PUBLISHER: Allied Market Research | PRODUCT CODE: 1414772

PUBLISHER: Allied Market Research | PRODUCT CODE: 1414772

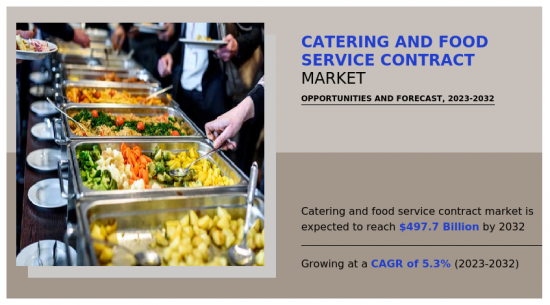

Catering And Food Service Contract Market By Ownership, By Application : Global Opportunity Analysis and Industry Forecast, 2023-2032

According to a new report published by Allied Market Research, titled, "Catering And Food Service Contract Market," The catering and food service contract market was valued at $251.1 billion in 2021, and is estimated to reach $477.3 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031.

Improvement in living standard of people, catering and food and service contract market has grown at a significant rate. Young generations are more willing to pay for the high quality and experiences. Moreover, after COVID-19 pandemic, catering and food service contract market continued to develop the possibility of increasing the efficiency of the market participants, as per macroeconomic indicators showing economic growth, unemployment, and the demographic situation. A major element that shows the increased in catering and food service contract market is the systematically growth in revenue. The revenue of catering and food and service establishments is generated mainly by own food production, followed by alcohol and tobacco sales.

Moreover, with increase in use of contract catering and food services among the working-class people, technological advancement in delivering contract catering services and fulfilling the expectations of the clients by providing customized and nutritious food boosts the growth of the market. According to European Commission JRC (Joint Research Center) Technical report, Europe is expected to hold significant share in the global catering and food service contractor market during the forecast period.

Market growth in the region is attributed to the increase in number of merger and acquisition activities in the region. For instance, in 2017, CH&Co Group and Harbour & Jones merged, which brought a turnover of US$ 299.46 million. The merger of both companies was aimed to offer catering services across the UK and Ireland. Prior to this, Harbour & Jones acquired PCC Ltd along with its two brands namely Fare of London and Principals Catering. The deal made a turnover of over US$ 55.48 million. Therefore, increasing M&A activities in Europe is expected to boost market growth in terms of revenue.

Catering is the business of providing food service at various locations. The growth in business is influenced by several factors, such as a change in the lifestyle of city dwellers. Moreover, corporate culture that holds several meetings, conferences, business lunch and dinner parties are dependent upon the catering and food service contract industry services. The trend might not be that new for the developed countries, but the countries that have recently discovered the corporate culture help the industry to attain popularity.

Furthermore, catering and food services contract businesses add more services such as birthday parties, wedding receptions and others. Companies with greater reliance on the service part of their business focus on a better return on sales that can improve their value. Based on high-quality products, companies invest more in service differentiation to achieve competitive advantages. Moreover, the increase in popularity of online contract catering and food service is one of the major factors driving the growth of the contract catering and food service market.

The catering and food service contract market is segmented into ownership, application, and region. On the basis of ownership, the market is divided into standalone and chain. On the basis of application, it is classified into a corporate, educational institution, healthcare, industrial, hospitality services, sports and leisure, and others. On the basis of region, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

The players in the catering and food service contract market have adopted acquisition and product launch as their key development strategies to increase profitability and improve their position in the market. The key players profiled in the catering and food service contract market include The RK Group, Gulf Catering Company, Delaware North Companies, Inc., Comprehensive Support Services PTE., Ltd., Australian Camp Services, Of Food Catering, Conntrak Catering Service., National Catering Services & Foodstuff, NCC Group, Compass Group PLC., Sodexo, Elior Group, Aramark, ISS A/S, Thompson Hospitality Corporation, NTUC Foodfare Co-operative Limited, SATS Ltd., Catering Solutions Pte. Ltd., Neo Group Limited, Algosaibi Services Company, Ltd., Cater Care Holdings Pty., Ltd., Catering HQ, Gnocci Holdings Pty. Ltd., WSH Investments Limited., Fusion Foods & Catering Pvt. Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the catering and food service contract market analysis from 2022 to 2032 to identify the prevailing catering and food service contract market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the catering and food service contract market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global catering and food service contract market trends, key players, market segments, application areas, and market growth strategies.

Additional benefits you will get with this purchase are:

- Quarterly Update and* (only available with a corporate license, on listed price)

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Five and Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 15% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Five and Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline, please talk to the sales executive to know more)

- End user preferences and pain points

- Senario Analysis & Growth Trend Comparision

- Supply Chain Analysis & Vendor Margins

- Consumer Preference and Product Specifications

- Additional company profiles with specific to client's interest

- Additional country or region analysis- market size and forecast

- Expanded list for Company Profiles

- Historic market data

Key Market Segments

By Ownership

- Standalone

- Chain

By Application

- Healthcare

- Corporate

- Educational Institutions

- Industrial

- Hospitality Services

- Sports and Leisure

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- Singapore

- Vietnam

- Mayanmar

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- UAE

- Saudi Arabia

- Argentina

- Rest of LAMEA

Key Market Players:

- Comprehensive Support Services PTE., Ltd.

