PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727188

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727188

Global Binocular Market 2025-2035

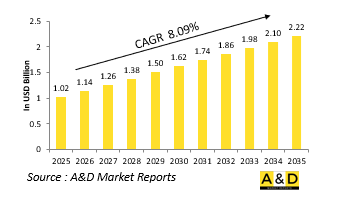

The Global Binocular market is estimated at USD 1.02 billion in 2025, projected to grow to USD 2.22 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.09% over the forecast period 2025-2035.

Introduction to Binocular Market:

Defense binoculars are critical tools used by military personnel for enhanced visual surveillance, threat detection, and tactical operations across various terrains and weather conditions. Designed to provide reliable performance in high-stakes environments, these binoculars offer superior magnification, clarity, and durability. Unlike commercial models, defense binoculars are specifically engineered to withstand harsh treatment, including exposure to dust, moisture, and impacts. They are a key component in reconnaissance missions, target acquisition, and battlefield awareness, giving users the ability to observe distant objects with precision while maintaining cover. Often used by scouts, snipers, commanders, and forward observers, these devices aid in collecting actionable intelligence without requiring electronic systems that may be vulnerable to interference or detection. As military strategies evolve to emphasize rapid response and strategic positioning, binoculars remain indispensable for ground units operating independently or as part of a larger force. They support both day and night operations, particularly when integrated with features like low-light optics or modular attachments. The simplicity, portability, and immediate feedback offered by binoculars ensure they retain their relevance even as newer technologies emerge. Globally, defense forces continue to prioritize high-quality optics to maintain an edge in visibility and situational awareness during complex operations.

Technology Impact in Binocular Market:

Technological innovation has significantly transformed the capabilities of defense binoculars, shifting them from purely optical tools to multi-functional devices integrated with advanced sensors and digital systems. Night vision and thermal imaging have become increasingly common, allowing soldiers to operate effectively in low visibility and darkness. The addition of image stabilization helps maintain a clear view during movement, whether on foot or in vehicles, enhancing accuracy and reducing fatigue during extended use. Digital overlays, such as compass bearings, range indicators, and target marking, now provide real-time situational data directly within the field of view. Some models incorporate video capture and wireless transmission features, enabling data sharing and remote command coordination. Artificial intelligence is beginning to play a role in automatic object recognition and behavioral pattern analysis, giving operators a tactical advantage. Advances in lens materials and coatings also contribute to clearer images in challenging light conditions, such as fog or glare. Overall, these technological enhancements improve both the effectiveness and efficiency of field operations by reducing guesswork and supporting quicker, more informed decisions. As militaries adapt to increasingly complex environments, the integration of smart features into binoculars ensures they remain relevant and powerful assets in modern defense strategies.

Key Drivers in Binocular Market:

Several critical factors are fueling the demand and continuous improvement of defense binoculars. The growing need for real-time visual intelligence and stealth observation in modern conflict zones places a premium on high-performance optics. Binoculars offer an immediate tactical advantage by allowing personnel to observe from safe distances, assess threats, and plan maneuvers with greater confidence. As operations shift toward urban warfare and decentralized engagements, lightweight and compact binoculars become vital for mobility and rapid deployment. The focus on soldier modernization programs across multiple countries is also driving investments in advanced optical tools that complement other battlefield technologies. In addition, the rise of asymmetric warfare, where enemy forces may not follow conventional patterns, highlights the importance of passive observation methods that don't emit signals detectable by adversaries. Procurement decisions are influenced by ease of use, adaptability, and durability, especially for units operating in extreme climates or under sustained field conditions. Training programs and simulation exercises further increase demand, ensuring troops are familiar with binocular-based reconnaissance from early stages. Global political shifts, border tensions, and regional security challenges all contribute to the continuous demand for versatile and reliable defense binoculars capable of meeting diverse mission requirements.

Regional Trends in Binocular Market:

Defense binoculars are experiencing varied levels of demand and innovation across different regions, shaped by local security needs, military doctrines, and budget allocations. In North America, particularly the United States, emphasis is placed on equipping infantry and special forces with high-end optics that include digital and low-light features. The region's focus on advanced battlefield integration supports continuous upgrades in binocular capabilities. European countries, especially those aligned with NATO, are prioritizing rugged, multifunctional binoculars that perform in a range of weather conditions and terrains, from arctic environments to mountainous zones. Eastern European nations are accelerating investments due to rising border concerns and regional instability. In the Asia-Pacific region, increasing defense expenditures and strategic rivalry are driving significant growth in optical equipment, with countries like India and South Korea advancing domestic manufacturing of military-grade binoculars. The Middle East's harsh climate has led to demand for models that resist heat and sand while providing long-range clarity in open landscapes. African and Latin American militaries, often engaged in anti-insurgency and counter-narcotics operations, favor robust and cost-effective binoculars that can endure jungle or desert patrols. Across all regions, the emphasis is shifting toward compact, weather-resistant, and easily integrated binoculars that enhance real-time field effectiveness.

