PUBLISHER: Allied Market Research | PRODUCT CODE: 1344441

PUBLISHER: Allied Market Research | PRODUCT CODE: 1344441

Dental Imaging Market By Product (Extraoral Imaging System, Intraoral Imaging System), By Application (Medical, Others), By End Users (Hospitals, Dental Clinics, Others): Global Opportunity Analysis and Industry Forecast, 2023-2032

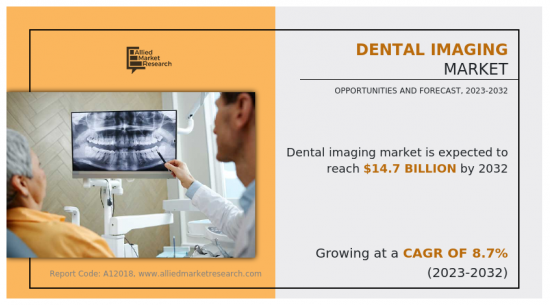

According to a new report published by Allied Market Research, titled, "Dental Imaging Market," The dental imaging market was valued at $6.4 billion in 2022, and is estimated to reach $14.7 billion by 2032, growing at a CAGR of 8.7% from 2023 to 2032.

The dental imaging market was negatively impacted during the lockdown period owing to a decrease in demand for dental imaging systems. In addition, decrease in a patient visit to the dental hospitals and clinics for diagnosis and treatment of dental; disorders due to pandemic further negatively impacted the market growth.

Market Dynamics

Rise in demand for more accurate and efficient diagnostic tools such as intraoral cameras in dental practices drives dental imaging market growth. Rise in digital technologies led to development of new imaging devices and software, which offer improved resolution, faster processing times, and greater ease of use is expected to drive the market growth led to development of new imaging devices and software, which offer improved resolution, faster processing times, and greater ease of use is expected to drive the market growth.Furthermore, the increase in prevalence of dental disorders such as cavities, gum disease, and oral cancer are driving the demand for dental imaging technologies which is expected to drive the market growth.

Growing demand for cosmetic industry as people are increasingly concerned about the appearance of their teeth and smiles which further support the market growth. Dental imaging technologies such as intraoral cameras, and 3D imaging systems are used in cosmetic dental procedures such as teeth whitening, orthodontics, and dental implants. Thus, the rise in adoption of dental imaging procedure in cosmetic industry contributes towards the growth during dental imaging market forecast.

The growth of the dental imaging market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, rise in prevalence of oral diseases such as oral cancer and tooth decay.

Increase in awareness among patients about the importance of maintaining good oral health led to an increase in demand for dental imaging technologies. Rise in awareness about benefits of early detection and prevention of dental disorders led to propels the market growth. Moreover, governments initiatives in various countries are taking initiatives to promote oral health and improve access to dental care which is expected to boost the market growth. For instance, the American Dental Association and the Centers for Disease Control and Prevention (CDC), in U.S. developed the guidelines to promote the use of dental imaging technologies for the prevention and treatment of dental disorders. Such initiatives are expected to drive growth of dental imaging industry.

Significant advancements in dental imaging technology led to the development of advanced imaging system with improved image quality, and diagnostic accuracy has supported the market growth. For instance, cone-beam computed tomography uses a cone shaped beam of x-rays to produce high resolution 3D images of the teeth, jawbone, and surrounding tissues. These advancements enable dentists to provide better care to their patients and increase the demand for dental imaging technology.

The demand for dental imaging is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as rise in adoption of extraoral imaging and intraoral imaging systems and increase in awareness toward early diagnosis and treatment, further drive the growth of the dental imaging market size.

However, the high cost of dental imaging equipment and procedures negatively impacted the market growth. Dental imaging technologies can be expensive, and the cost can be a major barrier for some dental practices and patients. In addition, there are also concerns around the potential health risks associated with repeated exposure to ionizing radiation from X-ray imaging. While dental X-rays are generally considered safe, the risks associated with radiation exposure can be a concern for some patients and healthcare professionals which may restrain market growth.

The outbreak of COVID-19 disrupted workflows in the health care sector around the world. The delay in diagnosis and treatment of dental disorders during the pandemic had a significant impact on patient outcomes. Many dental practices were temporarily closed or had reduced capacity during the pandemic, leading to a decline in the demand for dental imaging technologies. In addition, patients may have hesitance to visit dental offices due to concerns about infection risk, leading to further decreases in demand. Many dental clinics and hospitals postponed non-urgent procedures during the pandemic, including dental imaging procedures. This led to a decrease in demand for dental imaging technologies. Thus, pandemic initially had a negative impact on the dental imaging market.

