PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727189

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727189

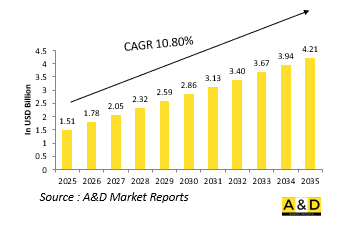

Global Fighter Aircraft IRST Market 2025-2035

The Global Fighter Aircraft IRST market is estimated at USD 1.51 billion in 2025, projected to grow to USD 4.21 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 10.80% over the forecast period 2025-2035.

Introduction to Fighter Aircraft IRST Market:

Infrared Search and Track (IRST) systems in fighter aircraft serve as critical passive sensors designed to detect, track, and identify airborne targets using infrared radiation. Unlike radar systems, IRST operates without emitting signals, allowing aircraft to locate enemies without revealing their position. This stealth-compatible capability has made IRST increasingly vital in modern aerial combat, especially as adversaries adopt technologies aimed at evading radar detection. Mounted typically on the nose or under the fuselage of fighter jets, these systems provide valuable heat signature data from engines and airframes, even in environments where radar performance is degraded. IRST complements other onboard sensors by offering a silent and resilient tracking mechanism against both manned and unmanned threats. It is particularly effective in close-combat situations, where rapid threat identification and targeting are essential. As air forces face more complex and contested airspaces, the value of having a passive sensor system that performs independently of electronic emissions is steadily increasing. Globally, the inclusion of IRST in next-generation and upgraded legacy fighters reflects the broader strategic push for enhanced survivability, situational awareness, and air superiority across a wide range of mission profiles.

Technology Impact in Fighter Aircraft IRST Market:

Technological progress has greatly expanded the capabilities and roles of IRST systems aboard fighter aircraft. Improvements in infrared sensor resolution and sensitivity now allow pilots to detect and identify heat sources at extended ranges, even against low-observable or stealthy targets. Modern IRST systems can distinguish between aircraft types by analyzing heat signatures, contributing to accurate threat assessment without relying on radar. The fusion of IRST data with other onboard sensors, such as radar and electronic warfare suites, enhances overall situational awareness and supports more informed decision-making during high-speed engagements. These systems are increasingly integrated with helmet-mounted displays and advanced targeting pods, allowing pilots to engage targets visually with minimal cockpit distraction. Furthermore, software algorithms embedded in IRST systems can now track multiple objects simultaneously, filter out background noise, and prioritize threats in real time. As airborne threats become faster, smaller, and more elusive, the ability to passively monitor the airspace with high fidelity has become essential. The evolution of IRST from a supplementary sensor to a key component in modern air combat is a direct result of ongoing innovations in optics, signal processing, and artificial intelligence, which together elevate the effectiveness of fighter aircraft in dynamic threat environments.

Key Drivers in Fighter Aircraft IRST market:

The increasing emphasis on survivability, stealth, and situational awareness in aerial warfare is driving global demand for IRST systems in fighter aircraft. As radar jamming and low-observable aircraft become more prevalent, IRST offers a critical alternative method of detection that is immune to electronic countermeasures. Militaries are seeking to reduce dependence on active emissions that can betray aircraft positions, making passive infrared sensors highly attractive for both offensive and defensive air operations. The need for early warning and target tracking without compromising position is particularly vital in contested airspace where radar use is constrained. Additionally, the growing threat from advanced missiles and high-speed aerial platforms reinforces the requirement for sensors that can rapidly identify and follow targets based on thermal output. Rising investments in multi-role and fifth-generation fighters are also boosting the integration of sophisticated sensor suites, with IRST serving as a core component. The demand is further supported by evolving combat doctrines that favor multi-sensor fusion and real-time intelligence. As air forces prioritize capabilities that extend detection ranges while maintaining operational stealth, IRST systems have become essential tools that align with both strategic objectives and technological advancement in modern air combat.

