PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927663

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927663

Global Corvettes Market 2026-2036

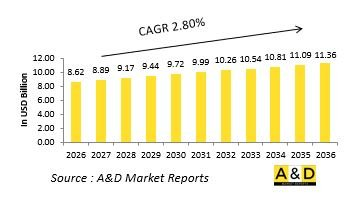

The Global Corvettes market is estimated at USD 8.62 billion in 2026, projected to grow to USD 11.36 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 2.80% over the forecast period 2026-2036.

Introduction to Corvettes

Corvettes are versatile naval warships designed for multi-role operations in coastal and littoral waters. Smaller and more maneuverable than frigates and destroyers, corvettes provide a balance of firepower, speed, and operational flexibility. They are deployed for anti-surface warfare, anti-submarine missions, surveillance, reconnaissance, and maritime security. Corvettes are equipped with a combination of missile systems, torpedoes, naval guns, and electronic warfare equipment, allowing them to engage diverse threats while supporting larger fleet operations. Their compact size enables rapid deployment, efficient maintenance, and operations in shallow or congested waters where larger vessels may be limited. Modern corvettes are built with modular designs, allowing them to be quickly adapted for specialized missions such as mine countermeasures, amphibious support, or unmanned vehicle operations. They serve both defensive and offensive roles, complementing larger naval assets while providing national coastal protection and regional presence. As maritime threats evolve, corvettes play an increasingly important role in strategic naval planning, demonstrating operational versatility, quick-response capabilities, and cost-effectiveness in modern naval warfare. Investment in corvettes reflects a broader effort to maintain naval agility, project power, and secure maritime trade routes while adapting to emerging security challenges.

Technology Impact in Global Corvettes

Advances in technology have significantly enhanced the capabilities of corvettes, improving operational efficiency, combat effectiveness, and survivability. Modern propulsion systems enable higher speeds, longer range, and quieter operation, enhancing stealth and tactical flexibility. Integration of advanced sensors, radar, sonar, and electronic warfare suites allows corvettes to detect, track, and engage multiple targets simultaneously with precision. Modular mission bays and flexible weapon configurations enable adaptation to various roles, including anti-submarine warfare, surface engagements, and reconnaissance. Networked communication and command systems enhance situational awareness, enabling corvettes to operate seamlessly with larger fleets, unmanned platforms, and aerial reconnaissance. Automation in navigation, targeting, and damage control reduces crew workload while improving reaction times and reliability. Materials innovation, such as lightweight composites and corrosion-resistant alloys, improves hull durability, reduces maintenance, and supports higher speed operations. Stealth technology and signature management reduce detectability, increasing survivability in hostile environments. Continuous technological upgrades ensure that corvettes remain capable of addressing emerging threats, integrating next-generation weapons, and adapting to evolving naval strategies. Overall, technology strengthens corvettes' operational versatility, force projection, and strategic relevance in modern maritime defense.

Key Drivers in Corvettes

Several factors drive the development and deployment of corvettes globally. The need for flexible, rapid-response naval platforms capable of operating in coastal and shallow waters motivates investment in these smaller warships. Modern maritime threats, including asymmetric attacks, piracy, and territorial disputes, require vessels that can perform a range of combat, surveillance, and reconnaissance missions. Budget constraints and cost-effectiveness favor corvettes over larger, more expensive surface combatants, offering a balance between capability and affordability. Advances in modular design, propulsion, sensors, and weapon systems allow corvettes to meet diverse operational needs while remaining adaptable for future upgrades. Naval modernization programs and fleet expansion initiatives also stimulate demand, particularly in regions seeking to strengthen coastal defense and maritime security. The integration of corvettes into networked naval operations, along with interoperability with unmanned systems, helicopters, and larger surface vessels, enhances their tactical value. Geopolitical competition, emerging security challenges, and the emphasis on rapid deployment and force projection further drive acquisition programs. Together, operational requirements, technological advancements, cost considerations, and strategic priorities establish corvettes as critical assets in modern naval doctrine, ensuring their continued relevance in contemporary maritime defense strategies.

