PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1811816

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1811816

Global Surveillance Radar Market 2025 - 2035

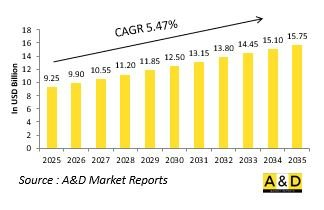

The Global Surveillance Radar market is estimated at USD 9.25 billion in 2025, projected to grow to USD 15.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.47% over the forecast period 2025-2035.

Introduction to Surveillance Radar Market:

The defense surveillance radar market is an integral part of modern security infrastructure, supporting the detection, tracking, and monitoring of aerial, maritime, and ground-based threats. These systems are designed to provide early warning and situational awareness, enabling armed forces to make informed decisions in both defensive and offensive operations. Unlike civilian radars that primarily focus on weather or air traffic control, defense surveillance radars are engineered for resilience, precision, and the ability to operate under hostile conditions. The importance of these radars has grown as militaries face increasingly complex threats ranging from stealth aircraft and drones to hypersonic weapons and low-altitude cruise missiles. Their role extends beyond combat, as they are also vital for border security, coastal monitoring, and peacekeeping operations. The market has evolved to include a wide variety of systems, from large fixed installations to mobile units capable of rapid deployment in conflict zones. This diversity reflects the need for flexibility in modern defense strategies. With the rising emphasis on integrated air and missile defense, surveillance radars remain the cornerstone of detection networks, ensuring that nations maintain a comprehensive picture of activities in contested environments and safeguard their airspace and territorial waters.

Technology Impact in Surveillance Radar Market:

Technological advances are reshaping the capabilities of defense surveillance radars, driving improvements in detection range, accuracy, and resilience against countermeasures. One of the most transformative developments has been the widespread adoption of active electronically scanned array systems, which allow radars to track multiple targets simultaneously while maintaining a low probability of interception. This technology enhances responsiveness and survivability in contested airspace, where adversaries deploy electronic warfare to disrupt traditional radar signals. Advances in digital signal processing and artificial intelligence are further enhancing performance. Modern radars can filter through background clutter, distinguish between genuine threats and decoys, and deliver actionable insights in real time. These systems also integrate with command-and-control networks, allowing seamless sharing of data across air, land, and sea domains. Such connectivity is crucial for joint and coalition operations where rapid coordination determines mission success. Materials and miniaturization technologies are also shaping the market, enabling the development of lighter, mobile systems that can be mounted on vehicles, ships, or even unmanned platforms. Meanwhile, research into quantum radar and passive radar concepts highlights future directions aimed at countering stealth technologies. Collectively, these innovations ensure that surveillance radars remain indispensable in modern and next-generation defense strategies.

Key Drivers in Surveillance Radar Market:

The growth of the defense surveillance radar market is fueled by evolving security requirements and the increasing sophistication of threats. Nations recognize that early detection is fundamental to safeguarding airspace, coastlines, and critical infrastructure. The proliferation of unmanned aerial systems, stealth technologies, and advanced missile systems has created demand for radars capable of identifying threats that are smaller, faster, and harder to detect than ever before. Another major driver is the emphasis on integrated defense systems. Modern militaries seek radars that not only detect but also seamlessly connect with interceptors, aircraft, and command centers. This interoperability allows for coordinated responses to multi-domain threats and strengthens layered defense architectures. The rising importance of ballistic missile defense has further increased reliance on long-range radars capable of tracking high-speed projectiles across vast distances. Budgetary allocations for defense modernization also play a key role. Governments are prioritizing investments in radar technology to ensure preparedness for both conventional and asymmetric warfare scenarios. In addition, the increasing involvement of defense forces in non-combat roles, such as disaster monitoring and border surveillance, ensures consistent demand. Collectively, these drivers underline the central role of surveillance radars in shaping resilient and future-ready defense strategies.

Regional Trends in Surveillance Radar Market:

Regional trends in the defense surveillance radar market reflect a blend of geographic needs, security challenges, and technological priorities. Maritime nations emphasize coastal and naval radar systems to monitor expansive sea lanes and deter potential intrusions, while landlocked regions focus on border surveillance and air defense radars to protect against aerial incursions. Geography, therefore, heavily influences radar procurement strategies. Advanced defense powers are leading the adoption of cutting-edge technologies such as electronically scanned arrays and long-range early warning radars. Their focus lies in building integrated air and missile defense systems that can counter stealth aircraft and hypersonic threats. In contrast, emerging economies often prioritize mobile, cost-effective solutions that can serve multiple purposes, from battlefield surveillance to disaster response. Regional tensions and alliances also shape demand. Areas experiencing territorial disputes or heightened rivalries invest heavily in radar networks to ensure constant vigilance and deterrence. Meanwhile, nations engaged in multinational operations emphasize interoperability, ensuring that their systems align with those of allies. Industrial capability further defines regional dynamics, as some countries push for indigenous radar development to reduce dependency on imports, while others rely on collaborations to access advanced designs. These trends together highlight the diversity and vitality of the global defense surveillance radar market.

Key Surveillance Radar Program:

After receiving approval from the German Parliament, Indra has signed a contract with the National Procurement Office (BAAINBw) of the Bundeswehr to equip the Luftwaffe with a next-generation radar system designed to detect objects in low Earth orbit. The radar will safeguard active satellites from potential collisions with high-speed orbital debris and help counter risks posed by other satellites attempting to approach, interfere with, or gather intelligence on them. Indra, through its German subsidiary, was invited to participate in the tender and secured the contract based on the proven maturity, superior performance, and modular, flexible design of its space radar, which allows for scalable capability upgrades.

Table of Contents

Surveillance Radar Market Report Definition

Surveillance Radar Market Segmentation

By Application

By Platform

By Region

Surveillance Radar Market Analysis for next 10 Years

The 10-year surveillance radar market analysis would give a detailed overview of surveillance radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Surveillance Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Surveillance Radar Market Forecast

The 10-year Surveillance Radar Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Surveillance Radar Market Trends & Forecast

The regional surveillance radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Surveillance Radar Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Surveillance Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Surveillance Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Surveillance Radar Market Forecast, 2025-2035

- Figure 2: Global Surveillance Radar Market Forecast, By Region, 2025-2035

- Figure 3: Global Surveillance Radar Market Forecast, By Platform, 2025-2035

- Figure 4: Global Surveillance Radar Market Forecast, By Application, 2025-2035

- Figure 5: North America, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 6: Europe, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 8: APAC, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 9: South America, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 10: United States, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 11: United States, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 12: Canada, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 14: Italy, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 16: France, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 17: France, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 18: Germany, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 24: Spain, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 30: Australia, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 32: India, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 33: India, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 34: China, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 35: China, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 40: Japan, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Surveillance Radar Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Surveillance Radar Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Surveillance Radar Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Surveillance Radar Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Surveillance Radar Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Surveillance Radar Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Surveillance Radar Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Surveillance Radar Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Surveillance Radar Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Surveillance Radar Market, By Region, 2025-2035

- Figure 58: Scenario 1, Surveillance Radar Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Surveillance Radar Market, By Application, 2025-2035

- Figure 60: Scenario 2, Surveillance Radar Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Surveillance Radar Market, By Region, 2025-2035

- Figure 62: Scenario 2, Surveillance Radar Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Surveillance Radar Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Surveillance Radar Market, 2025-2035