Regional Trends in Fighter Aircraft IRST Market:

The global adoption of IRST systems in fighter aircraft reflects varying regional priorities shaped by technological capabilities, threat perceptions, and defense strategies. In North America, there is a continued push to enhance fighter fleets with multispectral sensing, and while radar remains central, IRST is gaining traction as a silent tracker for air dominance missions. European nations, many of which operate in radar-contested zones, are integrating advanced IRST systems into both legacy and new aircraft to support long-range surveillance and tactical stealth. Countries like France, Germany, and the UK are particularly focused on sensor fusion, with IRST playing a pivotal role in next-generation fighter projects. In the Asia-Pacific region, rising tensions and rapid military modernization have led to increased interest in passive detection systems. Nations such as China, India, and Japan are incorporating or developing IRST technology as part of their efforts to counter stealth aircraft and maintain aerial superiority. In the Middle East, IRST-equipped platforms are valued for their performance in high-temperature environments where radar can be less effective. Latin American and African countries are slower to adopt these systems due to budget constraints, but regional partnerships and modernization programs are gradually increasing awareness and investment in this capability.

Key Defense Fighter Aircraft IRST Program:

The IRST21 represents the next generation of Lockheed Martin's legacy infrared search and track (IRST) sensor system, which has logged over 300,000 flight hours on F-14 and international F-15 aircraft. As a passive, long-range system, IRST21 employs infrared technology to detect and track airborne threats with weapon-grade accuracy-enhancing pilot situational awareness, reaction time, and survivability. Its compact design allows for flexible integration across multiple platforms. On the F/A-18E/F, the IRST21 is installed on the forward section of the centerline fuel tank. A podded version of the system is also in development, enabling compatibility with a broader range of aircraft, including the F-15C and F-16.

Table of Contents

Fighter Aircraft IRST Market - Table of Contents

Fighter Aircraft IRST market Report Definition

Fighter Aircraft IRST market Segmentation

By Region

By Technology

By Application

By Type

Fighter Aircraft IRST market Analysis for next 10 Years

The 10-year Fighter Aircraft IRST market analysis would give a detailed overview of Fighter Aircraft IRST market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Fighter Aircraft IRST market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Fighter Aircraft IRST market Forecast

The 10-year Fighter Aircraft IRST market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Fighter Aircraft IRST market Trends & Forecast

The regional Fighter Aircraft IRST market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Fighter Aircraft IRST market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Fighter Aircraft IRST market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Platform Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Platform Type, 2025-2035

List of Figures

- Figure 1: Global Fighter Aircraft IRST Market Forecast, 2025-2035

- Figure 2: Global Fighter Aircraft IRST Market Forecast, By Region, 2025-2035

- Figure 3: Global Fighter Aircraft IRST Market Forecast, By Type, 2025-2035

- Figure 4: Global Fighter Aircraft IRST Market Forecast, By Technology, 2025-2035

- Figure 5: Global Fighter Aircraft IRST Market Forecast, By Platform Type, 2025-2035

- Figure 6: North America, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 7: Europe, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 9: APAC, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 10: South America, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 11: United States, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 12: United States, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 13: Canada, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 15: Italy, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 17: France, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 18: France, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 19: Germany, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 25: Spain, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 31: Australia, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 33: India, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 34: India, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 35: China, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 36: China, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 41: Japan, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Fighter Aircraft IRST Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Fighter Aircraft IRST Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Fighter Aircraft IRST Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Fighter Aircraft IRST Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Fighter Aircraft IRST Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Fighter Aircraft IRST Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Fighter Aircraft IRST Market, By Technology (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Fighter Aircraft IRST Market, By Technology (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Fighter Aircraft IRST Market, By Platform Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Fighter Aircraft IRST Market, By Platform Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Fighter Aircraft IRST Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Fighter Aircraft IRST Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Fighter Aircraft IRST Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Fighter Aircraft IRST Market, By Region, 2025-2035

- Figure 61: Scenario 1, Fighter Aircraft IRST Market, By Type, 2025-2035

- Figure 62: Scenario 1, Fighter Aircraft IRST Market, By Technology, 2025-2035

- Figure 63: Scenario 1, Fighter Aircraft IRST Market, By Platform Type, 2025-2035

- Figure 64: Scenario 2, Fighter Aircraft IRST Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Fighter Aircraft IRST Market, By Region, 2025-2035

- Figure 66: Scenario 2, Fighter Aircraft IRST Market, By Type, 2025-2035

- Figure 67: Scenario 2, Fighter Aircraft IRST Market, By Technology, 2025-2035

- Figure 68: Scenario 2, Fighter Aircraft IRST Market, By Platform Type, 2025-2035

- Figure 69: Company Benchmark, Fighter Aircraft IRST Market, 2025-2035