PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1715443

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1715443

Global Semiconductor Test System Market 2025-2035

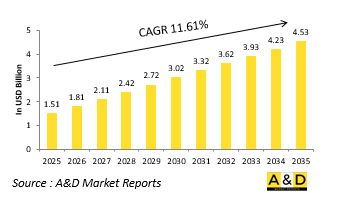

The Global Semiconductor Test System Market is estimated at USD 1.51 billion in 2025, projected to grow to USD 4.53 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 11.61% over the forecast period 2025-2035.

Introduction to Semiconductor Test System Market:

Military semiconductor test systems are essential tools for validating the performance, durability, and security of microelectronic components used across defense platforms. These systems are specifically designed to ensure that semiconductor devices-such as microprocessors, memory chips, power semiconductors, and signal processors-meet the stringent reliability and environmental requirements of military applications. As modern defense systems become increasingly dependent on high-performance computing, advanced sensing, and real-time data processing, the role of semiconductors has expanded significantly. These devices are at the heart of everything from guided munitions and radar systems to avionics and space-based surveillance, making rigorous testing indispensable. Military semiconductor test systems not only verify electrical characteristics and functional behavior but also assess how components respond to temperature extremes, radiation exposure, and electromagnetic interference. In an era of growing cyber-physical threats and semiconductor supply chain vulnerabilities, secure and comprehensive test systems are vital for certifying trust and resilience in mission-critical electronics. Globally, the increasing complexity of integrated circuits and the move toward system-on-chip designs are reinforcing the need for advanced, scalable, and secure test solutions across military R&D, production, and sustainment ecosystems.

Technology Impact in Semiconductor Test System Market:

Technological advancements are redefining the capabilities of military semiconductor test systems by introducing higher speed, greater precision, and enhanced adaptability to complex device architectures. The integration of machine learning algorithms enables faster fault isolation and pattern recognition during test cycles, streamlining diagnostics and increasing throughput. As defense electronics evolve toward heterogeneous integration and 3D packaging, test systems must now support multi-die and high-density chip configurations with minimal signal distortion and maximum accuracy. Innovations in thermal and radiation simulation have made it possible to test semiconductors for space and nuclear environments without compromising chip integrity. High-speed automated test equipment (ATE) platforms are becoming more modular and software-defined, allowing users to reconfigure test scenarios dynamically based on device types and mission profiles. Additionally, real-time analytics and data visualization tools are improving decision-making during validation processes, helping engineers detect anomalies at earlier stages. The increasing convergence of cyber assurance and hardware validation is also prompting the development of secure test environments that can verify embedded security features and detect hardware-level tampering. These technologies are positioning semiconductor testing as a critical pillar in ensuring operational superiority and electronic trustworthiness in military systems.

Key Drivers in Semiconductor Test System Market:

The growing complexity of defense systems and the strategic importance of semiconductor reliability are key drivers behind the rising demand for military semiconductor test systems. As militaries around the world transition toward autonomous platforms, AI-enabled decision systems, and high-bandwidth communication networks, the semiconductor content in these systems has surged. Each of these chips must undergo exhaustive testing to ensure that they can function flawlessly in high-stress and high-threat environments. Concerns over counterfeit components and cyber infiltration have further intensified the requirement for trusted semiconductor validation, particularly in sensitive defense supply chains. The global push for technological sovereignty and domestic semiconductor manufacturing has also led to increased investments in advanced testing infrastructure, both at the wafer level and final system integration stage. Miniaturization and multifunctionality within semiconductor devices demand more sophisticated and flexible test systems capable of covering a wide range of parameters and failure modes. Moreover, the focus on reducing the total cost of ownership and achieving high reliability over extended service lives reinforces the role of automated and condition-based semiconductor testing. These drivers collectively reflect a broader defense strategy to secure the microelectronic backbone of modern warfare and deterrence capabilities.

