PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727187

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727187

Global Spotting Scopes Market 2025-2035

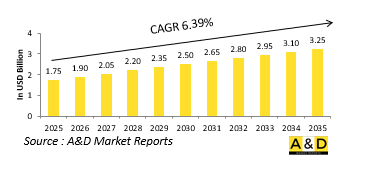

The global Spotting Scopes market is estimated at USD 1.75 billion in 2025, projected to grow to USD 3.25 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 6.39% over the forecast period 2025-2035.

Introduction to Global Spotting Scopes market:

Defense spotting scopes are essential optical devices used by military and security forces for long-range observation, target identification, and intelligence gathering. These scopes are designed to deliver enhanced clarity and magnification in diverse environmental conditions, often integrated into surveillance, reconnaissance, and battlefield targeting systems. Unlike standard consumer spotting scopes, defense models are engineered with ruggedness, precision, and durability in mind to withstand extreme temperatures, moisture, and physical impacts. Their importance has grown with the increasing need for real-time information and situational awareness in both conventional and asymmetric warfare. Modern defense spotting scopes support mission-critical activities such as forward observation, sniper team coordination, and artillery spotting. They are also commonly used in training exercises to simulate real-world scenarios. The integration of spotting scopes with advanced targeting systems has significantly improved the accuracy and effectiveness of ground forces. Whether mounted on tripods, vehicles, or used as handheld units, these scopes play a vital role in extending the vision and reach of defense personnel. As military operations evolve in complexity, the role of these tools continues to expand, ensuring that they remain an indispensable part of the global defense apparatus.

Technology Impact in Spotting Scopes Market:

Advancements in technology have transformed defense spotting scopes from simple optical tools into sophisticated multi-functional devices. The integration of digital imaging, thermal sensors, and laser rangefinders has significantly increased the utility and accuracy of spotting scopes in defense operations. Modern scopes often feature night vision capabilities and high-definition video output, enabling clear target visualization under low-light or obscured conditions. Some are also equipped with ballistic calculators and wireless connectivity, allowing for real-time data sharing with command centers or other field units. These innovations enhance coordination, reduce human error, and accelerate decision-making on the battlefield. The miniaturization of components has allowed for lighter, more compact designs without compromising performance. In parallel, software advancements allow for automated target recognition and tracking, reducing the workload on operators. These changes not only improve mission effectiveness but also contribute to greater personnel safety by allowing operators to observe and engage targets from concealed or distant positions. The convergence of optics, AI, and communications technology is reshaping the future of defense optics, making spotting scopes more than just passive observational tools-they are now active participants in a digitized, networked combat environment.

Key Drivers in Spotting Scopes Market:

Several strategic and operational factors drive the increasing adoption and evolution of spotting scopes in the defense sector. The rising demand for real-time intelligence and precision targeting has pushed military organizations to invest in high-performance optical systems. As modern warfare emphasizes speed, agility, and accuracy, spotting scopes help bridge critical gaps in visual reconnaissance and targeting support. Threats such as terrorism, border incursions, and insurgency require enhanced situational awareness, where spotting scopes provide long-range visibility without exposing personnel. Technological shifts, such as the integration of digital sensors and wireless data links, are also stimulating growth by enabling interoperability with drones, armored vehicles, and command systems. Furthermore, the demand for lightweight, rugged, and weather-resistant designs is fueled by the diverse operational environments in which modern militaries operate. Training needs and simulation exercises also contribute to demand, as realistic optics are essential for preparing personnel for actual combat situations. Global defense modernization initiatives, coupled with increased defense budgets and geopolitical tensions, act as further catalysts for this market. Together, these drivers ensure that spotting scopes remain a core component in enhancing tactical capabilities and maintaining superiority across a range of defense missions.

