PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936040

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936040

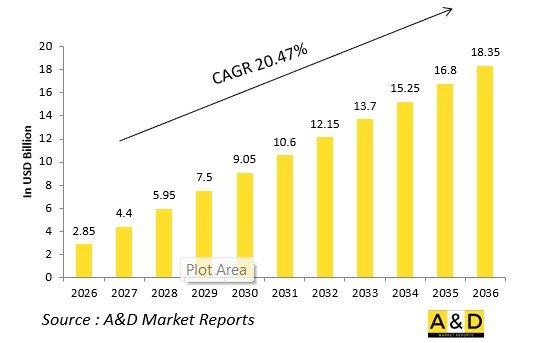

Global 5G in Defense Market 2026-2036

The Global 5G in Defense Market is estimated at USD 2.85 billion in 2026, projected to grow to USD 18.35 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 20.47% over the forecast period 2026-2036.

Introduction

The global 5G in defense market revolutionizes military communications, delivering high-bandwidth, low-latency links essential for joint all-domain operations. Deployed across airborne, land, and naval platforms, 5G supports real-time data sharing for ISR, autonomous systems, and distributed command nodes. Resilience against jamming defines its edge over legacy networks.

Market momentum builds on convergence with AI, IoT, and edge computing, enabling massive MIMO for spectrum efficiency and beamforming for directed signals. Private 5G networks secure tactical edges, while non-terrestrial extensions via satellites cover remote theaters. Vendors collaborate on software-defined radios and virtualization for agile deployments.

Geopolitical imperatives drive adoption, fortifying C4ISR against peer threats. Interoperability standards bridge commercial and military spectra. Supply chains prioritize hardened hardware amid cyber risks. Competition intensifies with primes like Ericsson and Thales pioneering defense-grade cores.

Technology Impact in 5G in Defense

5G profoundly impacts defense by slashing latencies to milliseconds, enabling real-time video feeds, AR overlays, and teleoperated drones in contested environments. Massive MIMO multiplies throughput, supporting sensor fusion from swarms of UAVs and ground robots via beamformed precision beams.

Edge computing at base stations processes ISR data locally, minimizing cloud dependency and enhancing survivability. Network slicing partitions bandwidth for mission-critical traffic, isolating command from logistics streams. Software-defined networking (SDN) and virtualization (NFV) allow dynamic reconfiguration mid-operation.

Satellite backhaul extends terrestrial 5G to austere zones, integrating NTNs for ubiquitous coverage. AI-optimized spectrum sharing evades jamming through cognitive radios. Secure waveforms resist electronic warfare, while quantum-safe encryption safeguards data links.

Augmented reality interfaces leverage high bandwidth for immersive training and remote maintenance. Autonomous convoys stream HD feeds for convoy ops. These capabilities compress OODA loops, empower manned-unmanned teaming, and scale logistics via smart warehouses, redefining tactical agility.

Key Drivers in 5G in Defense

Demand for joint all-domain command drives 5G adoption, requiring seamless data fusion across services. Proliferating drones and autonomy necessitate ultra-reliable connectivity for beyond-line-of-sight control.

Modernization programs prioritize resilient networks against peer electronic warfare. High defense postures amid tensions accelerate private 5G deployments for forward bases. IoT proliferation-from wearables to munitions-demands massive device handling.

Interoperability with commercial ecosystems cuts costs via COTS hardware. Edge AI integration enables data-driven decisions at the tactical edge. Spectrum auctions favor dynamic allocation for contested bands.

Cybersecurity mandates spur hardened 5G cores with zero-trust architectures. Training revolutions via VR/AR simulations leverage bandwidth. Export potentials expand through allied standards.

Logistics transformation-predictive maintenance, automated resupply-relies on low-latency links. These drivers embed 5G as C4ISR backbone.

Regional Trends in 5G in Defense

North America leads with massive investments in tactical 5G for JADC2, pioneering MIMO testbeds and NTN integrations.

Europe harmonizes via NATO frameworks, deploying SDN for coalition networks and naval 5G for carrier ops.

Asia-Pacific surges amid Indo-Pacific rivalries, with China advancing sovereign 5G for island defenses and India localizing cores.

Middle East fortifies bases with beamformed ISR nets against asymmetric threats.

