PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709975

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709975

Global Digital Flight Control Computer Tester Market 2025-2035

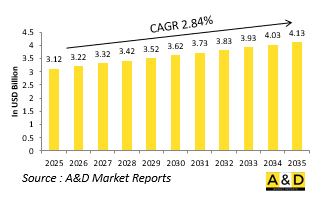

The Global Digital Flight Control Computer Tester market is estimated at USD 3.12 billion in 2025, projected to grow to USD 4.13 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.84% over the forecast period 2025-2035.

Introduction to Digital Flight Control Computer Tester Market:

The global market for digital flight control computer testers in defense is emerging as a pivotal support element in the era of highly automated military aviation. Digital flight control computers are central to managing aircraft stability, maneuverability, and system integration in modern combat and transport aircraft. These computers process sensor data and pilot input to control flight surfaces, making their flawless operation essential for mission success and pilot safety. As aircraft designs become increasingly reliant on fly-by-wire and fly-by-light systems, the need for sophisticated, reliable test solutions grows proportionally. Testers designed for these digital flight control units ensure functional accuracy, software integrity, fault isolation, and compliance with stringent military specifications. They support both initial verification during production and ongoing performance assessments during maintenance cycles. These systems are also critical during upgrade programs where legacy aircraft are retrofitted with newer digital flight systems. With increasing deployment of unmanned aerial platforms and stealth aircraft, where electronic control systems are more intricate and interdependent, these testers must evolve to match the pace of digital transformation. The DFCC tester market thus stands as a key enabler of operational readiness, directly supporting the growing complexity and precision of next-generation military aviation.

Technology Impact in Digital Flight Control Computer Tester Market:

Technological evolution is dramatically enhancing the scope and efficiency of digital flight control computer testers in defense applications. These systems are now embedded with advanced computational capabilities, allowing real-time emulation of complex flight scenarios and system behavior. Modern testers leverage high-fidelity simulation engines, graphical interfaces, and digital twins to replicate the operating environment of an aircraft in both nominal and failure conditions. The integration of artificial intelligence and predictive analytics offers the ability to preemptively identify system anomalies before they manifest in flight, reducing downtime and enhancing safety. Hardware-in-the-loop testing allows real components to interact with virtual scenarios, enabling a more comprehensive evaluation of flight control logic and sensor response. Cloud-connected testers and secure remote access features are also enabling decentralized testing, which is increasingly valuable for mobile military operations. Software-driven reconfigurability allows a single test unit to support multiple aircraft platforms, improving logistics and lowering the cost of ownership. These advancements are aligning the testers with the evolving complexity of electronic warfare environments, composite airframes, and increasingly software-defined cockpits. As digital ecosystems become the foundation of air dominance strategies, the technology built into DFCC testers is ensuring that defense aviation systems are not only functional, but also future-proof.

Key Drivers in Digital Flight Control Computer Tester Market:

The growing complexity of flight control systems in military aircraft is one of the most significant forces shaping demand for advanced digital flight control computer testers. As aircraft performance becomes increasingly tied to electronic control rather than mechanical linkage, the precision, stability, and integrity of flight computers must be thoroughly validated before each deployment. This critical function cannot be fulfilled without dedicated testers designed to simulate extreme flight scenarios, detect micro-level discrepancies, and verify embedded software behavior. The integration of advanced avionics suites, autonomous piloting capabilities, and all-weather operational requirements also drive the need for sophisticated diagnostics and validation tools. Defense forces are increasingly emphasizing system reliability and fault resilience to maintain air superiority, particularly in the context of network-centric warfare and joint force interoperability. Maintenance cycles are also becoming more data-driven, with testers playing a key role in feeding performance metrics into predictive maintenance platforms. Furthermore, lifecycle support for older aircraft now equipped with digital upgrades adds another layer of complexity, pushing demand for adaptable and backward-compatible test systems. Overall, the rising bar for safety, mission flexibility, and digital sophistication in military aviation is fueling a consistent and strategic demand for DFCC testers across global defense sectors.

Regional Trends in Digital Flight Control Computer Tester Market:

Regional trends in the defense digital flight control computer tester market are closely aligned with national aerospace strategies, military modernization plans, and the scale of domestic aircraft production. In North America, particularly the United States, sustained investments in fifth-generation fighters and unmanned systems have led to the widespread adoption of highly specialized testers that support advanced control algorithms and integrated avionics systems. The ecosystem is further supported by a robust defense-industrial base that prioritizes modular, scalable solutions. Europe is focusing on standardization and multinational collaboration in projects such as the Future Combat Air System, which requires testing platforms that are interoperable and adaptable to a variety of aircraft configurations. In the Asia-Pacific region, countries are accelerating the development of indigenous fighter jets and UAVs, necessitating local infrastructure for testing digital flight control units in line with global defense standards. Nations like India, South Korea, and Japan are building or expanding testing capabilities to support these ambitions. In the Middle East, the growth of national aerospace industries is encouraging regional investment in high-performance, turnkey test solutions. These regional dynamics are fostering a landscape where digital flight control testing is increasingly localized, tech-driven, and strategically integrated into national defense programs.