However, after the pandemic the dental practices adapted to the pandemic and implemented safety measures, and the demand for dental imaging technologies has started to recover. In addition, the pandemic has highlighted the importance of infection control measures in dental settings, which may lead to increase in adoption of technologies such as intraoral cameras and digital radiography that can help minimize patient contact and reduce the risk of infection which is contribute towards the growth during dental imaging market analysis.

Segmental Overview

The dental imaging market is segmented into product, application, end user, and region. By product, the market is categorized into extraoral imaging and intraoral imaging systems. Extraoral imaging systems segment is further classified into panoramic systems, cephalometric systems, and 3D CBCT systems. Intraoral imaging systems segment is further categorized into intraoral scanners, intraoral X-ray systems, intraoral sensors, intraoral PSP systems, and intraoral cameras. On the basis of application, the market is bifurcated into medical and others. By end user, the market is segregated into dental hospitals & clinics, dental diagnostic laboratories, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dental imaging market analysis from 2022 to 2032 to identify the prevailing dental imaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental imaging market segmentation assists to determine the prevailing dental imaging market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dental imaging market trends, key players, market segments, application areas, and market growth strategies.

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report description

- 1.2. Key market segments

- 1.3. Key benefits to the stakeholders

- 1.4. Research Methodology

- 1.4.1. Primary research

- 1.4.2. Secondary research

- 1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

- 3.1. Market definition and scope

- 3.2. Key findings

- 3.2.1. Top impacting factors

- 3.2.2. Top investment pockets

- 3.3. Porter's five forces analysis

- 3.3.1. Bargaining power of suppliers

- 3.3.2. Bargaining power of buyers

- 3.3.3. Threat of substitutes

- 3.3.4. Threat of new entrants

- 3.3.5. Intensity of rivalry

- 3.4. Market dynamics

- 3.4.1. Drivers

- 3.4.1.1. Rise in prevalence of oral diseases

- 3.4.1.2. Increase in adoption of portable dental imaging devices

- 3.4.1.3. Technological advancements in dental imaging

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.2.1. High cost of dental imaging systems

- 3.4.2.2. Lack of skilled professionals for handling advanced healthcare instruments

- 3.4.3. Opportunities

- 3.4.3.1. Growth opportunities in emerging markets

- 3.5. COVID-19 Impact Analysis on the market

CHAPTER 4: DENTAL IMAGING MARKET, BY PRODUCT

- 4.1. Overview

- 4.1.1. Market size and forecast

- 4.2. Extraoral Imaging System

- 4.2.1. Key market trends, growth factors and opportunities

- 4.2.2. Market size and forecast, by region

- 4.2.3. Market share analysis by country

- 4.2.4. Extraoral Imaging System Dental Imaging Market by Type

- 4.3. Intraoral Imaging System

- 4.3.1. Key market trends, growth factors and opportunities

- 4.3.2. Market size and forecast, by region

- 4.3.3. Market share analysis by country

- 4.3.4. Intraoral Imaging System Dental Imaging Market by Type

CHAPTER 5: DENTAL IMAGING MARKET, BY APPLICATION

- 5.1. Overview

- 5.1.1. Market size and forecast

- 5.2. Medical

- 5.2.1. Key market trends, growth factors and opportunities

- 5.2.2. Market size and forecast, by region

- 5.2.3. Market share analysis by country

- 5.3. Others

- 5.3.1. Key market trends, growth factors and opportunities

- 5.3.2. Market size and forecast, by region

- 5.3.3. Market share analysis by country

CHAPTER 6: DENTAL IMAGING MARKET, BY END USERS

- 6.1. Overview

- 6.1.1. Market size and forecast

- 6.2. Hospitals

- 6.2.1. Key market trends, growth factors and opportunities

- 6.2.2. Market size and forecast, by region

- 6.2.3. Market share analysis by country

- 6.3. Dental Clinics

- 6.3.1. Key market trends, growth factors and opportunities

- 6.3.2. Market size and forecast, by region

- 6.3.3. Market share analysis by country

- 6.4. Others

- 6.4.1. Key market trends, growth factors and opportunities

- 6.4.2. Market size and forecast, by region

- 6.4.3. Market share analysis by country

CHAPTER 7: DENTAL IMAGING MARKET, BY REGION

- 7.1. Overview

- 7.1.1. Market size and forecast By Region

- 7.2. North America

- 7.2.1. Key trends and opportunities

- 7.2.2. Market size and forecast, by Product

- 7.2.3. Market size and forecast, by Application

- 7.2.4. Market size and forecast, by End Users

- 7.2.5. Market size and forecast, by country

- 7.2.5.1. U.S.

