PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1714096

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1714096

Global Surface material testing Market 2025-2035

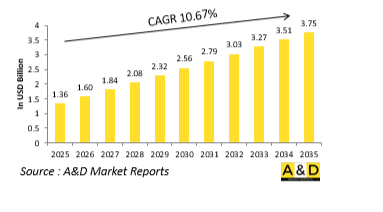

The Global Surface material testing market is estimated at USD 1.36 billion in 2025, projected to grow to USD 3.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 10.67% over the forecast period 2025-2035.

Introduction to Surface material testing Market:

Surface material testing in the defense sector plays a pivotal role in certifying the durability, survivability, and mission-readiness of military assets across air, land, sea, and space domains. The performance and safety of platforms-ranging from armored vehicles and aircraft fuselages to naval hulls and missile casings-depend heavily on how materials behave under extreme environmental, mechanical, and combat-related stressors. Surface testing involves evaluating resistance to corrosion, abrasion, thermal degradation, ballistic impact, chemical exposure, and fatigue, ensuring that coatings and structural materials meet rigorous defense specifications. These assessments extend to specialized surface treatments like stealth coatings, anti-reflective finishes, radar-absorbing materials (RAM), and thermal barrier coatings used in high-temperature environments. With defense platforms often operating in corrosive maritime settings, sand-laden deserts, arctic cold, or high-speed aerial regimes, material failure is not just costly-it can be catastrophic. Therefore, surface material testing is integrated into every stage of the defense product lifecycle, from development and prototyping to field validation and sustainment, forming a critical component of performance certification and lifecycle assurance programs.

Technology Impact in Surface material testing Market:

Technological progress is revolutionizing the way surface material testing is conducted in defense applications, introducing greater precision, efficiency, and predictive capability. Advanced non-destructive testing (NDT) techniques such as ultrasonic phased-array imaging, digital radiography, and eddy current scanning now enable detailed inspection of coatings and substrates without compromising material integrity. In parallel, laser ablation and scanning electron microscopy (SEM) provide micro-level surface analysis, helping defense engineers understand degradation mechanisms and microstructural changes under operational conditions. Machine learning algorithms are increasingly embedded into surface testing systems to identify patterns of wear, corrosion, or cracking that may escape human detection, allowing for proactive maintenance scheduling. Meanwhile, the adoption of automated test rigs and robotic arms in laboratory environments ensures consistent pressure application and exposure cycles in abrasion, adhesion, and impact resistance tests. Simulated environmental chambers-capable of replicating extreme heat, humidity, salt fog, and sandstorms-have become standard for accelerated aging analysis. These technological upgrades are complemented by digital twins of surface-treated components, allowing defense agencies to simulate long-term material behavior in various combat or climatic scenarios. The result is a more data-rich and dynamic approach to ensuring surface integrity, supporting both readiness and resilience in defense systems.

Key Drivers in Surface material testing Market:

Multiple strategic, operational, and regulatory factors are driving the demand for robust surface material testing in global defense programs. A primary driver is the increasing emphasis on survivability and stealth in modern combat environments, which places stringent requirements on surface coatings and finishes. As radar, infrared, and visual detection technologies become more advanced, platforms must rely on sophisticated surface treatments to reduce signatures and avoid detection. This has led to a surge in testing for radar-absorbent materials, matte coatings, and low-observable composites. Another key driver is the growing demand for multi-environment versatility, with military assets required to function reliably across diverse terrains-from corrosive saltwater environments to scorching desert theaters and sub-zero polar regions. These varied operational settings necessitate comprehensive testing for corrosion resistance, thermal stability, and particulate abrasion. Furthermore, as new composite materials and nano coatings enter the defense market, regulatory and performance validation processes must catch up, necessitating new or modified testing protocols. Defense procurement policies are also evolving to require more extensive verification of surface performance before full-scale production or export approval, making testing a key milestone in contract fulfillment. In addition, the trend toward lifecycle extension of legacy platforms drives increased testing of surface degradation over time, enabling cost-effective upgrades instead of full replacements.

