PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936037

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936037

Global Active Protection Systems Market 2026-2036

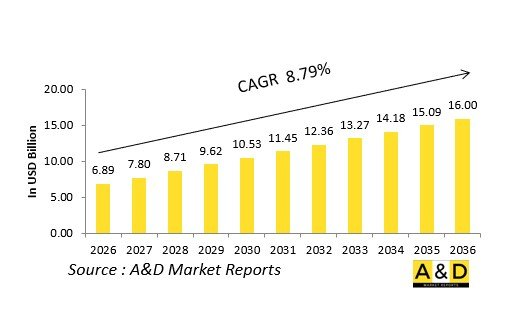

The Global Active protection system market is estimated at USD 6.89 billion in 2026, projected to grow to USD 16.00 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 8.79% over the forecast period 2026-2036.

Introduction

The global Active Protection Systems (APS) market stands at the forefront of armored vehicle defense, countering sophisticated anti-armor threats through automated detection and neutralization. APS employ sensors, launchers, and effectors to intercept projectiles mid-flight, safeguarding tanks, infantry carriers, and artillery from missiles, rockets, and drones. As hybrid warfare intensifies, these systems bridge vulnerabilities in passive armor.

Market growth mirrors escalating ground combat demands, with APS evolving from point-defense to network-centric solutions integrated with battle management systems. Key components include radar seekers, kinetic interceptors, and soft-kill jammers, designed for low-collateral urban operations. Manufacturers prioritize modularity for retrofitting legacy fleets alongside new platforms, enhancing export appeal.

Geopolitical flashpoints drive procurement, as armies seek asymmetric advantages against precision-guided munitions. Convergence with unmanned systems extends APS to robotic combat vehicles. Supply chains focus on resilient electronics and high-speed effectors, while standards ensure interoperability across alliances. Competitive dynamics feature primes collaborating with startups on AI-driven threat classifiers.

This market underscores a paradigm shift toward proactive survivability, intertwining APS with digital fires and sensor fusion for dominant maneuver warfare.

Technology Impact in Active Protection Systems

Technological leaps redefine Active Protection Systems (APS), elevating them from reactive countermeasures to predictive shields. Multi-spectral sensors-fusing radar, infrared, and electro-optical-enable 360-degree threat tracking, discerning decoys from live munitions amid clutter. AI algorithms process data in milliseconds, prioritizing intercepts and minimizing false alarms through machine learning trained on diverse threat libraries.

Kinetic effectors advance with high-velocity projectiles that fragment incoming warheads, while directed-energy variants like lasers promise unlimited "magazine" depth for drone swarms. Soft-kill measures deploy directed infrared countermeasures and electronic decoys, disrupting seeker heads without physical intercept. Networked APS share threat data across vehicle platoons, creating protective bubbles via mesh communications.

Modular architectures facilitate platform-agnostic integration, from light tactical vehicles to heavy tanks, with plug-and-play sensor pods. GaN-based radars boost range and resolution, resisting jamming. Hypersonic threat countermeasures emerge, incorporating plasma shields and adaptive optics. Digital twins accelerate development, simulating engagements for rapid iteration.

These innovations slash engagement timelines, boost hit probabilities, and reduce crew workload, transforming APS into force multipliers that enable aggressive tactics in high-threat zones.

Key Drivers in Active Protection Systems

Intensifying armored threats propel the Active Protection Systems (APS) market. Proliferation of man-portable anti-tank guided missiles and loitering munitions exposes vulnerabilities in traditional armor, compelling forces to adopt APS for hard-kill capabilities against top-attack profiles.

Modernization waves across global armies drive retrofits, prioritizing systems that layer with reactive armor and trophy-like effectors. Urban and hybrid warfare doctrines demand low-collateral solutions that neutralize threats without endangering civilians or friendly forces nearby.

Allied interoperability standards accelerate adoption, with programs mandating APS for joint operations. Export markets boom as emerging powers counter regional rivals through licensed production and technology transfers. Logistics imperatives favor low-weight, automated systems that integrate with active suspension and power systems.

Sustainability pushes for reusable interceptors and energy-efficient lasers, aligning with green defense initiatives. Cyber-resilient designs counter electronic warfare, embedding hardened processors. Human-centric factors emphasize crew protection, reducing exposure to blasts via standoff intercepts.

Rising defense postures amid tensions sustain R&D, blending APS with directed energy and hypersonics. Collectively, these drivers position APS as indispensable for next-era armored dominance.

Regional Trends in Active Protection Systems

Regional variations shape the Active Protection Systems (APS) market landscape. In Europe, NATO harmonization drives mature, networked APS for main battle tanks, emphasizing soft-kill integration against precision fires in high-intensity conflicts.

Middle East procurement surges, with desert-optimized systems countering asymmetric rocket threats; local assembly offsets bolster self-reliance amid prolonged engagements.

Asia-Pacific sees indigenous development, tailoring APS to mountainous and island terrains for anti-access/area-denial scenarios, fused with domestic radars.

