PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1715446

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1715446

Global Handheld Test systems Market 2025-2035

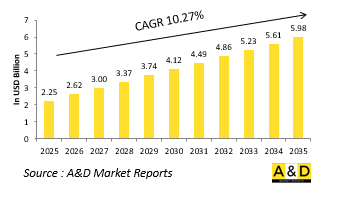

The Global Handheld Test systems market is estimated at USD 2.25 billion in 2025, projected to grow to USD 5.98 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 10.27% over the forecast period 2025-2035.

Introduction to Handheld Test systems Market:

Global military handheld test systems have become indispensable tools for field diagnostics, maintenance verification, and real-time performance assessments across a range of defense platforms. Compact, portable, and rugged by design, these systems are engineered to function reliably in harsh operational conditions while providing quick and accurate results. Whether used for checking communication integrity, electrical continuity, signal quality, or network stability, handheld testers are essential in environments where mobility and rapid response are critical. They empower maintenance teams, both in garrison and in forward-deployed locations, to conduct diagnostics without the need for bulky equipment or centralized facilities. Their applications span across various domains, including aviation electronics, ground vehicle systems, naval instrumentation, and personal soldier equipment. With growing emphasis on expeditionary warfare, autonomous operations, and reduced logistics footprints, the value of lightweight, versatile testing solutions has increased substantially. These systems support not only post-deployment inspections but also real-time fault detection during missions, ensuring continuous performance of mission-critical systems. As defense organizations aim to improve maintenance efficiency and responsiveness, handheld test systems have evolved from simple measurement tools into multifunctional diagnostic platforms aligned with the needs of modern, network-centric warfare.

Technology Impact in Handheld Test systems Market:

The evolution of military handheld test systems has been significantly influenced by advancements in miniaturization, digital integration, and ruggedization technologies. Today's devices are equipped with powerful processors, high-resolution displays, and multi-interface capabilities, enabling them to test a broad spectrum of electrical, electronic, and communication systems in the field. Integration of wireless connectivity allows for real-time data transfer to central command or maintenance databases, improving coordination and decision-making. Many handheld units now support modular plug-ins, allowing operators to switch between testing modes-such as RF signal analysis, data bus diagnostics, or power system evaluation-without carrying multiple devices. Battery efficiency and thermal management technologies have also advanced, extending operational endurance in field environments. Some systems are equipped with augmented reality and guided testing features to support technicians with less experience, while artificial intelligence-driven analytics help interpret results more quickly and accurately. Enhanced cybersecurity protocols are being incorporated to safeguard sensitive data and prevent exploitation through maintenance devices. These innovations collectively transform handheld testers into intelligent support tools, bridging the gap between on-site troubleshooting and centralized maintenance analysis, and aligning closely with the digital transformation occurring across global defense forces.

Key Drivers in Handheld Test systems Market:

The increasing demand for mobility, responsiveness, and operational agility is driving widespread adoption of handheld test systems in the military sector. Modern warfare's reliance on electronic and digital systems necessitates frequent, reliable testing-often in remote or hostile environments where traditional diagnostic infrastructure is unavailable. The ability to conduct fast, on-the-spot fault isolation minimizes equipment downtime and enhances mission continuity. Defense logistics and sustainment strategies are increasingly emphasizing lightweight and modular equipment, making handheld systems a natural fit for decentralized maintenance models. The proliferation of complex electronic subsystems in vehicles, aircraft, and wearable technologies has expanded the range of applications for these tools, pushing manufacturers to offer multifunctional and interoperable devices. Another critical factor is cost efficiency; handheld systems reduce the need for transporting damaged components back to centralized depots, cutting both time and resources. Their role is also expanding in training programs, where they help bridge the skill gap for new technicians with intuitive interfaces and guided procedures. As militaries shift toward networked operations and digital command environments, handheld testers are becoming essential components in ensuring seamless system performance and maintaining high levels of operational readiness across all domains.

