PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439799

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439799

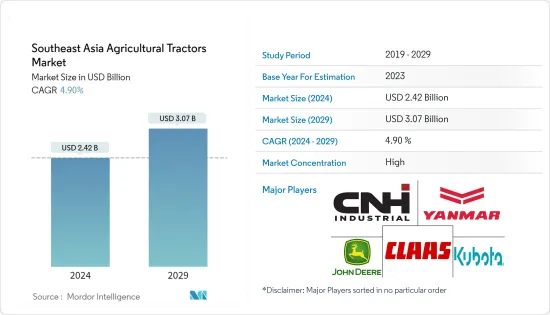

Southeast Asia Agricultural Tractors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Southeast Asia Agricultural Tractors Market size is estimated at USD 2.42 billion in 2024, and is expected to reach USD 3.07 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Key Highlights

- The increasing unavailability of farm laborers, growing mechanization of agriculture, and demand for various tractors with different horsepower are boosting the sales of agriculture tractors in Southeast Asia. Farmers are increasingly adopting agricultural mechanization as a substitute for manual labor. Among Southeast Asian countries, agriculture tractors were widely used in Vietnam. In 2021, the total import value of tractors was recorded at around USD 517 million.

- In developing countries of the region, the demand for lower HP tractors is high due to the low disposable income of farmers and high labor costs. Farmers prefer small and customized tractors for agricultural purposes due to small farmland sizes. Moreover, lesser fuel consumption by small tractors helps to empower small and marginal farmers. Increasing demands for power, precision, handling, and efficiency have shaped the development of modern tractors and continue to drive the development of these tractors during the forecast period.

- Increasing farm mechanization in developing countries fortifies the demand and production of agricultural tractors. However, repair and maintenance expenses are also expanding, which acts as a restraint to the market.

Southeast Asia Agriculture Tractors Market Trends

Shortage of Farm Labor is driving the Market

- The cost of farm labor is directly related to the percentage of the country's total population employed in agriculture, considering simple demand-supply economics, thereby affecting the agricultural tractors market in Southeast Asia. On average, developing economies have larger percentages of the population dependent on agriculture. However, the percentages have decreased over time as many people migrate to urban areas yearly.

- Farmers are increasingly adopting agricultural mechanization as a substitute for manual labor with a more cost-effective, easily available, and more efficient means of agricultural operation. The reduced workforce in agriculture, increasing adoption of precision farming, and advancement in tractor technology reduce the cost of spending on work labor in the countries. It is anticipated to boost the growth of the agricultural tractor market during the forecast period.

- Furthermore, the government initiatives aimed at promoting mechanization and modernization of agriculture in Southeast Asian countries are also driving the growth of the agricultural tractors market. The governments provide farmers subsidies, loans, and other incentives to encourage them to adopt new technologies and increase productivity.

Increasing Usage of Tractors in Vietnam

- Vietnam has experienced rapid growth in agricultural mechanization lately, particularly in the use of tractors. The recent growth in mechanization has been similar to other developing countries. However, in the long term, the historical growth of agricultural mechanization has been unique due to the considerable changes in Vietnam's political and economic systems. The country is facing the challenge of labor shortage. Thus, there is a demand for tractors in the region.

- In 2021, the country imported around 16,569 pieces of tractors. However, in 2021, the country exported a total of 1,882 tractors worth USD 14 million. More than 3,000 tractors are sold in the country, mainly in the 80-100 HP power range, due to the increasing focus on growing sugar cane, natural rubber, cotton, coffee, rice, etc.

- The country imported tractors majorly to China worth USD 407 million in 2021, with a 78.6% share in value. The Republic of Korea, Thailand, Mexico, and Japan followed it. Overall, the growth in agricultural mechanization in Vietnam is expected to increase in the forecast period, driven by the increasing demand for food and the need to improve productivity and efficiency in the agricultural sector. The government and private sector will play an important role in supporting this growth by investing in research and development, promoting new technologies, and addressing farmers' challenges in adopting mechanization.

Southeast Asia Agriculture Tractors Industry Overview

The Southeast Asia agricultural tractor market is consolidated, with the major players occupying the major share of the market in 2022. The Deere and Company, Kubota Corporation, CNH Industrial NV, Yanmanr Co. Ltd, and CLAAS KGaA mbH are the major players in the market. New product launches, partnerships, and acquisitions are the major strategies the leading companies adopt.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Orchard Tractors

- 5.1.2 Row-Crop Tractors

- 5.1.3 Utility Tractors

- 5.2 Horse Power

- 5.2.1 Less than 12 HP

- 5.2.2 12 HP to 99 HP

- 5.2.3 100 HP to 175 HP

- 5.2.4 Above 175 HP

- 5.3 Geography

- 5.3.1 Thailand

- 5.3.2 Vietnam

- 5.3.3 Malaysia

- 5.3.4 Indonesia

- 5.3.5 Singapore

- 5.3.6 Philippines

- 5.3.7 Cambodia

- 5.3.8 Mynamar

- 5.3.9 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 KUBOTA TRACTOR CORPORATION

- 6.3.2 CLAAS KGaA mbH

- 6.3.3 Deere & Company

- 6.3.4 YANMAR CO. LTD

- 6.3.5 CNH Industrial

- 6.3.6 ISEKI CO. LTD

- 6.3.7 Mitsubishi Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS