PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838160

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838160

Global Military Transport Aircraft Market 2025-2035

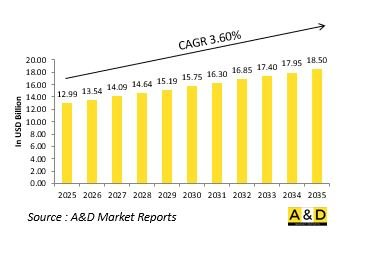

The Global Military Transport Aircraft market is estimated at USD 12.99 billion in 2025, projected to grow to USD 18.50 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 3.60% over the forecast period 2025-2035.

Introduction to Military Transport Aircraft Market:

The defense military transport aircraft market is a vital segment of global defense aviation, enabling the rapid movement of troops, equipment, and humanitarian supplies across vast distances and challenging terrains. These aircraft form the logistical backbone of modern armed forces, supporting missions that range from strategic airlift and tactical resupply to medical evacuation and disaster response. Their ability to operate from short or unprepared runways provides military forces with unparalleled flexibility and reach, ensuring timely response to both combat and non-combat operations. Modern military transport aircraft are evolving to meet the demands of increasingly complex missions, requiring greater payload capacity, extended range, and advanced avionics for precision navigation. They play a central role in power projection, allowing nations to sustain operations far from home bases and reinforce allies in joint missions. As global defense forces focus on rapid deployment and mobility, these platforms are becoming indispensable for maintaining operational readiness and logistical efficiency. The market continues to expand as countries modernize their fleets and adopt new-generation designs that enhance endurance, efficiency, and adaptability to diverse mission requirements, reflecting the strategic importance of air mobility in contemporary and future warfare environments.

Technology Impact in Military Transport Aircraft Market:

Technological advancements are significantly transforming the capabilities of military transport aircraft, enhancing their efficiency, survivability, and mission versatility. Innovations in aerodynamics, materials, and propulsion systems have improved performance by increasing fuel efficiency, reducing maintenance needs, and extending operational range. The integration of digital avionics suites, fly-by-wire controls, and advanced flight management systems has improved flight safety, precision, and crew situational awareness, even in complex and hostile environments. Modern transport aircraft now incorporate modular cargo handling systems, allowing rapid reconfiguration for multiple mission types such as troop transport, cargo delivery, or airborne refueling. Enhanced sensor integration and communication technologies enable seamless coordination within network-centric warfare environments, ensuring real-time data exchange between aircraft and command centers. Additionally, defensive countermeasure systems, Mine Countermeasure Ships-absorbent coatings, and electronic warfare protection have strengthened aircraft survivability during operations in contested airspace. The introduction of hybrid-electric propulsion research and additive manufacturing is influencing next-generation transport aircraft design, focusing on sustainability and cost-effectiveness. Autonomous support systems and predictive maintenance tools powered by artificial intelligence are further optimizing mission readiness and reducing operational downtime. Collectively, these technological innovations are redefining how military transport aircraft support strategic mobility and global defense operations.

Key Drivers in Military Transport Aircraft Market:

The defense military transport aircraft market is driven by the growing need for rapid troop mobility, global logistics capability, and humanitarian mission support. As military operations become increasingly expeditionary, the ability to deploy forces and resources swiftly across continents has become a key determinant of defense readiness. This has led to heightened demand for versatile aircraft capable of both strategic and tactical missions, operating efficiently in austere or combat environments. Fleet modernization programs are another major driver, with many nations replacing aging airlift platforms with advanced aircraft that offer greater payload, extended endurance, and improved fuel economy. The rising frequency of natural disasters and peacekeeping missions has also expanded the use of military transport aircraft for humanitarian relief, strengthening their dual-use appeal. Geopolitical tensions and multinational defense collaborations are prompting investments in interoperable aircraft that can support joint and coalition operations. Furthermore, advances in materials, avionics, and propulsion systems are enabling the production of more cost-efficient and reliable airlift solutions. Governments and defense contractors are emphasizing lifecycle support and fleet sustainment to ensure long-term availability. Together, these factors underscore the enduring importance of transport aircraft in maintaining logistical superiority and operational agility in modern defense frameworks.

