PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727196

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727196

Global Periscope Market 2025-2035

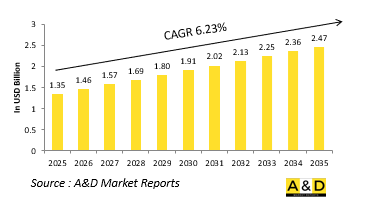

The Global Periscope market is estimated at USD 1.35 billion in 2025, projected to grow to USD 2.47 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 6.23% over the forecast period 2025-2035.

Introduction to Periscope Market

Periscopes remain a vital optical system within the defense sector, particularly in armored vehicles and submarines, where they enable safe, concealed observation of the surrounding environment. In ground vehicles like tanks, periscopes provide the crew with a field of view outside the heavily protected hull without exposing themselves to external threats. In submarines, these systems are essential for visual reconnaissance and targeting while maintaining a submerged position, preserving stealth. Over the decades, the role of the periscope has evolved from a basic optical device to a sophisticated multisensor suite incorporating digital imaging, thermal detection, and laser range-finding. Their contribution to battlefield awareness and navigation continues to be significant, especially in conditions where direct line-of-sight is compromised. Modern combat increasingly demands precision, situational awareness, and operational security-functions that well-designed periscope systems directly support. These devices are also used in surveillance towers, reconnaissance platforms, and forward observation systems, extending their utility beyond traditional vehicles. Their integration with other sensor and communication systems further enhances their value by allowing real-time data transmission to command units. As defense platforms continue to evolve, periscopes remain a dependable and adaptable tool for observation, targeting, and maintaining a tactical edge across various operational environments.

Technology Impact in Periscope Market:

Advancements in optics, digital processing, and sensor fusion have significantly transformed periscope systems in modern defense applications. Traditional mechanical periscopes, which relied solely on mirrors and prisms for optical transmission, have largely been replaced or augmented by electronically enhanced models that integrate multiple imaging channels. Contemporary systems often include low-light, thermal, and high-definition digital cameras, enabling superior visibility under all lighting and weather conditions. These technologies have expanded the functional scope of periscopes, allowing operators to detect, identify, and track targets with greater precision from protected positions. Real-time video feeds, image stabilization, and data overlays provide enhanced situational understanding, while modular designs make integration with digital fire control systems and remote weapon stations more seamless. Many periscopes are now capable of transmitting imagery and telemetry to command centers, facilitating coordinated tactical decisions. Additionally, improvements in compact design and ruggedization have made them more durable and adaptable to various vehicle types. Some advanced systems are even transitioning toward panoramic periscopes, offering a broader and more continuous field of view. These technological leaps have elevated periscopes from simple viewing tools to essential battlefield sensors, reinforcing their place in both legacy upgrades and next-generation defense platforms.

Key Drivers in Periscope Market:

Several strategic and operational factors are driving continued investment in periscope technologies within defense sectors worldwide. One of the key motivations is the need to enhance crew survivability by allowing observation and targeting from within armored protection or submerged environments. As threats become more unpredictable and engagements more complex, maintaining visibility without compromising position is critical. Another driving factor is the modernization of aging military fleets, where periscope systems are being upgraded to align with newer surveillance and targeting technologies. Enhanced periscopes help bridge the capability gap between older platforms and modern combat demands without requiring complete vehicle overhauls. Additionally, the push for all-weather, day-night operability has made it essential to incorporate sensors like thermal imagers and low-light cameras directly into viewing systems. Periscopes also serve as key components in surveillance and reconnaissance roles, making them valuable not only in combat but also in border monitoring and intelligence gathering. The demand for interoperability and data sharing across military units further increases the relevance of digitally enhanced periscopes that can transmit visual intelligence in real time. Ultimately, the emphasis on force protection, situational awareness, and platform efficiency continues to make advanced periscope systems a priority in global defense planning.

Regional Trends in Periscope Market:

Regional trends in defense periscope adoption and development vary depending on military doctrine, industrial capabilities, and platform modernization needs. In North America, particularly the United States, defense manufacturers focus on integrating periscopes with advanced targeting systems and digital battlefield networks, supporting both armored and naval applications. European nations emphasize modularity and interoperability, especially in line with NATO standards, allowing periscopes to be seamlessly integrated into multinational operations and diverse vehicle types. In Asia-Pacific, growing investments in armored forces and indigenous manufacturing capabilities have spurred the development of customized periscope solutions tailored to regional terrains and mission profiles. Countries like South Korea and India are focusing on locally produced systems that balance cost with advanced imaging features. The Middle East, with its challenging environmental conditions and high demand for both border security and armored capability, is adopting rugged, sensor-rich periscopes that support day-night operations. In contrast, African and Latin American nations are incorporating periscopes through upgrade programs and foreign defense collaborations, focusing on essential visibility and durability over high-end features. Across all regions, the shared emphasis lies in enhancing operational awareness, integrating with modern vehicle systems, and ensuring reliable performance under demanding conditions.