- Conntrak Catering Services.

- Fusion Foods & Catering Pvt. Ltd.

- ISS A/S

- SATS Ltd.

- National Catering Services & Foodstuff

- Sodexo

- Gulf Catering Company

- Neo Group Limited

- Cater Care Holdings Pty., Ltd.

- Australian Camp Services

- Elior Group SA

- Catering HQ Pty Ltd.

- Catering Solutions Pte. Ltd.

- Algosaibi Services Company, Ltd.

- Thompson Hospitality Corporation

- WSH Investments Limited.

- Compass Group PLC

- Delaware North Companies, Inc.

- NTUC Foodfare Co-operative Limited

- Aramark

- Gnocci Holdings Pty. Ltd.

- Of Food Catering

- The RK Group

- National Catering Company Limited WLL

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report description

- 1.2. Key market segments

- 1.3. Key benefits to the stakeholders

- 1.4. Research methodology

- 1.4.1. Primary research

- 1.4.2. Secondary research

- 1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

- 3.1. Market definition and scope

- 3.2. Key findings

- 3.2.1. Top impacting factors

- 3.2.2. Top investment pockets

- 3.3. Porter's five forces analysis

- 3.3.1. Low bargaining power of suppliers

- 3.3.2. Low threat of new entrants

- 3.3.3. Low threat of substitutes

- 3.3.4. Low intensity of rivalry

- 3.3.5. Low bargaining power of buyers

- 3.4. Market dynamics

- 3.4.1. Drivers

- 3.4.1.1. Rise corporate and travel sector

- 3.4.1.2. Technological advancement

- 3.4.2. Restraints

- 3.4.2.1. Increase in competition

- 3.4.3. Opportunities

- 3.4.3.1. Surge in events and occasions

- 3.4.3.2. Rise in consumer living standard

- 3.4.1. Drivers

CHAPTER 4: CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP

- 4.1. Overview

- 4.1.1. Market size and forecast

- 4.2. Standalone

- 4.2.1. Key market trends, growth factors and opportunities

- 4.2.2. Market size and forecast, by region

- 4.2.3. Market share analysis by country

- 4.3. Chain

- 4.3.1. Key market trends, growth factors and opportunities

- 4.3.2. Market size and forecast, by region

- 4.3.3. Market share analysis by country

CHAPTER 5: CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION

- 5.1. Overview

- 5.1.1. Market size and forecast

- 5.2. Corporate

- 5.2.1. Key market trends, growth factors and opportunities

- 5.2.2. Market size and forecast, by region

- 5.2.3. Market share analysis by country

- 5.3. Educational Institutions

- 5.3.1. Key market trends, growth factors and opportunities

- 5.3.2. Market size and forecast, by region

- 5.3.3. Market share analysis by country

- 5.4. Healthcare

- 5.4.1. Key market trends, growth factors and opportunities

- 5.4.2. Market size and forecast, by region

- 5.4.3. Market share analysis by country

- 5.5. Industrial

- 5.5.1. Key market trends, growth factors and opportunities

- 5.5.2. Market size and forecast, by region

- 5.5.3. Market share analysis by country

- 5.6. Hospitality Services

- 5.6.1. Key market trends, growth factors and opportunities

- 5.6.2. Market size and forecast, by region

- 5.6.3. Market share analysis by country

- 5.7. Sports and Leisure

- 5.7.1. Key market trends, growth factors and opportunities

- 5.7.2. Market size and forecast, by region

- 5.7.3. Market share analysis by country

- 5.8. Others

- 5.8.1. Key market trends, growth factors and opportunities

- 5.8.2. Market size and forecast, by region

- 5.8.3. Market share analysis by country

CHAPTER 6: CATERING AND FOOD SERVICE CONTRACT MARKET, BY REGION

- 6.1. Overview

- 6.1.1. Market size and forecast By Region

- 6.2. North America

- 6.2.1. Key market trends, growth factors and opportunities

- 6.2.2. Market size and forecast, by Ownership

- 6.2.3. Market size and forecast, by Application

- 6.2.4. Market size and forecast, by country

- 6.2.4.1. U.S.

