PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936042

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936042

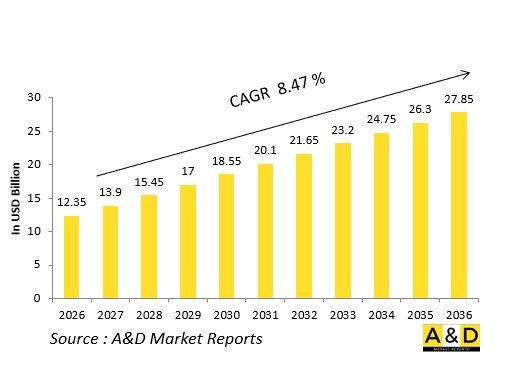

Global AESA Radar Market 2026-2036

The Global AESA Radar Market is estimated at USD 12.35 billion in 2026, projected to grow to USD 27.85 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 8.47% over the forecast period 2026-2036.

Introduction

The global AESA Radar market anchors modern air dominance, powering fighter fire control, naval surveillance, and ground-based missile defense with solid-state phased arrays. Thousands of transmit-receive modules (TRMs) enable rapid beam agility, simultaneous air-to-air tracking, and ground mapping, surpassing mechanical radars in reliability and versatility.

Market evolution reflects fleet modernization, where AESA retrofits extend legacy platforms while new designs incorporate gallium nitride for compact power. Core features include frequency agility, low sidelobes, and electronic counter-countermeasures, supporting interleaved modes for beyond-visual-range engagements and synthetic aperture imaging.

Geopolitical tensions drive procurement, with air forces seeking scalable architectures for multirole fighters and UAVs. Interoperability standards facilitate exports, while open-system designs ease upgrades. Supply chains focus on resilient semiconductors amid chip constraints. Competition pits established primes against emerging players in GaN-based modules.

This market exemplifies sensor fusion's role in networked warfare.

Technology Impact in AESA Radar

AESA technology revolutionizes radar performance through electronic beam steering, eliminating mechanical gimbals for instantaneous azimuth and elevation shifts. GaN-based TRMs boost power output and efficiency, shrinking arrays while extending detection against stealthy targets and hypersonics.

Multi-function capabilities track dozens of contacts simultaneously, cueing missiles via track-while-scan amid clutter. Adaptive waveforms evade jamming, hopping frequencies faster than adversaries react. Low-probability-of-intercept modes use spread-spectrum signals, concealing emissions from passive detectors.

Digital beamforming shapes narrow pencil beams for precision or wide fans for search, optimizing synthetic aperture resolution in ground modes. Non-cooperative target recognition analyzes micro-Doppler signatures for friend-foe decisions. Integration with EW suites suppresses threats via directed noise.

Cognitive algorithms self-optimize against clutter or deception, while digital twins accelerate mode development. Naval variants ruggedize for ship motion, supporting volume search and horizon extension. These strides compress kill chains, enabling first-look-first-kill advantages in contested airspace.

Key Drivers in AESA Radar

Fighter fleet modernization propels AESA adoption, retrofitting legacy airframes to counter stealthy threats and saturation attacks. Naval aviation demands compact nose radars for multirole carriers amid blue-water rivalries.

Proliferating hypersonic and low-observable munitions necessitate agile tracking beyond mechanically scanned limits. Export markets thrive on scalable TRM counts suiting diverse platforms, bundled with offset production.

Interoperability mandates drive common architectures for coalition ops. GaN transitions slash size-weight-power, enabling UAV and loyal wingman swarms. Electronic warfare escalation favors ECCM-hardened designs.

Budget pressures favor long-life solid-state over maintenance-heavy tubes. Urban air combat doctrines prioritize multi-mode flexibility. Supply chain localization counters vulnerabilities.

Sustainability via efficient modules aligns with green procurement. These forces embed AESA as C4ISR cornerstone.

Regional Trends in AESA Radar

North America leads with mature GaN programs for F-35 derivatives and Aegis upgrades, emphasizing multi-domain fusion.

Europe collaborates on scalable arrays for Eurofighter and Rafale, harmonizing via NATO standards for eastern flanks.

Asia-Pacific accelerates indigenous development-India's Uttam for Tejas, China's J-20 suites-tailored to island and Himalayan threats.

Middle East integrates Western imports with local assembly for air superiority.

Russia advances gallium arsenide arrays resilient to EW saturation.

South Korea and Japan prioritize compact naval AESA for sea denial.

Latin America focuses ground-based imports for territorial vigilance.

Trends converge on digital AESA with AI processing, Asia-Pacific gaining via volume production.

