PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1714095

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1714095

Global Rigs for engine and engine component testing Market 2025-2035

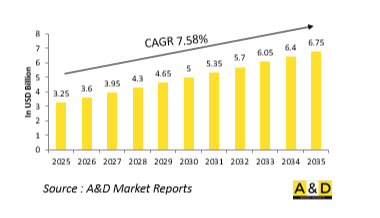

The Global Rigs for engine and engine component testing market is estimated at USD 3.25 billion in 2025, projected to grow to USD 6.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.58% over the forecast period 2025-2035.

Introduction to Rigs for engine and engine component testing Market:

In the global defense sector, the rigorous testing of engines and engine components is foundational to ensuring the reliability, performance, and safety of military vehicles, aircraft, ships, and unmanned systems. Test rigs-specialized systems designed to simulate real-world operational conditions-serve as critical tools for validating engine durability, thermal resilience, power output, fuel efficiency, and integration compatibility before deployment. These systems replicate harsh operational environments, including extreme temperatures, altitude changes, vibration profiles, and varying loads. Whether testing turbojet engines for fighter aircraft or diesel powertrains for armored ground vehicles, defense-specific engine test rigs are built to accommodate the unique standards and tolerances required by military specifications. Unlike commercial aviation or automotive sectors, defense engine testing often involves classified requirements, multi-role usage, and greater stress profiles, making it essential for rigs to be highly configurable, data-intensive, and capable of extended-duration testing. The growing complexity of propulsion systems-particularly with hybrid-electric concepts and supersonic performance demands-has led to a surge in global interest in expanding and modernizing test rig infrastructure to support next-generation defense programs.

Technology Impact in Rigs for engine and engine component testing Market:

Technological advancements are transforming how engine and component testing is conducted in defense applications. One of the most significant shifts is the integration of advanced instrumentation and control systems into test rigs, enabling real-time diagnostics, high-resolution data capture, and predictive analytics. Digital twin technology allows engineers to create virtual replicas of engine systems, which are then tested against real-world rig results to simulate degradation, performance deviation, and maintenance scenarios. Furthermore, automation and adaptive feedback loops allow test rigs to adjust stress levels, fuel composition, airflow, and thermal conditions based on live performance metrics, reducing human intervention and increasing test accuracy. Advanced sensors, such as fiber-optic strain gauges, piezoelectric pressure transducers, and laser Doppler velocimetry tools, have also enhanced the ability to capture minute mechanical changes and dynamic responses under load. In addition, closed-loop fluid systems and combustion simulators are enabling high-fidelity replication of operational conditions across different altitudes and climates. Emerging propulsion technologies, including scramjets and electric-assisted turbines, are also prompting the design of novel rigs that combine aerodynamic, electrical, and thermodynamic testing capabilities in one integrated platform. These innovations have accelerated the shift from static, manually operated test setups to intelligent, interconnected environments that optimize both speed and reliability in engine qualification.

Key Drivers in Rigs for engine and engine component testing market:

Several strategic and programmatic forces are driving growth and innovation in the global market for defense engine and component test rigs. A key driver is the proliferation of advanced propulsion systems being developed for next-generation military aircraft, such as sixth-generation fighters and long-range strike drones, which demand more sophisticated test environments than ever before. The push for hypersonic weapons and reusable space-based systems has created a demand for test rigs capable of withstanding intense heat flux, high vibration, and ultra-high-speed airflow. Additionally, the trend toward integrated platform design-where propulsion is no longer isolated from avionics, structural materials, and mission systems-has required a more holistic testing methodology that can be executed through versatile rig systems. Another important driver is the need to accelerate development cycles through simulation-backed validation, thereby reducing physical prototyping costs while increasing test confidence. Defense organizations are also investing in test rigs to extend the lifecycle of legacy systems by evaluating component upgrades and retrofits under modern operational demands. As sustainability gains traction even in the defense space, engines are being redesigned for greater efficiency and reduced emissions, creating new testing requirements for hybrid combustion models and biofuel compatibility. Meanwhile, defense procurement frameworks increasingly demand verifiable data and modularity, pushing OEMs and testing centers to equip their rigs with plug-and-play features and standardized measurement protocols.

