PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927661

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927661

Global Combat Submersible Vehicles Market 2026-2036

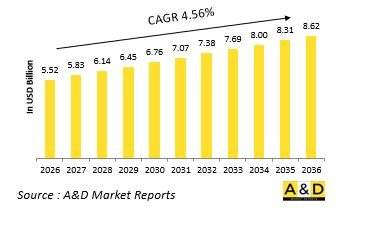

The Global Combat Submersible vehicles market is estimated at USD 5.52 billion in 2026, projected to grow to USD 8.62 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.56% over the forecast period 2026-2036.

Introduction to Global Combat Submersible Vehicles

Combat submersible vehicles are specialized underwater platforms designed to support a range of military operations, providing stealth, mobility, and versatility in contested maritime environments. These vehicles enable covert deployment of personnel, equipment, and reconnaissance tools, allowing forces to conduct special operations, surveillance, and intelligence-gathering missions undetected. Unlike traditional submarines, combat submersibles are often smaller, more maneuverable, and optimized for rapid deployment and retrieval in shallow or restricted waters. Modern designs focus on hydrodynamic efficiency, noise reduction, and operational reliability, ensuring effective navigation under diverse conditions. They can operate independently or in coordination with larger naval vessels, facilitating precision insertions, extraction of special forces, and support for mine countermeasure or anti-submarine operations. With modular configurations, these vehicles can carry specialized payloads, sensors, or unmanned systems, enhancing mission flexibility. The increasing complexity of maritime security challenges, including territorial disputes, asymmetric threats, and the need for rapid response capabilities, has elevated the strategic value of combat submersibles. Investment in their development reflects a broader trend toward enhancing naval operational reach while maintaining stealth and operational security. These platforms are increasingly recognized as indispensable assets in modern naval warfare, bridging the gap between conventional surface operations and advanced underwater missions.

Technology Impact in Global Combat Submersible Vehicles

Technological advancements have dramatically transformed the capabilities of combat submersible vehicles, enhancing their operational performance, stealth, and mission versatility. Modern propulsion systems, including electric and hybrid drives, reduce acoustic signatures, making detection by adversaries more difficult. Advanced navigation systems, combining sonar mapping, inertial guidance, and GPS integration, allow precise maneuvering in complex underwater environments. Sensors equipped with multi-spectral detection, imaging sonar, and environmental monitoring provide real-time situational awareness, enabling accurate reconnaissance and threat assessment. Automation and artificial intelligence facilitate adaptive route planning, threat avoidance, and mission optimization, reducing operator workload and increasing mission success rates. Modular payload designs allow integration of unmanned underwater vehicles, surveillance equipment, or specialized combat systems depending on operational requirements. Advanced materials, such as lightweight composites and corrosion-resistant alloys, improve durability and enhance performance under extreme pressure and temperature variations. Secure communication networks ensure reliable data exchange between submersibles and command centers, even in contested electronic environments. Cybersecurity measures protect vehicle control systems from hacking or electronic interference. These technological innovations collectively enable combat submersible vehicles to operate with higher efficiency, flexibility, and survivability, making them crucial assets for modern naval strategies and special operations missions.

Key Drivers in Combat Submersible Vehicles

Several key factors drive the development and deployment of combat submersible vehicles globally. The increasing need for covert maritime operations, such as intelligence gathering, reconnaissance, and special forces insertions, creates demand for stealthy underwater platforms. Geopolitical tensions and regional disputes in coastal and contested waters compel nations to strengthen maritime capabilities with rapid-response, low-visibility assets. Technological progress in propulsion, sensor systems, materials, and automation supports the creation of vehicles that are faster, quieter, and more versatile. Modern naval strategies emphasize multi-domain operations, integrating submersible vehicles with surface fleets, unmanned platforms, and aerial reconnaissance for coordinated missions. Budget allocations toward force modernization and asymmetric warfare capabilities encourage investment in submersible platforms. Operational experience from past conflicts has demonstrated the effectiveness of these vehicles in enhancing situational awareness, conducting precision operations, and supporting broader naval objectives. Partnerships, defense collaborations, and domestic manufacturing initiatives accelerate research and production, ensuring timely acquisition. Increasing maritime security challenges, such as piracy, territorial incursions, and undersea infrastructure protection, further amplify the need for specialized submersible solutions. Collectively, these drivers establish combat submersible vehicles as critical components of modern naval doctrine, bridging technological innovation with operational necessity.

