PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1811808

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1811808

Global Smart Weapons Market 2025 - 2035

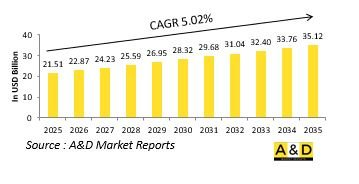

The global Smart Weapons market is estimated at USD 21.51 billion in 2025, projected to grow to USD 35.12 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.02% over the forecast period 2025-2035.

Introduction to Global Smart Weapons market:

Smart weapons, often referred to as precision-guided munitions, represent a transformative leap in modern warfare, redefining the accuracy, lethality, and efficiency of military operations. These advanced systems integrate sophisticated guidance technologies, sensors, and real-time data processing capabilities to strike designated targets with minimal collateral damage. Unlike conventional armaments, smart weapons can adapt to changing battlefield conditions and engage targets with pinpoint precision. Their use spans across various platforms, including air-launched missiles, naval strike systems, and ground-based artillery. The evolution of smart weapons is closely linked to the broader trend of digital warfare, where connectivity, automation, and situational awareness play central roles. As militaries around the world seek to modernize their arsenals, smart weapons have become a key area of investment, particularly in scenarios requiring fast, decisive action. Their ability to reduce mission risk and enhance operational success makes them highly valuable in both conventional and asymmetric conflicts. The global defense community continues to prioritize the development and deployment of these systems as strategic assets, aiming to gain tactical superiority and deter adversaries with advanced, network-enabled capabilities. As threats evolve, the role of smart weapons in achieving precise, scalable, and timely military responses becomes increasingly critical.

Technology Impact in Smart Weapons Market:

Technology plays a central role in the continuous evolution of smart weapons, driving performance improvements, cost-efficiency, and adaptability. Innovations in microelectronics, artificial intelligence, and advanced materials have significantly enhanced the capabilities of precision-guided munitions. With AI and machine learning, smart weapons can process sensor data in real time, enabling them to track moving targets, avoid countermeasures, and make dynamic decisions during flight. Satellite-based navigation and inertial guidance systems have improved accuracy, even in GPS-denied environments. In addition, advancements in data fusion allow multiple sensors to work together, enhancing targeting precision and environmental awareness. Enhanced communication protocols enable smart weapons to integrate into larger command-and-control networks, allowing them to receive updated mission parameters mid-flight and adjust course based on live intelligence. Miniaturization of components also facilitates the deployment of these technologies across a wider range of platforms, from drones to handheld launchers. Furthermore, modular design trends are allowing for quicker adaptation of smart weapons to different mission requirements without redesigning entire systems. These technological advances not only extend the tactical versatility of smart weapons but also lower the threshold for adoption by a wider range of military forces, ultimately shaping the future operational doctrines of technologically advanced and emerging defense powers alike.

Key Drivers in Smart Weapons Market:

Several strategic, operational, and technological factors are fueling the growing demand for smart weapons worldwide. One of the primary drivers is the increasing need for precision in modern combat to minimize civilian casualties and infrastructure damage while maintaining high mission effectiveness. As warfare shifts toward urban and asymmetric environments, the requirement for targeted strikes with minimal collateral impact becomes even more critical. Budget efficiency also plays a role, as smart weapons reduce the number of munitions needed per mission by increasing the likelihood of a first-strike success. Evolving threat landscapes-marked by non-state actors, drones, and dispersed enemy formations-require adaptable weapons capable of engaging fast-moving or concealed targets. Strategic deterrence is another motivator, with smart weapons serving as tools of power projection that convey technological and military superiority. In addition, interoperability within allied forces is driving the need for standardized, network-enabled munitions that can operate across joint or coalition platforms. Defense modernization programs are consistently integrating smart weapons to maintain parity or gain an edge over peer competitors. The shift toward digitized, multi-domain operations further underscores the demand for weapons systems that can function seamlessly across air, sea, land, and cyber environments, amplifying their operational value.