Regional Trends in Rigs for engine and engine component testing Market:

Regional developments in defense engine testing reflect varied national defense priorities, industrial capabilities, and strategic goals. In North America, the United States continues to dominate in engine test rig development, with major defense contractors and research institutions operating sophisticated facilities for evaluating turbine engines, rotary propulsion units, and electric thrust systems. These include both military and dual-use platforms, with test cells equipped for high-altitude simulation, acoustic analysis, and combustion diagnostics. Canada, while smaller in scale, contributes to regional testing expertise with a focus on cold-weather engine validation and NATO-aligned requirements. In Europe, the UK, Germany, and France are leading investments in test rigs through programs like FCAS (Future Combat Air System) and Tempest, which include propulsion testbeds tailored for stealth-compatible and high-performance engines. European facilities often emphasize modularity and cross-national cooperation, reflecting the continent's integrated defense manufacturing environment. In the Asia-Pacific region, China is rapidly building independent capabilities in propulsion testing as part of its broader push for self-reliant military technology. China's investment in jet engine development has resulted in expansive test infrastructure built around high-thrust engines and long-range UAVs. India, through HAL and DRDO, is expanding indigenous testing capacity for engines like the Kaveri and for strategic projects such as AMCA. Japan and South Korea are developing advanced engine testing infrastructure for both air and naval platforms, with a strong emphasis on stealth propulsion and export compliance. In the Middle East, nations like Saudi Arabia and the UAE are investing in establishing in-country test and evaluation hubs, often through partnerships with Western OEMs, as part of their localization strategies under Vision 2030 and similar initiatives. Globally, this regional diversity is fostering both cooperation and competition in the defense test rig ecosystem, ensuring steady innovation and growth in capabilities.

Key Defense Rigs for engine and engine component testing Program:

Boeing has been awarded the Engineering and Manufacturing Development (EMD) contract for the U.S. Air Force's Next-Generation Air Dominance (NGAD) fighter jet program. In a formal announcement from the Oval Office, President Donald Trump, Defense Secretary Pete Hegseth, and Air Force Chief General David Allvin revealed that the aircraft will be designated the F-47-marking the United States' first sixth-generation fighter jet. This contract marks a significant milestone for Boeing, representing its first "clean-sheet" fighter jet design selected since its 1997 merger with McDonnell Douglas. Unlike the F-15EX and other Boeing aircraft based on legacy McDonnell Douglas platforms, a clean-sheet design is developed entirely from scratch, tailored specifically to meet the customer's requirements.

Table of Contents

Global Rigs for engine and engine component testing in defense- Table of Contents

Global Rigs for engine and engine component testing in defense Report Definition

Global Rigs for engine and engine component testing in defense Segmentation

By Type

By Platform

By Application

By Region

Global Rigs for engine and engine component testing in defense Analysis for next 10 Years

The 10-year Global Rigs for engine and engine component testing in defense analysis would give a detailed overview of Global Rigs for engine and engine component testing in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Rigs for engine and engine component testing in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Rigs for engine and engine component testing in defense Forecast

The 10-year Global Rigs for engine and engine component testing in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Rigs for engine and engine component testing in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Rigs for engine and engine component testing in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Rigs for engine and engine component testing in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Rigs for engine and engine component testing in defense

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Engine Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Engine Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Rigs for Engine and Engine Component Testing Market Forecast, 2025-2035

- Figure 2: Global Rigs for Engine and Engine Component Testing Market Forecast, By Region, 2025-2035

- Figure 3: Global Rigs for Engine and Engine Component Testing Market Forecast, By Engine Type, 2025-2035

- Figure 4: Global Rigs for Engine and Engine Component Testing Market Forecast, By Application, 2025-2035

- Figure 5: Global Rigs for Engine and Engine Component Testing Market Forecast, By Type, 2025-2035

- Figure 6: North America, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 7: Europe, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 9: APAC, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 10: South America, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 11: United States, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 12: United States, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 13: Canada, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 15: Italy, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 17: France, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 18: France, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 19: Germany, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 25: Spain, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 31: Australia, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 33: India, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 34: India, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 35: China, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 36: China, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 41: Japan, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Engine Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Engine Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Rigs for Engine and Engine Component Testing Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Rigs for Engine and Engine Component Testing Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Rigs for Engine and Engine Component Testing Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Rigs for Engine and Engine Component Testing Market, By Region, 2025-2035

- Figure 61: Scenario 1, Rigs for Engine and Engine Component Testing Market, By Engine Type, 2025-2035

- Figure 62: Scenario 1, Rigs for Engine and Engine Component Testing Market, By Application, 2025-2035

- Figure 63: Scenario 1, Rigs for Engine and Engine Component Testing Market, By Type, 2025-2035

- Figure 64: Scenario 2, Rigs for Engine and Engine Component Testing Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Rigs for Engine and Engine Component Testing Market, By Region, 2025-2035

- Figure 66: Scenario 2, Rigs for Engine and Engine Component Testing Market, By Engine Type, 2025-2035

- Figure 67: Scenario 2, Rigs for Engine and Engine Component Testing Market, By Application, 2025-2035

- Figure 68: Scenario 2, Rigs for Engine and Engine Component Testing Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Rigs for Engine and Engine Component Testing Market, 2025-2035