PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1831820

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1831820

Global Personal Protective Equipment Market 2025-2035

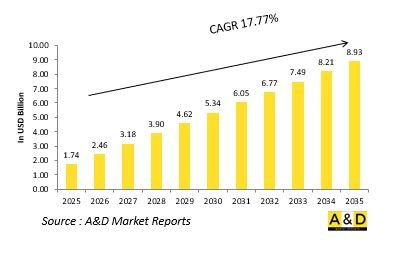

The Global Personal Protective Equipment market is estimated at USD 1.74 billion in 2025, projected to grow to USD 8.93 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 17.77% over the forecast period 2025-2035.

Introduction to Personal Protective Equipment Market:

The defense personal protective equipment (PPE) market plays a critical role in safeguarding military personnel from a wide range of threats on the battlefield and in hostile environments. This market encompasses a broad spectrum of protective solutions, including body armor, helmets, ballistic eyewear, chemical-biological protective suits, blast-resistant clothing, and advanced combat gear. The primary objective of defense PPE is to enhance soldier survivability while maintaining mobility, comfort, and operational effectiveness. As modern warfare evolves to include asymmetric threats, urban combat, and chemical or biological risks, the demand for advanced, multifunctional protective equipment is increasing. Defense forces are seeking PPE that not only shields against kinetic and environmental hazards but also integrates seamlessly with communication devices, sensors, and wearable systems. Moreover, modern protective solutions are being designed to address a variety of mission-specific requirements, from counter-terrorism operations and peacekeeping missions to high-intensity combat scenarios. As a result, the defense PPE market is transitioning from conventional protective gear to technologically advanced, modular systems that support a more agile and resilient fighting force, ultimately contributing to enhanced mission success and soldier safety in complex operational theaters.

Technology Impact in Personal Protective Equipment Market:

Technological innovation is significantly shaping the future of the defense PPE market by enhancing protection, comfort, and functionality. Advances in lightweight composite materials and high-performance fibers are enabling the development of gear that offers superior ballistic resistance without adding excessive weight, thereby improving soldier endurance and maneuverability. Smart textiles and wearable technologies are introducing capabilities such as temperature regulation, biometric monitoring, and chemical detection directly into protective gear. Integration with digital communication systems and heads-up displays is also transforming helmets and eyewear into multi-functional platforms that enhance situational awareness and battlefield connectivity. Emerging nanomaterials and adaptive armor technologies are providing dynamic protection that can respond to varying threat levels, while modular designs allow for customization based on mission profiles. Additionally, advances in chemical, biological, radiological, and nuclear (CBRN) defense technologies are improving protective suits and respiratory systems to shield personnel from non-conventional threats. Together, these innovations are not only enhancing survivability but also turning PPE into an active component of the soldier's operational toolkit, enabling them to operate more effectively, safely, and intelligently in increasingly complex and unpredictable combat environments.

Key Drivers in Personal Protective Equipment Market:

Several factors are driving the growth of the defense PPE market, primarily centered on the evolving nature of warfare and the heightened emphasis on soldier safety. The rise of asymmetric threats, including insurgencies, terrorism, and urban combat, has created a pressing need for advanced protective solutions that can adapt to unpredictable environments. Additionally, the proliferation of chemical, biological, and radiological risks has pushed militaries to invest in comprehensive protective systems beyond conventional ballistic gear. Modernization programs focused on enhancing soldier lethality and survivability are further fueling demand for next-generation PPE that combines protection with integrated communications and situational awareness features. The increasing participation of armed forces in peacekeeping and humanitarian missions also necessitates versatile protective gear suitable for diverse operational contexts. Furthermore, heightened awareness of long-term soldier health and injury prevention is influencing procurement decisions, with a focus on ergonomics and reduced physical strain. Geopolitical tensions, rising defense budgets, and the push toward network-centric warfare are additional catalysts encouraging the adoption of advanced protective technologies. These drivers collectively underscore the strategic importance of PPE as a critical enabler of mission readiness and force protection in modern defense operations.

