PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927657

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927657

Global Defense Actuation System Market 2026-2036

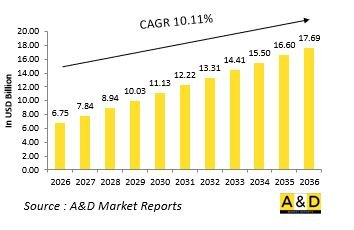

The Global Defense Actuation System market is estimated at USD 6.75 billion in 2026, projected to grow to USD 17.69 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 10.11% over the forecast period 2026-2036.

Introduction to Global Defense Actuation Systems

Global defense actuation systems enable controlled mechanical movement that translates electronic or manual commands into physical action across military platforms. These systems operate at the core of motion-critical functions, including directional control, force application, stabilization, and positioning of key subsystems. Their reliability directly influences platform safety, operational accuracy, and mission continuity. In contemporary defense environments, actuation systems must perform consistently under extreme mechanical stress, hostile operating conditions, and prolonged deployment cycles. They support coordinated interaction between sensors, control software, and mechanical assemblies, ensuring predictable behavior during high-speed or high-load operations. As defense platforms evolve toward integrated and automated architectures, actuation systems are increasingly designed as precision control enablers rather than standalone mechanical elements. Their role extends across aircraft maneuvering, naval steering, ground vehicle mobility, and weapon alignment. The growing complexity of defense platforms has elevated the strategic importance of actuation systems, positioning them as essential contributors to responsiveness, survivability, and overall platform effectiveness within modern military forces.

Technology Impact in Global Defense Actuation Systems

Technological development has redefined how defense actuation systems are designed and deployed. Modern solutions emphasize digital command interfaces, enabling precise execution of motion with continuous feedback control. Sensor-embedded actuators provide real-time performance awareness, allowing systems to adjust dynamically to changing operational loads. Advances in materials engineering support compact designs that deliver higher output while reducing structural mass. Electrically driven actuation architectures improve efficiency and simplify integration with automated control systems. Diagnostic intelligence embedded within actuators supports condition-based maintenance, improving availability and reducing unplanned downtime. Enhanced signal integrity and fault tolerance strengthen reliability in electronically challenged environments. These technological shifts allow actuation systems to function as intelligent motion modules that enhance coordination, accuracy, and control across complex defense platforms.

Key Drivers in Global Defense Actuation Systems

The demand for advanced defense actuation systems is driven by multiple operational and strategic factors. Platform modernization initiatives require motion control solutions compatible with digital and automated environments. Increased adoption of remotely operated and autonomous systems places greater reliance on dependable mechanical execution without direct human intervention. Defense organizations also seek improved mission readiness through reduced maintenance burden and longer service intervals. Weight optimization efforts across air and land platforms support adoption of compact, high-performance actuators. Precision requirements in targeting, navigation, and stabilization further reinforce the need for advanced actuation solutions. Additionally, supply security considerations encourage development of trusted and locally supported actuation technologies. These drivers collectively highlight the growing emphasis on performance reliability, operational efficiency, and system resilience.

Regional Trends in Global Defense Actuation Systems

Regional approaches to defense actuation systems reflect differences in platform focus, industrial capability, and operational doctrine. Aerospace-focused regions prioritize lightweight, high-precision actuation for flight control and stability. Naval-oriented regions emphasize resistance to corrosion and sustained performance in maritime conditions. Regions with extensive land force requirements focus on ruggedized solutions designed for shock tolerance and mobility support. Emerging defense markets increasingly adopt modular actuation systems that allow incremental upgrades and cross-platform compatibility. Regional investment in domestic manufacturing and technical partnerships influences system design and lifecycle strategies. These trends demonstrate how actuation systems are adapted to meet localized defense needs while aligning with global priorities for precision, durability, and integration.

Key Defense Defense Actuation System Program:

The Ministry of Defence entered into a contract with Hindustan Aeronautics Limited for the acquisition of 97 Light Combat Aircraft Mk1A for the Indian Air Force, comprising 68 single-seat fighters and 29 twin-seat variants, along with related equipment. Valued at more than ₹62,370 crore, excluding taxes, the agreement was signed on September 25, 2025. Deliveries are scheduled to begin in the 2027-28 timeframe and will be completed over a six-year period. The Mk1A aircraft will feature indigenous content exceeding 64 percent, with 67 additional systems and components incorporated beyond those included in the earlier LCA Mk1A contract signed. The integration of advanced domestically developed technologies, including the UTTAM Active Electronically Scanned Array radar, Swayam Raksha Kavach self-protection suite, and indigenous control surface actuators, will further reinforce India's Aatmanirbhar Bharat objectives in the defense aerospace sector.

Table of Contents

Defense Actuation Systems Market - Table of Contents

Defense Actuation Systems Market Report Definition

Defense Actuation Systems Market Segmentation

By Application

By Region

By Type

Defense Actuation Systems Market Analysis for next 10 Years

The 10-year Defense Actuation Systems Market analysis would give a detailed overview of Defense Actuation Systems Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Actuation Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Actuation Systems Market Forecast

The 10-year Defense Actuation Systems Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Actuation Systems Market Trends & Forecast

The regional Defense Actuation Systems Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Actuation Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Actuation Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Actuation Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Application, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Type, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Application, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Type, 2026-2036

List of Figures

- Figure 1: Global Defense Actuation System Market Forecast, 2026-2036

- Figure 2: Global Defense Actuation System Market Forecast, By Region, 2026-2036

- Figure 3: Global Defense Actuation System Market Forecast, By Application, 2026-2036

- Figure 4: Global Defense Actuation System Market Forecast, By Type, 2026-2036

- Figure 5: North America, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 6: Europe, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 8: APAC, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 9: South America, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 10: United States, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 11: United States, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 12: Canada, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 14: Italy, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 16: France, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 17: France, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 18: Germany, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 24: Spain, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 30: Australia, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 32: India, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 33: India, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 34: China, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 35: China, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 40: Japan, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Defense Actuation System Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Defense Actuation System Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Defense Actuation System Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Defense Actuation System Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Defense Actuation System Market, By Application (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Defense Actuation System Market, By Application (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Defense Actuation System Market, By Type (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Defense Actuation System Market, By Type (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Defense Actuation System Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Defense Actuation System Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Defense Actuation System Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Defense Actuation System Market, By Region, 2026-2036

- Figure 58: Scenario 1, Defense Actuation System Market, By Application, 2026-2036

- Figure 59: Scenario 1, Defense Actuation System Market, By Type, 2026-2036

- Figure 60: Scenario 2, Defense Actuation System Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Defense Actuation System Market, By Region, 2026-2036

- Figure 62: Scenario 2, Defense Actuation System Market, By Application, 2026-2036

- Figure 63: Scenario 2, Defense Actuation System Market, By Type, 2026-2036

- Figure 64: Company Benchmark, Defense Actuation System Market, 2026-2036