Regional Trends in Semiconductor Test System Market:

Military semiconductor test systems are experiencing varied regional adoption patterns driven by defense priorities, manufacturing capacity, and national security concerns. North America, particularly the United States, leads the field with strong government and private sector collaboration aimed at securing a resilient semiconductor ecosystem, including robust testing capabilities for defense-grade chips. This includes advanced ATE platforms and radiation-hardened test protocols tailored for aerospace and missile applications. Europe is intensifying its focus on strategic autonomy in microelectronics, with countries like Germany and France investing in secure and sovereign semiconductor supply chains, leading to greater demand for localized, secure test infrastructure. In the Asia-Pacific region, China, South Korea, Japan, and Taiwan are rapidly enhancing their semiconductor manufacturing and testing capabilities, not only for commercial use but also to meet growing military requirements amid regional security challenges. India is making strides in establishing indigenous testing facilities as part of its defense modernization and self-reliance initiatives. In the Middle East, test systems are being integrated into new semiconductor fabrication and research centers to support electronic warfare and communication projects. While Latin America and Africa remain emerging markets, there is growing interest in semiconductor testing through defense partnerships and technology acquisition programs, laying the groundwork for future capacity development.

Key Semiconductor Test System Program:

The European Commission has announced €60 million in funding for the Common Armoured Vehicle System (CAVS) project under the EDIRPA program (European Defense Industry Reinforcement Instrument through Joint Procurement). This ambitious initiative seeks to develop a modern, standardized armored vehicle to strengthen the operational capabilities of the armed forces in Finland, Latvia, Sweden, and Germany. The CAVS project aims to meet increasing demands for troop mobility and protection, while promoting defense collaboration and equipment standardization among European nations.

Table of Contents

Global Semiconductor Test Systems Market - Table of Contents

Global Semiconductor Test Systems market Report Definition

Global Semiconductor Test Systems market Segmentation

By Region

By Type

By Application

By Technology

Global Semiconductor Test Systems market Analysis for next 10 Years

The 10-year Global Semiconductor Test Systems market analysis would give a detailed overview of Global Semiconductor Test Systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Semiconductor Test Systems

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Semiconductor Test Systems market Forecast

The 10-year Global Semiconductor Test Systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Semiconductor Test Systems market Trends & Forecast

The regional Global Semiconductor Test Systems market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Semiconductor Test Systems market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Semiconductor Test Systems market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Semiconductor Test System Market Forecast, 2025-2035

- Figure 2: Global Semiconductor Test System Market Forecast, By Region, 2025-2035

- Figure 3: Global Semiconductor Test System Market Forecast, By Technology, 2025-2035

- Figure 4: Global Semiconductor Test System Market Forecast, By Application, 2025-2035

- Figure 5: Global Semiconductor Test System Market Forecast, By Type, 2025-2035

- Figure 6: North America, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 7: Europe, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 9: APAC, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 10: South America, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 11: United States, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 12: United States, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 13: Canada, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 15: Italy, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 17: France, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 18: France, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 19: Germany, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 25: Spain, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 31: Australia, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 33: India, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 34: India, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 35: China, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 36: China, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 41: Japan, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Semiconductor Test System Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Semiconductor Test System Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Semiconductor Test System Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Semiconductor Test System Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Semiconductor Test System Market, By Technology (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Semiconductor Test System Market, By Technology (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Semiconductor Test System Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Semiconductor Test System Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Semiconductor Test System Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Semiconductor Test System Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Semiconductor Test System Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Semiconductor Test System Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Semiconductor Test System Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Semiconductor Test System Market, By Region, 2025-2035

- Figure 61: Scenario 1, Semiconductor Test System Market, By Technology, 2025-2035

- Figure 62: Scenario 1, Semiconductor Test System Market, By Application, 2025-2035

- Figure 63: Scenario 1, Semiconductor Test System Market, By Type, 2025-2035

- Figure 64: Scenario 2, Semiconductor Test System Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Semiconductor Test System Market, By Region, 2025-2035

- Figure 66: Scenario 2, Semiconductor Test System Market, By Technology, 2025-2035

- Figure 67: Scenario 2, Semiconductor Test System Market, By Application, 2025-2035

- Figure 68: Scenario 2, Semiconductor Test System Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Semiconductor Test System Market, 2025-2035