is due to the country's strong culture of dog appreciation and animal welfare, portraying that people in the country are more likely to enjoy taking care of dogs and have higher disposable income. Labrador Retriever was the most adopted dog breed in 2022, with 40,000 registered, because of their friendly dispositions, intelligence, and ability to get along well.

- The dog population increased in the country by 44.4% between 2019 and 2022. During the COVID-19 pandemic, there was an increase in the adoption of dogs from animal shelters and rescue organizations. With more people spending time at home, there was an increased desire for companionship, and many saw this as an opportunity to adopt a dog. Pet parents in the country adopted a dog, which helped dog ownership to 10 million households in 2022, representing about 34% having a dog in their homes as pets. Pet ownership rose by 1% between 2021 and 2022 because they provide loyalty, love, and support during difficult situations, such as the pandemic.

- The increase in the dog population in the country has resulted in a rise in adoption and fostering programs. As a result, companies have many opportunities to explore new ideas in this industry. For instance, in the United Kingdom, companies offer paid "paw-ternity" leave for the pet parents. Therefore, encouraging pet parents to adopt more than one dog. Therefore, factors such as increasing pet adoption, rising pet ownership, and benefits such as providing companionship are anticipated to help in the growth of the dog population in the country during the forecast period.

The growing premiumization of pet food products and increasing demand for high-quality natural pet foods are driving dog expenditure in the United Kingdom

- Dogs are the most popular pets in the United Kingdom, and pet owners spend more money on dog food compared to any other pet food. Pet dog food expenditure in the country has been on the rise, growing by 23.7% between 2019 and 2022. This increase in overall pet dog expenditure can be attributed to the rising population of pet dogs in the country, which grew from 9.0 million in 2019 to 13.0 million in 2022. Additionally, the growing humanization of pets has led to an increased demand for premium dog food products, such as natural and grain-free pet foods.

- The increasing expenditure on dogs and cats between 2019 and 2022 was nearly equal as the population of dogs and cats in the country is similar, with 13 million and 12.7 million, respectively, as of 2022. However, the average spending by pet owners on dogs was about 9.7% higher than the average spending on cats. This is mainly due to the larger size of dogs, which require a higher quantity of food compared to cats. Additionally, pet owners are shifting toward premium dog brands, particularly those that provide specific nutrition based on the needs of dogs.

- Despite the financial crisis in 2022, a significant number of pet owners in the United Kingdom, amounting to 58%, still choose to purchase birthday and Christmas presents for their dogs, indicating the growing trend of pet humanization. Supermarkets remain the preferred distribution channels for buying pet food products in the country, although e-commerce has become increasingly popular due to the impact of the pandemic. The increasing awareness of the benefits of high-quality pet food and the premiumization of pet food are expected to continue driving pet expenditure in the United Kingdom.

UK Dog Food Industry Overview

The UK Dog Food Market is moderately consolidated, with the top five companies occupying 42.20%. The major players in this market are Colgate-Palmolive Company (Hill's Pet Nutrition Inc.), Mars Incorporated, Nestle (Purina), Schell & Kampeter Inc. (Diamond Pet Foods) and Virbac (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001472

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Pet Food Product

- 5.1.1 Food

- 5.1.1.1 By Sub Product

- 5.1.1.1.1 Dry Pet Food

- 5.1.1.1.1.1 By Sub Dry Pet Food

- 5.1.1.1.1.1.1 Kibbles

- 5.1.1.1.1.1.2 Other Dry Pet Food

- 5.1.1.1.2 Wet Pet Food

- 5.1.2 Pet Nutraceuticals/Supplements

- 5.1.2.1 By Sub Product

- 5.1.2.1.1 Milk Bioactives

- 5.1.2.1.2 Omega-3 Fatty Acids

- 5.1.2.1.3 Probiotics

- 5.1.2.1.4 Proteins and Peptides

- 5.1.2.1.5 Vitamins and Minerals

- 5.1.2.1.6 Other Nutraceuticals

- 5.1.3 Pet Treats

- 5.1.3.1 By Sub Product

- 5.1.3.1.1 Crunchy Treats

- 5.1.3.1.2 Dental Treats

- 5.1.3.1.3 Freeze-dried and Jerky Treats

- 5.1.3.1.4 Soft & Chewy Treats

- 5.1.3.1.5 Other Treats

- 5.1.4 Pet Veterinary Diets

- 5.1.4.1 By Sub Product

- 5.1.4.1.1 Diabetes

- 5.1.4.1.2 Digestive Sensitivity

- 5.1.4.1.3 Oral Care Diets

- 5.1.4.1.4 Renal

- 5.1.4.1.5 Urinary tract disease

- 5.1.4.1.6 Other Veterinary Diets

- 5.1.1 Food

- 5.2 Distribution Channel

- 5.2.1 Convenience Stores

- 5.2.2 Online Channel

- 5.2.3 Specialty Stores

- 5.2.4 Supermarkets/Hypermarkets

- 5.2.5 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Alltech

- 6.4.2 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 6.4.3 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 6.4.4 Dechra Pharmaceuticals PLC

- 6.4.5 FARMINA PET FOODS

- 6.4.6 General Mills Inc.

- 6.4.7 Mars Incorporated

- 6.4.8 Nestle (Purina)

- 6.4.9 Schell & Kampeter Inc. (Diamond Pet Foods)

- 6.4.10 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.