PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1504286

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1504286

GMIPulse - Consumer Goods & Services Market Intelligence Subscription

Please contact us using the inquiry form for pricing information.

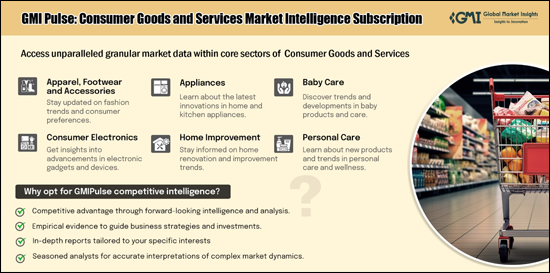

Global Market Insights Inc. offers GMIPulse, a cutting-edge, Business Intelligence (BI)-enabled platform designed to deliver the finest strategic value. GMIPulse offers an adaptable subscription service, customizable to meet your unique needs, providing comprehensive and granular market data, competitive landscape insights, and an in-depth understanding of industry ecosystems. This platform is your go-to solution for all market research needs, ensuring you stay ahead with the latest trends and technological advancements.

Advantages of GMIPulse

- 1. Easy Access to Accurate Market Data: GMIPulse provides instant access to granular and authentic market data, empowering you with precise and up-to-date information for strategic decision-making.

- 2. Comprehensive Market Research Solution: As your all-encompassing market research tool, GMIPulse covers a wide array of industries, offering detailed analyses and forecasts to help you navigate market dynamics effectively.

- 3. In-Depth Competitive Landscape: The platform offers comprehensive insights into competitive landscapes and company profiles, enabling you to understand your competitors and industry benchmarks thoroughly.

- 4. Understanding Industry Ecosystems: GMIPulse allows you to gain a profound understanding of industry ecosystems, tracking technological advancements and their impact on industry trends.

- 5. Customized Client Profiles: Tailor-made client profiles help you identify the latest growth opportunities and understand specific market needs, enhancing your strategic planning.

- 6. Technology Tracking Stay informed about the latest technological trends and their implications on the market, ensuring you are well-prepared for future developments.

- 7. Access to Latest Reports: Subscribers receive access to previously published reports and upcoming releases, keeping you updated with the most recent market intelligence.

- 8. Interactive and User-Friendly Interface: The platform's interactive interface ensures a seamless user experience, allowing you to navigate through data effortlessly and derive meaningful insights efficiently.

- 9. Enhanced Analyst Hours: Benefit from improved access to analysts for strategic assistance and in-depth explanations, ensuring you make well-informed decisions.

- 10. Secure Login: Enjoy password-protected access to all reports, ensuring your data security and confidentiality.

Exceptional Benefits of GMIPulse

- 1. Instant Report Access GMIPulse offers clients direct access to comprehensive market reports instantly, facilitating timely and informed decision-making.

- 2. PulseAI, Introducing PulseAI Assistance within GMI Pulse: a game-changing feature that makes data insights accessible to everyone, in any language. With multilingual support, PulseAI seamlessly translates complex reports and answers your questions in real-time, breaking down language barriers for effortless, intuitive data exploration.

- 3. Interactive Dashboard We're excited to announce that the Interactive Dashboard is now available to all GMI Pulse users, changing the way you interact with your data. With easy data filtering by region, segment, and more, you can focus on what matters most. The simple interface lets you make adjustments without technical skills, and real-time updates provide live insights as you work.

- 4. Tailor-Made Reports Access customized reports detailing market trends, technological developments, and innovations by industry leaders, tailored to your specific needs.

- 5. Priority Sales Support Receive best-in-class sales support and assistance promptly, enhancing your customer service experience.

- 6. Market Tracker Stay updated with streamlined access to all market trends and happenings, aiding in strategic planning and decision-making.

- 7. Pricing Benefits Obtain reports that are not only comprehensive but also cost-effective, tailored to fit your budget and needs.

Industry Focus: Consumer Goods & Services

The consumer goods & services industry is evolving rapidly with advancements in technology, shifting consumer preferences, and new market dynamics. GMIPulse provides in-depth insights into the following key clusters within the consumer goods & services industry:

Apparel, Footwear, and Accessories Market Category Description

The apparel, footwear and accessories sector is facing intricate market trends marked by economic volatility and changing consumer behavior. Uncertainty in the sector mirrors the general economic landscape, with strain on household incomes likely to suppress apparel demand and trigger trading down across categories.