- 6.2.4.1.1. Market size and forecast, by Ownership

- 6.2.4.1.2. Market size and forecast, by Application

- 6.2.4.2. Canada

- 6.2.4.2.1. Market size and forecast, by Ownership

- 6.2.4.2.2. Market size and forecast, by Application

- 6.2.4.3. Mexico

- 6.2.4.3.1. Market size and forecast, by Ownership

- 6.2.4.3.2. Market size and forecast, by Application

- 6.3. Europe

- 6.3.1. Key market trends, growth factors and opportunities

- 6.3.2. Market size and forecast, by Ownership

- 6.3.3. Market size and forecast, by Application

- 6.3.4. Market size and forecast, by country

- 6.3.4.1. Germany

- 6.3.4.1.1. Market size and forecast, by Ownership

- 6.3.4.1.2. Market size and forecast, by Application

- 6.3.4.2. France

- 6.3.4.2.1. Market size and forecast, by Ownership

- 6.3.4.2.2. Market size and forecast, by Application

- 6.3.4.3. Italy

- 6.3.4.3.1. Market size and forecast, by Ownership

- 6.3.4.3.2. Market size and forecast, by Application

- 6.3.4.4. Spain

- 6.3.4.4.1. Market size and forecast, by Ownership

- 6.3.4.4.2. Market size and forecast, by Application

- 6.3.4.5. UK

- 6.3.4.5.1. Market size and forecast, by Ownership

- 6.3.4.5.2. Market size and forecast, by Application

- 6.3.4.6. Russia

- 6.3.4.6.1. Market size and forecast, by Ownership

- 6.3.4.6.2. Market size and forecast, by Application

- 6.3.4.7. Rest of Europe

- 6.3.4.7.1. Market size and forecast, by Ownership

- 6.3.4.7.2. Market size and forecast, by Application

- 6.4. Asia-Pacific

- 6.4.1. Key market trends, growth factors and opportunities

- 6.4.2. Market size and forecast, by Ownership

- 6.4.3. Market size and forecast, by Application

- 6.4.4. Market size and forecast, by country

- 6.4.4.1. China

- 6.4.4.1.1. Market size and forecast, by Ownership

- 6.4.4.1.2. Market size and forecast, by Application

- 6.4.4.2. Japan

- 6.4.4.2.1. Market size and forecast, by Ownership

- 6.4.4.2.2. Market size and forecast, by Application

- 6.4.4.3. India

- 6.4.4.3.1. Market size and forecast, by Ownership

- 6.4.4.3.2. Market size and forecast, by Application

- 6.4.4.4. Australia

- 6.4.4.4.1. Market size and forecast, by Ownership

- 6.4.4.4.2. Market size and forecast, by Application

- 6.4.4.5. South Korea

- 6.4.4.5.1. Market size and forecast, by Ownership

- 6.4.4.5.2. Market size and forecast, by Application

- 6.4.4.6. Thailand

- 6.4.4.6.1. Market size and forecast, by Ownership

- 6.4.4.6.2. Market size and forecast, by Application

- 6.4.4.7. Malaysia

- 6.4.4.7.1. Market size and forecast, by Ownership

- 6.4.4.7.2. Market size and forecast, by Application

- 6.4.4.8. Indonesia

- 6.4.4.8.1. Market size and forecast, by Ownership

- 6.4.4.8.2. Market size and forecast, by Application

- 6.4.4.9. Singapore

- 6.4.4.9.1. Market size and forecast, by Ownership

- 6.4.4.9.2. Market size and forecast, by Application

- 6.4.4.10. Vietnam

- 6.4.4.10.1. Market size and forecast, by Ownership

- 6.4.4.10.2. Market size and forecast, by Application

- 6.4.4.11. Mayanmar

- 6.4.4.11.1. Market size and forecast, by Ownership

- 6.4.4.11.2. Market size and forecast, by Application

- 6.4.4.12. Rest of Asia-Pacific

- 6.4.4.12.1. Market size and forecast, by Ownership

- 6.4.4.12.2. Market size and forecast, by Application

- 6.5. LAMEA

- 6.5.1. Key market trends, growth factors and opportunities

- 6.5.2. Market size and forecast, by Ownership

- 6.5.3. Market size and forecast, by Application

- 6.5.4. Market size and forecast, by country

- 6.5.4.1. Brazil

- 6.5.4.1.1. Market size and forecast, by Ownership

- 6.5.4.1.2. Market size and forecast, by Application

- 6.5.4.2. South Africa

- 6.5.4.2.1. Market size and forecast, by Ownership

- 6.5.4.2.2. Market size and forecast, by Application

- 6.5.4.3. UAE

- 6.5.4.3.1. Market size and forecast, by Ownership

- 6.5.4.3.2. Market size and forecast, by Application

- 6.5.4.4. Saudi Arabia

- 6.5.4.4.1. Market size and forecast, by Ownership

- 6.5.4.4.2. Market size and forecast, by Application

- 6.5.4.5. Argentina

- 6.5.4.5.1. Market size and forecast, by Ownership

- 6.5.4.5.2. Market size and forecast, by Application

- 6.5.4.6. Rest of LAMEA

- 6.5.4.6.1. Market size and forecast, by Ownership

- 6.5.4.6.2. Market size and forecast, by Application

CHAPTER 7: COMPETITIVE LANDSCAPE

- 7.1. Introduction

- 7.2. Top winning strategies

- 7.3. Product mapping of top 10 player

- 7.4. Competitive dashboard

- 7.5. Competitive heatmap

- 7.6. Top player positioning, 2022

CHAPTER 8: COMPANY PROFILES

- 8.1. Algosaibi Services Company, Ltd.