Regional Trends in Combat Submersible Vehicles

Regional trends in the deployment and development of combat submersible vehicles vary according to strategic priorities, security environments, and naval capabilities. North America focuses on highly advanced, long-endurance submersibles designed for special operations, deep reconnaissance, and integration with multi-domain networks. European nations prioritize interoperability, collaborative development programs, and modular platforms to balance capabilities with cost-effectiveness. In the Asia-Pacific region, rising maritime territorial disputes and the need for rapid coastal defense drive investment in domestically produced, versatile submersibles capable of operating in shallow waters and congested maritime zones. Middle Eastern countries emphasize tactical submersibles for surveillance, coastal protection, and special forces operations, often acquiring technology through partnerships or imports. African and South American nations focus on cost-efficient, operationally flexible designs to enhance maritime security without extensive investment in large naval fleets. Across regions, integration with unmanned underwater vehicles, advanced sensors, and real-time command networks is increasingly common. Regional exercises and joint operations support operational readiness while influencing vehicle design and capability requirements. Variations in strategic priorities, threat perception, and technological infrastructure shape the development of combat submersible vehicles worldwide, reflecting diverse operational needs while advancing stealth, mobility, and multi-role effectiveness.

Key Combat Submersible vehicles Program:

Teledyne Technologies Incorporated announced that its Huntsville, Alabama-based subsidiary, Teledyne Brown Engineering, has been awarded a sole-source contract by the Naval Sea Systems Command for the follow-on production of MK11 Shallow Water Combat Submersible systems. Including all available options, the contract carries a total value of $178 million. The MK11 SWCS is a manned combat submersible designed to support the covert insertion and extraction of Special Operations Forces in high-threat environments. Under an earlier agreement with the U.S. Special Operations Command, Teledyne Brown Engineering successfully completed the design, manufacturing, testing, and delivery of the Engineering Development Model of the system. Following the successful completion of the EDM phase, USSOCOM exercised contract options authorizing the production and delivery of additional MK11 SWCS units.

Table of Contents

Combat Submersible Vehicles Market - Table of Contents

Combat Submersible Vehicles Market Report Definition

Combat Submersible Vehicles Market Segmentation

By Region

By Type

By Propulsion

Combat Submersible Vehicles Market Analysis for next 10 Years

The 10-year combat submersible vehicles market analysis would give a detailed overview of missile and smart kits guidance market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Combat Submersible Vehicles Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Combat Submersible Vehicles Market Forecast

The 10-year combat submersible vehicles market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Combat Submersible Vehicles Market Trends & Forecast

The regional combat submersible vehicles market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Combat Submersible Vehicles Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Combat Submersible Vehicles Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Combat Submersible Vehicles Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Type, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Propulsion, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Type, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Propulsion, 2026-2036

List of Figures

- Figure 1: Global Combat Submersible Vehicles Market Forecast, 2026-2036

- Figure 2: Global Combat Submersible Vehicles Market Forecast, By Region, 2026-2036

- Figure 3: Global Combat Submersible Vehicles Market Forecast, By Type, 2026-2036

- Figure 4: Global Combat Submersible Vehicles Market Forecast, By Propulsion, 2026-2036

- Figure 5: North America, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 6: Europe, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 8: APAC, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 9: South America, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 10: United States, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 11: United States, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 12: Canada, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 14: Italy, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 16: France, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 17: France, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 18: Germany, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 24: Spain, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 30: Australia, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 32: India, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 33: India, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 34: China, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 35: China, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 40: Japan, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Combat Submersible Vehicles Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Combat Submersible Vehicles Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Combat Submersible Vehicles Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Combat Submersible Vehicles Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Combat Submersible Vehicles Market, By Type (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Combat Submersible Vehicles Market, By Type (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Combat Submersible Vehicles Market, By Propulsion (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Combat Submersible Vehicles Market, By Propulsion (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Combat Submersible Vehicles Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Combat Submersible Vehicles Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Combat Submersible Vehicles Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Combat Submersible Vehicles Market, By Region, 2026-2036

- Figure 58: Scenario 1, Combat Submersible Vehicles Market, By Type, 2026-2036

- Figure 59: Scenario 1, Combat Submersible Vehicles Market, By Propulsion, 2026-2036

- Figure 60: Scenario 2, Combat Submersible Vehicles Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Combat Submersible Vehicles Market, By Region, 2026-2036

- Figure 62: Scenario 2, Combat Submersible Vehicles Market, By Type, 2026-2036

- Figure 63: Scenario 2, Combat Submersible Vehicles Market, By Propulsion, 2026-2036

- Figure 64: Company Benchmark, Combat Submersible Vehicles Market, 2026-2036