Regional Trends in Smart Weapons Market:

Regional dynamics play a significant role in shaping the development and deployment of smart weapons. In North America, especially within the United States, there is a strong emphasis on integrating smart weapons into a broader digital battlespace, often linked with space-based surveillance and real-time data-sharing platforms. European nations are increasingly investing in collaborative defense initiatives, with a focus on interoperability and autonomous targeting systems, especially for use in rapid-response and peacekeeping missions. The Asia-Pacific region is seeing significant growth, fueled by territorial tensions and a drive for military modernization, particularly among countries with expanding naval and aerial capabilities. In the Middle East, regional rivalries and ongoing conflicts have accelerated the adoption of smart weapons for both deterrence and active engagement purposes, often with a focus on minimizing civilian harm in densely populated areas. Emerging economies in Latin America and Africa are showing increasing interest in cost-effective smart munitions that can be integrated into existing platforms without extensive overhaul. Across these regions, localized innovation is also beginning to emerge, with indigenous development programs aiming to reduce dependency on foreign suppliers. These regional trends highlight a common interest in achieving precision, scalability, and strategic control in modern conflict scenarios through the integration of smart weapons.

Key Smart Weapons Program:

Raytheon, an RTX business, has secured a $400 million contract from the U.S. Air Force to manufacture and supply over 1,500 StormBreaker(R) smart weapons. This advanced air-to-surface, network-enabled system is designed to strike moving targets in all weather conditions, equipped with a tri-mode seeker and multi-effects warhead. Currently deployed on the F-15E Strike Eagle and F/A-18E/F Super Hornet, StormBreaker is also undergoing testing across all F-35 variants. In 2023, the weapon system successfully completed 28 test drops across platforms.

Table of Contents

Smart Weapons Market Report Definition

Smart Weapons Market Segmentation

By Region

By Navigation

By Type

Smart Weapons Market Analysis for next 10 Years

The 10-year Smart Weapons Market analysis would give a detailed overview of Smart Weapons Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Smart Weapons Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Smart Weapons Market Forecast

The 10-year smart weapons market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Smart Weapons Market Trends & Forecast

The regional smart weapons market rends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Smart Weapons Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Smart Weapons Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Smart Weapons Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Guidance, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Guidance, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Smart Weapons Market Forecast, 2025-2035

- Figure 2: Global Smart Weapons Market Forecast, By Region, 2025-2035

- Figure 3: Global Smart Weapons Market Forecast, By Type, 2025-2035

- Figure 4: Global Smart Weapons Market Forecast, By Guidance, 2025-2035

- Figure 5: Global Smart Weapons Market Forecast, By Platform, 2025-2035

- Figure 6: North America, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 7: Europe, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 9: APAC, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 10: South America, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 11: United States, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 12: United States, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 13: Canada, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 15: Italy, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 17: France, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 18: France, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 19: Germany, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 25: Spain, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 31: Australia, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 33: India, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 34: India, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 35: China, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 36: China, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 41: Japan, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Smart Weapons Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Smart Weapons Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Smart Weapons Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Smart Weapons Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Smart Weapons Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Smart Weapons Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Smart Weapons Market, By Guidance (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Smart Weapons Market, By Guidance (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Smart Weapons Market, By Platform (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Smart Weapons Market, By Platform (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Smart Weapons Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Smart Weapons Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Smart Weapons Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Smart Weapons Market, By Region, 2025-2035

- Figure 61: Scenario 1, Smart Weapons Market, By Type, 2025-2035

- Figure 62: Scenario 1, Smart Weapons Market, By Guidance, 2025-2035

- Figure 63: Scenario 1, Smart Weapons Market, By Platform, 2025-2035

- Figure 64: Scenario 2, Smart Weapons Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Smart Weapons Market, By Region, 2025-2035

- Figure 66: Scenario 2, Smart Weapons Market, By Type, 2025-2035

- Figure 67: Scenario 2, Smart Weapons Market, By Guidance, 2025-2035

- Figure 68: Scenario 2, Smart Weapons Market, By Platform, 2025-2035

- Figure 69: Company Benchmark, Smart Weapons Market, 2025-2035