Regional Trends in Handheld Test systems Market:

Regional adoption of military handheld test systems is closely linked to defense modernization priorities, field logistics strategies, and localized industrial capabilities. In North America, particularly within the U.S. military, there is a strong focus on integrating handheld systems into digital maintenance workflows, with tools that support both legacy platforms and emerging technologies across all services. These systems are often paired with cloud-based diagnostics and predictive analytics platforms to streamline field operations. European nations are embracing handheld test technologies to support interoperable maintenance standards across NATO operations, especially for mobile ground forces and multinational training missions. In the Asia-Pacific region, growing defense budgets and an emphasis on indigenous capability development are accelerating the deployment of handheld systems in countries like India, Japan, South Korea, and Australia. These tools are being integrated into programs aimed at strengthening autonomous operational capabilities and reducing dependence on foreign logistical support. The Middle East is focusing on ruggedized and multi-functional handheld solutions to maintain recently acquired advanced systems under challenging environmental conditions. Latin America and Africa, while at earlier stages of adoption, are increasingly utilizing handheld test equipment through joint ventures and defense assistance programs, enhancing their ability to maintain modern systems in decentralized and resource-limited environments.

Key Handheld Test systems Program:

The European Commission has announced €60 million in funding for the Common Armoured Vehicle System (CAVS) project under the EDIRPA program (European Defense Industry Reinforcement Instrument through Joint Procurement). This ambitious initiative seeks to develop a modern, standardized armored vehicle to strengthen the operational capabilities of the armed forces in Finland, Latvia, Sweden, and Germany. The CAVS project aims to meet increasing demands for troop mobility and protection, while promoting defense collaboration and equipment standardization among European nations.

Table of Contents

Global Aerospace and defense Handheld Test systems Market - Table of Contents

Global Aerospace and defense Handheld Test systems Market Report Definition

Global Aerospace and defense Handheld Test systems Market Segmentation

By Region

By Type

By Technology

By Application

Global Aerospace and defense Handheld Test systems Market Analysis for next 10 Years

The 10-year Global Aerospace and defense Handheld Test systems market analysis would give a detailed overview of Global Aerospace and defense Handheld Test systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Aerospace and defense Handheld Test systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aerospace and defense Handheld Test systems Market Forecast

The 10-year Global Aerospace and defense Handheld Test systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Aerospace and defense Handheld Test systems Market Trends & Forecast

The regional Global Aerospace and defense Handheld Test systems market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Aerospace and defense Handheld Test systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Aerospace and defense Handheld Test systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Aerospace and defense Handheld Test systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Handheld Test Systems Market Forecast, 2025-2035

- Figure 2: Global Handheld Test Systems Market Forecast, By Region, 2025-2035

- Figure 3: Global Handheld Test Systems Market Forecast, By Technology, 2025-2035

- Figure 4: Global Handheld Test Systems Market Forecast, By Application, 2025-2035

- Figure 5: Global Handheld Test Systems Market Forecast, By Type, 2025-2035

- Figure 6: North America, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 7: Europe, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 9: APAC, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 10: South America, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 11: United States, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 12: United States, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 13: Canada, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 15: Italy, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 17: France, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 18: France, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 19: Germany, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 25: Spain, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 31: Australia, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 33: India, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 34: India, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 35: China, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 36: China, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 41: Japan, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Handheld Test Systems Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Handheld Test Systems Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Handheld Test Systems Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Handheld Test Systems Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Handheld Test Systems Market, By Technology (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Handheld Test Systems Market, By Technology (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Handheld Test Systems Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Handheld Test Systems Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Handheld Test Systems Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Handheld Test Systems Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Handheld Test Systems Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Handheld Test Systems Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Handheld Test Systems Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Handheld Test Systems Market, By Region, 2025-2035

- Figure 61: Scenario 1, Handheld Test Systems Market, By Technology, 2025-2035

- Figure 62: Scenario 1, Handheld Test Systems Market, By Application, 2025-2035

- Figure 63: Scenario 1, Handheld Test Systems Market, By Type, 2025-2035

- Figure 64: Scenario 2, Handheld Test Systems Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Handheld Test Systems Market, By Region, 2025-2035

- Figure 66: Scenario 2, Handheld Test Systems Market, By Technology, 2025-2035

- Figure 67: Scenario 2, Handheld Test Systems Market, By Application, 2025-2035

- Figure 68: Scenario 2, Handheld Test Systems Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Handheld Test Systems Market, 2025-2035