PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709977

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709977

Global Ground Station Simulation Market 2025-2035

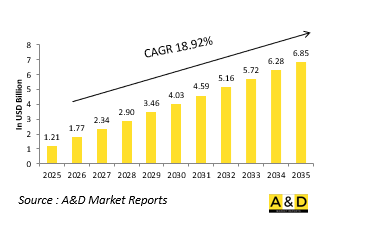

The Global Ground Station Simulation market is estimated at USD 1.21 billion in 2025, projected to grow to USD 6.85 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 18.92% over the forecast period 2025-2035.

Introduction to Ground Station Simulation Market:

The global defense ground station simulation market is emerging as a critical enabler in the development, training, and operational validation of complex satellite communication and command systems. Ground stations serve as the vital link between terrestrial defense networks and space-based assets, managing data exchange, telemetry, and mission command. Simulators are essential for testing these interactions in a controlled environment, replicating satellite behavior, atmospheric conditions, signal disruptions, and cyber intrusions. As military reliance on satellite-driven capabilities grows-spanning communications, intelligence gathering, navigation, and early warning-the accuracy and resilience of ground station systems become central to mission assurance. Ground station simulators offer armed forces a cost-effective, repeatable, and secure way to train personnel, validate new equipment, and fine-tune operational protocols without placing actual assets at risk. These systems also support interoperability testing for multinational operations, enabling various command units to harmonize communications before deployment. Whether preparing for space-based conflicts or enhancing traditional surveillance and reconnaissance missions, ground station simulation has become indispensable to modern defense planning. The market is defined by the increasing sophistication of simulation platforms and the pressing need to prepare for evolving threats in a domain that is both technically complex and strategically decisive.

Technology Impact in Ground Station Simulation Market:

Technological advancement is rapidly expanding the capabilities of ground station simulators, enhancing their ability to model increasingly complex operational environments. High-fidelity simulation platforms now leverage advanced processing power, cloud integration, and software-defined architectures to recreate the dynamic behavior of multiple satellites across various orbits. This includes the simulation of real-time data transmission, signal interference, latency, and loss scenarios-all vital for stress-testing ground systems before deployment. Machine learning and artificial intelligence are being integrated to emulate unpredictable satellite behaviors, cybersecurity threats, or jamming tactics used by adversaries. These features allow operators to practice adaptive responses in near-realistic settings. Enhanced visualization tools, such as immersive 3D interfaces and augmented displays, help personnel understand system operations from a broader situational perspective. Additionally, digital twins are being used to mirror actual ground station configurations, offering precise modeling for maintenance and upgrade planning. As military organizations shift toward network-centric and space-enabled operations, simulation tools must evolve to reflect multi-domain dependencies. These technological innovations are pushing the boundaries of what can be tested on the ground, allowing defense agencies to minimize operational risk, optimize response protocols, and improve readiness for both terrestrial and extraterrestrial challenges.

Key Drivers in Ground Station Simulation Market:

The defense ground station simulation market is driven by the growing need for resilient, responsive, and interoperable command systems in an era of space-reliant military operations. Armed forces worldwide are expanding their use of satellite communications, navigation systems, and space-based intelligence-creating a demand for simulation tools that can replicate and test ground-satellite interactions in detail. With space becoming a contested domain, ensuring the survivability and functionality of ground stations under cyberattacks, electronic warfare, and physical threats is paramount. Simulators allow for continuous validation of defense protocols without depending on live satellite operations, reducing cost and risk. Another key factor is the need for comprehensive training environments where operators can develop proficiency in both routine and emergency procedures. These platforms support mission rehearsal, software integration checks, and system upgrades-all without disrupting live command-and-control infrastructure. The pace of innovation in satellite technologies and launch capabilities also requires ground stations to adapt quickly, which is only possible with flexible simulation environments. Finally, the increasing push for cross-border and inter-service collaboration calls for tools that support standardization and compatibility across systems. Together, these drivers are elevating simulation from a support function to a strategic necessity in modern defense operations.

Regional Trends in Ground Station Simulation Market:

Regional dynamics in the defense ground station simulation market reflect varied strategic priorities, industrial maturity, and space program development. North America, led by the United States, continues to dominate due to its advanced military satellite infrastructure and emphasis on space as a warfighting domain. The region invests heavily in simulation to train multi-agency personnel, integrate new command technologies, and rehearse cyber-resilient operations. Europe is focused on building autonomy in space-based defense systems through collaborative programs that increasingly incorporate ground simulation as part of their systems engineering lifecycle. Countries such as France, Germany, and the United Kingdom are investing in localized simulation facilities to support new satellite constellations and military space operations centers. In Asia-Pacific, emerging space powers like India, China, and Japan are rapidly expanding ground station simulation capabilities alongside their growing defense space initiatives. These nations are integrating simulation into military education, R&D, and systems acquisition to ensure readiness and self-sufficiency. In the Middle East, defense modernization efforts are leading to partnerships with global simulation technology providers, emphasizing system interoperability and training. Each region's activity is influenced by a mix of geopolitical pressures and technological ambition, making the global landscape both competitive and innovation-driven.