Whereas luxury drove value creation over the last few years, nonluxury will be responsible for all the increase in economic profit for the first time since 2010. In 2025, 80% of CEOs anticipate no enhancement in the world's fashion industry, with sustainability dropping off the agenda to only 18% of fashion CEOs to name it as a top-three threat for growth in 2025, from 29% in 2024.

Apparel is the primary segment that shows mixed performance at varying market levels. The global outdoor apparel and accessories market volume was USD 37.1 billion in 2024 and is forecast to grow at a CAGR of 6.9% during 2034, led by growing popularity in outdoor activities. Fashion accessories complement the larger apparel ecosystem with niche growth opportunities fueled by consumer demand for personalization and brand distinction.

The sports and activewear segments are proving to be uniquely strong and promising amid large industry headwinds. The Europe sportswear market value was estimated at $89.88 Billion in 2024, and will show a CAGR of 6.2% during the 2025 - 2034 period. Exercise and fitness equipment is tied to health awareness and personal lifestyle changes whereas footwear stems from a fashion and performance perspective. In 2023, the market size for power sports accessories surpassed USD 5.8 billion and is anticipated to grow at an approximate 9.5 CAGR from 2024 to 2032, due in part to growth in tourism and adventure travel.Sustainability initiatives are still crucial despite decreasing executive focus, as brands concentrate on carbon neutrality pledges and renewable energy incorporation within supply chains.

Appliances Market Category Description

The home appliances sector is facing unprecedented disruption fuelled by smart technology uptake, energy efficiency needs, and changing consumer lifestyle demands. The connected home vision is finally coming to life as consumer preferences lean towards convenience, energy efficiency, and new technologies such as IoT and AI. Smart refrigerators are the market leaders in the connected home concept and amongst connected devices, Wi-Fi connectivity leads the pack but issues such as high cost and security are still primary obstacles for mass adoption. The only way to be successful is to eliminate consumer pain points and find a real value proposition with technology and a design thinking strategy.

Household appliances is the largest sector in the appliances ecosystem and is growing fast in a few product categories. The market for kitchen appliances was estimated at USD 291.3 billion in 2024 and has a projected CARG of 5.5% between 2025 and 2034 to due increased spending in the home automation segment and demand for intelligent kitchen appliances. Major kitchen appliances still have a hold on the market share, and the size of the small kitchen appliances market was USD 130 billion in 2023 and is anticipated to grow at a CAGR of 4.7% during 2032, with the boost from increasing disposable income.

Outdoor cooking is a nascent high-growth segment fueled by lifestyle transformation and outdoor recreational choices. Market for outdoor kitchen appliances was USD 7.2 billion in 2024 and is anticipated to grow at a CAGR of 8% during 2025-2034. Technology integration in all the segments features connected cooking experiences, AI-driven functionality, and motor systems with better energy efficiency, which depicts the focus areas of the industry in the direction of sustainability and user convenience across home appliances, big kitchen appliances, outdoor cooking, and small kitchen appliances segments.

Baby Care Market Category Description

The Baby care market mirrors overall patterns of consumer spending characterized by guarded optimism and selective buying choices. Consumer willingness to spend remained flat or declined in most discretionary, semidiscretionary, and essential categories despite better consumer sentiment, with a greater percentage of consumers indicating they planned to spend more on toys in the fourth quarter. Yet statistics point to while consumers are increasingly optimistic about the economy, their confidence is not being translated into spending intentions, implying parents continue to be prudent over baby purchases. This caution is reflective of changing priorities over value, quality, and mandatory versus discretionary baby goods.

The global market for baby care products shows robust growth, despite a challenging economy powered by evolving demographic needs and changing means of parenting. The global baby care products market size was estimated at USD 107.6 billion in 2024 and is projected to have a compound annual growth rate (CAGR) of 4.3% between 2025 and 2034 driven by increasing e-commerce capabilities. Baby wear is an important subsegment, with the global baby clothing market size being USD 44.5 billion in 2024, growing at a CAGR of 4.9% during 2034 on account of rising disposable income and spending power.

Niche segments of baby care reflect focused opportunity growth fueled by health awareness and safety issues. The size of the baby feeding accessories market was USD 2.1 billion in 2022 and is expected to witness a CAGR of 6% during 2032, driven by increasing lifestyle levels. Child safety factors are now more prominently dictating technology uptake, and the market for smart baby monitors is projected to be USD 1.4 billion in 2024, growing at a CAGR of 10.3% during 2025-2034 as demand for remote monitoring continues to increase. Toiletries and cosmetics experienced a boost through increased demand commercially for organic and natural baby care products, while infant formula was valued at $47.2 billion in 2024 and is expected to see a CAGR of 10.3% for the period 2025 to 2034 as a result of increased premature births and metabolic issues.