Regional Trends in Corvettes

Regional trends in corvette development and deployment are shaped by strategic priorities, naval capabilities, and maritime threat perceptions. North America emphasizes advanced multi-role designs with high-speed propulsion, integrated sensors, and networked combat systems to enhance fleet coordination and operational flexibility. European nations focus on interoperability, modular configurations, and multi-mission platforms that can operate within joint defense frameworks, balancing performance with cost efficiency. The Asia-Pacific region exhibits rapid growth in corvette fleets, driven by territorial disputes, coastal security needs, and investment in domestic shipbuilding capabilities. Middle Eastern countries prioritize corvettes for maritime defense, surveillance, and strategic deterrence, often sourcing technology through international partnerships. African and South American nations focus on cost-effective, versatile platforms capable of patrolling territorial waters, countering piracy, and supporting maritime security operations. Across regions, trends include integration of unmanned systems, advanced radar and sonar suites, and electronic warfare technologies to maintain operational superiority. Fleet modernization, regional naval exercises, and increasing emphasis on littoral defense further influence corvette design, procurement, and deployment strategies. Regional variation in defense spending, industrial infrastructure, and security requirements ensures that corvettes remain a flexible and essential component of naval operations worldwide.

Key Corvettes Program:

Defence public sector undertaking Garden Reach Shipbuilders and Engineers secured the contract to build the Indian Navy's Next Generation Corvettes after emerging as the lowest bidder in the competitive tendering process. At the same time, an export order worth approximately ₹180 crore from Bangladesh has been cancelled. GRSE is currently executing multiple naval construction programs for the Indian Navy, including four Next Generation Offshore Patrol Vessels, three Advanced Guided Missile Frigates, and eight Anti-Submarine Warfare Shallow Water Crafts, with one vessel already delivered. In addition, the shipyard is constructing four Large Survey Vessels, two of which have been handed over to the Navy.

Table of Contents

Corvettes Market - Table of Contents

Corvettes Market Report Definition

Corvettes Market Segmentation

By Type

By Region

By Class

Corvettes Market Analysis for next 10 Years

The 10-year corvettes market analysis would give a detailed overview of corvettes market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Corvettes Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Corvettes Market Forecast

The 10-year corvettes market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Corvettes Market Trends & Forecast

The regional corvettes market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Corvettes Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Corvettes Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Corvettes Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Type, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Class, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Type, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Class, 2026-2036

List of Figures

- Figure 1: Global Corvettes Market Forecast, 2026-2036

- Figure 2: Global Corvettes Market Forecast, By Region, 2026-2036

- Figure 3: Global Corvettes Market Forecast, By Type, 2026-2036

- Figure 4: Global Corvettes Market Forecast, By Class, 2026-2036

- Figure 5: North America, Corvettes Market, Market Forecast, 2026-2036

- Figure 6: Europe, Corvettes Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Corvettes Market, Market Forecast, 2026-2036

- Figure 8: APAC, Corvettes Market, Market Forecast, 2026-2036

- Figure 9: South America, Corvettes Market, Market Forecast, 2026-2036

- Figure 10: United States, Corvettes Market, Technology Maturation, 2026-2036

- Figure 11: United States, Corvettes Market, Market Forecast, 2026-2036

- Figure 12: Canada, Corvettes Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Corvettes Market, Market Forecast, 2026-2036

- Figure 14: Italy, Corvettes Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Corvettes Market, Market Forecast, 2026-2036

- Figure 16: France, Corvettes Market, Technology Maturation, 2026-2036

- Figure 17: France, Corvettes Market, Market Forecast, 2026-2036

- Figure 18: Germany, Corvettes Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Corvettes Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Corvettes Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Corvettes Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Corvettes Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Corvettes Market, Market Forecast, 2026-2036

- Figure 24: Spain, Corvettes Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Corvettes Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Corvettes Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Corvettes Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Corvettes Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Corvettes Market, Market Forecast, 2026-2036

- Figure 30: Australia, Corvettes Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Corvettes Market, Market Forecast, 2026-2036

- Figure 32: India, Corvettes Market, Technology Maturation, 2026-2036

- Figure 33: India, Corvettes Market, Market Forecast, 2026-2036

- Figure 34: China, Corvettes Market, Technology Maturation, 2026-2036

- Figure 35: China, Corvettes Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Corvettes Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Corvettes Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Corvettes Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Corvettes Market, Market Forecast, 2026-2036

- Figure 40: Japan, Corvettes Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Corvettes Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Corvettes Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Corvettes Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Corvettes Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Corvettes Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Corvettes Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Corvettes Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Corvettes Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Corvettes Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Corvettes Market, By Type (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Corvettes Market, By Type (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Corvettes Market, By Class (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Corvettes Market, By Class (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Corvettes Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Corvettes Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Corvettes Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Corvettes Market, By Region, 2026-2036

- Figure 58: Scenario 1, Corvettes Market, By Type, 2026-2036

- Figure 59: Scenario 1, Corvettes Market, By Class, 2026-2036

- Figure 60: Scenario 2, Corvettes Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Corvettes Market, By Region, 2026-2036

- Figure 62: Scenario 2, Corvettes Market, By Type, 2026-2036

- Figure 63: Scenario 2, Corvettes Market, By Class, 2026-2036

- Figure 64: Company Benchmark, Corvettes Market, 2026-2036