PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927659

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927659

Global Combat Helicopter Market 2026-2036

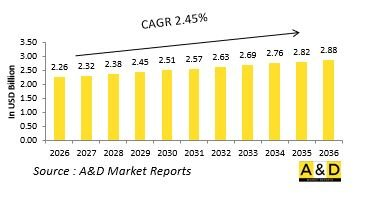

The Global Combat Helicopter market is estimated at USD 2.26 billion in 2026, projected to grow to USD 2.88 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 2.45% over the forecast period 2026-2036.

Introduction to Global Combat Helicopter

Global combat helicopters occupy a unique position in modern military operations by combining mobility, precision firepower, and battlefield visibility within a single aerial platform. Designed to operate close to the ground, these aircraft provide direct support to ground forces, conduct armed reconnaissance, and respond rapidly to evolving combat situations. Their ability to maneuver in confined terrain, hover in place, and engage targets with accuracy makes them indispensable in both conventional and irregular warfare. Combat helicopters are valued for their flexibility, as they can operate from forward bases and austere environments with minimal infrastructure. They play a vital role in force protection, escort missions, and rapid reaction tasks where fixed-wing aircraft may be less effective. The global landscape for combat helicopters is shaped by the need for versatile platforms capable of operating across diverse terrains and threat environments. Their continued relevance reflects the enduring requirement for responsive aerial fire support and battlefield coordination in modern military doctrine.

Technology Impact in Global Combat Helicopter

Technological innovation has significantly enhanced the performance and survivability of combat helicopters. Modern avionics provide advanced navigation, targeting, and situational awareness capabilities that support operations in complex environments. Sensor integration enables pilots to detect, identify, and track threats beyond visual range. Improved propulsion systems enhance lift performance, endurance, and high-altitude capability. Advanced materials contribute to reduced weight while improving structural strength and resistance to damage. Defensive systems such as countermeasures and threat warning sensors improve survivability against modern air defense threats. Digital flight control systems support stability and precision during demanding maneuvers. Together, these technologies allow combat helicopters to operate effectively in contested airspace while maintaining mission flexibility and crew safety.

Key Drivers in Global Combat Helicopter

Demand for combat helicopters is driven by the need for close air support, rapid response, and battlefield mobility. Modern military operations often require precision engagement in environments where ground forces face limited visibility and high threat exposure. Combat helicopters provide timely firepower and reconnaissance support in such conditions. Fleet modernization programs sustain demand as older platforms are upgraded or replaced. The need for multi-role aircraft capable of performing attack, escort, and surveillance missions further strengthens adoption. Operational experience in diverse conflict scenarios continues to reinforce the value of rotary-wing combat assets.

Regional Trends in Global Combat Helicopter

Regional trends reflect terrain, climate, and operational doctrine. Mountainous regions emphasize high-altitude performance and engine reliability. Desert regions prioritize thermal resilience and endurance. Maritime regions adapt helicopters for shipborne operations and corrosion resistance. Emerging defense markets focus on adaptable platforms with scalable capabilities. These regional differences shape design preferences and procurement strategies worldwide.

Key Combat Helicopter Program:

On March 28, 2025, the Ministry of Defence concluded two separate contracts with Hindustan Aeronautics Limited for the procurement of 156 Light Combat Helicopters, Prachand, along with training and related support equipment, at a total value of ₹62,700 crore, excluding taxes. Under these agreements, 66 helicopters will be supplied to the Indian Air Force, while 90 units will be delivered to the Indian Army. Deliveries are scheduled to begin in the third year of the contract period and will continue over the subsequent five years. The induction of the LCH Prachand will significantly enhance the Armed Forces' combat capabilities in high-altitude environments. As India's first indigenously designed and developed combat helicopter, the LCH is capable of operating at altitudes exceeding 5,000 meters. The platform incorporates a substantial number of domestically designed and manufactured components, with overall indigenous content expected to surpass 65 percent during contract execution. The program will engage more than 250 Indian companies, largely MSMEs, and is projected to create over 8,500 direct and indirect employment opportunities.

Table of Contents

Combat Helicopter Market Report - Table of Contents

Combat Helicopter Market Report Definition

Combat Helicopter Market Segmentation

By Type

By Region

By End User

Combat Helicopter Market Analysis for next 10 Years

The 10-year combat helicopter market analysis would give a detailed overview of combat helicopter market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Combat Helicopter Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Combat Helicopter Market Forecast

The 10-year combat helicopter market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Combat Helicopter Market Trends & Forecast

The regional combat helicopter market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Combat Helicopter Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Combat Helicopter Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Combat Helicopter Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Type, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By End User, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Type, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By End User, 2026-2036

List of Figures

- Figure 1: Global Combat Helicopter Market Forecast, 2026-2036

- Figure 2: Global Combat Helicopter Market Forecast, By Region, 2026-2036

- Figure 3: Global Combat Helicopter Market Forecast, By Type, 2026-2036

- Figure 4: Global Combat Helicopter Market Forecast, By End User, 2026-2036

- Figure 5: North America, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 6: Europe, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 8: APAC, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 9: South America, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 10: United States, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 11: United States, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 12: Canada, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 14: Italy, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 16: France, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 17: France, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 18: Germany, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 24: Spain, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 30: Australia, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 32: India, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 33: India, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 34: China, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 35: China, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 40: Japan, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Combat Helicopter Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Combat Helicopter Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Combat Helicopter Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Combat Helicopter Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Combat Helicopter Market, By Type (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Combat Helicopter Market, By Type (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Combat Helicopter Market, By End User (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Combat Helicopter Market, By End User (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Combat Helicopter Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Combat Helicopter Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Combat Helicopter Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Combat Helicopter Market, By Region, 2026-2036

- Figure 58: Scenario 1, Combat Helicopter Market, By Type, 2026-2036

- Figure 59: Scenario 1, Combat Helicopter Market, By End User, 2026-2036

- Figure 60: Scenario 2, Combat Helicopter Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Combat Helicopter Market, By Region, 2026-2036

- Figure 62: Scenario 2, Combat Helicopter Market, By Type, 2026-2036

- Figure 63: Scenario 2, Combat Helicopter Market, By End User, 2026-2036

- Figure 64: Company Benchmark, Combat Helicopter Market, 2026-2036