Key AESA Radar Programs

Fighter programs anchor AESA evolution: AN/APG-81 equips stealth platforms with interleaved A2A/A2G modes and jamming resistance.

Rafale RBE2-AA delivers compact GaN power for export fleets.

Eurofighter Captor-E scales TRMs for role flexibility.

India's Uttam indigenous array powers LCA successors with multimode agility.

Naval AN/SPY-6 scales for destroyer volume search.

Ground-based AN/TPY-4 mobile arrays cue missile defenses.

UAV variants like MQ-9 Predator upgrades extend endurance ISR.

Digital AESA roadmaps fuse quantum processors for cognitive modes.

Collaborative prototypes test hypersonic tracking.

Export packages bundle with missiles for holistic lethality.

These initiatives redefine radar as dynamic effectors.

Table of Contents

AESA Radar Market - Table of Contents

AESA Radar Market Report Definition

AESA Radar Market Segmentation

By Region

By Fit

By Platform

AESA Radar Market Analysis for next 10 Years

The 10-year AESA radar market analysis would give a detailed overview of AESA radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of AESA Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global AESA Radar Market Forecast

The 10-year AESA radar market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional AESA Radar Market Trends & Forecast

The regional AESA radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of (Market name)

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for AESA Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on AESA Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Fit , 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Fit , 2026-2036

List of Figures

- Figure 1: Global AESA Radar Market Forecast, 2026-2036

- Figure 2: Global AESA Radar Market Forecast, By Region, 2026-2036

- Figure 3: Global AESA Radar Market Forecast, By Platform, 2026-2036

- Figure 4: Global AESA Radar Market Forecast, By Fit , 2026-2036

- Figure 5: North America, AESA Radar Market, Forecast, 2026-2036

- Figure 6: Europe, AESA Radar Market, Forecast, 2026-2036

- Figure 7: Middle East, AESA Radar Market, Forecast, 2026-2036

- Figure 8: APAC, AESA Radar Market, Forecast, 2026-2036

- Figure 9: South America, AESA Radar Market, Forecast, 2026-2036

- Figure 10: United States, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 11: United States, AESA Radar Market, Forecast, 2026-2036

- Figure 12: Canada, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 13: Canada, AESA Radar Market, Forecast, 2026-2036

- Figure 14: Italy, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 15: Italy, AESA Radar Market, Market Forecast, 2026-2036

- Figure 16: France, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 17: France, AESA Radar Market, Market Forecast, 2026-2036

- Figure 18: Germany, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 19: Germany, AESA Radar Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, AESA Radar Market, Market Forecast, 2026-2036

- Figure 22: Belgium, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, AESA Radar Market, Market Forecast, 2026-2036

- Figure 24: Spain, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 25: Spain, AESA Radar Market, Market Forecast, 2026-2036

- Figure 26: Sweden, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, AESA Radar Market, Market Forecast, 2026-2036

- Figure 28: Brazil, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, AESA Radar Market, Market Forecast, 2026-2036

- Figure 30: Australia, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 31: Australia, AESA Radar Market, Market Forecast, 2026-2036

- Figure 32: India, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 33: India, AESA Radar Market, Market Forecast, 2026-2036

- Figure 34: China, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 35: China, AESA Radar Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, AESA Radar Market, Market Forecast, 2026-2036

- Figure 38: South Korea, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, AESA Radar Market, Market Forecast, 2026-2036

- Figure 40: Japan, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 41: Japan, AESA Radar Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, AESA Radar Market, Market Forecast, 2026-2036

- Figure 44: Singapore, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, AESA Radar Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, AESA Radar Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, AESA Radar Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, AESA Radar Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, AESA Radar Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, AESA Radar Market, By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, AESA Radar Market, By Platform (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, AESA Radar Market, By Fit (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, AESA Radar Market, By Fit (CAGR), 2026-2036

- Figure 54: Scenario Analysis, AESA Radar Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, AESA Radar Market, Global Market, 2026-2036

- Figure 56: Scenario 1, AESA Radar Market, Total Market, 2026-2036

- Figure 57: Scenario 1, AESA Radar Market, By Region, 2026-2036

- Figure 58: Scenario 1, AESA Radar Market, By Platform, 2026-2036

- Figure 59: Scenario 1, AESA Radar Market, By Fit , 2026-2036

- Figure 60: Scenario 2, AESA Radar Market, Total Market, 2026-2036

- Figure 61: Scenario 2, AESA Radar Market, By Region, 2026-2036

- Figure 62: Scenario 2, AESA Radar Market, By Platform, 2026-2036

- Figure 63: Scenario 2, AESA Radar Market, By Fit , 2026-2036

- Figure 64: Company Benchmark, AESA Radar Market, 2026-2036