PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820809

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820809

Global SATCOM Market 2025-2035

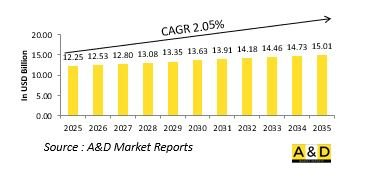

The global SATCOM market is estimated at USD 12.25 billion in 2025, projected to grow to USD 15.01 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.05% over the forecast period 2025-2035.

Introduction to Global SATCOM market:

The defense satellite communication (SATCOM) market plays a critical role in enabling secure, reliable, and global connectivity for military operations across land, sea, air, and space domains. It forms the backbone of modern defense communication networks, supporting real-time command and control, intelligence sharing, surveillance, reconnaissance, and mission-critical decision-making. As armed forces increasingly operate in geographically dispersed and contested environments, the need for uninterrupted, encrypted, and high-bandwidth communication links has become essential. Defense SATCOM systems bridge gaps in terrestrial networks, ensuring seamless communication in remote or hostile regions where conventional infrastructure is unavailable. They also support interoperability among allied forces during joint missions and coalition operations. With growing emphasis on multi-domain operations, space-based communication assets are being integrated with terrestrial and airborne systems to deliver comprehensive situational awareness and enhance mission effectiveness. As global security threats evolve, defense agencies are prioritizing the modernization of SATCOM capabilities, investing in advanced satellite constellations, resilient ground infrastructure, and flexible payload technologies. This continuous evolution underscores SATCOM's role as a strategic enabler of defense readiness, shaping the future of military communication architectures and reinforcing its importance in maintaining operational superiority across complex and dynamic battlefields.

Technology Impact in SATCOM Market:

Technological advancements are profoundly reshaping the defense SATCOM market, transforming how military forces communicate, coordinate, and execute missions. The transition from traditional geostationary satellites to more agile, high-capacity, and resilient constellations in low and medium Earth orbits has significantly improved latency, coverage, and throughput. Innovations in software-defined payloads and flexible transponders allow defense networks to dynamically reconfigure communication channels and allocate bandwidth based on mission priorities. The integration of artificial intelligence and machine learning enhances network management, enabling predictive maintenance, autonomous traffic routing, and adaptive interference mitigation. Advancements in encryption and quantum communication are strengthening security protocols, ensuring the integrity and confidentiality of sensitive data even in contested electronic warfare environments. Additionally, the convergence of SATCOM with emerging technologies such as 5G, edge computing, and cloud-based command platforms is expanding the operational scope of military communications. These developments support data-heavy applications like real-time video intelligence, autonomous vehicle coordination, and network-centric warfare. Miniaturization and modular satellite designs are further reducing deployment times and costs while enhancing resilience through distributed architectures. Overall, technological innovation is enabling more agile, robust, and future-ready SATCOM systems that empower defense forces to maintain information dominance in increasingly complex operational theaters.

Key Drivers in SATCOM Market:

The defense SATCOM market is being propelled by a combination of strategic, technological, and operational imperatives. Rising geopolitical tensions and the need for superior situational awareness are driving defense forces to enhance secure communication capabilities that function seamlessly across global theaters. The increasing complexity of modern warfare, characterized by multi-domain operations and network-centric strategies, demands robust satellite communication systems to ensure real-time data exchange and coordinated decision-making. Expanding reliance on unmanned platforms, remote sensing, and autonomous systems further amplifies the need for resilient, high-bandwidth SATCOM networks. Additionally, the growing threat of cyberattacks and electronic warfare is pushing defense agencies to invest in advanced encryption, anti-jamming technologies, and protected communication architectures. Space militarization and the strategic importance of space assets are also motivating nations to develop indigenous satellite capabilities and reduce dependence on foreign infrastructure. Furthermore, the shift toward joint and coalition operations underscores the demand for interoperable communication frameworks that support multinational missions. Rising defense budgets, coupled with public-private collaborations, are accelerating research and deployment of next-generation satellite constellations. Together, these drivers are shaping a dynamic and rapidly evolving defense SATCOM landscape, where secure, flexible, and resilient communication networks are pivotal to mission success.

Regional Trends in SATCOM Market:

Regional dynamics in the defense SATCOM market are shaped by differing strategic priorities, technological capabilities, and defense modernization agendas. In North America, a strong focus on space dominance and multi-domain command networks is driving significant investments in next-generation satellite constellations and resilient communication architectures. Europe is prioritizing collaborative defense programs and secure communication systems to enhance interoperability among allied forces, particularly in response to evolving security challenges on its borders. The Asia-Pacific region is witnessing rapid growth, fueled by increasing defense expenditures, space infrastructure development, and the need for secure communication to support maritime surveillance and border security. Middle Eastern nations are also enhancing their SATCOM capabilities to strengthen regional defense cooperation and improve strategic communication in conflict-prone zones. In contrast, emerging economies in Latin America and Africa are gradually investing in SATCOM technologies to support peacekeeping, border monitoring, and disaster response missions. Across all regions, the emphasis is shifting toward sovereign satellite networks, secure data transmission, and resilience against electronic and kinetic threats. Collaborative initiatives, joint ventures, and commercial partnerships are further accelerating innovation, making defense SATCOM a central pillar of national security strategies worldwide.

Key SATCOM Program:

SES Space & Defense, a wholly owned subsidiary of SES, has secured a five-year Sustainment Tactical Network (STN) contract valued at USD 89.6 million to deliver commercial satellite communication (COMSATCOM) services to the U.S. Army. The agreement encompasses the provision of global commercial Ku-band geostationary (GEO) bandwidth and commercial teleport services, aimed at enhancing strategic long-haul network transport and base-support communications for Combat Service Support, Department of Defense (DoD) initiatives, and other U.S. government agencies.

