PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1896746

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1896746

Global Defense Support Equipment Market 2026-2036

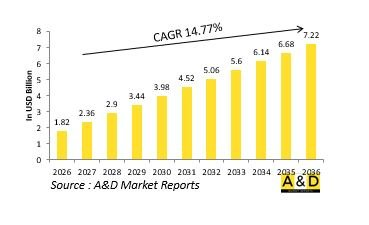

The Global Defense Support Equipment market is estimated at USD 1.82 billion in 2026, projected to grow to USD 7.22 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 14.77% over the forecast period 2026-2036.

Introduction to Defense Support Equipment Market

The defense support equipment market encompasses a wide range of systems, machinery, and tools designed to maintain, transport, and sustain military platforms and operations. It includes ground handling units, maintenance and repair systems, power supply units, transport vehicles, and logistics support tools critical to ensuring operational readiness. This market forms the backbone of defense infrastructure, enabling efficient deployment, repair, and upkeep of aircraft, land vehicles, naval vessels, and weapon systems. As defense forces modernize, the role of support equipment becomes increasingly vital in maintaining mission continuity and reducing downtime. The emphasis on rapid mobility, expeditionary operations, and multi-domain warfare has expanded the demand for modular, automated, and interoperable support systems. Defense agencies recognize that efficient support equipment enhances the lifecycle management of platforms and contributes significantly to mission success, making it a key focus in modernization and sustainment strategies.

Technology Impact in Defense Support Equipment Market:

Technology is redefining the defense support equipment market through automation, predictive maintenance, and digital integration. Advanced sensors and IoT-enabled systems now allow real-time monitoring of equipment health, improving reliability and reducing maintenance cycles. Artificial intelligence and data analytics are being applied to forecast component failures, streamline logistics, and optimize resource allocation. Additive manufacturing has introduced rapid prototyping and on-demand part production in field conditions, enhancing operational agility. Robotics and autonomous vehicles are transforming ground support operations, reducing manpower requirements and increasing precision in hazardous environments. Cloud-based maintenance management platforms provide centralized visibility over dispersed assets, ensuring coordinated support across theaters of operation. Additionally, sustainable technologies and energy-efficient systems are being integrated to align defense operations with environmental goals. These advancements are enabling smarter, more responsive support ecosystems that enhance mission efficiency and operational readiness.

Key Drivers in Defense Support Equipment Market:

The defense support equipment market is driven by the growing complexity of modern military systems, which require advanced maintenance and logistical support to remain combat-ready. Increasing global deployments and the need for rapid response capabilities have underscored the importance of mobile and easily deployable support solutions. Defense modernization programs emphasize equipment reliability, lifecycle management, and cost-effective sustainment, creating consistent demand for high-performance support infrastructure. The rising adoption of unmanned and next-generation platforms has further amplified the need for specialized testing, refueling, and diagnostic systems. Governments are prioritizing logistical efficiency as a strategic enabler, focusing on minimizing equipment downtime through digitalized and automated support systems. Additionally, the integration of joint and coalition operations has driven the need for standardized and interoperable support equipment. Together, these factors reinforce the market's importance in maintaining force readiness and ensuring operational superiority across diverse and challenging environments.

Regional Trends in Defense Support Equipment Market:

Regional trends in the defense support equipment market vary based on strategic priorities and defense infrastructure maturity. North America leads with strong investments in advanced logistics and maintenance automation supporting global defense operations. Europe focuses on interoperability and sustainability, upgrading its support equipment to align with NATO standards and environmental objectives. The Asia-Pacific region emphasizes rapid military expansion, investing heavily in indigenous production of maintenance and transport systems to support growing defense fleets. The Middle East prioritizes rugged and climate-resilient support systems tailored to harsh environments, while Latin America and Africa are gradually upgrading through partnerships and imported technologies. Across regions, there is an increasing focus on digital maintenance ecosystems, modular designs, and energy-efficient equipment. This global trend reflects the recognition that effective defense support infrastructure is as crucial as front-line assets in achieving sustained operational capability and strategic dominance.

Key Defense Support Equipment Program:

The BOM wagons and MMME systems will be built using equipment and sub-systems sourced from domestic manufacturers, supporting indigenous production and increasing private sector involvement in defence manufacturing in line with the Atmanirbhar Bharat initiative. Both contracts fall under the Indian Designed, Developed, and Manufactured (IDDM) category, reflecting the government's emphasis on promoting indigenous capabilities and encouraging private sector participation in defence production. Manufacturing of the BOM wagons and MMME Mark II will involve close collaboration with local manufacturers, further advancing the vision of self-reliance in defence. Designed by the Research Design and Standardization Organization (RDSO) under the Ministry of Defence, BOM wagons are specialised transport vehicles used by the Indian Army. They enable the rapid movement of lightweight vehicles, artillery guns, BMPs and engineering equipment from non-operational zones to active deployment areas. Their procurement will strengthen the armed forces' rapid mobilisation capabilities during conflict and ensure efficient transportation between stations during peacetime.

Table of Contents

Defense Support Equipment Market - Table of Contents

Defense Support Equipment Market Report Definition

Defense Support Equipment Market Segmentation

By Region

By Type

By Application

Defense Support Equipment Market Analysis for next 10 Years

The 10-year defense support equipment market analysis would give a detailed overview of defense support equipment market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Support Equipment Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Support Equipment Market Forecast

The 10-year defense support equipment market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Support Equipment Market Trends & Forecast

The regional defense support equipment market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Support Equipment Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Support Equipment Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Support Equipment Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Defense Support Equipment Forecast, 2025-2035

- Figure 2: Global Defense Support Equipment Forecast, By Region, 2025-2035

- Figure 3: Global Defense Support Equipment Forecast, By Type, 2025-2035

- Figure 4: Global Defense Support Equipment Forecast, By Application, 2025-2035

- Figure 5: North America, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 9: South America, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 10: United States, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 16: France, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 17: France, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 20: Netherlands, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 32: India, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 33: India, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 34: China, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 35: China, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Support Equipment, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Support Equipment, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Support Equipment, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Support Equipment, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Support Equipment, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Support Equipment, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Support Equipment, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Support Equipment, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Support Equipment, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Support Equipment, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Support Equipment, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Support Equipment, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Support Equipment, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Support Equipment, By Application, 2025-2035

- Figure 60: Scenario 2, Defense Support Equipment, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Support Equipment, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Support Equipment, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Support Equipment, By Application, 2025-2035

- Figure 64: Company Benchmark, Defense Support Equipment, 2025-2035