PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1715445

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1715445

Global Ciruit Tracer Test System Market 2025-2035

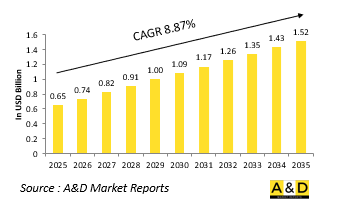

The Global Circuit Tracer Test System market is estimated at USD 0.65 billion in 2025, projected to grow to USD 1.52 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.87% over the forecast period 2025-2035.

Introduction to Circuit Tracer Test System Market:

Military circuit tracer test systems are essential tools for identifying, diagnosing, and verifying the integrity of electrical circuits within complex defense platforms. These systems are designed to trace wiring paths, detect breaks or shorts, and map circuit connections without disassembling components, making them invaluable for maintenance and troubleshooting in constrained or high-density electronic environments. From aircraft avionics to vehicle power systems and shipboard wiring, circuit tracer systems help technicians quickly locate faults that could impair mission-critical operations. In defense applications, where time-sensitive repairs and high operational availability are paramount, circuit tracers contribute to reducing diagnostic time and enhancing overall system readiness. Their ability to operate on both powered and unpowered circuits offers flexibility in varied maintenance scenarios. As military platforms evolve to include more sophisticated electrical systems and digital interconnects, the importance of circuit tracing grows in tandem. These systems not only support routine diagnostics but also aid in validating new installations, retrofits, and system upgrades, ensuring that every connection functions as intended. Globally, circuit tracer test systems are becoming a standard element of military electrical toolkits, supporting efficient maintenance workflows across the air, land, sea, and cyber domains.

Technology Impact in Circuit Tracer Test System Market:

Advancements in military circuit tracer test systems are enabling more accurate, efficient, and intuitive diagnostics across increasingly complex electrical architectures. The integration of digital signal processing and adaptive tracing algorithms allows modern tracers to differentiate signal types, identify faults through multiple layers, and function effectively in environments with high electromagnetic interference. Wireless connectivity and touchscreen interfaces enhance usability, enabling real-time visualization of circuit paths and fault points on tablets or handheld devices. Some systems now offer augmented reality overlays, guiding technicians visually through wiring layouts, which is particularly beneficial in dense or compartmentalized military systems. Miniaturized probe designs and non-invasive detection methods are improving access to hard-to-reach areas without requiring disassembly. Built-in memory and data logging capabilities enable detailed fault tracking, trend analysis, and integration with maintenance management systems. Additionally, secure firmware and encryption features are being incorporated to protect diagnostic data, a growing necessity as digital vulnerabilities expand across defense networks. These technological enhancements are transforming circuit tracing from a time-consuming manual task into a rapid, intelligent diagnostic process, critical for sustaining the electrical integrity of modern defense assets operating in high-pressure, high-tempo missions.

Key Drivers in Circuit Tracer Test System Market:

The increasing complexity of electrical systems in modern military platforms is a primary driver behind the growing demand for circuit tracer test systems. As platforms integrate more advanced avionics, sensors, and control systems, the density and intricacy of wiring networks have significantly expanded, making efficient circuit tracing critical for fault isolation and system verification. The shift toward condition-based and predictive maintenance strategies further emphasizes the need for accurate, real-time diagnostic tools that reduce downtime and maintenance costs. In fast-paced operational environments, the ability to rapidly locate and repair faults in wiring can directly influence mission success and equipment survivability. Additionally, defense modernization initiatives are incorporating upgrades and retrofits into aging platforms, requiring precise circuit tracing to ensure compatibility and performance. The rise of modular and digital subsystems across land, sea, and air assets also necessitates more adaptable and intelligent testing solutions. Global emphasis on increasing platform availability, improving maintenance efficiency, and ensuring the operational safety of personnel are all reinforcing the critical role of circuit tracer systems. These drivers are making circuit tracing technology a key enabler in the sustainment and operational readiness of next-generation defense systems.