Russia develops jamming-resistant waveforms for frontline use.

Indo-Pacific allies emphasize satellite-augmented 5G for maritime domain awareness.

Latin America pilots counter-drone networks. Africa integrates for peacekeeping comms.

Trends favor hybrid terrestrial-space architectures, with Asia capturing supply shares.

Key 5G in Defense Programs

DoD's Innovate Beyond 5G (IB5G) pioneers Massive MIMO from MHz to GHz, boosting tactical throughput with Nokia Bell Labs.

JADC2 initiatives weave 5G into multi-domain webs for real-time fires.

Golden Dome missile defense leverages 5G for alerts and intercepts.

Naval 5G-to-NextG demos harden shipboard networks.

European 5G military networks fuse land-air-sea slices.

Indo-Pacific exercises test beamforming for drone swarms.

Private 5G base camps enable smart logistics.

ORION program integrates 5G with AI for edge ISR.

Tactical Edge Node prototypes deliver resilient 5G at forward positions.

These programs forge secure, scalable nets for future warfighters.

Table of Contents

5G in Defense Market - Table of Contents

5G in Defense Market Report Definition

5G in Defense Market Segmentation

By Platform

By Region

By Chipset

5G in Defense Market Analysis for next 10 Years

The 10-year 5G in Defense Market analysis would give a detailed overview of 5G in Defense Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of 5G in Defense Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global 5G in Defense Market Forecast

The 10-year 5G in defense market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional 5G in Defense Market Trends & Forecast

The regional 5G in Defense Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of 5G in Defense Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for 5G in Defense Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on 5G in Defense Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Type, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Type, 2026-2036

List of Figures

- Figure 1: Global 5G in Defense Market Forecast, 2026-2036

- Figure 2: Global 5G in Defense Market Forecast, By Region, 2026-2036

- Figure 3: Global 5G in Defense Market Forecast, By Platform, 2026-2036

- Figure 4: Global 5G in Defense Market Forecast, By Chipset, 2026-2036

- Figure 5: North America, 5G in Defense Market, Forecast, 2026-2036

- Figure 6: Europe, 5G in Defense Market, Forecast, 2026-2036

- Figure 7: Middle East, 5G in Defense Market, Forecast, 2026-2036

- Figure 8: APAC, 5G in Defense Market, Forecast, 2026-2036

- Figure 9: South America, 5G in Defense Market, Forecast, 2026-2036

- Figure 10: United States, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 11: United States, 5G in Defense Market, Forecast, 2026-2036

- Figure 12: Canada, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 13: Canada, 5G in Defense Market, Forecast, 2026-2036

- Figure 14: Italy, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 15: Italy, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 16: France, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 17: France, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 18: Germany, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 19: Germany, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 22: Belgium, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 24: Spain, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 25: Spain, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 26: Sweden, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 28: Brazil, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 30: Australia, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 31: Australia, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 32: India, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 33: India, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 34: China, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 35: China, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 38: South Korea, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 40: Japan, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 41: Japan, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 44: Singapore, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, 5G in Defense Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, 5G in Defense Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, 5G in Defense Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, 5G in Defense Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, 5G in Defense Market, By Platform (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, 5G in Defense Market, By Platform (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, 5G in Defense Market, By Chipset (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, 5G in Defense Market, By Chipset (CAGR), 2026-2036

- Figure 54: Scenario Analysis, 5G in Defense Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, 5G in Defense Market, Global Market, 2026-2036

- Figure 56: Scenario 1, 5G in Defense Market, Total Market, 2026-2036

- Figure 57: Scenario 1, 5G in Defense Market, By Region, 2026-2036

- Figure 58: Scenario 1, 5G in Defense Market, By Platform, 2026-2036

- Figure 59: Scenario 1, 5G in Defense Market, By Chipset, 2026-2036

- Figure 60: Scenario 2, 5G in Defense Market, Total Market, 2026-2036

- Figure 61: Scenario 2, 5G in Defense Market, By Region, 2026-2036

- Figure 62: Scenario 2, 5G in Defense Market, By Platform, 2026-2036

- Figure 63: Scenario 2, 5G in Defense Market, By Chipset, 2026-2036

- Figure 64: Company Benchmark, 5G in Defense Market, 2026-2036