PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820814

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820814

Global Shoulder Fired Missiles Market 2025-2035

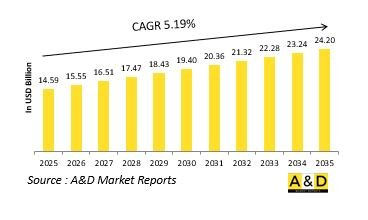

The Global Shoulder Fired Missiles market is estimated at USD 14.59 billion in 2025, projected to grow to USD 24.20 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.19% over the forecast period 2025-2035.

Introduction to Shoulder Fired Missiles Market:

The defense shoulder fired missiles market is a vital component of modern infantry and special operations capabilities, providing highly portable, easily deployable, and effective solutions for engaging aerial, armored, and fortified targets. These man-portable systems offer ground forces significant tactical flexibility, enabling rapid response to evolving threats without reliance on heavier, vehicle-mounted platforms. Their lightweight design, ease of use, and ability to be operated by a single soldier make them ideal for asymmetric warfare, counterinsurgency missions, and battlefield scenarios requiring mobility and stealth. Shoulder fired missiles are essential for neutralizing low-flying aircraft, helicopters, armored vehicles, and fortifications, often acting as force multipliers in close-combat environments. Their widespread adoption by defense forces reflects a growing emphasis on versatile, cost-effective, and easily transportable firepower solutions that enhance infantry lethality and operational reach. As modern conflicts become increasingly dynamic and decentralized, these systems are evolving to address a broader range of threats, integrating advanced guidance, targeting, and propulsion technologies. Their strategic importance continues to grow as militaries seek agile, high-impact weapon systems capable of providing decisive firepower in diverse operational theaters, from conventional battlefield engagements to irregular warfare and counterterrorism operations.

Technology Impact in Shoulder Fired Missiles Market:

Technological advancements are significantly enhancing the effectiveness, precision, and versatility of shoulder fired missiles, transforming them into sophisticated, multi-mission battlefield tools. Modern systems now incorporate advanced seeker technologies, such as infrared, laser, and imaging sensors, which enable accurate target acquisition and engagement even in adverse conditions or against moving targets. Improved guidance and homing algorithms enhance hit probability while reducing operator workload, allowing for fire-and-forget capabilities that increase survivability in combat. Lightweight composite materials and compact propulsion systems are improving range, speed, and portability without compromising destructive power. The integration of modular warhead options and multi-target engagement capabilities is expanding mission versatility, enabling a single platform to counter a variety of threats. Additionally, digital fire control systems and network-enabled targeting are enhancing coordination with other battlefield assets, improving situational awareness and engagement efficiency. Innovations in training simulators and augmented reality are further refining operator proficiency and mission readiness. As threats evolve, emerging technologies such as AI-assisted targeting and enhanced countermeasure resistance are being incorporated to maintain battlefield relevance. These technological advancements are elevating shoulder fired missiles from simple infantry weapons to highly capable systems that significantly enhance tactical effectiveness across a range of combat scenarios.

Key Drivers in Shoulder Fired Missiles Market:

The growth of the shoulder fired missiles market is driven by evolving combat requirements, shifting strategic priorities, and advances in weapon technology. The increasing prevalence of asymmetric warfare, insurgent activity, and urban combat environments has intensified the demand for lightweight, easily deployable anti-armor and anti-air solutions. Rising global tensions and modernization of ground forces are prompting militaries to enhance infantry firepower and close-range engagement capabilities. The need for cost-effective yet potent deterrents against aircraft, armored vehicles, and fortified positions is also a key factor fueling adoption. Additionally, the mobility and flexibility offered by man-portable systems make them highly suitable for rapid deployment forces, special operations units, and territorial defense missions. Defense modernization programs and the replacement of aging missile inventories are further driving procurement, as are joint development initiatives aimed at improving system range, precision, and multi-role performance. The growing threat from unmanned aerial systems has also highlighted the importance of portable air defense solutions. Furthermore, export demand from developing nations seeking affordable, versatile weaponry is expanding the market's reach. Collectively, these factors underscore the strategic importance of shoulder fired missiles as essential battlefield tools that enhance infantry effectiveness, operational flexibility, and mission success.