- 8.1.1. Company overview

- 8.1.2. Key executives

- 8.1.3. Company snapshot

- 8.1.4. Operating business segments

- 8.1.5. Product portfolio

- 8.2. Aramark

- 8.2.1. Company overview

- 8.2.2. Key executives

- 8.2.3. Company snapshot

- 8.2.4. Operating business segments

- 8.2.5. Product portfolio

- 8.2.6. Business performance

- 8.2.7. Key strategic moves and developments

- 8.3. Australian Camp Services

- 8.3.1. Company overview

- 8.3.2. Key executives

- 8.3.3. Company snapshot

- 8.3.4. Operating business segments

- 8.3.5. Product portfolio

- 8.4. Cater Care Holdings Pty., Ltd.

- 8.4.1. Company overview

- 8.4.2. Key executives

- 8.4.3. Company snapshot

- 8.4.4. Operating business segments

- 8.4.5. Product portfolio

- 8.5. Catering HQ Pty Ltd.

- 8.5.1. Company overview

- 8.5.2. Key executives

- 8.5.3. Company snapshot

- 8.5.4. Operating business segments

- 8.5.5. Product portfolio

- 8.6. Catering Solutions Pte. Ltd.

- 8.6.1. Company overview

- 8.6.2. Key executives

- 8.6.3. Company snapshot

- 8.6.4. Operating business segments

- 8.6.5. Product portfolio

- 8.7. Compass Group PLC

- 8.7.1. Company overview

- 8.7.2. Key executives

- 8.7.3. Company snapshot

- 8.7.4. Operating business segments

- 8.7.5. Product portfolio

- 8.7.6. Business performance

- 8.7.7. Key strategic moves and developments

- 8.8. Comprehensive Support Services PTE., Ltd.

- 8.8.1. Company overview

- 8.8.2. Key executives

- 8.8.3. Company snapshot

- 8.8.4. Operating business segments

- 8.8.5. Product portfolio

- 8.9. Conntrak Catering Services.

- 8.9.1. Company overview

- 8.9.2. Key executives

- 8.9.3. Company snapshot

- 8.9.4. Operating business segments

- 8.9.5. Product portfolio

- 8.9.6. Key strategic moves and developments

- 8.10. Delaware North Companies, Inc.

- 8.10.1. Company overview

- 8.10.2. Key executives

- 8.10.3. Company snapshot

- 8.10.4. Operating business segments

- 8.10.5. Product portfolio

- 8.10.6. Key strategic moves and developments

- 8.11. Elior Group SA

- 8.11.1. Company overview

- 8.11.2. Key executives

- 8.11.3. Company snapshot

- 8.11.4. Operating business segments

- 8.11.5. Product portfolio

- 8.11.6. Business performance

- 8.12. Fusion Foods & Catering Pvt. Ltd.

- 8.12.1. Company overview

- 8.12.2. Key executives

- 8.12.3. Company snapshot

- 8.12.4. Operating business segments

- 8.12.5. Product portfolio

- 8.13. Gnocci Holdings Pty. Ltd.

- 8.13.1. Company overview

- 8.13.2. Key executives

- 8.13.3. Company snapshot

- 8.13.4. Operating business segments

- 8.13.5. Product portfolio

- 8.14. Gulf Catering Company

- 8.14.1. Company overview

- 8.14.2. Key executives

- 8.14.3. Company snapshot

- 8.14.4. Operating business segments

- 8.14.5. Product portfolio

- 8.15. ISS A/S

- 8.15.1. Company overview

- 8.15.2. Key executives

- 8.15.3. Company snapshot

- 8.15.4. Operating business segments

- 8.15.5. Product portfolio

- 8.15.6. Business performance

- 8.16. National Catering Services & Foodstuff

- 8.16.1. Company overview

- 8.16.2. Key executives

- 8.16.3. Company snapshot

- 8.16.4. Operating business segments

- 8.16.5. Product portfolio

- 8.17. Neo Group Limited

- 8.17.1. Company overview

- 8.17.2. Key executives

- 8.17.3. Company snapshot

- 8.17.4. Operating business segments

- 8.17.5. Product portfolio

- 8.17.6. Business performance

- 8.18. NTUC Foodfare Co-operative Limited

- 8.18.1. Company overview

- 8.18.2. Key executives

- 8.18.3. Company snapshot

- 8.18.4. Operating business segments

- 8.18.5. Product portfolio

- 8.19. Of Food Catering

- 8.19.1. Company overview

- 8.19.2. Key executives

- 8.19.3. Company snapshot

- 8.19.4. Operating business segments

- 8.19.5. Product portfolio

- 8.20. SATS Ltd.

