PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1904995

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1904995

Global Defense Cables and Harness Market 2026-2036

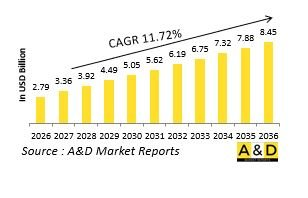

The Global Defense Cables and Harness market is estimated at USD 2.79 billion in 2026, projected to grow to USD 8.45 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 11.72% over the forecast period 2026-2036.

Introduction to Defense Cables and Harness Market:

The Global Defense Cables and Harness Market encompasses the specialized wiring systems that transmit power, data, and signals throughout military platforms, forming the nervous system that connects sensors, processors, displays, controls, and effectors. These are not commercial cables but engineered systems designed to withstand extreme temperatures, vibration, moisture, chemicals, electromagnetic interference, and physical abuse encountered in military operations. Harness assemblies organize hundreds of individual wires into bundled, protected configurations that can be efficiently installed and maintained in confined spaces. Applications span all defense domains-from aircraft and ground vehicles to ships and soldier systems-with requirements varying from mil-spec power transmission to high-speed data links for sensor networks. As platforms become more electrified and networked, the complexity, density, and criticality of cable and harness systems increase correspondingly, making them essential yet often overlooked components of defense capability.

Technology Impact in Defense Cables and Harness Market:

Technological advancement in defense cabling focuses on weight reduction, data capability, and durability. Fiber optic cables increasingly supplement or replace copper for high-bandwidth data transmission while offering immunity to electromagnetic interference and reduced weight. Advanced composite materials and nanotechnology coatings enhance cable protection while minimizing mass. Connector designs evolve toward higher density, quick-disconnect, and blind-mate capabilities for easier maintenance in confined spaces. Wireless intra-platform communication reduces some cabling requirements but introduces new challenges in security and reliability. Integrated health monitoring capabilities within cables detect incipient faults before they cause system failures. Automated harness fabrication using robotics improves consistency and reduces production time for complex configurations. These innovations address the competing demands for higher performance, increased reliability, and reduced lifecycle costs in platform electrical systems.

Key Drivers in Defense Cables and Harness Market:

Platform electrification trends-from more electric aircraft to electric combat vehicles-substantially increase power distribution requirements, driving development of higher-capacity cabling systems. The proliferation of sensors and effectors on modern platforms creates exponential growth in data transmission needs, necessitating both higher bandwidth and more robust electromagnetic protection. Weight reduction imperatives across all mobile platforms favor advanced materials and optimization of harness routing and configuration. Maintenance efficiency requirements drive designs that facilitate easier inspection, testing, and replacement without extensive platform disassembly. Obsolescence management for legacy platforms creates sustained demand for reproduction of discontinued cable types and connector designs. Additionally, harsh environment operation-from desert heat to shipboard salt spray-mandates continuous improvement in protective materials and sealing technologies to ensure long-term reliability despite extreme conditions.

Regional Trends in Defense Cables and Harness Market:

Regional cable and harness capabilities often align with indigenous platform manufacturing capacity and military-industrial ecosystems. North America maintains extensive specialized suppliers integrated with prime contractor supply chains for major programs. European industry shows particular strength in aerospace applications, with multinational suppliers serving both civil and military aircraft markets. The Asia-Pacific region demonstrates growing capability, particularly in countries with developing indigenous platform programs that require complete supply chain development. Israeli industry excels in specialized applications for upgraded legacy systems and unique platform configurations. Middle Eastern nations increasingly seek localized maintenance and repair capabilities for cable systems to reduce turnaround times for platform servicing. Global standardization initiatives compete with proprietary approaches, with different platform types and customer preferences driving varied adoption patterns across regions and applications.

Key Defense Cables and Harness Program:

Reliance Defence & Engineering's June 2025 joint venture with U.S.-based Coastal Mechanics Inc. at MIHAN, Nagpur, secures MRO and upgrade contracts for land systems wiring harnesses and cables, starting with L-70 40mm air defense guns. The 10-year deal, worth multi-crore annually, modernizes electrical harnesses for reliability in harsh terrains, reducing downtime by 30%. It includes indigenous cable production using MIL-SPEC standards, integrating with Army's 100k+ vehicle fleet predictive maintenance AI pilots. This offsets import dependency, creates 500 jobs, and extends to BMP-II infantry vehicles. Phased rollout covers 500+ L-70 units by 2027, boosting layered air defense amid LAC tensions.

Table of Contents

Defense Cables and Harness Market Report Definition

Defense Cables and Harness Market Segmentation

By Region

By Platform

By Type

Defense Cables and Harness Market Analysis for next 10 Years

The 10-year defense cables and harness market analysis would give a detailed overview of defense cables and harness market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Cables and Harness Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Cables and Harness Market Forecast

The 10-year defense cables and harness market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Cables and Harness Market Trends & Forecast

The regional defense cables and harness market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Cables and Harness Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Cables and Harness Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Cables and Harness Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Defense Cables and Harness Market Forecast, 2025-2035

- Figure 2: Global Defense Cables and Harness Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Cables and Harness Market Forecast, By Type, 2025-2035

- Figure 4: Global Defense Cables and Harness Market Forecast, By Platform, 2025-2035

- Figure 5: North America, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Cables and Harness Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Cables and Harness Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Cables and Harness Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Cables and Harness Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Cables and Harness Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Cables and Harness Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Cables and Harness Market, By Platform (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Cables and Harness Market, By Platform (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Cables and Harness Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Cables and Harness Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Cables and Harness Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Cables and Harness Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Cables and Harness Market, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Cables and Harness Market, By Platform, 2025-2035

- Figure 60: Scenario 2, Defense Cables and Harness Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Cables and Harness Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Cables and Harness Market, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Cables and Harness Market, By Platform, 2025-2035

- Figure 64: Company Benchmark, Defense Cables and Harness Market, 2025-2035