Regional Trends in Surface material testing Market:

The development and application of surface material testing in defense vary significantly across regions, shaped by distinct operational priorities, threat perceptions, and industrial capacities. In North America, the United States leads in surface testing sophistication, with DoD-backed research institutions and defense OEMs investing heavily in materials for signature reduction, thermal shielding, and corrosion resistance. Facilities across the U.S. support multi-domain testing, including naval testing for anti-fouling coatings and aviation-focused labs for high-velocity erosion analysis. Canada complements this with a strong focus on testing materials for arctic resilience and NATO interoperability. In Europe, nations such as Germany, the UK, and France emphasize high-performance surface treatments for air and ground systems, with extensive research into hybrid coatings that combine camouflage with environmental resistance. European defense consortia often collaborate with universities and advanced materials laboratories, supporting integrated surface testing for multinational programs like Eurofighter and FCAS. Asia-Pacific presents a mixed but rapidly evolving landscape: China is scaling up its testing infrastructure to support its expanding domestic defense manufacturing sector, with particular emphasis on naval coatings, thermal-resistant composites, and stealth materials for its new-generation aircraft and missile systems. India, through DRDO and state-run laboratories, is expanding its capabilities to test surface treatments for a wide range of indigenous platforms including the Tejas fighter and INS-class naval vessels. Japan and South Korea, although more technologically mature, maintain highly specialized testing ecosystems focused on precision coatings and export-compliant materials. In the Middle East, nations like the UAE and Saudi Arabia are rapidly developing in-country testing facilities as part of broader localization agendas. These include corrosion and wear testing centers designed for desert and maritime environments, often developed through partnerships with global defense contractors. Globally, the emphasis on tailored surface testing is increasing as platforms become more complex and versatile, and as countries seek greater autonomy in defense technology development and validation.

Key Defense Surface material testing Program:

BEML has entered into a strategic partnership with Goa Shipyard Limited (GSL) to collaborate on maritime and composite technology projects. Under a newly signed Memorandum of Understanding (MoU), the two state-owned entities will focus on the production of glass fibre-reinforced polymer (GFRP) composite components and assemblies for both defence and commercial applications, along with other specialized marine equipment, BEML announced in a statement. As part of the agreement, BEML will also make use of GSL's ship lift facility and dry dock for the maintenance, repair, and overhaul of yard crafts, tugs, and vessels operated by the Indian Navy, Indian Coast Guard, and merchant fleets. The MoU was formally exchanged by BEML Chairman and Managing Director Shantanu Roy and GSL CMD Brajesh Kumar Upadhyay during Aero India 2025 in Bengaluru.

Table of Contents

Global Surface material testing in defense- Table of Contents

Global Surface material testing in defense Report Definition

Global Surface material testing in defense Segmentation

By Region

By Type

By Engine Type

By Application

Global Surface material testing in defense Analysis for next 10 Years

The 10-year Global Surface material testing in defense analysis would give a detailed overview of Global Surface material testing in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Surface material testing in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Surface material testing in defense Forecast

The 10-year Global Surface material testing in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Surface material testing in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Surface material testing in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Surface material testing in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Surface material testing in defense

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Material, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Methods, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Material, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Methods, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Surface Material Testing Market Forecast, 2025-2035

- Figure 2: Global Surface Material Testing Market Forecast, By Region, 2025-2035

- Figure 3: Global Surface Material Testing Market Forecast, By Material, 2025-2035

- Figure 4: Global Surface Material Testing Market Forecast, By Methods, 2025-2035

- Figure 5: Global Surface Material Testing Market Forecast, By Type, 2025-2035

- Figure 6: North America, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 7: Europe, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 9: APAC, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 10: South America, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 11: United States, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 12: United States, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 13: Canada, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 15: Italy, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 17: France, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 18: France, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 19: Germany, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 25: Spain, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 31: Australia, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 33: India, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 34: India, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 35: China, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 36: China, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 41: Japan, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Surface Material Testing Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Surface Material Testing Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Surface Material Testing Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Surface Material Testing Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Surface Material Testing Market, By Material (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Surface Material Testing Market, By Material (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Surface Material Testing Market, By Methods (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Surface Material Testing Market, By Methods (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Surface Material Testing Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Surface Material Testing Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Surface Material Testing Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Surface Material Testing Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Surface Material Testing Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Surface Material Testing Market, By Region, 2025-2035

- Figure 61: Scenario 1, Surface Material Testing Market, By Material, 2025-2035

- Figure 62: Scenario 1, Surface Material Testing Market, By Methods, 2025-2035

- Figure 63: Scenario 1, Surface Material Testing Market, By Type, 2025-2035

- Figure 64: Scenario 2, Surface Material Testing Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Surface Material Testing Market, By Region, 2025-2035

- Figure 66: Scenario 2, Surface Material Testing Market, By Material, 2025-2035

- Figure 67: Scenario 2, Surface Material Testing Market, By Methods, 2025-2035

- Figure 68: Scenario 2, Surface Material Testing Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Surface Material Testing Market, 2025-2035