With support from the Commercial Satellite Communications Office (CSCO), SES Space & Defense will deliver robust global connectivity through commercial teleport infrastructure and specialized equipment, enabling seamless COMSATCOM links. The service integrates with terrestrial network components to create a unified communication environment connecting teleports and Global Network Centers (GNC). This comprehensive solution is designed to reinforce the U.S. Army's communications framework, ensuring secure, resilient, and continuous connectivity to support mission-critical operations worldwide. Through this contract, SES Space & Defense continues to advance military communications capabilities, providing reliable satellite-based solutions that meet the evolving demands of defense networks and operational readiness across diverse and challenging environments.

Table of Contents

SATCOM Market Report Definition

SATCOM Market Segmentation

By Region

By Platform

By End - User

SATCOM Market Analysis for next 10 Years

The 10-year SATCOM Market analysis would give a detailed overview of SATCOM market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of SATCOM Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global SATCOM Market Forecast

The 10-year SATCOM market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional SATCOM Market Trends & Forecast

The regional SATCOM market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of SATCOM Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for SATCOM Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on SATCOM Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Component, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global SATCOM Market Forecast, 2025-2035

- Figure 2: Global SATCOM Market Forecast, By Region, 2025-2035

- Figure 3: Global SATCOM Market Forecast, By Platform, 2025-2035

- Figure 4: Global SATCOM Market Forecast, By Component, 2025-2035

- Figure 5: Global SATCOM Market Forecast, By Application, 2025-2035

- Figure 6: North America, SATCOM Market, Market Forecast, 2025-2035

- Figure 7: Europe, SATCOM Market, Market Forecast, 2025-2035

- Figure 8: Middle East, SATCOM Market, Market Forecast, 2025-2035

- Figure 9: APAC, SATCOM Market, Market Forecast, 2025-2035

- Figure 10: South America, SATCOM Market, Market Forecast, 2025-2035

- Figure 11: United States, SATCOM Market, Technology Maturation, 2025-2035

- Figure 12: United States, SATCOM Market, Market Forecast, 2025-2035

- Figure 13: Canada, SATCOM Market, Technology Maturation, 2025-2035

- Figure 14: Canada, SATCOM Market, Market Forecast, 2025-2035

- Figure 15: Italy, SATCOM Market, Technology Maturation, 2025-2035

- Figure 16: Italy, SATCOM Market, Market Forecast, 2025-2035

- Figure 17: France, SATCOM Market, Technology Maturation, 2025-2035

- Figure 18: France, SATCOM Market, Market Forecast, 2025-2035

- Figure 19: Germany, SATCOM Market, Technology Maturation, 2025-2035

- Figure 20: Germany, SATCOM Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, SATCOM Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, SATCOM Market, Market Forecast, 2025-2035

- Figure 23: Belgium, SATCOM Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, SATCOM Market, Market Forecast, 2025-2035

- Figure 25: Spain, SATCOM Market, Technology Maturation, 2025-2035

- Figure 26: Spain, SATCOM Market, Market Forecast, 2025-2035

- Figure 27: Sweden, SATCOM Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, SATCOM Market, Market Forecast, 2025-2035

- Figure 29: Brazil, SATCOM Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, SATCOM Market, Market Forecast, 2025-2035

- Figure 31: Australia, SATCOM Market, Technology Maturation, 2025-2035

- Figure 32: Australia, SATCOM Market, Market Forecast, 2025-2035

- Figure 33: India, SATCOM Market, Technology Maturation, 2025-2035

- Figure 34: India, SATCOM Market, Market Forecast, 2025-2035

- Figure 35: China, SATCOM Market, Technology Maturation, 2025-2035

- Figure 36: China, SATCOM Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, SATCOM Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, SATCOM Market, Market Forecast, 2025-2035

- Figure 39: South Korea, SATCOM Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, SATCOM Market, Market Forecast, 2025-2035

- Figure 41: Japan, SATCOM Market, Technology Maturation, 2025-2035

- Figure 42: Japan, SATCOM Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, SATCOM Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, SATCOM Market, Market Forecast, 2025-2035

- Figure 45: Singapore, SATCOM Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, SATCOM Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, SATCOM Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, SATCOM Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, SATCOM Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, SATCOM Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, SATCOM Market, By Platform (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, SATCOM Market, By Platform (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, SATCOM Market, By Component (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, SATCOM Market, By Component (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, SATCOM Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, SATCOM Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, SATCOM Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, SATCOM Market, Global Market, 2025-2035

- Figure 59: Scenario 1, SATCOM Market, Total Market, 2025-2035

- Figure 60: Scenario 1, SATCOM Market, By Region, 2025-2035

- Figure 61: Scenario 1, SATCOM Market, By Platform, 2025-2035

- Figure 62: Scenario 1, SATCOM Market, By Component, 2025-2035

- Figure 63: Scenario 1, SATCOM Market, By Application, 2025-2035

- Figure 64: Scenario 2, SATCOM Market, Total Market, 2025-2035

- Figure 65: Scenario 2, SATCOM Market, By Region, 2025-2035

- Figure 66: Scenario 2, SATCOM Market, By Platform, 2025-2035

- Figure 67: Scenario 2, SATCOM Market, By Component, 2025-2035

- Figure 68: Scenario 2, SATCOM Market, By Application, 2025-2035

- Figure 69: Company Benchmark, SATCOM Market, 2025-2035