- 7.2.5.1.1. Key market trends, growth factors and opportunities

- 7.2.5.1.2. Market size and forecast, by Product

- 7.2.5.1.3. Market size and forecast, by Application

- 7.2.5.1.4. Market size and forecast, by End Users

- 7.2.5.2. Canada

- 7.2.5.2.1. Key market trends, growth factors and opportunities

- 7.2.5.2.2. Market size and forecast, by Product

- 7.2.5.2.3. Market size and forecast, by Application

- 7.2.5.2.4. Market size and forecast, by End Users

- 7.2.5.3. Mexico

- 7.2.5.3.1. Key market trends, growth factors and opportunities

- 7.2.5.3.2. Market size and forecast, by Product

- 7.2.5.3.3. Market size and forecast, by Application

- 7.2.5.3.4. Market size and forecast, by End Users

- 7.3. Europe

- 7.3.1. Key trends and opportunities

- 7.3.2. Market size and forecast, by Product

- 7.3.3. Market size and forecast, by Application

- 7.3.4. Market size and forecast, by End Users

- 7.3.5. Market size and forecast, by country

- 7.3.5.1. Germany

- 7.3.5.1.1. Key market trends, growth factors and opportunities

- 7.3.5.1.2. Market size and forecast, by Product

- 7.3.5.1.3. Market size and forecast, by Application

- 7.3.5.1.4. Market size and forecast, by End Users

- 7.3.5.2. France

- 7.3.5.2.1. Key market trends, growth factors and opportunities

- 7.3.5.2.2. Market size and forecast, by Product

- 7.3.5.2.3. Market size and forecast, by Application

- 7.3.5.2.4. Market size and forecast, by End Users

- 7.3.5.3. UK

- 7.3.5.3.1. Key market trends, growth factors and opportunities

- 7.3.5.3.2. Market size and forecast, by Product

- 7.3.5.3.3. Market size and forecast, by Application

- 7.3.5.3.4. Market size and forecast, by End Users

- 7.3.5.4. Italy

- 7.3.5.4.1. Key market trends, growth factors and opportunities

- 7.3.5.4.2. Market size and forecast, by Product

- 7.3.5.4.3. Market size and forecast, by Application

- 7.3.5.4.4. Market size and forecast, by End Users

- 7.3.5.5. Spain

- 7.3.5.5.1. Key market trends, growth factors and opportunities

- 7.3.5.5.2. Market size and forecast, by Product

- 7.3.5.5.3. Market size and forecast, by Application

- 7.3.5.5.4. Market size and forecast, by End Users

- 7.3.5.6. Rest of Europe

- 7.3.5.6.1. Key market trends, growth factors and opportunities

- 7.3.5.6.2. Market size and forecast, by Product

- 7.3.5.6.3. Market size and forecast, by Application

- 7.3.5.6.4. Market size and forecast, by End Users

- 7.4. Asia-Pacific

- 7.4.1. Key trends and opportunities

- 7.4.2. Market size and forecast, by Product

- 7.4.3. Market size and forecast, by Application

- 7.4.4. Market size and forecast, by End Users

- 7.4.5. Market size and forecast, by country

- 7.4.5.1. Japan

- 7.4.5.1.1. Key market trends, growth factors and opportunities

- 7.4.5.1.2. Market size and forecast, by Product

- 7.4.5.1.3. Market size and forecast, by Application

- 7.4.5.1.4. Market size and forecast, by End Users

- 7.4.5.2. China

- 7.4.5.2.1. Key market trends, growth factors and opportunities

- 7.4.5.2.2. Market size and forecast, by Product

- 7.4.5.2.3. Market size and forecast, by Application

- 7.4.5.2.4. Market size and forecast, by End Users

- 7.4.5.3. India

- 7.4.5.3.1. Key market trends, growth factors and opportunities

- 7.4.5.3.2. Market size and forecast, by Product

- 7.4.5.3.3. Market size and forecast, by Application

- 7.4.5.3.4. Market size and forecast, by End Users

- 7.4.5.4. Australia