Regional Trends in Spotting Scopes Market:

Regional demand for defense spotting scopes is shaped by geopolitical tensions, military modernization programs, and the specific operational needs of armed forces. In North America, especially the United States, there is a strong focus on integrating advanced optics into networked warfare systems. The region's emphasis on technological superiority and precision engagement supports continued investment in sophisticated spotting solutions. Europe follows with significant demand from NATO members who seek to enhance reconnaissance and border defense capabilities. Countries in Eastern Europe are particularly focused on surveillance tools due to heightened regional instability. In Asia-Pacific, rising military budgets and ongoing territorial disputes are driving strong growth, especially in countries such as China, India, and South Korea. These nations are increasingly focused on indigenous development of optical technologies to reduce dependency on foreign suppliers. The Middle East, with its unique desert and urban warfare environments, prioritizes scopes that can perform in extreme heat and challenging visibility conditions. Meanwhile, Latin America and Africa see more moderate growth, with interest largely driven by anti-narcotics operations and counter-insurgency efforts. Across all regions, the focus is shifting toward lightweight, multi-role, and digitally enhanced spotting scopes that can seamlessly integrate with other defense systems.

Key Spotting Scopes Program:

the Armament Agency announced the signing of a contract valued at 12,712,050 PLN with Griffin Group Defence for the supply of 300 Hensoldt Spotter 60 spotting scopes. Deliveries are scheduled to take place within this year. This follows a previous contract signed on June 24, 2022, for 250 scopes of the same type, worth 9.2 million PLN. The selection process was based solely on price (100%), which was subject to negotiation. The new agreement was concluded under a single-source procurement procedure on January 28, 2025. According to the contract, the equipment will be delivered within 11 months to the Multi-Industry Material Depot in Pila, which is part of the 1st Regional Logistics Base in Walcz. Griffin Group Defence serves as the exclusive representative of the German firm Hensoldt Optronics (a part of the Hensoldt Group) in Poland.

Table of Contents

Global Spotting Scopes Market - Table of Contents

Global Spotting Scopes market Report Definition

Global Spotting Scopes market Segmentation

By Region

By Product Type

By Magnification Range

By Objective Lens Diameter

Global Spotting Scopes market Analysis for next 10 Years

The 10-year Global Scopes market market analysis would give a detailed overview of Global Scopes market market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Spotting Scopes

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Spotting Scopes market Forecast

The 10-year Global Scopes market market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Spotting Scopes market Trends & Forecast

The regional Global Scopes market market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Spotting Scopes market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Spotting Scopes market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Product Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Magnification Range, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Objective Lens Diameter, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Product Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Magnification Range, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Objective Lens Diameter, 2025-2035

List of Figures

- Figure 1: Global Spotting Scopes Market Forecast, 2025-2035

- Figure 2: Global Spotting Scopes Market Forecast, By Region, 2025-2035

- Figure 3: Global Spotting Scopes Market Forecast, By Product Type, 2025-2035

- Figure 4: Global Spotting Scopes Market Forecast, By Magnification Range, 2025-2035

- Figure 5: Global Spotting Scopes Market Forecast, By Objective Lens Diameter, 2025-2035

- Figure 6: North America, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 7: Europe, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 9: APAC, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 10: South America, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 11: United States, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 12: United States, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 13: Canada, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 15: Italy, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 17: France, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 18: France, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 19: Germany, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 25: Spain, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 31: Australia, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 33: India, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 34: India, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 35: China, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 36: China, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 41: Japan, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Spotting Scopes Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Spotting Scopes Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Spotting Scopes Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Spotting Scopes Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Spotting Scopes Market, By Product Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Spotting Scopes Market, By Product Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Spotting Scopes Market, By Magnification Range (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Spotting Scopes Market, By Magnification Range (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Spotting Scopes Market, By Objective Lens Diameter (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Spotting Scopes Market, By Objective Lens Diameter (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Spotting Scopes Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Spotting Scopes Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Spotting Scopes Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Spotting Scopes Market, By Region, 2025-2035

- Figure 61: Scenario 1, Spotting Scopes Market, By Product Type, 2025-2035

- Figure 62: Scenario 1, Spotting Scopes Market, By Magnification Range, 2025-2035

- Figure 63: Scenario 1, Spotting Scopes Market, By Objective Lens Diameter, 2025-2035

- Figure 64: Scenario 2, Spotting Scopes Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Spotting Scopes Market, By Region, 2025-2035

- Figure 66: Scenario 2, Spotting Scopes Market, By Product Type, 2025-2035

- Figure 67: Scenario 2, Spotting Scopes Market, By Magnification Range, 2025-2035

- Figure 68: Scenario 2, Spotting Scopes Market, By Objective Lens Diameter, 2025-2035

- Figure 69: Company Benchmark, Spotting Scopes Market, 2025-2035