Key Periscope Program:

HENSOLDT, a leading provider of sensor solutions, has secured a $43.6 million contract from the Norwegian Defence Materiel Agency to upgrade the aging "Ula" class submarines with state-of-the-art periscopes and optronic mast systems. The modernization effort aims to significantly enhance the submarines' visual capabilities and maintain their operational effectiveness well into the future. As part of the life-extension program for the over 30-year-old vessels, HENSOLDT will replace the existing periscopes and optronic systems with advanced technology. These upgrades will improve situational awareness and strengthen the submarines' overall mission capabilities.

Table of Contents

Periscope Market - Table of Contents

periscope market Report Definition

periscope market Segmentation

By Region

By Components

By Technology

By Application

periscope market Analysis for next 10 Years

The 10-year periscope market analysis would give a detailed overview of periscope market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of periscope market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global periscope market Forecast

The 10-year periscope market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional periscope market Trends & Forecast

The regional periscope market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for periscope market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on periscope market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Components, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Components, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Periscope Market Forecast, 2025-2035

- Figure 2: Global Periscope Market Forecast, By Region, 2025-2035

- Figure 3: Global Periscope Market Forecast, By Components, 2025-2035

- Figure 4: Global Periscope Market Forecast, By Technology, 2025-2035

- Figure 5: Global Periscope Market Forecast, By Application, 2025-2035

- Figure 6: North America, Periscope Market, Market Forecast, 2025-2035

- Figure 7: Europe, Periscope Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Periscope Market, Market Forecast, 2025-2035

- Figure 9: APAC, Periscope Market, Market Forecast, 2025-2035

- Figure 10: South America, Periscope Market, Market Forecast, 2025-2035

- Figure 11: United States, Periscope Market, Technology Maturation, 2025-2035

- Figure 12: United States, Periscope Market, Market Forecast, 2025-2035

- Figure 13: Canada, Periscope Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Periscope Market, Market Forecast, 2025-2035

- Figure 15: Italy, Periscope Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Periscope Market, Market Forecast, 2025-2035

- Figure 17: France, Periscope Market, Technology Maturation, 2025-2035

- Figure 18: France, Periscope Market, Market Forecast, 2025-2035

- Figure 19: Germany, Periscope Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Periscope Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Periscope Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Periscope Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Periscope Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Periscope Market, Market Forecast, 2025-2035

- Figure 25: Spain, Periscope Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Periscope Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Periscope Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Periscope Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Periscope Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Periscope Market, Market Forecast, 2025-2035

- Figure 31: Australia, Periscope Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Periscope Market, Market Forecast, 2025-2035

- Figure 33: India, Periscope Market, Technology Maturation, 2025-2035

- Figure 34: India, Periscope Market, Market Forecast, 2025-2035

- Figure 35: China, Periscope Market, Technology Maturation, 2025-2035

- Figure 36: China, Periscope Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Periscope Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Periscope Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Periscope Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Periscope Market, Market Forecast, 2025-2035

- Figure 41: Japan, Periscope Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Periscope Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Periscope Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Periscope Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Periscope Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Periscope Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Periscope Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Periscope Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Periscope Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Periscope Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Periscope Market, By Components (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Periscope Market, By Components (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Periscope Market, By Technology (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Periscope Market, By Technology (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Periscope Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Periscope Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Periscope Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Periscope Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Periscope Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Periscope Market, By Region, 2025-2035

- Figure 61: Scenario 1, Periscope Market, By Components, 2025-2035

- Figure 62: Scenario 1, Periscope Market, By Technology, 2025-2035

- Figure 63: Scenario 1, Periscope Market, By Application, 2025-2035

- Figure 64: Scenario 2, Periscope Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Periscope Market, By Region, 2025-2035

- Figure 66: Scenario 2, Periscope Market, By Components, 2025-2035

- Figure 67: Scenario 2, Periscope Market, By Technology, 2025-2035

- Figure 68: Scenario 2, Periscope Market, By Application, 2025-2035

- Figure 69: Company Benchmark, Periscope Market, 2025-2035