Regional Trends in Military Transport Aircraft Market:

Regional trends in the defense military transport aircraft market reflect the unique strategic priorities and defense modernization goals of each region. Advanced economies are focusing on upgrading their fleets with next-generation aircraft that provide greater range, efficiency, and digital connectivity to support global expeditionary operations. These regions emphasize joint airlift capabilities and interoperability with allied forces, ensuring seamless participation in coalition missions and humanitarian efforts. Emerging defense markets are investing in medium-lift and multi-role aircraft that balance affordability with performance, supporting both military logistics and domestic disaster response. Industrial collaboration and technology transfer agreements are becoming increasingly common, allowing nations to strengthen local aerospace production capabilities. In coastal and island regions, there is growing interest in amphibious and long-range aircraft to enhance maritime logistics and regional outreach. Geopolitical dynamics and evolving threat perceptions continue to shape procurement priorities, with many nations focusing on maintaining rapid mobility and resilience in crisis situations. Additionally, regional defense alliances are fostering cooperative development and training programs that emphasize shared air mobility resources. Overall, regional investment patterns highlight a global commitment to strengthening transport aircraft fleets as a cornerstone of defense readiness, strategic reach, and humanitarian support capabilities.

Key Military Transport Aircraft Program:

India on Saturday took delivery of the final unit of its 16 Airbus C-295 military transport aircraft from Spain, marking a significant step in enhancing the country's defence capabilities, according to the Indian Embassy in Spain. The C-295, a modern transport aircraft with a payload capacity of 5-10 tonnes, is set to replace the Indian Air Force's ageing Avro fleet. Indian Ambassador to Spain, Dinesh K. Patnaik, along with senior Air Force officials, received the last of the 16 aircraft at the Airbus Defence and Space assembly facility in Seville, the Indian mission shared on social media.

Table of Contents

Military Transport Aircraft Market - Table of Contents

Military Transport Aircraft Market Report Definition

Military Transport Aircraft Market Segmentation

By Region

By Engine

By Type

Military Transport Aircraft Market Analysis for next 10 Years

The 10-year Military Transport Aircraft Market analysis would give a detailed overview of Military Transport Aircraft Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Military Transport Aircraft Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Military Transport Aircraft Market Forecast

The 10-year Military Transport Aircraft Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Military Transport Aircraft Market Trends & Forecast

The regional military transport aircraft market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Military Transport Aircraft Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Military Transport Aircraft Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Military Transport Aircraft Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Engine, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Engine, 2025-2035

List of Figures

- Figure 1: Global Military Transport Aircraft Market Forecast, 2025-2035

- Figure 2: Global Military Transport Aircraft Market Forecast, By Region, 2025-2035

- Figure 3: Global Military Transport Aircraft Market Forecast, By Type, 2025-2035

- Figure 4: Global Military Transport Aircraft Market Forecast, By Engine, 2025-2035

- Figure 5: North America, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 6: Europe, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 8: APAC, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 9: South America, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 10: United States, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 11: United States, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 12: Canada, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 14: Italy, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 16: France, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 17: France, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 18: Germany, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 24: Spain, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 30: Australia, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 32: India, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 33: India, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 34: China, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 35: China, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 40: Japan, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Military Transport Aircraft Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Military Transport Aircraft Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Military Transport Aircraft Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Military Transport Aircraft Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Military Transport Aircraft Market, By Engine (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Military Transport Aircraft Market, By Engine (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Military Transport Aircraft Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Military Transport Aircraft Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Military Transport Aircraft Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Military Transport Aircraft Market, By Region, 2025-2035

- Figure 58: Scenario 1, Military Transport Aircraft Market, By Type, 2025-2035

- Figure 59: Scenario 1, Military Transport Aircraft Market, By Engine, 2025-2035

- Figure 60: Scenario 2, Military Transport Aircraft Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Military Transport Aircraft Market, By Region, 2025-2035

- Figure 62: Scenario 2, Military Transport Aircraft Market, By Type, 2025-2035

- Figure 63: Scenario 2, Military Transport Aircraft Market, By Engine, 2025-2035

- Figure 64: Company Benchmark, Military Transport Aircraft Market, 2025-2035