PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744372

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744372

Global Target Drone Systems Market 2025-2035

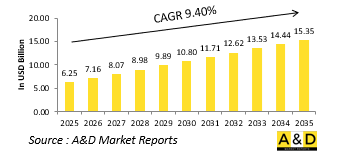

The Global Target Drone Systems market is estimated at USD 6.25 billion in 2025, projected to grow to USD 15.35 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.40% over the forecast period 2025-2035.

Introduction to Target Drone Systems Market:

Target drone systems are essential components in modern defense training and weapons testing. These unmanned aerial platforms are primarily used to simulate enemy threats, allowing armed forces to evaluate and refine their combat readiness. Designed to replicate various airborne threats-from fast jets and cruise missiles to loitering drones-these systems provide realistic scenarios for testing radar systems, air defense batteries, and missile intercept capabilities. Military training exercises benefit significantly from the use of target drones, as they help sharpen accuracy, coordination, and responsiveness without risking human life. They are frequently deployed in both live-fire and electronic warfare drills, serving as stand-ins for adversarial platforms. Their versatility extends to naval and ground force applications, offering a wide spectrum of operational use-cases. By presenting variable speeds, altitudes, and maneuvering patterns, these drones help defense units simulate diverse combat environments. They also contribute to validating new technologies under development, such as advanced sensor suites or missile tracking algorithms. With the increasing sophistication of aerial threats, the demand for advanced, reusable, and cost-effective target drone systems has grown across defense sectors. These systems ensure that forces remain prepared to counter evolving air threats and maintain strategic dominance during complex operations.

Technology Impact in Target Drone Systems Market:

Technological progress has had a transformative impact on target drone systems, enhancing their realism, complexity, and value to modern defense forces. Recent innovations have introduced high-speed maneuverability, extended endurance, and advanced flight control systems, allowing drones to more accurately mimic real-world threats. Autonomous navigation and artificial intelligence now enable these systems to operate with minimal ground control, adjusting flight paths and responses based on programmed threat profiles. Advanced materials and modular airframe designs allow for greater durability and reusability, even during demanding live-fire exercises. Enhanced propulsion systems and sensor payloads help simulate radar signatures and infrared profiles of various threat platforms, making training scenarios more authentic. Some systems now include stealth features, making them suitable for testing next-generation detection technologies. Electronic warfare capabilities have also been integrated, allowing drones to jam or deceive sensors during simulated engagements. This realism supports better evaluation of defense readiness and system performance. Additionally, real-time telemetry and post-mission data collection enable detailed analysis and refinement of tactics. These technological advances are not only improving operational realism but also reducing training costs over time, as reusable and programmable platforms minimize the need for manned surrogate targets in both airspace and coastal defense operations.

Key Drivers in Target Drone Systems Market:

Several key factors are influencing the growing demand and development of target drone systems in defense sectors worldwide. One major driver is the need for realistic, high-fidelity training to prepare personnel for modern aerial threats. As adversaries deploy more complex and faster air platforms, militaries require drones that can accurately simulate these threats under controlled but challenging scenarios. The integration of advanced air defense systems also necessitates consistent testing against dynamic aerial targets, pushing the development of drones that can emulate various flight patterns and threat behaviors. Rising focus on multi-domain operations-spanning air, land, sea, and cyber-has further expanded the role of drones in joint-force training environments. The shift toward unmanned and semi-autonomous weapons makes target drones vital in validating performance and reliability of these platforms. Additionally, rapid innovation in radar, missile guidance, and electronic warfare tools demands a reliable means of evaluation under stress conditions. Budget efficiency also plays a role, as reusable drones offer a cost-effective alternative to manned target simulation. Lastly, the growing emphasis on national defense modernization encourages countries to invest in domestic production and customization of drone systems tailored to their specific strategic needs, ensuring long-term capability and control.

Regional Trends in Target Drone Systems Market:

Target drone system development and deployment vary significantly by region, reflecting unique security priorities and technological capacities. In North America, particularly the United States, there is a strong emphasis on highly autonomous, advanced systems capable of simulating a broad range of threats. These drones are used extensively in both homeland defense drills and global military training operations. Europe focuses on interoperability and collaborative exercises, with many NATO nations adopting standardized drone platforms for multinational training missions. Innovation in this region is geared toward modularity and seamless integration with legacy systems. In Asia-Pacific, growing maritime tensions and contested airspace zones have driven demand for agile, high-speed drones that support both naval and air defense exercises. Several nations in this region are also investing in indigenous drone development to reduce reliance on foreign suppliers. The Middle East, marked by active conflict zones and complex threat environments, employs target drones to train for irregular aerial assaults, including missile and drone swarm scenarios. Meanwhile, emerging defense markets in Latin America and Africa are adopting more basic systems focused on cost-efficiency and operational training. Across all regions, the role of target drones is expanding, shaped by evolving strategic doctrines and defense modernization agendas.

Key Defense Target Drone Systems Program:

Diehl Defence and RV Connex have signed a contract for the supply of target drones to support live-fire testing of the IRIS-T missile system. Diehl Defence, a leading provider of ground-based air defense systems, guided missiles, and ammunition, is strengthening its collaboration with Thai defense and security company RV Connex. The agreement covers the initial delivery of JRV-01 target drones, along with associated services for live firing exercises involving Diehl Defence's IRIS-T air-to-air missile. Additionally, the contract includes support services related to weapon airworthiness certification projects. This marks the first delivery under the partnership, which was formalized with a Memorandum of Understanding signed in November 2023. The two companies will now begin joint evaluation of the drone system as part of their expanded cooperation.

Table of Contents

Target Drone Systems Market Report Definition

Target Drone Systems Market Segmentation

By Region

By End User

By Type

Target Drone Systems Market Analysis for next 10 Years

The 10-year target drone systems market analysis would give a detailed overview of target drone systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Target Drone Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Target Drone Systems Market Forecast

The 10-year target drone systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Target Drone Systems Market Trends & Forecast

The regional target drone systems market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Target Drone Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Target Drone Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Target Drone Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Target Drone Systems Market Forecast, 2025-2035

- Figure 2: Global Target Drone Systems Market Forecast, By Region, 2025-2035

- Figure 3: Global Target Drone Systems Market Forecast, By End User, 2025-2035

- Figure 4: Global Target Drone Systems Market Forecast, By Type, 2025-2035

- Figure 5: North America, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 6: Europe, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 8: APAC, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 9: South America, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 10: United States, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 11: United States, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 12: Canada, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 14: Italy, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 16: France, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 17: France, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 18: Germany, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 24: Spain, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 30: Australia, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 32: India, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 33: India, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 34: China, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 35: China, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 40: Japan, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Target Drone Systems Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Target Drone Systems Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Target Drone Systems Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Target Drone Systems Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Target Drone Systems Market, By End User (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Target Drone Systems Market, By End User (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Target Drone Systems Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Target Drone Systems Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Target Drone Systems Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Target Drone Systems Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Target Drone Systems Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Target Drone Systems Market, By Region, 2025-2035

- Figure 58: Scenario 1, Target Drone Systems Market, By End User, 2025-2035

- Figure 59: Scenario 1, Target Drone Systems Market, By Type, 2025-2035

- Figure 60: Scenario 2, Target Drone Systems Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Target Drone Systems Market, By Region, 2025-2035

- Figure 62: Scenario 2, Target Drone Systems Market, By End User, 2025-2035

- Figure 63: Scenario 2, Target Drone Systems Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Target Drone Systems Market, 2025-2035