PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1905001

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1905001

Global Defense Armor Materials Market 2026-2036

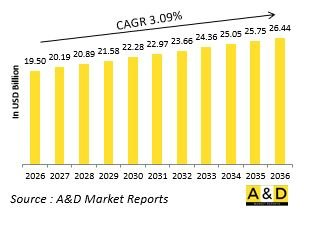

The Global Defense Armor Materials market is estimated at USD 19.50 billion in 2026, projected to grow to USD 26.44 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.09% over the forecast period 2026-2036.

Introduction to Defense Armor Materials Market

The Global Defense Armor Materials Market encompasses specialized materials engineered to protect personnel, vehicles, vessels, and aircraft from ballistic, blast, fragmentary, and directed energy threats. Modern armor represents a sophisticated materials science challenge, balancing protection level, weight, thickness, cost, and multi-threat capability across diverse operational scenarios. Materials employed include high-hardness steels, aluminum alloys, ceramics, composites, transparent armors, and reactive systems that actively defeat threats. Applications range from personal body armor and vehicle applique kits to integrated hull structures for main battle tanks and protective systems for ships and aircraft. As threat mechanisms evolve-incorporating shaped charges, explosively formed penetrators, and kinetic energy penetrators-armor materials must correspondingly advance through novel material combinations, geometrical arrangements, and active protection integration. The perpetual competition between threat and protection drives continuous innovation in this fundamentally important defense sector.

Technology Impact in Defense Armor Materials Market:

Technological evolution in armor materials focuses on multi-functional capability, weight reduction, and adaptive protection. Nano-engineered materials-including carbon nanotubes, graphene, and metallic glasses-offer exceptional strength-to-weight ratios for next-generation armor systems. Transparent ceramics and laminated polymer composites provide improved ballistic protection for vision blocks and canopy applications with reduced weight. Additive manufacturing enables complex geometry armor components with graded material properties optimized for specific threat directions. Active protection systems detect and intercept incoming threats before impact, complementing passive armor materials. Multi-hit capability designs ensure continued protection after initial impacts through carefully engineered failure modes. Integrated health monitoring sensors detect armor damage without visual inspection. These advancements address the fundamental armor design challenge of providing maximum protection within minimum weight and volume allocations while maintaining affordability for widespread deployment.

Key Drivers in Defense Armor Materials Market:

The proliferation of increasingly potent anti-armor weapons-from advanced rocket-propelled grenades to top-attack missile systems-creates continuous demand for improved protective solutions. Asymmetric warfare environments expose platforms and personnel to diverse threats including improvised explosive devices, requiring armor solutions effective across multiple threat mechanisms. Vehicle weight constraints-dictated by transportability, mobility, and fuel efficiency-mandate lightweight armor materials that maximize protection per unit mass. Personnel protection enhancement drives development of more comfortable, flexible body armor that provides greater coverage without restricting mobility. Platform survivability requirements favor integrated armor architectures that protect critical components and crew compartments while minimizing overall weight penalty. Additionally, cost considerations drive innovation in manufacturing processes and material alternatives that deliver required protection levels at sustainable acquisition and lifecycle costs for large-scale deployment.

Regional Trends in Defense Armor Materials Market:

Regional armor material capabilities reflect differing threat environments, vehicle inventories, and industrial expertise. North American development emphasizes integrated vehicle protection suites combining passive, reactive, and active elements for next-generation combat vehicles. European innovation focuses on lightweight composite solutions for wheeled armored vehicles and personal protection systems. The Asia-Pacific region shows rapid advancement in ceramic armor materials and vehicle upgrade packages for existing platforms. Israeli industry excels in innovative armor solutions derived from continuous operational experience and rapid prototyping capabilities. Middle Eastern nations invest in comprehensive vehicle protection upgrades tailored to specific regional threats and environmental conditions. Developing nations increasingly seek technology transfer for local armor production as part of vehicle procurement agreements. Global material availability and export controls influence regional capabilities, with some strategic materials subject to restrictions that drive local substitution or development efforts in strategically important regions.

Key Defense Armor Materials Program:

BEML Limited's June 2025 licensing pacts with DRDO's VRDE for Arjun MBT variants include composite armor modules for Unit Maintenance Vehicle (UMV) and Repair Vehicle (URV). Valued at ₹1,000+ crore over 5 years, contracts cover 100+ units with Kanchan-Dyneema hybrid panels offering 1.5x steel protection at 40% weight. Production at BEML's Bangalore plant ramps to 20/year by 2027, enhancing 124 Arjun Mk1A fleet sustainment. Field trials validated blast resistance, addressing mobility issues in deserts. This supports Army's 2030 armored recapitalization, reducing import reliance from Israel/Russia.

Table of Contents

Defense Armor Materials Market Report Definition

Defense Armor Materials Market Segmentation

By Region

By Type

By Application

Defense Armor Materials Market Analysis for next 10 Years

The 10-year Defense Armor Materials Market analysis would give a detailed overview of Defense Armor Materials Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Armor Materials Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Armor Materials Market Forecast

The 10-year Defense Armor Materials Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Armor Materials Market Trends & Forecast

The regional Defense Armor Materials Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Armor Materials Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Armor Materials Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Armor Materials Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Defense Armor Materials Market Forecast, 2025-2035

- Figure 2: Global Defense Armor Materials Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Armor Materials Market Forecast, By Type, 2025-2035

- Figure 4: Global Defense Armor Materials Market Forecast, By Application, 2025-2035

- Figure 5: North America, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Armor Materials Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Armor Materials Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Armor Materials Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Armor Materials Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Armor Materials Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Armor Materials Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Armor Materials Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Armor Materials Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Armor Materials Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Armor Materials Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Armor Materials Market, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Armor Materials Market, By Application, 2025-2035

- Figure 60: Scenario 2, Defense Armor Materials Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Armor Materials Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Armor Materials Market, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Armor Materials Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Defense Armor Materials Market, 2025-2035