- 8.20.1. Company overview

- 8.20.2. Key executives

- 8.20.3. Company snapshot

- 8.20.4. Operating business segments

- 8.20.5. Product portfolio

- 8.20.6. Business performance

- 8.20.7. Key strategic moves and developments

- 8.21. Sodexo

- 8.21.1. Company overview

- 8.21.2. Key executives

- 8.21.3. Company snapshot

- 8.21.4. Operating business segments

- 8.21.5. Product portfolio

- 8.21.6. Business performance

- 8.21.7. Key strategic moves and developments

- 8.22. The RK Group

- 8.22.1. Company overview

- 8.22.2. Key executives

- 8.22.3. Company snapshot

- 8.22.4. Operating business segments

- 8.22.5. Product portfolio

- 8.23. Thompson Hospitality Corporation

- 8.23.1. Company overview

- 8.23.2. Key executives

- 8.23.3. Company snapshot

- 8.23.4. Operating business segments

- 8.23.5. Product portfolio

- 8.24. WSH Investments Limited.

- 8.24.1. Company overview

- 8.24.2. Key executives

- 8.24.3. Company snapshot

- 8.24.4. Operating business segments

- 8.24.5. Product portfolio

- 8.24.6. Business performance

- 8.25. National Catering Company Limited WLL

- 8.25.1. Company overview

- 8.25.2. Key executives

- 8.25.3. Company snapshot

- 8.25.4. Operating business segments

- 8.25.5. Product portfolio

LIST OF TABLES

- TABLE 01. GLOBAL CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 02. CATERING AND FOOD SERVICE CONTRACT MARKET FOR STANDALONE, BY REGION, 2022-2032 ($MILLION)

- TABLE 03. CATERING AND FOOD SERVICE CONTRACT MARKET FOR CHAIN, BY REGION, 2022-2032 ($MILLION)

- TABLE 04. GLOBAL CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 05. CATERING AND FOOD SERVICE CONTRACT MARKET FOR CORPORATE, BY REGION, 2022-2032 ($MILLION)

- TABLE 06. CATERING AND FOOD SERVICE CONTRACT MARKET FOR EDUCATIONAL INSTITUTIONS, BY REGION, 2022-2032 ($MILLION)

- TABLE 07. CATERING AND FOOD SERVICE CONTRACT MARKET FOR HEALTHCARE, BY REGION, 2022-2032 ($MILLION)

- TABLE 08. CATERING AND FOOD SERVICE CONTRACT MARKET FOR INDUSTRIAL, BY REGION, 2022-2032 ($MILLION)

- TABLE 09. CATERING AND FOOD SERVICE CONTRACT MARKET FOR HOSPITALITY SERVICES, BY REGION, 2022-2032 ($MILLION)

- TABLE 10. CATERING AND FOOD SERVICE CONTRACT MARKET FOR SPORTS AND LEISURE, BY REGION, 2022-2032 ($MILLION)

- TABLE 11. CATERING AND FOOD SERVICE CONTRACT MARKET FOR OTHERS, BY REGION, 2022-2032 ($MILLION)

- TABLE 12. CATERING AND FOOD SERVICE CONTRACT MARKET, BY REGION, 2022-2032 ($MILLION)

- TABLE 13. NORTH AMERICA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 14. NORTH AMERICA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 15. NORTH AMERICA CATERING AND FOOD SERVICE CONTRACT MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 16. U.S. CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 17. U.S. CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 18. CANADA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 19. CANADA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 20. MEXICO CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 21. MEXICO CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 22. EUROPE CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 23. EUROPE CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 24. EUROPE CATERING AND FOOD SERVICE CONTRACT MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 25. GERMANY CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 26. GERMANY CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 27. FRANCE CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 28. FRANCE CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 29. ITALY CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 30. ITALY CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 31. SPAIN CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 32. SPAIN CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 33. UK CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 34. UK CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 35. RUSSIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 36. RUSSIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 37. REST OF EUROPE CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 38. REST OF EUROPE CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 39. ASIA-PACIFIC CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 40. ASIA-PACIFIC CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 41. ASIA-PACIFIC CATERING AND FOOD SERVICE CONTRACT MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 42. CHINA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 43. CHINA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 44. JAPAN CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 45. JAPAN CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 46. INDIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 47. INDIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 48. AUSTRALIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 49. AUSTRALIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 50. SOUTH KOREA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 51. SOUTH KOREA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 52. THAILAND CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 53. THAILAND CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 54. MALAYSIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 55. MALAYSIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 56. INDONESIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 57. INDONESIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 58. SINGAPORE CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 59. SINGAPORE CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 60. VIETNAM CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 61. VIETNAM CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 62. MAYANMAR CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 63. MAYANMAR CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 64. REST OF ASIA-PACIFIC CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 65. REST OF ASIA-PACIFIC CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 66. LAMEA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 67. LAMEA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 68. LAMEA CATERING AND FOOD SERVICE CONTRACT MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 69. BRAZIL CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 70. BRAZIL CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 71. SOUTH AFRICA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 72. SOUTH AFRICA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 73. UAE CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 74. UAE CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 75. SAUDI ARABIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 76. SAUDI ARABIA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 77. ARGENTINA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 78. ARGENTINA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 79. REST OF LAMEA CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022-2032 ($MILLION)