Regional Trends in Shoulder Fired Missiles Market:

Regional trends in the shoulder fired missiles market reflect diverse security needs, defense strategies, and modernization efforts across different parts of the world. North America remains a leader in developing and fielding advanced shoulder fired systems, focusing on enhancing range, precision, and countermeasure resistance to address evolving battlefield challenges. European nations are prioritizing the modernization of infantry capabilities and investing in new-generation systems to support rapid deployment forces and joint operations. In the Asia-Pacific region, rising territorial disputes, growing defense budgets, and the expansion of ground forces are fueling significant demand for portable missile systems. Middle Eastern countries are actively acquiring these weapons to counter aerial threats, improve border security, and strengthen capabilities against unconventional warfare tactics. In Latin America and Africa, procurement is gradually increasing as nations seek cost-effective solutions for internal security, counterinsurgency, and peacekeeping missions. Across all regions, there is a clear emphasis on multi-role capabilities, improved targeting technologies, and integration with networked battlefield systems. Additionally, international defense cooperation and technology transfer agreements are shaping procurement strategies and accelerating adoption. This widespread demand highlights the enduring strategic value of shoulder fired missiles in strengthening infantry lethality and providing rapid-response capabilities in diverse operational environments

Key Shoulder Fired Missiles Program:

The Indian Army is progressing with two initiatives worth over Rs 6,800 crore to develop Very Short Range Air Defence (V/SHORAD) systems indigenously, addressing a shortage of shoulder-fired missiles needed to counter aerial threats along the borders with China and Pakistan. The plan includes the production and procurement of more than 500 launchers and roughly 3,000 missiles through domestic manufacturers. Meanwhile, due to delays in replacing the outdated Igla-1M missiles, the Army and other stakeholders are considering revisiting a previous tender in which the Russian Igla-S had been selected.

Table of Contents

Shoulder Fired Missiles Market Report Definition

Shoulder Fired Missiles Market Segmentation

By Region

By Technology

By Range

Shoulder Fired Missiles Market Analysis for next 10 Years

The 10-year shoulder fired missiles market analysis would give a detailed overview of shoulder fired missiles market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Shoulder Fired Missiles Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Shoulder Fired Missiles Market Forecast

The 10-year shoulder fired missiles market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Shoulder Fired Missiles Market Trends & Forecast

The regional Shoulder Fired Missiles Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Shoulder Fired Missiles Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Shoulder Fired Missiles Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Shoulder Fired Missiles Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Range, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Range, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Component, 2025-2035

List of Figures

- Figure 1: Global Shoulder Fired Missiles Market Forecast, 2025-2035

- Figure 2: Global Shoulder Fired Missiles Market Forecast, By Region, 2025-2035

- Figure 3: Global Shoulder Fired Missiles Market Forecast, By Range, 2025-2035

- Figure 4: Global Shoulder Fired Missiles Market Forecast, By Component, 2025-2035

- Figure 5: North America, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 6: Europe, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 8: APAC, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 9: South America, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 10: United States, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 11: United States, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 12: Canada, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 14: Italy, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 16: France, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 17: France, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 18: Germany, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 24: Spain, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 30: Australia, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 32: India, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 33: India, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 34: China, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 35: China, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 40: Japan, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Shoulder Fired Missiles Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Shoulder Fired Missiles Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Shoulder Fired Missiles Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Shoulder Fired Missiles Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Shoulder Fired Missiles Market, By Range (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Shoulder Fired Missiles Market, By Range (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Shoulder Fired Missiles Market, By Component (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Shoulder Fired Missiles Market, By Component (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Shoulder Fired Missiles Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Shoulder Fired Missiles Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Shoulder Fired Missiles Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Shoulder Fired Missiles Market, By Region, 2025-2035

- Figure 58: Scenario 1, Shoulder Fired Missiles Market, By Range, 2025-2035

- Figure 59: Scenario 1, Shoulder Fired Missiles Market, By Component, 2025-2035

- Figure 60: Scenario 2, Shoulder Fired Missiles Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Shoulder Fired Missiles Market, By Region, 2025-2035

- Figure 62: Scenario 2, Shoulder Fired Missiles Market, By Range, 2025-2035

- Figure 63: Scenario 2, Shoulder Fired Missiles Market, By Component, 2025-2035

- Figure 64: Company Benchmark, Shoulder Fired Missiles Market, 2025-2035