Key Binocular Program:

Thales has unveiled its new Panoramic next-generation night vision goggles during a special operations technology event in Martignas-sur-Jalle, France. Engineered for high-stakes missions such as counter-terrorism and personnel extraction, the system features four image intensification tubes, allowing dismounted operators to benefit from a wider peripheral field of view without needing to turn their heads. The goggles have an ergonomic design, weighing just 740 grams (1.6 pounds), and are compact enough to remain within the width of a standard helmet.

Table of Contents

Global Binocular Market in defense- Table of Contents

Global Binocular Market in defense Report Definition

Global Binocular Market in defense Segmentation

By Region

By Technology

By Type

By Application

Global Binocular Market in defense Analysis for next 10 Years

The 10-year Global Binocular Market in defense analysis would give a detailed overview of Global Binocular Market in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Binocular Market in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Binocular Market in defense Forecast

The 10-year Global Binocular Market in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Binocular Market in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Binocular Market in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Binocular Market in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Binocular Market in defense

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Binocular Market Forecast, 2025-2035

- Figure 2: Global Binocular Market Forecast, By Region, 2025-2035

- Figure 3: Global Binocular Market Forecast, By Type, 2025-2035

- Figure 4: Global Binocular Market Forecast, By Technology, 2025-2035

- Figure 5: Global Binocular Market Forecast, By Application, 2025-2035

- Figure 6: North America, Binocular Market, Market Forecast, 2025-2035

- Figure 7: Europe, Binocular Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Binocular Market, Market Forecast, 2025-2035

- Figure 9: APAC, Binocular Market, Market Forecast, 2025-2035

- Figure 10: South America, Binocular Market, Market Forecast, 2025-2035

- Figure 11: United States, Binocular Market, Technology Maturation, 2025-2035

- Figure 12: United States, Binocular Market, Market Forecast, 2025-2035

- Figure 13: Canada, Binocular Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Binocular Market, Market Forecast, 2025-2035

- Figure 15: Italy, Binocular Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Binocular Market, Market Forecast, 2025-2035

- Figure 17: France, Binocular Market, Technology Maturation, 2025-2035

- Figure 18: France, Binocular Market, Market Forecast, 2025-2035

- Figure 19: Germany, Binocular Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Binocular Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Binocular Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Binocular Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Binocular Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Binocular Market, Market Forecast, 2025-2035

- Figure 25: Spain, Binocular Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Binocular Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Binocular Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Binocular Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Binocular Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Binocular Market, Market Forecast, 2025-2035

- Figure 31: Australia, Binocular Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Binocular Market, Market Forecast, 2025-2035

- Figure 33: India, Binocular Market, Technology Maturation, 2025-2035

- Figure 34: India, Binocular Market, Market Forecast, 2025-2035

- Figure 35: China, Binocular Market, Technology Maturation, 2025-2035

- Figure 36: China, Binocular Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Binocular Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Binocular Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Binocular Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Binocular Market, Market Forecast, 2025-2035

- Figure 41: Japan, Binocular Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Binocular Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Binocular Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Binocular Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Binocular Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Binocular Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Binocular Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Binocular Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Binocular Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Binocular Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Binocular Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Binocular Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Binocular Market, By Technology (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Binocular Market, By Technology (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Binocular Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Binocular Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Binocular Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Binocular Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Binocular Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Binocular Market, By Region, 2025-2035

- Figure 61: Scenario 1, Binocular Market, By Type, 2025-2035

- Figure 62: Scenario 1, Binocular Market, By Technology, 2025-2035

- Figure 63: Scenario 1, Binocular Market, By Application, 2025-2035

- Figure 64: Scenario 2, Binocular Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Binocular Market, By Region, 2025-2035

- Figure 66: Scenario 2, Binocular Market, By Type, 2025-2035

- Figure 67: Scenario 2, Binocular Market, By Technology, 2025-2035

- Figure 68: Scenario 2, Binocular Market, By Application, 2025-2035

- Figure 69: Company Benchmark, Binocular Market, 2025-2035