Consumer Electronics Market Category Description

The consumer electronics market is witnessing disruptive growth fueled by connected home adoption, artificial intelligence integration, and changing consumer trends for connected appliances. The US market has witnessed significant year-over-year growth in connected home numbers, with clear customer segments forming on the speed of tech adoption, willingness to spend, and channel choices. Consumer demand for connected devices favors price, energy efficiency opportunity, reliability, simplicity of use, and simplicity of installation, although many consumers remain unfamiliar with connected device value propositions. Success in this segment is based on a broad range of skills-from go-to-market to design thinking to partnership and M&A strategy.

The global consumer electronics market exhibits strong growth across a broad set of different product categories. The global consumer electronics market in 2024 was USD 949.7 billion and is projected to register a CAGR of 2.8% during the period 2024-2034. Major home appliances are high-growth segments with the global refrigerator market in 2024 estimated at USD 123 billion, which will have a growth CAGR of 9% between 2025 and 2034, supported by increasing energy efficiency and sustainability demands.

Technology integration and energy efficiency issues are pushing innovation in various categories of appliances. Consumer electronics electric motor market size exceeded USD 14 billion in 2023 and is anticipated to mark over 5.4% CAGR between 2024 and 2032, fueled by the increased consumption of efficient appliances and advancements in technology such as the creation of brushless DC motors. The smart technologies integration transcends televisions, air conditioners, air purifiers, electric mops, vacuum cleaners, washing machines, and water purifiers, with accessories facilitating ecosystem connectivity. The consumer electronics packaging market size was USD 26.2 billion in 2023 and is expected to grow at 18.4% CAGR until 2032 due to increased focus on environmental-friendly materials.

Home Improvement Market Category Description

The home improvement market, being a consumer market, is volatile, as there are constant changes in the market driven by shifting lifestyle orientation, changing financial conditions, and technological advancement. In February, consumers indicated a greater willingness to spend on travel and home (including short-term rental, home improvement, hotel resort, and airfare) than in Q4 2023. Yet, entertainment, cars, and home improvement spending are likely to fall by most respondents over the next three months, as economic uncertainty affects discretionary consumer behavior. Consumer behavior study conducted by the Home Improvement Research Institute signifies that 76% of consumers reducing their spending impacts upscale home improvement categories especially.

The global home improvement industry is exhibits significant growth potential in different product categories. The industry is valued at USD 894.2 billion in 2024 and is expected to grow by 4% from 2025 to 2034, thanks to rising disposable income. Doors and windows make up the largest subcategory, with the market size for window and door frames exceeding USD 105 billion in 2024. This segment is projected to grow 3.6% CAGR from 2025 to 2034, thanks to increased construction activities in both residential and commercial sectors.

Specialized product segments in doors and windows demonstrate impressive performance paths. Doors market size exceeded USD 162.9 billion in 2024 and will exhibit approximately 4.5% CAGR during the period of 2025 to 2034, driven by increasing construction and real estate development. High-end materials are becoming increasingly popular, with the market size for fiberglass doors being USD 20.6 billion in 2024 and projected to expand at a CAGR of 6.1% during the period 2025 to 2034, led by aesthetics and customization. Consideration of energy efficiency is fuelling demand for sophisticated solutions, such as composite doors and windows market growth and integration with smart home throughout fixtures, fittings, furniture, and gardening equipment categories.

Personal Care Market Category Description

The personal care market is evolving at a rapid pace. This phase includes evolving consumer needs, higher quality products, and new technology. The beauty industry grew at a 7% CAGR from 2022 to 2024. However, geopolitical and economic instability, market saturation, and shifting consumer preferences could reverse this progress. Industry leaders will need new strategies for growth. The high-end beauty segment is likely to expand at an 8% CAGR versus 5% for mass beauty during 2022-2027, as consumers upgrade and enhance their spending, particularly in the fragrance category. In the U.S., 46% of consumers spent more on cosmetic treatments in 2024 compared with 2023, and Gen Z is likely to spend more during the next year.

Skin care is the biggest part of personal care and continues to grow in different areas. The market for skin care products was worth USD 148 billion in 2022. It is expected to grow at a rate of 4.5% from 2023 to 2032. This growth is driven by an increasing focus on personal appearance and grooming. The customized skin care market was valued at USD 25.1 billion in 2024. It is projected to grow at more than 8.3% from 2025 to 2034, fueled by rising awareness about skin health.