- 7.4.5.4.1. Key market trends, growth factors and opportunities

- 7.4.5.4.2. Market size and forecast, by Product

- 7.4.5.4.3. Market size and forecast, by Application

- 7.4.5.4.4. Market size and forecast, by End Users

- 7.4.5.5. South Korea

- 7.4.5.5.1. Key market trends, growth factors and opportunities

- 7.4.5.5.2. Market size and forecast, by Product

- 7.4.5.5.3. Market size and forecast, by Application

- 7.4.5.5.4. Market size and forecast, by End Users

- 7.4.5.6. Rest of Asia-Pacific

- 7.4.5.6.1. Key market trends, growth factors and opportunities

- 7.4.5.6.2. Market size and forecast, by Product

- 7.4.5.6.3. Market size and forecast, by Application

- 7.4.5.6.4. Market size and forecast, by End Users

- 7.5. LAMEA

- 7.5.1. Key trends and opportunities

- 7.5.2. Market size and forecast, by Product

- 7.5.3. Market size and forecast, by Application

- 7.5.4. Market size and forecast, by End Users

- 7.5.5. Market size and forecast, by country

- 7.5.5.1. Brazil

- 7.5.5.1.1. Key market trends, growth factors and opportunities

- 7.5.5.1.2. Market size and forecast, by Product

- 7.5.5.1.3. Market size and forecast, by Application

- 7.5.5.1.4. Market size and forecast, by End Users

- 7.5.5.2. Saudi Arabia

- 7.5.5.2.1. Key market trends, growth factors and opportunities

- 7.5.5.2.2. Market size and forecast, by Product

- 7.5.5.2.3. Market size and forecast, by Application

- 7.5.5.2.4. Market size and forecast, by End Users

- 7.5.5.3. South Africa

- 7.5.5.3.1. Key market trends, growth factors and opportunities

- 7.5.5.3.2. Market size and forecast, by Product

- 7.5.5.3.3. Market size and forecast, by Application

- 7.5.5.3.4. Market size and forecast, by End Users

- 7.5.5.4. Rest of LAMEA

- 7.5.5.4.1. Key market trends, growth factors and opportunities

- 7.5.5.4.2. Market size and forecast, by Product

- 7.5.5.4.3. Market size and forecast, by Application

- 7.5.5.4.4. Market size and forecast, by End Users

CHAPTER 8: COMPETITIVE LANDSCAPE

- 8.1. Introduction

- 8.2. Top winning strategies

- 8.3. Product Mapping of Top 10 Player

- 8.4. Competitive Dashboard

- 8.5. Competitive Heatmap

- 8.6. Top player positioning, 2022

CHAPTER 9: COMPANY PROFILES

- 9.1. Acteon

- 9.1.1. Company overview

- 9.1.2. Key Executives

- 9.1.3. Company snapshot

- 9.1.4. Operating business segments

- 9.1.5. Product portfolio

- 9.2. Air Techniques, Inc.

- 9.2.1. Company overview

- 9.2.2. Key Executives

- 9.2.3. Company snapshot

- 9.2.4. Operating business segments

- 9.2.5. Product portfolio

- 9.3. Cefla s.c.

- 9.3.1. Company overview

- 9.3.2. Key Executives

- 9.3.3. Company snapshot

- 9.3.4. Operating business segments

- 9.3.5. Product portfolio

- 9.3.6. Business performance

- 9.4. Corix Medical Systems

- 9.4.1. Company overview

- 9.4.2. Key Executives

- 9.4.3. Company snapshot

- 9.4.4. Operating business segments

- 9.4.5. Product portfolio

- 9.5. Dentsply Sirona Inc.

- 9.5.1. Company overview

- 9.5.2. Key Executives

- 9.5.3. Company snapshot

- 9.5.4. Operating business segments

- 9.5.5. Product portfolio

- 9.5.6. Business performance

- 9.6. Envista Holdings Corporation

- 9.6.1. Company overview

- 9.6.2. Key Executives

- 9.6.3. Company snapshot

- 9.6.4. Operating business segments

- 9.6.5. Product portfolio

- 9.6.6. Business performance

- 9.6.7. Key strategic moves and developments

- 9.7. J. MORITA CORP.