Regional Trends in Personal Protective Equipment Market:

Regional dynamics in the defense PPE market reflect diverse strategic priorities, threat perceptions, and technological capabilities. In North America, continuous investment in soldier modernization programs and extensive R&D activities drive innovation in advanced protective systems, with a strong focus on integrating digital technologies and modular capabilities. European countries are emphasizing interoperability and multi-mission adaptability, spurred by evolving security challenges and collaborative defense initiatives. The Asia-Pacific region is witnessing rapid market growth due to increased defense spending, border tensions, and modernization efforts aimed at equipping large standing armies with state-of-the-art protective gear. In the Middle East, demand is driven by regional conflicts, counter-terrorism operations, and the need for chemical and biological defense capabilities. Latin America and Africa, while smaller markets, are gradually investing in modern PPE to support peacekeeping, border security, and counterinsurgency missions. Across all regions, partnerships between defense agencies and private manufacturers are strengthening supply chains and accelerating innovation. Moreover, localized production and technology transfer initiatives are becoming increasingly important as nations seek self-reliance in defense equipment manufacturing. These regional trends highlight a global recognition of PPE as a fundamental component of military readiness and personnel safety in both conventional and unconventional warfare environments.

Key Personal Protective Equipment Program:

SMPP, an Indian defense equipment manufacturer, has secured two contracts from the Indian Army. Issued under Emergency Procurement 5 on June 22, 2025, the orders are for the supply of Bulletproof Jackets and Advanced Ballistic Helmets, with a combined value exceeding ₹300 crore (around $36.14 million USD). Under these agreements, SMPP is expected to deliver 27,700 bulletproof jackets and 11,700 Advanced Ballistic Helmets to the Indian Army.

Table of Contents

Personal Protective Equipment Market - Table of Contents

Personal Protective Equipment Market Report Definition

Personal Protective Equipment Market Segmentation

By Region

By Product

By End - User

Personal Protective Equipment Market Analysis for next 10 Years

The 10-year personal protective equipment market analysis would give a detailed overview of personal protective equipment growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Personal Protective Equipment Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Personal Protective Equipment Market Forecast

The 10-year personal protective equipment market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Personal Protective Equipment Market Trends & Forecast

The regional personal protective equipment trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Personal Protective Equipment Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Personal Protective Equipment Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Personal Protective Equipment Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Product, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Product, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Personal Protective Equipment Market Forecast, 2025-2035

- Figure 2: Global Personal Protective Equipment Market Forecast, By Region, 2025-2035

- Figure 3: Global Personal Protective Equipment Market Forecast, By Product, 2025-2035

- Figure 4: Global Personal Protective Equipment Market Forecast, By End User, 2025-2035

- Figure 5: North America, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 6: Europe, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 8: APAC, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 9: South America, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 10: United States, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 11: United States, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 12: Canada, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 14: Italy, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 16: France, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 17: France, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 18: Germany, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 24: Spain, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 30: Australia, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 32: India, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 33: India, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 34: China, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 35: China, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 40: Japan, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Personal Protective Equipment Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Personal Protective Equipment Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Personal Protective Equipment Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Personal Protective Equipment Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Personal Protective Equipment Market, By Product (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Personal Protective Equipment Market, By Product (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Personal Protective Equipment Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Personal Protective Equipment Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Personal Protective Equipment Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Personal Protective Equipment Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Personal Protective Equipment Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Personal Protective Equipment Market, By Region, 2025-2035

- Figure 58: Scenario 1, Personal Protective Equipment Market, By Product, 2025-2035

- Figure 59: Scenario 1, Personal Protective Equipment Market, By End User, 2025-2035

- Figure 60: Scenario 2, Personal Protective Equipment Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Personal Protective Equipment Market, By Region, 2025-2035

- Figure 62: Scenario 2, Personal Protective Equipment Market, By Product, 2025-2035

- Figure 63: Scenario 2, Personal Protective Equipment Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Personal Protective Equipment Market, 2025-2035