North America pioneers directed-energy APS variants for expeditionary forces, leveraging vast R&D ecosystems for multi-domain operations.

Russia and allies focus on heavy armor-centric hard-kill suites, resilient to electronic countermeasures in peer fights.

Latin America adopts cost-effective retrofits for counter-narcotics vehicles, prioritizing urban collateral mitigation.

Africa trends toward light, vehicle-agnostic APS for peacekeeping, combating improvised threats with modular kits.

Indo-Pacific alliances emphasize swarm defense, integrating APS with air defense nets. Global trends converge on open architectures for upgrades, with supply chains shifting to diversified electronics hubs.

Key Active Protection Systems Programs

Landmark programs anchor the Active Protection Systems (APS) landscape. Trophy-like hard-kill systems equip elite tank brigades, launching explosive projectiles to shred incoming missiles, proven in urban combat validations.

Next-gen networked APS fuse vehicle sensors with overhead drones, sharing intercept cues for platoon-level shields against salvo attacks. Navalized derivatives protect amphibious assault vehicles, adapting effectors for maritime launch constraints. Light tactical APS programs outfit infantry carriers with compact radars and micro-interceptors, enabling convoy survivability in insurgent zones. Directed-energy prototypes mature, deploying high-power microwaves to fry drone electronics, extending to laser dazzlers for non-lethal options.

Retrofit initiatives upgrade legacy platforms with bolt-on pods, incorporating gallium nitride seekers for extended envelopes. Collaborative alliances develop common APS architectures, standardizing interfaces for multinational fleets. Export packages bundle APS with armor sales, including training simulators for operator proficiency. Emerging hypersonic countermeasures test plasma-based deflectors, paired with quantum sensors for ultra-fast detection.

Table of Contents

Active Protection Systems - Table of Contents

Market Definition

Market Segmentation of Active Protection Systems

By Region

By Application

By Material

10 Year Market Outlook of Active Protection Systems

The 10-year market outlook would give a detailed overview of changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Active Protection Systems

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Market Forecast of Active Protection Systems

The 10-year market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Market Trends & Forecast of Active Protection Systems

The regional market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Active Protection Systems

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix of Active Protection Systems

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions of Active Protection Systems

Hear from our experts their opinion of the possible outlook for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Type, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Type, 2026-2036

List of Figures

- Figure 1: Global Active Protection System Market Forecast, 2026-2036

- Figure 2: Global Active Protection System Market Forecast, By Region, 2026-2036

- Figure 3: Global Active Protection System Market Forecast, By Platform, 2026-2036

- Figure 4: Global Active Protection System Market Forecast, By Type, 2026-2036

- Figure 5: North America, Active Protection System Market, Forecast, 2026-2036

- Figure 6: Europe, Active Protection System Market, Forecast, 2026-2036

- Figure 7: Middle East, Active Protection System Market, Forecast, 2026-2036

- Figure 8: APAC, Active Protection System Market, Forecast, 2026-2036

- Figure 9: South America, Active Protection System Market, Forecast, 2026-2036

- Figure 10: United States, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 11: United States, Active Protection System Market, Forecast, 2026-2036

- Figure 12: Canada, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Active Protection System Market, Forecast, 2026-2036

- Figure 14: Italy, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Active Protection System Market, Market Forecast, 2026-2036

- Figure 16: France, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 17: France, Active Protection System Market, Market Forecast, 2026-2036

- Figure 18: Germany, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Active Protection System Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Active Protection System Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Active Protection System Market, Market Forecast, 2026-2036

- Figure 24: Spain, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Active Protection System Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Active Protection System Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Active Protection System Market, Market Forecast, 2026-2036

- Figure 30: Australia, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Active Protection System Market, Market Forecast, 2026-2036

- Figure 32: India, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 33: India, Active Protection System Market, Market Forecast, 2026-2036

- Figure 34: China, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 35: China, Active Protection System Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Active Protection System Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Active Protection System Market, Market Forecast, 2026-2036

- Figure 40: Japan, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Active Protection System Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Active Protection System Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Active Protection System Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Active Protection System Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Active Protection System Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Active Protection System Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Active Protection System Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Active Protection System Market, By Platform (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Active Protection System Market, By Platform (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Active Protection System Market, By Type (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Active Protection System Market, By Type (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Active Protection System Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Active Protection System Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Active Protection System Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Active Protection System Market, By Region, 2026-2036

- Figure 58: Scenario 1, Active Protection System Market, By Platform, 2026-2036

- Figure 59: Scenario 1, Active Protection System Market, By Type, 2026-2036

- Figure 60: Scenario 2, Active Protection System Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Active Protection System Market, By Region, 2026-2036

- Figure 62: Scenario 2, Active Protection System Market, By Platform, 2026-2036

- Figure 63: Scenario 2, Active Protection System Market, By Type, 2026-2036

- Figure 64: Company Benchmark, Active Protection System Market, 2026-2036