Key Ground Station Simulation Program:

IonQ and Intellian have announced a partnership to explore the potential of quantum networking in securing satellite communications. IonQ (NYSE: IONQ), a pioneer in quantum computing and networking, signed a memorandum of understanding (MoU) with Intellian Technologies, Inc., a global leader in satellite communication antennas and ground gateway solutions. The collaboration aims to investigate how quantum networking can revolutionize secure satellite connectivity. This agreement also supports IonQ's broader strategy of forming key partnerships across South Korea's enterprise, government, and academic sectors to drive the growth of its quantum ecosystem. Headquartered in Pyeongtaek, South Korea, Intellian is a major provider of satellite, marine radio, terminal, and antenna technologies. As the most widely partnered hardware provider among global network operators, Intellian plays a vital role in global satellite connectivity. The MoU highlights Intellian's ongoing dedication to pushing the boundaries of satellite communications technology.

Table of Contents

Global Ground Station Simulation Market in Aerospace and defense - Table of Contents

Global Ground Station Simulation Market in Aerospace and defense Report Definition

Global Ground Station Simulation Market in Aerospace and defense Segmentation

By Simulation Type

By Technology

By Application

By Region

Global Ground Station Simulation Market in Aerospace and defense Analysis for next 10 Years

The 10-year Global Ground Station Simulation Market in Aerospace and defense analysis would give a detailed overview of Global Ground Station Simulation Market in Aerospace and defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Ground Station Simulation Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Ground Station Simulation Market Forecast

The 10-year Global Ground Station Simulation Market in Aerospace and defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Ground Station Simulation Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Ground Station Simulation Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Ground Station Simulation Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Ground Station Simulation Market

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Application, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Simulation Type, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Application, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Simulation Type, 2022-2032

List of Figures

- Figure 1: Global Ground Station Simulation Forecast, 2022-2032

- Figure 2: Global Ground Station Simulation Forecast, By Region, 2022-2032

- Figure 3: Global Ground Station Simulation Forecast, By Application, 2022-2032

- Figure 4: Global Ground Station Simulation Forecast, By Technology, 2022-2032

- Figure 5: Global Ground Station Simulation Forecast, By Simulation Type, 2022-2032

- Figure 6: North America, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 7: Europe, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 8: Middle East, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 9: APAC, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 10: South America, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 11: United States, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 12: United States, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 13: Canada, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 14: Canada, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 15: Italy, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 16: Italy, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 17: France, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 18: France, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 19: Germany, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 20: Germany, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 21: Netherlands, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 23: Belgium, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 24: Belgium, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 25: Spain, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 26: Spain, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 27: Sweden, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 28: Sweden, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 29: Brazil, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 30: Brazil, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 31: Australia, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 32: Australia, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 33: India, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 34: India, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 35: China, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 36: China, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 39: South Korea, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 40: South Korea, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 41: Japan, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 42: Japan, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 43: Malaysia, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 45: Singapore, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 46: Singapore, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Ground Station Simulation, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Ground Station Simulation, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Ground Station Simulation, By Technology (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Ground Station Simulation, By Technology (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Ground Station Simulation, By Application (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Ground Station Simulation, By Application (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Ground Station Simulation, By Simulation Type (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Ground Station Simulation, By Simulation Type (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Ground Station Simulation, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Ground Station Simulation, Global Market, 2022-2032

- Figure 59: Scenario 1, Ground Station Simulation, Total Market, 2022-2032

- Figure 60: Scenario 1, Ground Station Simulation, By Region, 2022-2032

- Figure 61: Scenario 1, Ground Station Simulation, By Application, 2022-2032

- Figure 62: Scenario 1, Ground Station Simulation, By Application, 2022-2032

- Figure 63: Scenario 1, Ground Station Simulation, By Simulation Type, 2022-2032

- Figure 64: Scenario 2, Ground Station Simulation, Total Market, 2022-2032

- Figure 65: Scenario 2, Ground Station Simulation, By Region, 2022-2032

- Figure 66: Scenario 2, Ground Station Simulation, By Application, 2022-2032

- Figure 67: Scenario 2, Ground Station Simulation, By Technology, 2022-2032

- Figure 68: Scenario 2, Ground Station Simulation, By Simulation Type, 2022-2032

- Figure 69: Company Benchmark, Ground Station Simulation, 2022-2032