PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1719519

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1719519

Global Naval Surface Vessels Simulation Market 2025-2035

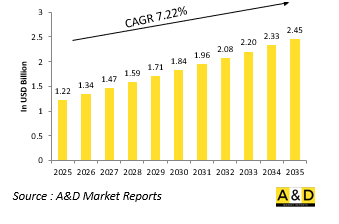

The Global Naval Surface Vessels Simulation market is estimated at USD 1.22 billion in 2025, projected to grow to USD 2.45 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.22% over the forecast period 2025-2035.

Introduction to Naval Surface Vessels Simulation Market:

Naval surface vessels simulation has become a core element of modern maritime training and operational readiness. These simulations are designed to replicate the complexities of surface fleet operations, which encompass a wide range of missions including maritime security, power projection, anti-surface and anti-air warfare, escort duties, and humanitarian support. The increasing diversity of naval threats, combined with the multifaceted roles of modern surface vessels, demands training environments that go beyond conventional drills. Simulation offers a highly controlled, cost-efficient, and repeatable setting in which crews can refine navigation, command decision-making, and tactical coordination under realistic conditions. The global push for enhanced naval capabilities has made simulation essential for both fleet development and maintenance of combat readiness. Naval forces are leveraging simulation not only for individual crew instruction but also for integrated task group training, allowing for synchronized operations across multiple ships and domains. Simulation ensures that personnel can safely prepare for high-risk scenarios, adapt to technological upgrades, and maintain procedural fluency during extended deployments. As maritime operations increasingly involve coordination across air, surface, and underwater platforms, simulation provides the connective framework to train and rehearse for the full spectrum of naval engagements in peacetime and conflict.

Technology Impact in Naval Surface Vessels Simulation Market:

Technological innovation is redefining the scope and realism of simulation in naval surface vessel operations. Modern platforms now utilize high-resolution virtual environments that accurately replicate maritime conditions, including sea states, visibility challenges, and environmental hazards. Integrated bridge simulators provide realistic representations of ship control, radar interpretation, and navigation in busy or contested waterways. The use of advanced artificial intelligence allows for dynamic threat modeling, including enemy ship maneuvers, missile trajectories, and electronic warfare scenarios. Simulation systems can now incorporate elements such as cyber intrusions and electronic countermeasures to reflect the hybrid nature of naval threats. Augmented and mixed reality tools are increasingly being adopted to enhance onboard maintenance training, damage control drills, and fire-fighting simulations, offering hands-on experience without putting crews at risk. Networked simulators enable real-time collaboration between multiple ship units, supporting coordinated fleet training, joint task force exercises, and multi-domain rehearsals. Modular software architectures also allow simulation programs to be easily updated as new ship classes, weapons systems, or operational procedures are introduced. These technological advancements not only improve training outcomes but also provide commanders with valuable tools for mission planning, system testing, and operational debriefing in both combat and non-combat maritime scenarios.

Key Drivers in Naval Surface Vessels Simulation Market:

The global focus on maritime security, naval modernization, and multi-domain operations is accelerating the adoption of simulation for naval surface vessels. As the roles of surface ships become increasingly complex-ranging from open-sea engagements to littoral missions-training must evolve to address a wide spectrum of threats and scenarios. Simulation offers the ability to conduct high-fidelity training without the cost and logistical challenges of deploying actual ships for exercises. It also addresses the growing need for training standardization across multinational forces, especially in regions where joint naval operations and coalition deployments are frequent. The rising tempo of naval operations and shorter crew rotations mean there is less time for traditional onboard training, pushing simulation to the forefront of readiness strategies. Another key factor is the integration of new technologies and weapon systems into naval fleets, requiring crews to familiarize themselves with advanced platforms without disrupting active missions. Simulation ensures smooth transitions by offering risk-free environments for procedural practice and mission rehearsals. Additionally, simulation plays a vital role in supporting strategic deterrence, enabling fleet commanders to test naval strategies and response plans against a range of emerging threats, from surface engagements to cyber and electronic warfare.

