PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927666

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927666

Global CBRN Market 2026-2036

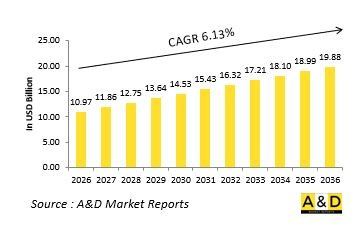

The Global CBRN market is estimated at USD 10.97 billion in 2026, projected to grow to USD 19.88 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 6.13% over the forecast period 2026-2036.

Introduction to Global CBRN

CBRN defense focuses on protection, detection, and mitigation against chemical, biological, radiological, and nuclear threats. These systems are critical for both military and civilian protection, ensuring preparedness against industrial accidents, terrorism, and weapons of mass destruction. CBRN platforms include detection sensors, protective gear, decontamination equipment, analytical tools, and response units capable of operating in hazardous environments. The increasing sophistication of threats and the potential for asymmetric attacks drive investment in advanced CBRN solutions. Military applications encompass troop protection, contamination monitoring, and rapid hazard assessment, while civilian applications include emergency response, critical infrastructure protection, and public safety. International collaboration and research initiatives enhance detection accuracy, response protocols, and knowledge sharing. Technological innovations, including autonomous monitoring, sensor miniaturization, and rapid diagnostic tools, improve detection efficiency and operational effectiveness. Training, drills, and preparedness programs complement equipment deployment to ensure readiness during incidents. Environmental and urban risk factors amplify the relevance of CBRN preparedness. The global market is supported by ongoing defense modernization, heightened awareness of WMD threats, and national security imperatives, positioning CBRN systems as essential components of comprehensive defense, public safety, and emergency response frameworks.

Technology Impact in Global CBRN

Technology plays a pivotal role in modern CBRN defense, enhancing detection, monitoring, and response capabilities. Advanced chemical and biological sensors enable rapid identification of hazardous agents with high sensitivity and precision. Radiological and nuclear detection technologies integrate real-time data collection with automated alert systems, allowing for rapid decision-making. Autonomous platforms, drones, and robotic systems support surveillance and sample collection in contaminated areas, reducing human exposure. Data analytics, machine learning, and predictive modeling improve threat assessment, hazard mapping, and operational planning. Protective materials, including advanced suits and filtration systems, enhance survivability in extreme conditions. Rapid decontamination technologies and automated response mechanisms streamline hazard mitigation and recovery efforts. Integration with command and control networks enables coordinated responses across military, emergency services, and civilian agencies. Communication systems ensure timely dissemination of hazard information to personnel and populations at risk. Cybersecurity frameworks safeguard critical monitoring and alert systems from interference. Collectively, technological advancements improve efficiency, reliability, and safety, enabling proactive threat management, operational resilience, and enhanced preparedness for chemical, biological, radiological, and nuclear incidents.

Key Drivers in Global CBRN

The global CBRN market is driven by the increasing threat of chemical, biological, radiological, and nuclear hazards to military and civilian populations. Rising geopolitical tensions, proliferation of weapons of mass destruction, and asymmetric warfare necessitate advanced detection, protective, and mitigation systems. Industrial and urban expansion increases exposure risk to chemical and radiological hazards, reinforcing the need for robust emergency preparedness. Military modernization programs prioritize CBRN protection for personnel, critical infrastructure, and strategic assets. Technological advancements in sensors, protective equipment, decontamination systems, and autonomous monitoring platforms enhance efficiency, reliability, and response capabilities. International collaborations, defense partnerships, and research initiatives accelerate innovation and standardization. Civilian defense requirements, including disaster response and public safety, also contribute to market growth. Operational experience in handling hazardous materials and emergencies informs system design and procurement strategies. Regulatory frameworks, risk assessment protocols, and government funding further support adoption. Together, these factors establish sustained demand for CBRN solutions, highlighting the strategic importance of protective, detection, and mitigation systems in ensuring security, resilience, and operational readiness across military and civilian domains.

Regional Trends in Global CBRN

Regional trends in CBRN defense vary according to threat perception, technological infrastructure, and strategic priorities. North America focuses on highly advanced detection systems, autonomous monitoring platforms, and integrated emergency response networks. European nations emphasize interoperability, collaborative research programs, and regulatory compliance while upgrading protective equipment and decontamination systems. Asia-Pacific growth is driven by industrial hazards, military modernization, and the development of indigenous CBRN technologies. Middle Eastern countries prioritize protection against chemical and radiological threats in high-risk environments and critical infrastructure. African and South American regions adopt cost-effective, modular solutions for emergency response, urban protection, and military defense. Across all regions, there is increasing integration of automated detection, real-time analytics, and networked response systems. Joint exercises, training programs, and defense modernization initiatives influence adoption patterns. Regional variations in defense budgets, industrial capabilities, and hazard exposure shape deployment and procurement strategies. These trends demonstrate a global emphasis on operational readiness, technological innovation, and multi-agency coordination to manage chemical, biological, radiological, and nuclear threats effectively.

