PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1930542

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1930542

Global Airborne ISR Market 2026-2036

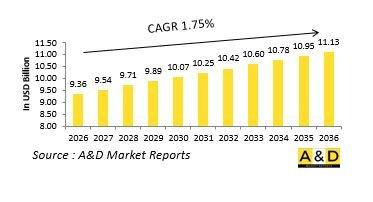

The Global Airborne ISR market is estimated at USD 9.36 billion in 2026, projected to grow to USD 11.13 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 1.75% over the forecast period 2026-2036.

Introduction

Airborne intelligence, surveillance, and reconnaissance capabilities form the backbone of modern situational awareness by providing persistent observation and information dominance across vast operational spaces. These capabilities enable military forces to monitor adversary activity, assess terrain, track movements, and support decision-making at tactical, operational, and strategic levels. Airborne ISR platforms operate across a wide spectrum, ranging from crewed aircraft and helicopters to long-endurance unmanned systems, each contributing unique advantages in coverage and responsiveness. The value of airborne ISR lies in its ability to deliver timely and actionable intelligence while maintaining flexibility in dynamic environments. As conflicts increasingly unfold across dispersed and contested domains, airborne ISR supports early warning, threat identification, and mission planning. It also plays a critical role in non-combat operations such as border monitoring, maritime patrol, disaster response, and humanitarian missions. The growing reliance on real-time intelligence has elevated airborne ISR from a supporting function to a decisive operational enabler. Its integration with command systems and strike assets underscores its importance in achieving information superiority and operational coherence.

Technology Impact in Airborne ISR

Technological advancements are significantly expanding the scope and effectiveness of airborne ISR systems. Sensor innovation enables higher-resolution imaging, multi-spectral analysis, and improved detection in adverse weather or low-visibility conditions. Advances in signal processing allow rapid interpretation of large data volumes, reducing the time between collection and dissemination. Artificial intelligence enhances automated target recognition and anomaly detection, supporting faster decision cycles. Secure data links enable seamless transmission of intelligence to command centers and deployed units. Platform endurance improvements extend mission duration and coverage. Miniaturization allows advanced sensors to be deployed on smaller and more agile platforms. Integration of multiple sensor types on a single platform supports comprehensive intelligence collection. These technological developments transform airborne ISR into a continuous and adaptive intelligence resource capable of supporting complex multi-domain operations.

Key Drivers in Airborne ISR

The expansion of airborne ISR capabilities is driven by the growing complexity of modern security environments. Military operations increasingly depend on accurate and timely intelligence to manage dispersed forces and rapidly evolving threats. Border security and maritime domain awareness requirements sustain continuous surveillance demand. The rise of asymmetric threats necessitates persistent monitoring and rapid intelligence dissemination. Defense modernization programs prioritize information dominance and networked operations. Interoperability among allied forces drives standardization and shared intelligence frameworks. The proliferation of unmanned systems further expands ISR reach and flexibility. Training and readiness considerations also influence investment in ISR platforms and analytics. These drivers collectively ensure sustained emphasis on airborne intelligence capabilities as a core defense function.

Regional Trends in Airborne ISR

Regional adoption of airborne ISR reflects diverse operational needs and geographic challenges. North American defense forces focus on long-range surveillance and integration across joint and allied networks. European nations emphasize cross-border intelligence sharing and persistent monitoring of air and maritime approaches. Asia-Pacific regions prioritize ISR to manage vast maritime spaces and complex territorial environments. Middle Eastern forces rely on airborne ISR for continuous situational awareness in volatile security contexts. African defense organizations increasingly employ ISR platforms to support border monitoring and peacekeeping operations. Across regions, investments are directed toward enhancing data fusion, platform endurance, and domestic capability development. These trends illustrate how airborne ISR strategies align with regional security priorities and operational realities.

Key Airborne ISR Program:

Northrop Grumman secured $1.4 billion in contracts during early 2025 to modernize global air and missile defense capabilities, including airborne intelligence, surveillance, and reconnaissance platforms. The company continues supporting U.S. Army fixed-wing ISR aircraft modernization under a potential $750 million program focused on sensor upgrades, data fusion capabilities, and extended endurance modifications for persistent wide-area surveillance missions supporting ground commanders and joint task forces.

Table of Contents

Airborne ISR Market - Table of Contents

Airborne ISR Market Report Definition

Airborne ISR Market Segmentation

By Application

By Region

By Aircraft Type

Airborne ISR Market Analysis for next 10 Years

The 10-year Airborne ISR Market analysis would give a detailed overview of Airborne ISR Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Airborne ISR Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Airborne ISR Market Forecast

The 10-year Airborne ISR Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Airborne ISR Market Trends & Forecast

The regional Airborne ISR Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Airborne ISR Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Airborne ISR Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Airborne ISR Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Application, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Aircraft Type, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Application, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Aircraft Type, 2026-2036

List of Figures

- Figure 1: Global Airborne ISR Market Forecast, 2026-2036

- Figure 2: Global Airborne ISR Market Forecast, By Application, 2026-2036

- Figure 3: Global Airborne ISR Market Forecast, By Region, 2026-2036

- Figure 4: Global Airborne ISR Market Forecast, By Aircraft Type, 2026-2036

- Figure 5: North America, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 6: Europe, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 8: APAC, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 9: South America, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 10: United States, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 11: United States, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 12: Canada, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 14: Italy, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 16: France, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 17: France, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 18: Germany, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 24: Spain, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 30: Australia, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 32: India, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 33: India, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 34: China, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 35: China, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 40: Japan, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Airborne ISR Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Airborne ISR Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Airborne ISR Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Airborne ISR Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Airborne ISR Market, By Application (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Airborne ISR Market, By Application (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Airborne ISR Market, By Aircraft Type (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Airborne ISR Market, By Aircraft Type (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Airborne ISR Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Airborne ISR Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Airborne ISR Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Airborne ISR Market, By Region, 2026-2036

- Figure 58: Scenario 1, Airborne ISR Market, By Application, 2026-2036

- Figure 59: Scenario 1, Airborne ISR Market, By Aircraft Type, 2026-2036

- Figure 60: Scenario 2, Airborne ISR Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Airborne ISR Market, By Region, 2026-2036

- Figure 62: Scenario 2, Airborne ISR Market, By Application, 2026-2036

- Figure 63: Scenario 2, Airborne ISR Market, By Aircraft Type, 2026-2036

- Figure 64: Company Benchmark, Airborne ISR Market, 2026-2036