Regional Trends in Naval Surface Vessels Simulation Market:

Regional approaches to naval surface vessels simulation reflect a diverse set of priorities and operational realities. In North America, simulation is a mature capability embedded into naval doctrine, supporting everything from ship handling and damage control to battle group coordination and multi-threat scenario planning. Emphasis is placed on replicating high-threat environments to ensure rapid adaptability and tactical superiority. European nations focus on interoperability and joint mission planning, using simulation to reinforce coordination among allies and standardize response procedures in shared maritime zones. This regional trend also supports rapid integration of new naval assets into existing fleets. In the Asia-Pacific, the focus is on expanding naval presence and securing vast maritime domains, leading to significant investments in simulation to train crews for blue-water operations, anti-piracy missions, and high-stakes regional disputes. Middle Eastern navies prioritize simulation for patrol vessel operations, coastal defense, and maritime interdiction, often in collaboration with international partners. In Latin America and Africa, simulation is increasingly seen as a force multiplier, enabling training scalability and preparedness even with limited access to live assets. Through partnerships and technology transfers, these regions are gradually building their simulation capabilities to support both national defense and cooperative maritime security efforts.

Key Naval Surface Vessels Simulation Program:

GE Aerospace has been awarded a contract to supply equipment for the Republic of Korea Navy's (ROKN) PKX-B Batch-II patrol boat program. Under the agreement, the U.S.-based company will provide eight additional LM500 marine gas turbine engines. These engines will be produced at GE's facility in Lynn, Massachusetts, and then delivered to Hanwha Aerospace for final assembly and testing before being installed on the patrol vessels. Hanwha Aerospace plays a key role in the program, not only assembling the engines but also co-manufacturing components and offering long-term support, including spare parts and maintenance services throughout the vessels' operational life. The PKX-B Batch-II patrol boats are designed to strengthen the ROKN's coastal defense capabilities, offering enhanced speed, agility, and firepower for operations in littoral and near-shore environments.

Table of Contents

Global Naval Surface Vessels Simulation Market in defense- Table of Contents

Global Naval Surface Vessels Simulation Market in defense Report Definition

Global Naval Surface Vessels Simulation Market in defense Segmentation

By Region

By Type

By Application

By Component

Global Naval Surface Vessels Simulation Market in defense Analysis for next 10 Years

The 10-year Global Naval Surface Vessels Simulation Market in defense analysis would give a detailed overview of Global Naval Surface Vessels Simulation Market in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Naval Surface Vessels Simulation Market in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Naval Surface Vessels Simulation Market in defense Forecast

The 10-year Global Naval Surface Vessels Simulation Market in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Naval Surface Vessels Simulation Market in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Naval Surface Vessels Simulation Market in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Naval Surface Vessels Simulation Market in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Naval Surface Vessels Simulation Market in defense

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Component, 2025-2035

List of Figures

- Figure 1: Global Naval Surface Vessels Simulation Market Forecast, 2025-2035

- Figure 2: Global Naval Surface Vessels Simulation Market Forecast, By Region, 2025-2035

- Figure 3: Global Naval Surface Vessels Simulation Market Forecast, By Type, 2025-2035

- Figure 4: Global Naval Surface Vessels Simulation Market Forecast, By Application, 2025-2035

- Figure 5: Global Naval Surface Vessels Simulation Market Forecast, By Component, 2025-2035

- Figure 6: North America, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 7: Europe, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 9: APAC, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 10: South America, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 11: United States, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 12: United States, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 13: Canada, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 15: Italy, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 17: France, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 18: France, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 19: Germany, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 25: Spain, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 31: Australia, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 33: India, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 34: India, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 35: China, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 36: China, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 41: Japan, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Naval Surface Vessels Simulation Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Naval Surface Vessels Simulation Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Naval Surface Vessels Simulation Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Naval Surface Vessels Simulation Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Naval Surface Vessels Simulation Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Naval Surface Vessels Simulation Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Naval Surface Vessels Simulation Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Naval Surface Vessels Simulation Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Naval Surface Vessels Simulation Market, By Component (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Naval Surface Vessels Simulation Market, By Component (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Naval Surface Vessels Simulation Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Naval Surface Vessels Simulation Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Naval Surface Vessels Simulation Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Naval Surface Vessels Simulation Market, By Region, 2025-2035

- Figure 61: Scenario 1, Naval Surface Vessels Simulation Market, By Type, 2025-2035

- Figure 62: Scenario 1, Naval Surface Vessels Simulation Market, By Application, 2025-2035

- Figure 63: Scenario 1, Naval Surface Vessels Simulation Market, By Component, 2025-2035

- Figure 64: Scenario 2, Naval Surface Vessels Simulation Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Naval Surface Vessels Simulation Market, By Region, 2025-2035

- Figure 66: Scenario 2, Naval Surface Vessels Simulation Market, By Type, 2025-2035

- Figure 67: Scenario 2, Naval Surface Vessels Simulation Market, By Application, 2025-2035

- Figure 68: Scenario 2, Naval Surface Vessels Simulation Market, By Component, 2025-2035

- Figure 69: Company Benchmark, Naval Surface Vessels Simulation Market, 2025-2035