Regional Trends in Circuit Tracer Test System Market:

Regional adoption of military circuit tracer test systems reflects each region's approach to defense modernization, maintenance doctrine, and industrial capabilities. In North America, particularly within the U.S. military and aerospace sectors, circuit tracer systems are widely deployed to support high-readiness requirements and sustainment of complex, multi-domain platforms. The emphasis on rapid diagnostics and electronic health monitoring has spurred investment in advanced, portable tracer systems integrated with digital maintenance ecosystems. Europe is aligning its use of circuit tracing tools with broader goals of electronic system standardization and interoperability, especially for multinational operations under NATO. In the Asia-Pacific region, rapid defense expansion and indigenous platform development in countries like India, China, and South Korea are driving the need for in-house diagnostic capabilities, with circuit tracers playing a central role in field support and logistics. Japan and Australia are also deploying sophisticated tracers as part of upgrades to air and naval fleets. In the Middle East, circuit tracing technology is being integrated into newly acquired systems and defense infrastructure as part of broader sustainment efforts. In Latin America and Africa, adoption is slower but gaining momentum through international military cooperation and technology transfers, enhancing the capabilities of local maintenance personnel in diverse operational environments.

Key Circuit Tracer Test System Program:

The European Commission has announced €60 million in funding for the Common Armoured Vehicle System (CAVS) project under the EDIRPA program (European Defense Industry Reinforcement Instrument through Joint Procurement). This ambitious initiative seeks to develop a modern, standardized armored vehicle to strengthen the operational capabilities of the armed forces in Finland, Latvia, Sweden, and Germany. The CAVS project aims to meet increasing demands for troop mobility and protection, while promoting defense collaboration and equipment standardization among European nations.

Table of Contents

Global Aerospace and defense Circuit Tracer Test System Market - Table of Contents

Global Aerospace and defense Circuit Tracer Test System Market Report Definition

Global Aerospace and defense Circuit Tracer Test System Market Segmentation

By Region

By Type

By Technology

By Application

Global Aerospace and defense Circuit Tracer Test System Market Analysis for next 10 Years

The 10-year Global Aerospace and defense Circuit Tracer Test System market analysis would give a detailed overview of Global Aerospace and defense Circuit Tracer Test System market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Aerospace and defense Circuit Tracer Test System Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aerospace and defense Circuit Tracer Test System Market Forecast

The 10-year Global Aerospace and defense Circuit Tracer Test System market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Aerospace and defense Circuit Tracer Test System Market Trends & Forecast

The regional Global Aerospace and defense Circuit Tracer Test System market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Aerospace and defense Circuit Tracer Test System Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Aerospace and defense Circuit Tracer Test System Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Aerospace and defense Circuit Tracer Test System Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Circuit Tracer Test Systems Market Forecast, 2025-2035

- Figure 2: Global Circuit Tracer Test Systems Market Forecast, By Region, 2025-2035

- Figure 3: Global Circuit Tracer Test Systems Market Forecast, By Technology, 2025-2035

- Figure 4: Global Circuit Tracer Test Systems Market Forecast, By Application, 2025-2035

- Figure 5: Global Circuit Tracer Test Systems Market Forecast, By Type, 2025-2035

- Figure 6: North America, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 7: Europe, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 9: APAC, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 10: South America, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 11: United States, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 12: United States, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 13: Canada, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 15: Italy, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 17: France, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 18: France, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 19: Germany, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 25: Spain, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 31: Australia, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 33: India, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 34: India, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 35: China, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 36: China, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 41: Japan, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Circuit Tracer Test Systems Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Circuit Tracer Test Systems Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Circuit Tracer Test Systems Market, By Technology (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Circuit Tracer Test Systems Market, By Technology (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Circuit Tracer Test Systems Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Circuit Tracer Test Systems Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Circuit Tracer Test Systems Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Circuit Tracer Test Systems Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Circuit Tracer Test Systems Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Circuit Tracer Test Systems Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Circuit Tracer Test Systems Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Circuit Tracer Test Systems Market, By Region, 2025-2035

- Figure 61: Scenario 1, Circuit Tracer Test Systems Market, By Technology, 2025-2035

- Figure 62: Scenario 1, Circuit Tracer Test Systems Market, By Application, 2025-2035

- Figure 63: Scenario 1, Circuit Tracer Test Systems Market, By Type, 2025-2035

- Figure 64: Scenario 2, Circuit Tracer Test Systems Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Circuit Tracer Test Systems Market, By Region, 2025-2035

- Figure 66: Scenario 2, Circuit Tracer Test Systems Market, By Technology, 2025-2035

- Figure 67: Scenario 2, Circuit Tracer Test Systems Market, By Application, 2025-2035

- Figure 68: Scenario 2, Circuit Tracer Test Systems Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Circuit Tracer Test Systems Market, 2025-2035