PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1858539

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1858539

Global Laser Range Finder and Designator Market 2025-2035

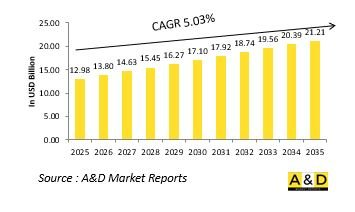

The Global Laser Range Finder and Designator market is estimated at USD 12.98 billion in 2025, projected to grow to USD 21.21 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.03% over the forecast period 2025-2035.

Introduction to Laser Range Finder and Designator Market:

The defense laser range finder and designator market is an integral component of modern targeting, reconnaissance, and fire-control systems. These devices provide precise distance measurement and target illumination capabilities, enabling enhanced accuracy in artillery, armored vehicles, aircraft, and infantry operations. Laser range finders determine exact target distances, while laser designators mark targets for guided munitions and precision strikes. Together, they significantly improve situational awareness, reduce targeting errors, and optimize mission success rates. Defense forces increasingly rely on these systems for surveillance, target tracking, and coordination between air and ground units. As warfare shifts toward precision engagement and network-centric operations, the demand for lightweight, rugged, and high-performance laser range finders and designators continues to rise across all major defense domains.

Technology Impact in Laser Range Finder and Designator Market:

Technological innovation is rapidly advancing the performance, integration, and reliability of laser range finders and designators. Miniaturization and the use of advanced optics have made systems more portable and energy efficient without compromising accuracy. Integration with digital targeting systems and night-vision devices enhances operational flexibility under all conditions. The adoption of eye-safe laser technologies allows safer use across diverse operational environments. Improvements in laser wavelength control, beam stabilization, and atmospheric compensation ensure precision even under challenging weather or terrain conditions. The fusion of range finding with AI-based target recognition and augmented reality interfaces further enhances real-time battlefield awareness. Additionally, integration into unmanned aerial and ground platforms expands their tactical utility. These technological developments collectively reinforce the role of laser range finders and designators as indispensable tools in precision warfare.

Key Drivers in Laser Range Finder and Designator Market:

The growing emphasis on precision engagement and rapid target acquisition is a primary driver of the laser range finder and designator market. Modern combat operations demand systems that enhance accuracy and minimize collateral damage, driving adoption across air, land, and naval platforms. Increased use of guided munitions and smart weapons necessitates reliable target designation equipment to ensure mission success. The shift toward networked and multi-domain warfare also fuels demand for interoperable and data-linked systems that can seamlessly connect with command and control networks. Additionally, the need for compact, soldier-portable systems supports investment in miniaturized and lightweight designs. Rising defense modernization initiatives and continuous upgrades of fire-control systems further stimulate market growth. Together, these drivers underscore the strategic importance of laser-based range finding and target designation technologies in contemporary defense operations.

Regional Trends in Laser Range Finder and Designator Market:

Regional developments in the defense laser range finder and designator market reflect distinct operational needs and modernization priorities. North America leads in advanced development and integration, focusing on multi-platform systems compatible with smart weapons and autonomous assets. European nations emphasize joint research programs to enhance precision engagement and improve interoperability within allied forces. The Asia-Pacific region is experiencing significant expansion driven by modernization of ground and air forces and the growing demand for indigenous targeting technologies. Middle Eastern defense forces are increasingly adopting these systems to improve accuracy in surveillance and strike missions under challenging environmental conditions. Emerging markets in Latin America and Africa are focusing on portable, cost-effective solutions for border security and counterinsurgency operations. Globally, the trend points toward smarter, lighter, and more connected laser targeting systems shaping future battlefield efficiency.

Key Laser Range Finder and Designator Program:

Northrop Grumman Corporation's Laser Systems division in Apopka, Florida, has been awarded a $599 million contract to supply the U.S. Army with Lightweight Laser Designator Rangefinders (LLDR).

The LLDR system assists forward observers by precisely marking enemy targets with a laser sensor that functions effectively day or night, and in challenging battlefield conditions such as haze, smoke, fog, or rain.

This advanced targeting system can identify targets, determine their range using an eye-safe laser, and calculate their coordinates for use with smart or laser-guided munitions. It also integrates seamlessly with digital battlefield networks, ensuring accurate target data is shared across other military systems.

Table of Contents

Laser Range Finder and Designator Market - Table of Contents

Laser Range Finder and Designator Market Report Definition

Laser Range Finder and Designator Market Segmentation

By Region

By Type

By End User

Laser Range Finder and Designator Market Analysis for next 10 Years

The 10-year laser range finder and designator market analysis would give a detailed overview of laser range finder and designator market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Laser Range Finder and Laser Designator Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Laser Range Finder and Laser Designator Market Forecast

The 10-year laser range finder and designator market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Laser Range Finder and Laser Designator Market Trends & Forecast

The regional laser range finder and designator market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Laser Range Finder and Laser Designator Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Laser Range Finder and Laser Designator Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Laser Range Finder and Laser Designator Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Laser Range Finder and Designator Market Forecast, 2025-2035

- Figure 2: Global Laser Range Finder and Designator Market Forecast, By Region, 2025-2035

- Figure 3: Global Laser Range Finder and Designator Market Forecast, By End User, 2025-2035

- Figure 4: Global Laser Range Finder and Designator Market Forecast, By Type, 2025-2035

- Figure 5: North America, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 6: Europe, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 8: APAC, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 9: South America, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 10: United States, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 11: United States, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 12: Canada, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 14: Italy, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 16: France, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 17: France, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 18: Germany, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 24: Spain, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 30: Australia, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 32: India, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 33: India, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 34: China, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 35: China, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 40: Japan, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Laser Range Finder and Designator Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Laser Range Finder and Designator Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Laser Range Finder and Designator Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Laser Range Finder and Designator Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Laser Range Finder and Designator Market, By End User (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Laser Range Finder and Designator Market, By End User (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Laser Range Finder and Designator Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Laser Range Finder and Designator Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Laser Range Finder and Designator Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Laser Range Finder and Designator Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Laser Range Finder and Designator Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Laser Range Finder and Designator Market, By Region, 2025-2035

- Figure 58: Scenario 1, Laser Range Finder and Designator Market, By End User, 2025-2035

- Figure 59: Scenario 1, Laser Range Finder and Designator Market, By Type, 2025-2035

- Figure 60: Scenario 2, Laser Range Finder and Designator Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Laser Range Finder and Designator Market, By Region, 2025-2035

- Figure 62: Scenario 2, Laser Range Finder and Designator Market, By End User, 2025-2035

- Figure 63: Scenario 2, Laser Range Finder and Designator Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Laser Range Finder and Designator Market, 2025-2035