Technology-based segments exhibit outstanding growth patterns. The size of the global personal care appliances market was USD 22.4 billion in 2023 and is expected to witness a CAGR of 5.6% from 2024 to 2032, led by heightened awareness towards grooming and hygiene. Natural and sustainable ingredients keep gathering pace, with the market for herbal personal care products reaching USD 87.1 billion in 2024, likely to reach USD 163.7 billion in 2034 at a CAGR of 6.7%. Men's personal hygiene products market reached USD 13.2 billion in 2024, growing at a rate of 8.9% from 2024 to 2034. This shows a rising demand in different areas like devices, eyewear, perfumes, hair care, hand massagers, hygiene, and services.

Retail Market Category Description

The retail industry continues to ride tough market conditions with the complexity of market forces following changing consumer behavior, economic turmoil, and altered patterns of spending. In Q1 2025, 75% of consumers said they traded down (up one percentage point from the end of 2024), though high-income consumers and baby boomers reported trading down less frequently than in the previous quarter. Some key points are cautious consumer optimism flavored with hints of recovery, as retail sales rose by 4.7% and auto sales recovered. While consumers showed they would spend cautiously and keep essential spending on items like baby products and gas in check while cutting back on semi-discretionary purchases like skin care and vehicles.

Recreational products are a strong growth driver in the retail sector, riding on growing emphasis on outdoor activities and changes in lifestyle. The size of the global recreational and outdoor products market was USD 137.7 billion in 2024 and is expected to grow at a CAGR of more than 5.7% from 2025 to 2034, fueled by more outdoor activities. In this segment, toys exhibit strong enthusiasm with the toy market projected at USD 114.4 billion in 2024 and anticipated to develop at a CAGR of 6% during 2025-2034, on account of the growth in the adult consumer segment. The market for educational toys was worth USD 58.9 million in 2024 and is anticipated to grow at a CAGR of 6.7% from 2025 to 2034 due to the infusion of technology in toys.

The stationery subsegment sustains consistent growth regardless of digital transformation pressures. The market for stationery products was USD 147.5 billion in 2024 and is anticipated to expand at a CAGR of 3.8% from 2025-2034, with a growth fueled by a boost in the demand for schools and colleges in rural regions. Consumer tastes are moving towards premium and sustainable stationery offerings, and channels like e-commerce are opening up markets and facilitating innovation in product form and functionality in both leisure and stationery categories.

Sports Equipment Market Category Description

Sports equipment industry is playing catch-up with a convoluted environment beset by changing consumer trends and market forces. The sporting goods industry maintained a 7 percent CAGR between 2021 and 2024, with the growth forecast for 2024 to 2029 estimated at a slightly lower 6 percent annually. Physical inactivity poses an existential threat to the sporting goods sector as the proportion of adults who are inactive rises from 26 percent in 2010 to 31 percent in 2022 and, by 2030, could reach 35 percent. Yet, the world's total population that currently fails to satisfy WHO's guideline physical activity levels comprises 1.8 billion-twice the number of adults living in India, a market waiting to be tapped.

Equipment and accessories are varied market segments with good growth patterns in various categories. The size of the gym equipment market reached USD 11.2 billion in 2024 and is anticipated to register a CAGR of 4.8% from 2025 to 2034, following the increasing awareness towards fitness and rising health consciousness. The size of the Sports Protective Equipment Market was USD 8.4 billion in 2023 and is expected to have a CAGR of 4.4% during 2024-2032. The size of the global water sports products market was USD 38.4 billion in 2023 and is expected to increase from USD 40 billion in 2024 to USD 58.5 billion in 2032, at a CAGR of 4.9%.

Sporting equipment and apparel highlight niche market segments with strong performance measures. The athletic footwear industry, globally, accounted for USD 131.1 billion in 2024 and is projected to advance at a CAGR of 5% from 2025 to 2034. The integration of technology is revolutionizing conventional equipment segments, with intelligent sports gear featuring advanced sensor technology and wireless connectivity supporting monitoring of performance and real-time feedback capability across fitness and sports applications.

GMIPulse offers unparalleled strategic value through its BI-enabled platform. With its customizable and interactive interface, accurate data, and comprehensive market insights, GMIPulse is your essential tool for staying ahead in the competitive consumer goods & services market landscape. Subscribe today to unlock the full potential of your market research and strategic planning capabilities.

Please contact us using the inquiry form for pricing information.