- TABLE 80. REST OF LAMEA CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 81. ALGOSAIBI SERVICES COMPANY, LTD.: KEY EXECUTIVES

- TABLE 82. ALGOSAIBI SERVICES COMPANY, LTD.: COMPANY SNAPSHOT

- TABLE 83. ALGOSAIBI SERVICES COMPANY, LTD.: SERVICE SEGMENTS

- TABLE 84. ALGOSAIBI SERVICES COMPANY, LTD.: PRODUCT PORTFOLIO

- TABLE 85. ARAMARK: KEY EXECUTIVES

- TABLE 86. ARAMARK: COMPANY SNAPSHOT

- TABLE 87. ARAMARK: PRODUCT SEGMENTS

- TABLE 88. ARAMARK: PRODUCT PORTFOLIO

- TABLE 89. ARAMARK: KEY STRATERGIES

- TABLE 90. AUSTRALIAN CAMP SERVICES: KEY EXECUTIVES

- TABLE 91. AUSTRALIAN CAMP SERVICES: COMPANY SNAPSHOT

- TABLE 92. AUSTRALIAN CAMP SERVICES: SERVICE SEGMENTS

- TABLE 93. AUSTRALIAN CAMP SERVICES: PRODUCT PORTFOLIO

- TABLE 94. CATER CARE HOLDINGS PTY., LTD.: KEY EXECUTIVES

- TABLE 95. CATER CARE HOLDINGS PTY., LTD.: COMPANY SNAPSHOT

- TABLE 96. CATER CARE HOLDINGS PTY., LTD.: SERVICE SEGMENTS

- TABLE 97. CATER CARE HOLDINGS PTY., LTD.: PRODUCT PORTFOLIO

- TABLE 98. CATERING HQ PTY LTD.: KEY EXECUTIVES

- TABLE 99. CATERING HQ PTY LTD.: COMPANY SNAPSHOT

- TABLE 100. CATERING HQ PTY LTD.: SERVICE SEGMENTS

- TABLE 101. CATERING HQ PTY LTD.: PRODUCT PORTFOLIO

- TABLE 102. CATERING SOLUTIONS PTE. LTD.: KEY EXECUTIVES

- TABLE 103. CATERING SOLUTIONS PTE. LTD.: COMPANY SNAPSHOT

- TABLE 104. CATERING SOLUTIONS PTE. LTD.: SERVICE SEGMENTS

- TABLE 105. CATERING SOLUTIONS PTE. LTD.: PRODUCT PORTFOLIO

- TABLE 106. COMPASS GROUP PLC: KEY EXECUTIVES

- TABLE 107. COMPASS GROUP PLC: COMPANY SNAPSHOT

- TABLE 108. COMPASS GROUP PLC: PRODUCT SEGMENTS

- TABLE 109. COMPASS GROUP PLC: PRODUCT PORTFOLIO

- TABLE 110. COMPASS GROUP PLC: KEY STRATERGIES

- TABLE 111. COMPREHENSIVE SUPPORT SERVICES PTE., LTD.: KEY EXECUTIVES

- TABLE 112. COMPREHENSIVE SUPPORT SERVICES PTE., LTD.: COMPANY SNAPSHOT

- TABLE 113. COMPREHENSIVE SUPPORT SERVICES PTE., LTD.: SERVICE SEGMENTS

- TABLE 114. COMPREHENSIVE SUPPORT SERVICES PTE., LTD.: PRODUCT PORTFOLIO

- TABLE 115. CONNTRAK CATERING SERVICES.: KEY EXECUTIVES

- TABLE 116. CONNTRAK CATERING SERVICES.: COMPANY SNAPSHOT

- TABLE 117. CONNTRAK CATERING SERVICES.: SERVICE SEGMENTS

- TABLE 118. CONNTRAK CATERING SERVICES.: PRODUCT PORTFOLIO

- TABLE 119. CONNTRAK CATERING SERVICES.: KEY STRATERGIES

- TABLE 120. DELAWARE NORTH COMPANIES, INC.: KEY EXECUTIVES

- TABLE 121. DELAWARE NORTH COMPANIES, INC.: COMPANY SNAPSHOT

- TABLE 122. DELAWARE NORTH COMPANIES, INC.: SERVICE SEGMENTS

- TABLE 123. DELAWARE NORTH COMPANIES, INC.: PRODUCT PORTFOLIO

- TABLE 124. DELAWARE NORTH COMPANIES, INC.: KEY STRATERGIES

- TABLE 125. ELIOR GROUP SA: KEY EXECUTIVES

- TABLE 126. ELIOR GROUP SA: COMPANY SNAPSHOT

- TABLE 127. ELIOR GROUP SA: SERVICE SEGMENTS

- TABLE 128. ELIOR GROUP SA: PRODUCT PORTFOLIO

- TABLE 129. FUSION FOODS & CATERING PVT. LTD.: KEY EXECUTIVES

- TABLE 130. FUSION FOODS & CATERING PVT. LTD.: COMPANY SNAPSHOT

- TABLE 131. FUSION FOODS & CATERING PVT. LTD.: SERVICE SEGMENTS

- TABLE 132. FUSION FOODS & CATERING PVT. LTD.: PRODUCT PORTFOLIO

- TABLE 133. GNOCCI HOLDINGS PTY. LTD.: KEY EXECUTIVES

- TABLE 134. GNOCCI HOLDINGS PTY. LTD.: COMPANY SNAPSHOT

