PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1858533

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1858533

Global Infantry Fighting Vehicles Market 2025-2035

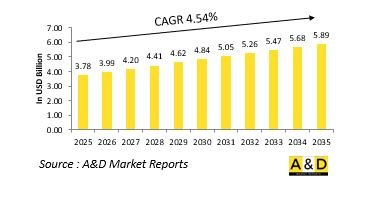

The Global Infantry Fighting Vehicles market is estimated at USD 3.78 billion in 2025, projected to grow to USD 5.89 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 4.54% over the forecast period 2025-2035.

Introduction to Infantry Fighting Vehicles Market:

The defense Infantry Fighting Vehicles (IFV) market represents a critical component of modern ground combat operations, combining mobility, protection, and firepower to support mechanized infantry units. IFVs are designed to transport soldiers safely across diverse terrains while engaging enemy forces through integrated weapon systems. Their ability to operate alongside main battle tanks and provide direct fire support makes them indispensable in both offensive and defensive missions. The market is experiencing a shift toward modular and adaptable vehicle designs capable of meeting multi-domain operational demands. As armed forces modernize their land warfare capabilities, IFVs are increasingly equipped with advanced electronics, active protection systems, and enhanced situational awareness tools. These developments position IFVs as key assets in achieving tactical superiority and operational flexibility in contemporary battlefields.

Technology Impact in Infantry Fighting Vehicles Market:

Technological innovation is reshaping the capabilities and effectiveness of infantry fighting vehicles. Advances in armor materials, such as composite and reactive systems, have significantly improved survivability without compromising mobility. Digital integration enables real-time situational awareness through networked sensors, communication systems, and battlefield management interfaces. The adoption of hybrid propulsion and electric drive technologies enhances fuel efficiency, stealth, and maneuverability. Automation and AI-based threat detection systems are being incorporated to assist crews in decision-making under high-pressure combat conditions. Weapon systems have also evolved, featuring remote-controlled turrets, advanced targeting optics, and programmable ammunition. Additionally, modular architecture allows for quick adaptation of mission-specific payloads. These technological enhancements collectively transform IFVs into intelligent, networked platforms that operate seamlessly within integrated land combat ecosystems.

Key Drivers in Infantry Fighting Vehicles market:

The rising complexity of land warfare and the need for flexible, survivable ground platforms are major forces driving the IFV market. Armed forces are prioritizing vehicle modernization to counter evolving threats such as anti-tank guided missiles and drone-based attacks. The growing emphasis on troop safety, rapid mobility, and interoperability across joint operations fuels demand for next-generation IFVs. Ongoing military modernization programs and replacement cycles for legacy armored fleets are further accelerating procurement. Geopolitical tensions and urban warfare trends have increased the need for vehicles capable of operating in confined environments while maintaining high levels of protection and firepower. Moreover, the integration of digital command networks and advanced communication systems aligns with broader defense digitization goals. These factors collectively sustain robust investment in the IFV segment across global defense markets.

Regional Trends in Infantry Fighting Vehicles Market:

Regional dynamics in the IFV market are influenced by security challenges, industrial capacities, and strategic defense objectives. In North America, modernization programs focus on developing next-generation IFVs with enhanced survivability and network-centric capabilities. European nations are emphasizing collaborative vehicle development and production to ensure interoperability within joint forces while reducing procurement costs. The Asia-Pacific region is witnessing significant growth, driven by territorial disputes, modernization of armored fleets, and rising defense budgets. Middle Eastern countries are investing in heavily protected IFVs suited for desert and urban combat scenarios, often integrating imported systems with local manufacturing. Emerging economies in Latin America and Africa are exploring cost-effective solutions and partnerships to upgrade their mechanized infantry capabilities. Overall, each region's approach reflects its unique balance between indigenous production, technological advancement, and operational priorities in land warfare modernization.

Key Defense Infantry Fighting Vehicles Program:

The European defense organization OCCAR (Organisation Conjointe de Cooperation en Matiere d'Armement) has awarded a contract to Artec GmbH for the delivery of 222 Schakal infantry fighting vehicles to the armed forces of Germany and the Netherlands. The Schakal combines the Boxer wheeled armoured vehicle chassis with the turret of the Puma tracked infantry fighting vehicle. Artec GmbH, a joint venture between Rheinmetall and KNDS Germany, serves as the main contractor. Under the agreement, 150 vehicles will go to Germany and 72 to the Netherlands.

The combined order is valued at approximately €4.7 billion, with Rheinmetall's share totaling about €3.4 billion. The contract also includes a comprehensive logistics package, covering spare parts, training materials, and specialized tools. In addition, it provides for optional enhancements such as protection against anti-tank weapons, attack detection and identification systems, and counter-drone measures. The agreement further includes an option for up to 248 additional vehicles.

Table of Contents

Infantry Fighting Vehicles Market - Table of Contents

Infantry Fighting Vehicles Market Report Definition

Infantry Fighting Vehicles Market Segmentation

By Configuration

By Region

By Type

Infantry Fighting Vehicles Market Analysis for next 10 Years

The 10-year infantry fighting vehicles market analysis would give a detailed overview of infantry fighting vehicles market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Infantry Fighting Vehicles Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Infantry Fighting Vehicles Market Forecast

The 10-year infantry fighting vehicles market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Infantry Fighting Vehicles Market Trends & Forecast

The regional infantry fighting vehicles market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Infantry Fighting Vehicles Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Infantry Fighting Vehicles Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Infantry Fighting Vehicles Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Configuration, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Configuration, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Infantry Fighting Vehicles Market Forecast, 2025-2035

- Figure 2: Global Infantry Fighting Vehicles Market Forecast, By Region, 2025-2035

- Figure 3: Global Infantry Fighting Vehicles Market Forecast, By Configuration, 2025-2035

- Figure 4: Global Infantry Fighting Vehicles Market Forecast, By Type, 2025-2035

- Figure 5: North America, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 6: Europe, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 8: APAC, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 9: South America, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 10: United States, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 11: United States, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 12: Canada, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 14: Italy, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 16: France, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 17: France, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 18: Germany, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 24: Spain, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 30: Australia, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 32: India, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 33: India, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 34: China, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 35: China, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 40: Japan, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Infantry Fighting Vehicles Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Infantry Fighting Vehicles Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Infantry Fighting Vehicles Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Infantry Fighting Vehicles Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Infantry Fighting Vehicles Market, By Configuration (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Infantry Fighting Vehicles Market, By Configuration (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Infantry Fighting Vehicles Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Infantry Fighting Vehicles Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Infantry Fighting Vehicles Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Infantry Fighting Vehicles Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Infantry Fighting Vehicles Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Infantry Fighting Vehicles Market, By Region, 2025-2035

- Figure 58: Scenario 1, Infantry Fighting Vehicles Market, By Configuration, 2025-2035

- Figure 59: Scenario 1, Infantry Fighting Vehicles Market, By Type, 2025-2035

- Figure 60: Scenario 2, Infantry Fighting Vehicles Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Infantry Fighting Vehicles Market, By Region, 2025-2035

- Figure 62: Scenario 2, Infantry Fighting Vehicles Market, By Configuration, 2025-2035

- Figure 63: Scenario 2, Infantry Fighting Vehicles Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Infantry Fighting Vehicles Market, 2025-2035