PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1904996

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1904996

Global Defense Composites Market 2026-2036

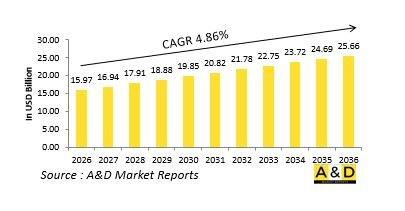

The Global Defense Composites market is estimated at USD 15.97 billion in 2026, projected to grow to USD 25.66 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.86% over the forecast period 2026-2036.

Introduction to Defense Composites Market

The Global Defense Composites Market encompasses engineered materials created by combining two or more constituent materials with significantly different physical or chemical properties to produce a material with characteristics different from the individual components. In defense applications, these typically involve reinforcing fibers-such as carbon, glass, or aramid-embedded in polymer, metal, or ceramic matrices. Composites deliver exceptional strength-to-weight ratios, corrosion resistance, radar transparency, and design flexibility compared to traditional materials like aluminum and steel. Applications span all military domains: aircraft structures, unmanned systems, vehicle armor, naval vessels, missile components, and personal protective equipment. The ability to tailor material properties through fiber orientation, layer sequencing, and resin formulation enables optimization for specific requirements-whether for stealth characteristics, ballistic protection, or extreme environment durability. As defense platforms pursue greater performance within strict weight constraints, composites have transitioned from specialized applications to fundamental materials influencing overall platform design and capability.

Technology Impact in Defense Composites Market:

Technological evolution in defense composites focuses on manufacturing efficiency, performance enhancement, and multifunctionality. Automated fiber placement and tape laying machines enable precise, repeatable fabrication of large complex structures with reduced labor content. Out-of-autoclave curing processes lower production costs while maintaining material properties. Nanotechnology enhancements-including carbon nanotubes and graphene additives-improve mechanical properties, electrical conductivity, and damage tolerance. Multifunctional composites incorporate embedded sensors for structural health monitoring, conductive traces for electromagnetic shielding, or phase-change materials for thermal management. Recyclable and bio-based resin systems address environmental concerns and lifecycle sustainability. Digital twin technology optimizes composite design and predicts performance throughout the service life. These advancements expand composite applications while improving affordability and reliability in demanding defense environments.

Key Drivers in Defense Composites Market:

The relentless pursuit of weight reduction across all mobile defense platforms to increase payload, range, and fuel efficiency drives continuous composite adoption and advancement. Stealth requirements for low observable platforms favor composites for their radar-absorbing and shaping capabilities. Armor applications benefit from composites' ability to provide ballistic protection at reduced weight compared to metallic alternatives. Corrosion resistance advantages reduce maintenance costs and increase availability for naval and coastal-deployed systems. Design flexibility enables integrated structures that combine multiple components into single composite parts, reducing assembly complexity. Unmanned system proliferation creates demand for cost-optimized composite solutions that balance performance and affordability for potentially expendable platforms. Additionally, supply chain security concerns encourage development of domestic composite material sources and processing capabilities in strategically important regions.

Regional Trends in Defense Composites Market:

Regional composite capabilities reflect differing industrial priorities, platform programs, and material science expertise. North American industry leads in advanced aerospace applications, particularly for combat aircraft and stealth platforms. European development emphasizes automotive-derived technologies for armored vehicle applications alongside sophisticated aerospace capabilities. The Asia-Pacific region shows rapid advancement, with Japan and South Korea excelling in carbon fiber production while China develops comprehensive composite ecosystems supporting indigenous platform programs. Israeli industry demonstrates innovation in specialized applications like armored vehicle upgrades and unmanned systems. Middle Eastern nations increasingly invest in composite repair and maintenance facilities to support their advanced aircraft inventories. Material export controls and technology transfer restrictions create competitive advantages for regions with indigenous material production capabilities while driving local development in regions seeking strategic industrial autonomy.

Key Defense Composites Program:

Bharat Forge's ATAGS 155mm towed howitzer contract, DAC-approved end-2025, incorporates advanced carbon-fiber composites for barrel jackets and recoil systems, approved for 307 units at ₹7,000 crore. Lighter by 20% than steel equivalents, composites enhance mobility for 48km range fire support. Indigenous materials from CFMRI Hyderabad ensure 60% local content, with trials validating extreme-weather durability. Supply starts Q2 2026, addressing artillery shortages post-Bofors era. This scales production via private sector, rivaling global peers like Elbit, and supports export bids to Armenia. Composites reduce logistics strain in high-altitude deployments like Ladakh.

Table of Contents

Defense Composites Market Report Definition

Defense Composites Market Segmentation

By Type

By Region

By Application

Defense Composites Market Analysis for next 10 Years

The 10-year Defense Composites Market analysis would give a detailed overview of Defense Composites Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Composites Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Composites Market Forecast

The 10-year Defense Composites Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Composites Market Trends & Forecast

The regional Defense Composites Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Composites Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Composites Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Composites Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Defense Composites Market Forecast, 2025-2035

- Figure 2: Global Defense Composites Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Composites Market Forecast, By Type, 2025-2035

- Figure 4: Global Defense Composites Market Forecast, By Application, 2025-2035

- Figure 5: North America, Defense Composites Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Composites Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Composites Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Composites Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Composites Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Composites Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Composites Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Composites Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Composites Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Composites Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Composites Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Composites Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Composites Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Composites Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Composites Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Composites Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Composites Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Composites Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Composites Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Composites Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Composites Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Composites Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Composites Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Composites Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Composites Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Composites Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Composites Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Composites Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Composites Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Composites Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Composites Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Composites Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Composites Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Composites Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Composites Market, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Composites Market, By Application, 2025-2035

- Figure 60: Scenario 2, Defense Composites Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Composites Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Composites Market, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Composites Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Defense Composites Market, 2025-2035