- 9.7.1. Company overview

- 9.7.2. Key Executives

- 9.7.3. Company snapshot

- 9.7.4. Operating business segments

- 9.7.5. Product portfolio

- 9.8. Midmark Corporation

- 9.8.1. Company overview

- 9.8.2. Key Executives

- 9.8.3. Company snapshot

- 9.8.4. Operating business segments

- 9.8.5. Product portfolio

- 9.8.6. Key strategic moves and developments

- 9.9. Planmeca OY

- 9.9.1. Company overview

- 9.9.2. Key Executives

- 9.9.3. Company snapshot

- 9.9.4. Operating business segments

- 9.9.5. Product portfolio

- 9.9.6. Key strategic moves and developments

- 9.10. Vatech

- 9.10.1. Company overview

- 9.10.2. Key Executives

- 9.10.3. Company snapshot

- 9.10.4. Operating business segments

- 9.10.5. Product portfolio

- 9.10.6. Business performance

- 9.10.7. Key strategic moves and developments

LIST OF TABLES

- TABLE 01. GLOBAL DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 02. DENTAL IMAGING MARKET FOR EXTRAORAL IMAGING SYSTEM, BY REGION, 2022-2032 ($MILLION)

- TABLE 03. GLOBAL EXTRAORAL IMAGING SYSTEM DENTAL IMAGING MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 04. DENTAL IMAGING MARKET FOR INTRAORAL IMAGING SYSTEM, BY REGION, 2022-2032 ($MILLION)

- TABLE 05. GLOBAL INTRAORAL IMAGING SYSTEM DENTAL IMAGING MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 06. GLOBAL DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 07. DENTAL IMAGING MARKET FOR MEDICAL, BY REGION, 2022-2032 ($MILLION)

- TABLE 08. DENTAL IMAGING MARKET FOR OTHERS, BY REGION, 2022-2032 ($MILLION)

- TABLE 09. GLOBAL DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 10. DENTAL IMAGING MARKET FOR HOSPITALS, BY REGION, 2022-2032 ($MILLION)

- TABLE 11. DENTAL IMAGING MARKET FOR DENTAL CLINICS, BY REGION, 2022-2032 ($MILLION)

- TABLE 12. DENTAL IMAGING MARKET FOR OTHERS, BY REGION, 2022-2032 ($MILLION)

- TABLE 13. DENTAL IMAGING MARKET, BY REGION, 2022-2032 ($MILLION)

- TABLE 14. NORTH AMERICA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 15. NORTH AMERICA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 16. NORTH AMERICA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 17. NORTH AMERICA DENTAL IMAGING MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 18. U.S. DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 19. U.S. DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 20. U.S. DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 21. CANADA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 22. CANADA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 23. CANADA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 24. MEXICO DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 25. MEXICO DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 26. MEXICO DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 27. EUROPE DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 28. EUROPE DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 29. EUROPE DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 30. EUROPE DENTAL IMAGING MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 31. GERMANY DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 32. GERMANY DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 33. GERMANY DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 34. FRANCE DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 35. FRANCE DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 36. FRANCE DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 37. UK DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 38. UK DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 39. UK DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 40. ITALY DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 41. ITALY DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 42. ITALY DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 43. SPAIN DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 44. SPAIN DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 45. SPAIN DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 46. REST OF EUROPE DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 47. REST OF EUROPE DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 48. REST OF EUROPE DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 49. ASIA-PACIFIC DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 50. ASIA-PACIFIC DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 51. ASIA-PACIFIC DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 52. ASIA-PACIFIC DENTAL IMAGING MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 53. JAPAN DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 54. JAPAN DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 55. JAPAN DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 56. CHINA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 57. CHINA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 58. CHINA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 59. INDIA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 60. INDIA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 61. INDIA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 62. AUSTRALIA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 63. AUSTRALIA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 64. AUSTRALIA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 65. SOUTH KOREA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 66. SOUTH KOREA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 67. SOUTH KOREA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 68. REST OF ASIA-PACIFIC DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 69. REST OF ASIA-PACIFIC DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 70. REST OF ASIA-PACIFIC DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 71. LAMEA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 72. LAMEA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 73. LAMEA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 74. LAMEA DENTAL IMAGING MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 75. BRAZIL DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 76. BRAZIL DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 77. BRAZIL DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 78. SAUDI ARABIA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 79. SAUDI ARABIA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 80. SAUDI ARABIA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 81. SOUTH AFRICA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 82. SOUTH AFRICA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 83. SOUTH AFRICA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 84. REST OF LAMEA DENTAL IMAGING MARKET, BY PRODUCT, 2022-2032 ($MILLION)