- TABLE 135. GNOCCI HOLDINGS PTY. LTD.: SERVICE SEGMENTS

- TABLE 136. GNOCCI HOLDINGS PTY. LTD.: PRODUCT PORTFOLIO

- TABLE 137. GULF CATERING COMPANY: KEY EXECUTIVES

- TABLE 138. GULF CATERING COMPANY: COMPANY SNAPSHOT

- TABLE 139. GULF CATERING COMPANY: SERVICE SEGMENTS

- TABLE 140. GULF CATERING COMPANY: PRODUCT PORTFOLIO

- TABLE 141. ISS A/S: KEY EXECUTIVES

- TABLE 142. ISS A/S: COMPANY SNAPSHOT

- TABLE 143. ISS A/S: SERVICE SEGMENTS

- TABLE 144. ISS A/S: PRODUCT PORTFOLIO

- TABLE 145. NATIONAL CATERING SERVICES & FOODSTUFF: KEY EXECUTIVES

- TABLE 146. NATIONAL CATERING SERVICES & FOODSTUFF: COMPANY SNAPSHOT

- TABLE 147. NATIONAL CATERING SERVICES & FOODSTUFF: SERVICE SEGMENTS

- TABLE 148. NATIONAL CATERING SERVICES & FOODSTUFF: PRODUCT PORTFOLIO

- TABLE 149. NEO GROUP LIMITED: KEY EXECUTIVES

- TABLE 150. NEO GROUP LIMITED: COMPANY SNAPSHOT

- TABLE 151. NEO GROUP LIMITED: SERVICE SEGMENTS

- TABLE 152. NEO GROUP LIMITED: PRODUCT PORTFOLIO

- TABLE 153. NTUC FOODFARE CO-OPERATIVE LIMITED: KEY EXECUTIVES

- TABLE 154. NTUC FOODFARE CO-OPERATIVE LIMITED: COMPANY SNAPSHOT

- TABLE 155. NTUC FOODFARE CO-OPERATIVE LIMITED: PRODUCT SEGMENTS

- TABLE 156. NTUC FOODFARE CO-OPERATIVE LIMITED: SERVICE SEGMENTS

- TABLE 157. NTUC FOODFARE CO-OPERATIVE LIMITED: PRODUCT PORTFOLIO

- TABLE 158. OF FOOD CATERING: KEY EXECUTIVES

- TABLE 159. OF FOOD CATERING: COMPANY SNAPSHOT

- TABLE 160. OF FOOD CATERING: SERVICE SEGMENTS

- TABLE 161. OF FOOD CATERING: PRODUCT PORTFOLIO

- TABLE 162. SATS LTD.: KEY EXECUTIVES

- TABLE 163. SATS LTD.: COMPANY SNAPSHOT

- TABLE 164. SATS LTD.: SERVICE SEGMENTS

- TABLE 165. SATS LTD.: PRODUCT PORTFOLIO

- TABLE 166. SATS LTD.: KEY STRATERGIES

- TABLE 167. SODEXO: KEY EXECUTIVES

- TABLE 168. SODEXO: COMPANY SNAPSHOT

- TABLE 169. SODEXO: SERVICE SEGMENTS

- TABLE 170. SODEXO: PRODUCT PORTFOLIO

- TABLE 171. SODEXO: KEY STRATERGIES

- TABLE 172. THE RK GROUP: KEY EXECUTIVES

- TABLE 173. THE RK GROUP: COMPANY SNAPSHOT

- TABLE 174. THE RK GROUP: SERVICE SEGMENTS

- TABLE 175. THE RK GROUP: PRODUCT PORTFOLIO

- TABLE 176. THOMPSON HOSPITALITY CORPORATION: KEY EXECUTIVES

- TABLE 177. THOMPSON HOSPITALITY CORPORATION: COMPANY SNAPSHOT

- TABLE 178. THOMPSON HOSPITALITY CORPORATION: SERVICE SEGMENTS

- TABLE 179. THOMPSON HOSPITALITY CORPORATION: PRODUCT PORTFOLIO

- TABLE 180. WSH INVESTMENTS LIMITED.: KEY EXECUTIVES

- TABLE 181. WSH INVESTMENTS LIMITED.: COMPANY SNAPSHOT

- TABLE 182. WSH INVESTMENTS LIMITED.: SERVICE SEGMENTS

- TABLE 183. WSH INVESTMENTS LIMITED.: PRODUCT PORTFOLIO

- TABLE 184. NATIONAL CATERING COMPANY LIMITED WLL: KEY EXECUTIVES

- TABLE 185. NATIONAL CATERING COMPANY LIMITED WLL: COMPANY SNAPSHOT

- TABLE 186. NATIONAL CATERING COMPANY LIMITED WLL: SERVICE SEGMENTS

- TABLE 187. NATIONAL CATERING COMPANY LIMITED WLL: PRODUCT PORTFOLIO

LIST OF FIGURES

- FIGURE 01. CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032

- FIGURE 02. SEGMENTATION OF CATERING AND FOOD SERVICE CONTRACT MARKET,2022-2032

- FIGURE 03. TOP IMPACTING FACTORS IN CATERING AND FOOD SERVICE CONTRACT MARKET (2022 TO 2032)

