PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1459444

PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1459444

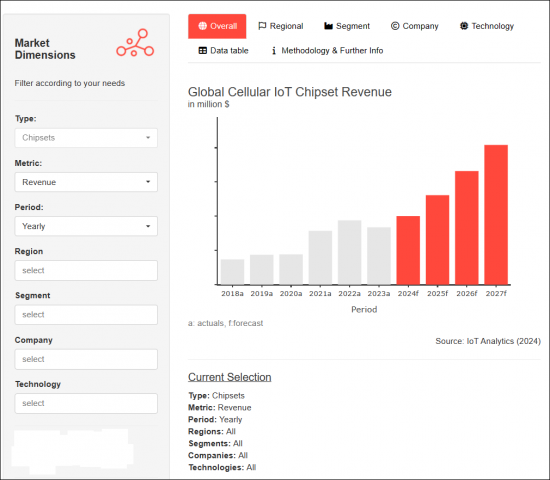

Global Cellular IoT Module and Chipset Market Tracker & Forecast - A Purpose-built Tool to Slice and Dice Market Data for the Cellular IoT Module and Chipset Market

Please contact us using the inquiry form for pricing information.

Discover in-depth data on global IoT module and chipset

- In-depth look at the quarterly market for cellular IoT modules and chipsets.

- Includes over 6.9 million data points, that allow for detailed drill-down options per region, technology, industry, and company.

- The tracker gets updated with the most recent data every quarter.

WHAT IS INCLUDED

The tracker & forecast includes these global data points

- 38 cellular IoT module brands

- 13 cellular IoT chipset companies

- 10 regions

- 10 technology splits

- 16 industry verticals

- 150 unique model-level chipsets

- 737 unique model-level modules

THE ACCOMPANYING INTERACTIVE WEB TOOL

Discover the Global Cellular Module and Chipset Dashboard

THE UPDATE PROCESS

How we update the data

Constant monitoring of investor relations documents and press releases of hundreds of IoT companies-specifically, the companies that are part of this tracker.

Industry-level forecasts based on revenue estimates of chipset vendors, module manufacturers, and network operations.

Numerous interviews with senior IoT experts from chipset vendors, module manufacturers, and network operations.

Integrating financial and operational data modeling from model level to brand, technology, and region.

PRODUCT SPECIFICATIONS

The "Global Cellular IoT Module and Chipset Market Tracker & Forecast" represents the updated view of the cellular IoT module and chipset market for the 2018-2023 period, including a forecast for the 2024-2027 period.

The forecast is based on the information and data available until March 8, 2024. This analysis considers significant macro and micro-events, such as the global economic situation, the recovery scenarios for general chip shortages, and the rise of AI chip shortage. Additionally, we have considered technological advancements, such as LTE-Cat 1, Cat 1 bis, 5G, and 5G RedCap. We have included 5G RedCap as a distinct technology in this projection. We have conducted over 45+ meetings with module, chipset, and mobile network operators during MWC 2024 for feedback on our forecast. This research focuses only on cellular IoT chipsets embedded within IoT modules. It does not include cellular IoT chipsets embedded standalone in a device.

Find out

- What is the global cellular IoT module and chipset market size in terms of shipment, revenue, and ASP (wholesale average selling price)?

- Who are the leading players globally?

- What are the ASP trends by cellular connectivity technology and region?

- Which cellular IoT player is strong across 4G?

- Which cellular connectivity technology is leading globally?

- How is LTE-Cat 1 performing in China and the rest of the world?

- Which regions are leading the market in terms of growth and in terms of market share?

- Which companies are leading the market, and what are their market shares?

- Which industry vertical has the highest demand for cellular IoT connectivity chipsets and modules, and which is growing the fastest?

Database structure

Module & Chipset Model level: Modules & Chipset Shipments, Revenue and ASP at Model level (nested database)

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- 1Q 2018-4Q 2023 (actuals)

- Connectivity technologies: 2G, 3G, LTE-Cat 1, LTE Cat 1 bis, 4G, LTE-M, NB-IoT, LPWA dual mode, 5G RedCap, and 5G. Including fallback and categories for each technology

- Ten regions: China, North America, Western Europe, Eastern Europe, the Middle East and Africa, Latin America, Japan, India, Korea, Asia, and Other

- 737 unique module models and 150 unique chipset models

Industry Vertical & Forecast: Modules & Chipset Shipments, Revenue and ASP at Company level (nested database)

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- 1Q 2018-4Q 2023 (actuals)

- Quarterly forecast 1Q 2024-4Q 2024

- Annual forecast 2025-2027

- Connectivity technologies: 2G, 3G, LTE-Cat 1, LTE Cat 1 bis, 4G, LTE-M, NB-IoT, LPWA dual mode, 5G RedCap, and 5G

- 10 regions: China, North America, Western Europe, Eastern Europe, the Middle East and Africa, Latin America, Japan, India, Korea, Asia, and Other

- 16 industry verticals

Companies mentioned in the tracker & forecast

|

|

Industry verticals covered in the tracker & forecast

|

|

Please contact us using the inquiry form for pricing information.