Key Defense Digital Flight Control Computer Tester Program:

When it comes to demonstrating America's strength and commitment, the B-21 Raider will be poised-silent, ready, and unwavering. Designed to equip U.S. warfighters with a cutting-edge platform, the B-21 combines extended range, significant payload capacity, and unmatched survivability. It will be capable of breaching the most advanced defenses to carry out precision strikes anywhere on the globe. As the world's first sixth-generation aircraft to take flight, the B-21 Raider represents the future of strategic deterrence.

Table of Contents

Global Digital Flight Control Computer Tester in A & D Market - Table of Contents

Global Digital Flight Control Computer Tester in A & D Market Report Definition

Global Digital Flight Control Computer Tester in A & D Market Segmentation

By Region

By Component

By Testing Type

By Platform

Global Digital Flight Control Computer Tester in A & D Market Analysis for next 10 Years

The 10-year Global Digital Flight Control Computer Tester in A & D market analysis would give a detailed overview of Global Digital Flight Control Computer Tester in A & D market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Digital Flight Control Computer Tester in A & D Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Digital Flight Control Computer Tester in A & D Market Forecast

The 10-year Global Digital Flight Control Computer Tester in A & D market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Digital Flight Control Computer Tester in A & D Market Trends & Forecast

The regional Global Digital Flight Control Computer Tester in A & D market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Digital Flight Control Computer Tester in A & D Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Digital Flight Control Computer Tester in A & D Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Digital Flight Control Computer Tester in A & D Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Component, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Testing Type, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Platform, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Component, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Testing Type, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Platform, 2022-2032

List of Figures

- Figure 1: Global Digital Flight Control Forecast, 2022-2032

- Figure 2: Global Digital Flight Control Forecast, By Region, 2022-2032

- Figure 3: Global Digital Flight Control Forecast, By Component, 2022-2032

- Figure 4: Global Digital Flight Control Forecast, By Testing Type, 2022-2032

- Figure 5: Global Digital Flight Control Forecast, By Platform, 2022-2032

- Figure 6: North America, Digital Flight Control, Market Forecast, 2022-2032

- Figure 7: Europe, Digital Flight Control, Market Forecast, 2022-2032

- Figure 8: Middle East, Digital Flight Control, Market Forecast, 2022-2032

- Figure 9: APAC, Digital Flight Control, Market Forecast, 2022-2032

- Figure 10: South America, Digital Flight Control, Market Forecast, 2022-2032

- Figure 11: United States, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 12: United States, Digital Flight Control, Market Forecast, 2022-2032

- Figure 13: Canada, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 14: Canada, Digital Flight Control, Market Forecast, 2022-2032

- Figure 15: Italy, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 16: Italy, Digital Flight Control, Market Forecast, 2022-2032

- Figure 17: France, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 18: France, Digital Flight Control, Market Forecast, 2022-2032

- Figure 19: Germany, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 20: Germany, Digital Flight Control, Market Forecast, 2022-2032

- Figure 21: Netherlands, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Digital Flight Control, Market Forecast, 2022-2032

- Figure 23: Belgium, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 24: Belgium, Digital Flight Control, Market Forecast, 2022-2032

- Figure 25: Spain, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 26: Spain, Digital Flight Control, Market Forecast, 2022-2032

- Figure 27: Sweden, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 28: Sweden, Digital Flight Control, Market Forecast, 2022-2032

- Figure 29: Brazil, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 30: Brazil, Digital Flight Control, Market Forecast, 2022-2032

- Figure 31: Australia, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 32: Australia, Digital Flight Control, Market Forecast, 2022-2032

- Figure 33: India, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 34: India, Digital Flight Control, Market Forecast, 2022-2032

- Figure 35: China, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 36: China, Digital Flight Control, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Digital Flight Control, Market Forecast, 2022-2032

- Figure 39: South Korea, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 40: South Korea, Digital Flight Control, Market Forecast, 2022-2032

- Figure 41: Japan, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 42: Japan, Digital Flight Control, Market Forecast, 2022-2032

- Figure 43: Malaysia, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Digital Flight Control, Market Forecast, 2022-2032

- Figure 45: Singapore, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 46: Singapore, Digital Flight Control, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Digital Flight Control, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Digital Flight Control, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Digital Flight Control, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Digital Flight Control, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Digital Flight Control, By Component (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Digital Flight Control, By Component (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Digital Flight Control, By Testing Type (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Digital Flight Control, By Testing Type (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Digital Flight Control, By Platform (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Digital Flight Control, By Platform (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Digital Flight Control, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Digital Flight Control, Global Market, 2022-2032

- Figure 59: Scenario 1, Digital Flight Control, Total Market, 2022-2032

- Figure 60: Scenario 1, Digital Flight Control, By Region, 2022-2032

- Figure 61: Scenario 1, Digital Flight Control, By Component, 2022-2032

- Figure 62: Scenario 1, Digital Flight Control, By Testing Type, 2022-2032

- Figure 63: Scenario 1, Digital Flight Control, By Platform, 2022-2032

- Figure 64: Scenario 2, Digital Flight Control, Total Market, 2022-2032

- Figure 65: Scenario 2, Digital Flight Control, By Region, 2022-2032

- Figure 66: Scenario 2, Digital Flight Control, By Component, 2022-2032

- Figure 67: Scenario 2, Digital Flight Control, By Testing Type, 2022-2032

- Figure 68: Scenario 2, Digital Flight Control, By Platform, 2022-2032

- Figure 69: Company Benchmark, Digital Flight Control, 2022-2032