PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744376

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744376

Global Trainer Aircraft Market 2025-2035

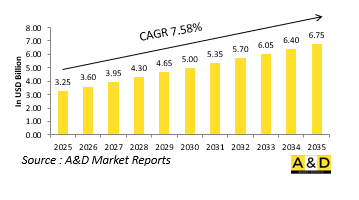

The Global Trainer Aircraft market is estimated at USD 3.25 billion in 2025, projected to grow to USD 6.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.58% over the forecast period 2025-2035.

Introduction to Trainer Aircraft Market:

Trainer aircraft form a foundational element in preparing military pilots for operational duty. These specialized aircraft are used to bridge the gap between basic flight instruction and the complex demands of modern combat aviation. They provide a controlled environment where aspiring aviators can master navigation, maneuvering, and mission-specific skills before transitioning to frontline fighter, bomber, or reconnaissance platforms. Trainer aircraft are typically categorized into basic, intermediate, and advanced levels, each offering progressively complex systems and flight dynamics. These platforms allow air forces to conduct cost-effective training without exposing expensive frontline assets to routine instruction or potential risk. Their design emphasizes safety, reliability, and modularity, enabling both simulated and live training in varied conditions. Beyond pilot development, trainer aircraft are increasingly used for systems familiarization, sensor training, and joint exercises. As air power remains a critical pillar of modern defense strategy, the role of trainer aircraft continues to expand, ensuring that aircrew are proficient, mission-ready, and able to adapt to the evolving dynamics of aerial warfare. Their significance extends beyond the cockpit, contributing to the overall efficiency and readiness of air forces in both peacetime and conflict scenarios.

Technology Impact in Trainer Aircraft Market:

Technological advancement is redefining the capabilities of trainer aircraft, enhancing both instructional quality and mission adaptability. Modern trainer platforms now integrate digital cockpits, touchscreen interfaces, and advanced avionics that closely resemble those of next-generation combat aircraft. This alignment allows trainees to develop operational familiarity early in their progression. Embedded simulation systems are increasingly common, enabling a mix of live flying and virtual training within the same flight session. These features reduce dependency on external simulators and offer dynamic mission rehearsal capabilities. Enhanced safety mechanisms such as real-time data monitoring and automatic recovery systems further support instruction by allowing instructors to intervene instantly when needed. Advanced propulsion systems also improve performance, allowing trainers to replicate a broader spectrum of flight conditions. Some platforms now support data links and mission planning software, enabling participation in networked training exercises alongside other air or ground assets. Additionally, developments in materials and aerodynamics have led to longer service life and reduced maintenance demands. These technological shifts ensure that trainer aircraft are not just stepping stones but strategic assets in themselves, preparing pilots to operate sophisticated systems while optimizing training costs, safety, and operational realism across all phases of military aviation instruction.

Key Drivers in Trainer Aircraft Market:

The growing complexity of aerial warfare and the increasing sophistication of frontline aircraft are major forces shaping the evolution of defense trainer aircraft. As air forces modernize their fleets with multirole and stealth platforms, there is a parallel need for training aircraft that can replicate similar cockpit environments, mission systems, and operational dynamics. Budget efficiency is another driving factor, with trainer aircraft offering a cost-effective means to develop pilot skills without the expense of deploying high-performance combat jets for routine instruction. The requirement to reduce training timelines while increasing pilot readiness has also led to the demand for platforms that support a blended learning approach-integrating live flight, simulation, and mission planning into a unified framework. Joint and coalition training initiatives further underscore the need for trainer aircraft compatible with allied standards and capable of supporting international pilot exchanges. The emergence of unmanned systems and the need for manned-unmanned teaming capabilities have also influenced training requirements, prompting the development of aircraft that can simulate these evolving mission profiles. Taken together, these drivers reflect a broader shift toward creating adaptable, future-ready aircrews who can seamlessly transition from training environments to the multifaceted challenges of modern aerial operations.

Regional Trends in Trainer Aircraft Market:

Defense trainer aircraft programs vary widely by region, shaped by distinct military priorities, industrial capabilities, and strategic partnerships. In Europe, modernization efforts focus on replacing aging fleets with trainer platforms that are compatible with digital mission systems used in frontline NATO aircraft. These programs often emphasize interoperability and joint training standards. In North America, emphasis is placed on advanced jet trainers that can prepare pilots for the complexities of fifth-generation aircraft and integrated combat operations. Training is increasingly networked, reflecting the high-tech nature of the region's broader defense architecture. Asia-Pacific nations are rapidly expanding pilot development capabilities, driven by growing air force modernization and the need to support both indigenous and imported combat platforms. Some countries in this region are also investing in domestic trainer production, reflecting strategic goals of self-reliance and defense industrial growth. The Middle East, facing a dynamic security landscape, prioritizes rapid pilot development and often acquires versatile, export-ready trainers that can support both instruction and light attack roles. Latin America and Africa, while more constrained by budgets, continue to invest in multi-role trainer platforms as part of broader air capability enhancements. Each region's approach reflects its operational needs, threat perceptions, and future air power ambitions.

Key Trainer Aircraft Program:

Textron Aviation has been awarded a $277 million contract to manufacture T-54A next-generation trainer aircraft for the U.S. military. Under procurement lots 2 and 3, the company will supply 26 aircraft to the U.S. Navy, Marine Corps, and Coast Guard. The contract also includes the provision of spare engines and related support equipment. Production will take place in Kansas and Texas, with project completion expected by September 2026. The T-54A is anticipated to enhance pilot training capabilities across U.S. military branches once delivered.

.

Table of Contents

Trainer Aircraft Market Report Definition

Trainer Aircraft Market Segmentation

By Region

By Type

By End User

Trainer Aircraft Market Analysis for next 10 Years

The 10-year trainer aircraft market analysis would give a detailed overview of trainer aircraft market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Trainer Aircraft Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Trainer Aircraft Market Forecast

The 10-year trainer aircraft market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Trainer Aircraft Market Trends & Forecast

The regional Trainer Aircraft Markettrends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Trainer Aircraft Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Trainer Aircraft Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Trainer Aircraft Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Trainer Aircraft Market Forecast, 2025-2035

- Figure 2: Global Trainer Aircraft Market Forecast, By Region, 2025-2035

- Figure 3: Global Trainer Aircraft Market Forecast, By End User, 2025-2035

- Figure 4: Global Trainer Aircraft Market Forecast, By Type, 2025-2035

- Figure 5: North America, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 6: Europe, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 8: APAC, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 9: South America, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 10: United States, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 11: United States, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 12: Canada, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 14: Italy, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 16: France, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 17: France, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 18: Germany, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 24: Spain, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 30: Australia, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 32: India, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 33: India, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 34: China, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 35: China, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 40: Japan, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Trainer Aircraft Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Trainer Aircraft Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Trainer Aircraft Market, By End User (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Trainer Aircraft Market, By End User (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Trainer Aircraft Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Trainer Aircraft Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Trainer Aircraft Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Trainer Aircraft Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Trainer Aircraft Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Trainer Aircraft Market, By Region, 2025-2035

- Figure 58: Scenario 1, Trainer Aircraft Market, By End User, 2025-2035

- Figure 59: Scenario 1, Trainer Aircraft Market, By Type, 2025-2035

- Figure 60: Scenario 2, Trainer Aircraft Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Trainer Aircraft Market, By Region, 2025-2035

- Figure 62: Scenario 2, Trainer Aircraft Market, By End User, 2025-2035

- Figure 63: Scenario 2, Trainer Aircraft Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Trainer Aircraft Market, 2025-2035