- TABLE 85. REST OF LAMEA DENTAL IMAGING MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 86. REST OF LAMEA DENTAL IMAGING MARKET, BY END USERS, 2022-2032 ($MILLION)

- TABLE 87. ACTEON: KEY EXECUTIVES

- TABLE 88. ACTEON: COMPANY SNAPSHOT

- TABLE 89. ACTEON: PRODUCT SEGMENTS

- TABLE 90. ACTEON: PRODUCT PORTFOLIO

- TABLE 91. AIR TECHNIQUES, INC.: KEY EXECUTIVES

- TABLE 92. AIR TECHNIQUES, INC.: COMPANY SNAPSHOT

- TABLE 93. AIR TECHNIQUES, INC.: PRODUCT SEGMENTS

- TABLE 94. AIR TECHNIQUES, INC.: PRODUCT PORTFOLIO

- TABLE 95. CEFLA S.C.: KEY EXECUTIVES

- TABLE 96. CEFLA S.C.: COMPANY SNAPSHOT

- TABLE 97. CEFLA S.C.: PRODUCT SEGMENTS

- TABLE 98. CEFLA S.C.: PRODUCT PORTFOLIO

- TABLE 99. CORIX MEDICAL SYSTEMS: KEY EXECUTIVES

- TABLE 100. CORIX MEDICAL SYSTEMS: COMPANY SNAPSHOT

- TABLE 101. CORIX MEDICAL SYSTEMS: PRODUCT SEGMENTS

- TABLE 102. CORIX MEDICAL SYSTEMS: PRODUCT PORTFOLIO

- TABLE 103. DENTSPLY SIRONA INC.: KEY EXECUTIVES

- TABLE 104. DENTSPLY SIRONA INC.: COMPANY SNAPSHOT

- TABLE 105. DENTSPLY SIRONA INC.: PRODUCT SEGMENTS

- TABLE 106. DENTSPLY SIRONA INC.: PRODUCT PORTFOLIO

- TABLE 107. ENVISTA HOLDINGS CORPORATION: KEY EXECUTIVES

- TABLE 108. ENVISTA HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 109. ENVISTA HOLDINGS CORPORATION: PRODUCT SEGMENTS

- TABLE 110. ENVISTA HOLDINGS CORPORATION: PRODUCT PORTFOLIO

- TABLE 111. ENVISTA HOLDINGS CORPORATION: KEY STRATERGIES

- TABLE 112. J. MORITA CORP.: KEY EXECUTIVES

- TABLE 113. J. MORITA CORP.: COMPANY SNAPSHOT

- TABLE 114. J. MORITA CORP.: PRODUCT SEGMENTS

- TABLE 115. J. MORITA CORP.: PRODUCT PORTFOLIO

- TABLE 116. MIDMARK CORPORATION: KEY EXECUTIVES

- TABLE 117. MIDMARK CORPORATION: COMPANY SNAPSHOT

- TABLE 118. MIDMARK CORPORATION: PRODUCT SEGMENTS

- TABLE 119. MIDMARK CORPORATION: PRODUCT PORTFOLIO

- TABLE 120. MIDMARK CORPORATION: KEY STRATERGIES

- TABLE 121. PLANMECA OY: KEY EXECUTIVES

- TABLE 122. PLANMECA OY: COMPANY SNAPSHOT

- TABLE 123. PLANMECA OY: PRODUCT SEGMENTS

- TABLE 124. PLANMECA OY: PRODUCT PORTFOLIO

- TABLE 125. PLANMECA OY: KEY STRATERGIES

- TABLE 126. VATECH: KEY EXECUTIVES

- TABLE 127. VATECH: COMPANY SNAPSHOT

- TABLE 128. VATECH: PRODUCT SEGMENTS

- TABLE 129. VATECH: PRODUCT PORTFOLIO

- TABLE 130. VATECH: KEY STRATERGIES

LIST OF FIGURES

- FIGURE 01. DENTAL IMAGING MARKET, 2022-2032

- FIGURE 02. SEGMENTATION OF DENTAL IMAGING MARKET, 2022-2032

- FIGURE 03. TOP INVESTMENT POCKETS IN DENTAL IMAGING MARKET (2023-2032)