Key Defense CBRN Program:

n 25 February 2025, the Indian Army entered into a contract with Larsen & Toubro Limited for the procurement of 223 Automatic Chemical Agent Detection and Alarm systems at a cost of ₹80.43 crore under the Buy Indian (IDDM) category. The acquisition strongly supports the Government of India's Aatmanirbhar Bharat initiative, as more than 80 percent of the system's components and subsystems will be sourced domestically. The ACADA system has been designed and developed by DRDO's Defence Research and Development Establishment, Gwalior, representing a key achievement in India's indigenisation efforts within the specialized CBRN domain. The system is designed to detect chemical warfare agents and pre-programmed toxic industrial chemicals by continuously sampling ambient air. Operating on the principle of ion mobility spectrometry, ACADA incorporates two high-sensitivity IMS cells that enable real-time detection and parallel monitoring of hazardous substances. The induction of ACADA into field units will significantly strengthen the Indian Army's defensive CBRN preparedness during operations and in peacetime, including enhanced response capabilities for industrial accident-related disaster relief scenarios.

Table of Contents

Table of Contents

CBRNE Market Report Definition

CBRNE Market Segmentation

By Component

By End Users

By Region

CBRNE Market Analysis for next 10 Years

The 10-year CBRNE market analysis would give a detailed overview of CBRNE market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of CBRNE Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global CBRNE Market Forecast

The 10-year CBRNE market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional CBRNE Market Trends & Forecast

The regional CBRNE market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of CBRNE Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Smart Airport Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on CBRNE Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Component, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By End Users, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Component, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By End Users, 2026-2036

List of Figures

- Figure 1: Global CBRN Market Forecast, 2026-2036

- Figure 2: Global CBRN Market Forecast, By Region, 2026-2036

- Figure 3: Global CBRN Market Forecast, By Component, 2026-2036

- Figure 4: Global CBRN Market Forecast, By End Users, 2026-2036

- Figure 5: North America, CBRN Market, Market Forecast, 2026-2036

- Figure 6: Europe, CBRN Market, Market Forecast, 2026-2036

- Figure 7: Middle East, CBRN Market, Market Forecast, 2026-2036

- Figure 8: APAC, CBRN Market, Market Forecast, 2026-2036

- Figure 9: South America, CBRN Market, Market Forecast, 2026-2036

- Figure 10: United States, CBRN Market, Technology Maturation, 2026-2036

- Figure 11: United States, CBRN Market, Market Forecast, 2026-2036

- Figure 12: Canada, CBRN Market, Technology Maturation, 2026-2036

- Figure 13: Canada, CBRN Market, Market Forecast, 2026-2036

- Figure 14: Italy, CBRN Market, Technology Maturation, 2026-2036

- Figure 15: Italy, CBRN Market, Market Forecast, 2026-2036

- Figure 16: France, CBRN Market, Technology Maturation, 2026-2036

- Figure 17: France, CBRN Market, Market Forecast, 2026-2036

- Figure 18: Germany, CBRN Market, Technology Maturation, 2026-2036

- Figure 19: Germany, CBRN Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, CBRN Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, CBRN Market, Market Forecast, 2026-2036

- Figure 22: Belgium, CBRN Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, CBRN Market, Market Forecast, 2026-2036

- Figure 24: Spain, CBRN Market, Technology Maturation, 2026-2036

- Figure 25: Spain, CBRN Market, Market Forecast, 2026-2036

- Figure 26: Sweden, CBRN Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, CBRN Market, Market Forecast, 2026-2036

- Figure 28: Brazil, CBRN Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, CBRN Market, Market Forecast, 2026-2036

- Figure 30: Australia, CBRN Market, Technology Maturation, 2026-2036

- Figure 31: Australia, CBRN Market, Market Forecast, 2026-2036

- Figure 32: India, CBRN Market, Technology Maturation, 2026-2036

- Figure 33: India, CBRN Market, Market Forecast, 2026-2036

- Figure 34: China, CBRN Market, Technology Maturation, 2026-2036

- Figure 35: China, CBRN Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, CBRN Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, CBRN Market, Market Forecast, 2026-2036

- Figure 38: South Korea, CBRN Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, CBRN Market, Market Forecast, 2026-2036

- Figure 40: Japan, CBRN Market, Technology Maturation, 2026-2036

- Figure 41: Japan, CBRN Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, CBRN Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, CBRN Market, Market Forecast, 2026-2036

- Figure 44: Singapore, CBRN Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, CBRN Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, CBRN Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, CBRN Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, CBRN Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, CBRN Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, CBRN Market, By Component (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, CBRN Market, By Component (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, CBRN Market, By End Users (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, CBRN Market, By End Users (CAGR), 2026-2036

- Figure 54: Scenario Analysis, CBRN Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, CBRN Market, Global Market, 2026-2036

- Figure 56: Scenario 1, CBRN Market, Total Market, 2026-2036

- Figure 57: Scenario 1, CBRN Market, By Region, 2026-2036

- Figure 58: Scenario 1, CBRN Market, By Component, 2026-2036

- Figure 59: Scenario 1, CBRN Market, By End Users, 2026-2036

- Figure 60: Scenario 2, CBRN Market, Total Market, 2026-2036

- Figure 61: Scenario 2, CBRN Market, By Region, 2026-2036

- Figure 62: Scenario 2, CBRN Market, By Component, 2026-2036

- Figure 63: Scenario 2, CBRN Market, By End Users, 2026-2036

- Figure 64: Company Benchmark, CBRN Market, 2026-2036