- FIGURE 04. TOP INVESTMENT POCKETS IN CATERING AND FOOD SERVICE CONTRACT MARKET (2023-2032)

- FIGURE 05. LOW BARGAINING POWER OF SUPPLIERS

- FIGURE 06. LOW THREAT OF NEW ENTRANTS

- FIGURE 07. LOW THREAT OF SUBSTITUTES

- FIGURE 08. LOW INTENSITY OF RIVALRY

- FIGURE 09. LOW BARGAINING POWER OF BUYERS

- FIGURE 10. GLOBAL CATERING AND FOOD SERVICE CONTRACT MARKET:DRIVERS, RESTRAINTS AND OPPORTUNITIES

- FIGURE 11. CATERING AND FOOD SERVICE CONTRACT MARKET, BY OWNERSHIP, 2022 AND 2032(%)

- FIGURE 12. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR STANDALONE, BY COUNTRY 2022 AND 2032(%)

- FIGURE 13. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR CHAIN, BY COUNTRY 2022 AND 2032(%)

- FIGURE 14. CATERING AND FOOD SERVICE CONTRACT MARKET, BY APPLICATION, 2022 AND 2032(%)

- FIGURE 15. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR CORPORATE, BY COUNTRY 2022 AND 2032(%)

- FIGURE 16. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR EDUCATIONAL INSTITUTIONS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 17. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR HEALTHCARE, BY COUNTRY 2022 AND 2032(%)

- FIGURE 18. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR INDUSTRIAL, BY COUNTRY 2022 AND 2032(%)

- FIGURE 19. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR HOSPITALITY SERVICES, BY COUNTRY 2022 AND 2032(%)

- FIGURE 20. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR SPORTS AND LEISURE, BY COUNTRY 2022 AND 2032(%)

- FIGURE 21. COMPARATIVE SHARE ANALYSIS OF CATERING AND FOOD SERVICE CONTRACT MARKET FOR OTHERS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 22. CATERING AND FOOD SERVICE CONTRACT MARKET BY REGION, 2022 AND 2032(%)

- FIGURE 23. U.S. CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 24. CANADA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 25. MEXICO CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 26. GERMANY CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 27. FRANCE CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 28. ITALY CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 29. SPAIN CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 30. UK CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 31. RUSSIA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 32. REST OF EUROPE CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 33. CHINA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 34. JAPAN CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 35. INDIA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 36. AUSTRALIA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 37. SOUTH KOREA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 38. THAILAND CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 39. MALAYSIA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 40. INDONESIA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 41. SINGAPORE CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 42. VIETNAM CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 43. MAYANMAR CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 44. REST OF ASIA-PACIFIC CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 45. BRAZIL CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 46. SOUTH AFRICA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 47. UAE CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 48. SAUDI ARABIA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 49. ARGENTINA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 50. REST OF LAMEA CATERING AND FOOD SERVICE CONTRACT MARKET, 2022-2032 ($MILLION)

- FIGURE 51. PRODUCT MAPPING OF TOP 10 PLAYERS

- FIGURE 52. COMPETITIVE DASHBOARD

- FIGURE 53. COMPETITIVE HEATMAP: CATERING AND FOOD SERVICE CONTRACT MARKET

- FIGURE 54. TOP PLAYER POSITIONING, 2022

- FIGURE 55. ARAMARK: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 56. ARAMARK: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 57. ARAMARK: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 58. COMPASS GROUP PLC: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 59. COMPASS GROUP PLC: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 60. ELIOR GROUP SA: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 61. ELIOR GROUP SA: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 62. ISS A/S: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 63. ISS A/S: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 64. ISS A/S: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 65. NEO GROUP LIMITED: NET SALES, 2018-2020 ($MILLION)

- FIGURE 66. NEO GROUP LIMITED: REVENUE SHARE BY SEGMENT, 2020 (%)

- FIGURE 67. NEO GROUP LIMITED: REVENUE SHARE BY REGION, 2020 (%)

- FIGURE 68. SATS LTD.: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 69. SATS LTD.: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 70. SATS LTD.: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 71. SODEXO: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 72. WSH INVESTMENTS LIMITED.: NET SALES, 2020-2022 ($MILLION)

- FIGURE 73. WSH INVESTMENTS LIMITED.: REVENUE SHARE BY REGION, 2022 (%)