- FIGURE 04. MODERATE BARGAINING POWER OF SUPPLIERS

- FIGURE 05. MODERATE BARGAINING POWER OF BUYERS

- FIGURE 06. MODERATE THREAT OF SUBSTITUTES

- FIGURE 07. MODERATE THREAT OF NEW ENTRANTS

- FIGURE 08. MODERATE INTENSITY OF RIVALRY

- FIGURE 09. DRIVERS, RESTRAINTS AND OPPORTUNITIES: GLOBALDENTAL IMAGING MARKET

- FIGURE 10. DENTAL IMAGING MARKET, BY PRODUCT, 2022(%)

- FIGURE 11. COMPARATIVE SHARE ANALYSIS OF DENTAL IMAGING MARKET FOR EXTRAORAL IMAGING SYSTEM, BY COUNTRY 2022 AND 2032(%)

- FIGURE 12. COMPARATIVE SHARE ANALYSIS OF DENTAL IMAGING MARKET FOR INTRAORAL IMAGING SYSTEM, BY COUNTRY 2022 AND 2032(%)

- FIGURE 13. DENTAL IMAGING MARKET, BY APPLICATION, 2022(%)

- FIGURE 14. COMPARATIVE SHARE ANALYSIS OF DENTAL IMAGING MARKET FOR MEDICAL, BY COUNTRY 2022 AND 2032(%)

- FIGURE 15. COMPARATIVE SHARE ANALYSIS OF DENTAL IMAGING MARKET FOR OTHERS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 16. DENTAL IMAGING MARKET, BY END USERS, 2022(%)

- FIGURE 17. COMPARATIVE SHARE ANALYSIS OF DENTAL IMAGING MARKET FOR HOSPITALS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 18. COMPARATIVE SHARE ANALYSIS OF DENTAL IMAGING MARKET FOR DENTAL CLINICS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 19. COMPARATIVE SHARE ANALYSIS OF DENTAL IMAGING MARKET FOR OTHERS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 20. DENTAL IMAGING MARKET BY REGION, 2022

- FIGURE 21. U.S. DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 22. CANADA DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 23. MEXICO DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 24. GERMANY DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 25. FRANCE DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 26. UK DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 27. ITALY DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 28. SPAIN DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 29. REST OF EUROPE DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 30. JAPAN DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 31. CHINA DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 32. INDIA DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 33. AUSTRALIA DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 34. SOUTH KOREA DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 35. REST OF ASIA-PACIFIC DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 36. BRAZIL DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 37. SAUDI ARABIA DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 38. SOUTH AFRICA DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 39. REST OF LAMEA DENTAL IMAGING MARKET, 2022-2032 ($MILLION)

- FIGURE 40. TOP WINNING STRATEGIES, BY YEAR

- FIGURE 41. TOP WINNING STRATEGIES, BY DEVELOPMENT

- FIGURE 42. TOP WINNING STRATEGIES, BY COMPANY

- FIGURE 43. PRODUCT MAPPING OF TOP 10 PLAYERS

- FIGURE 44. COMPETITIVE DASHBOARD

- FIGURE 45. COMPETITIVE HEATMAP: DENTAL IMAGING MARKET

- FIGURE 46. TOP PLAYER POSITIONING, 2022

- FIGURE 47. CEFLA S.C.: NET REVENUE, 2019-2021 ($MILLION)

- FIGURE 48. CEFLA S.C.: REVENUE SHARE BY REGION, 2021 (%)

- FIGURE 49. DENTSPLY SIRONA INC.: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 50. DENTSPLY SIRONA INC.: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 51. DENTSPLY SIRONA INC.: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 52. ENVISTA HOLDINGS CORPORATION: NET SALES, 2020-2022 ($MILLION)

- FIGURE 53. ENVISTA HOLDINGS CORPORATION: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 54. ENVISTA HOLDINGS CORPORATION: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 55. VATECH: SALES REVENUE, 2019-2021 ($MILLION)